Geek to Wealth - Page 2

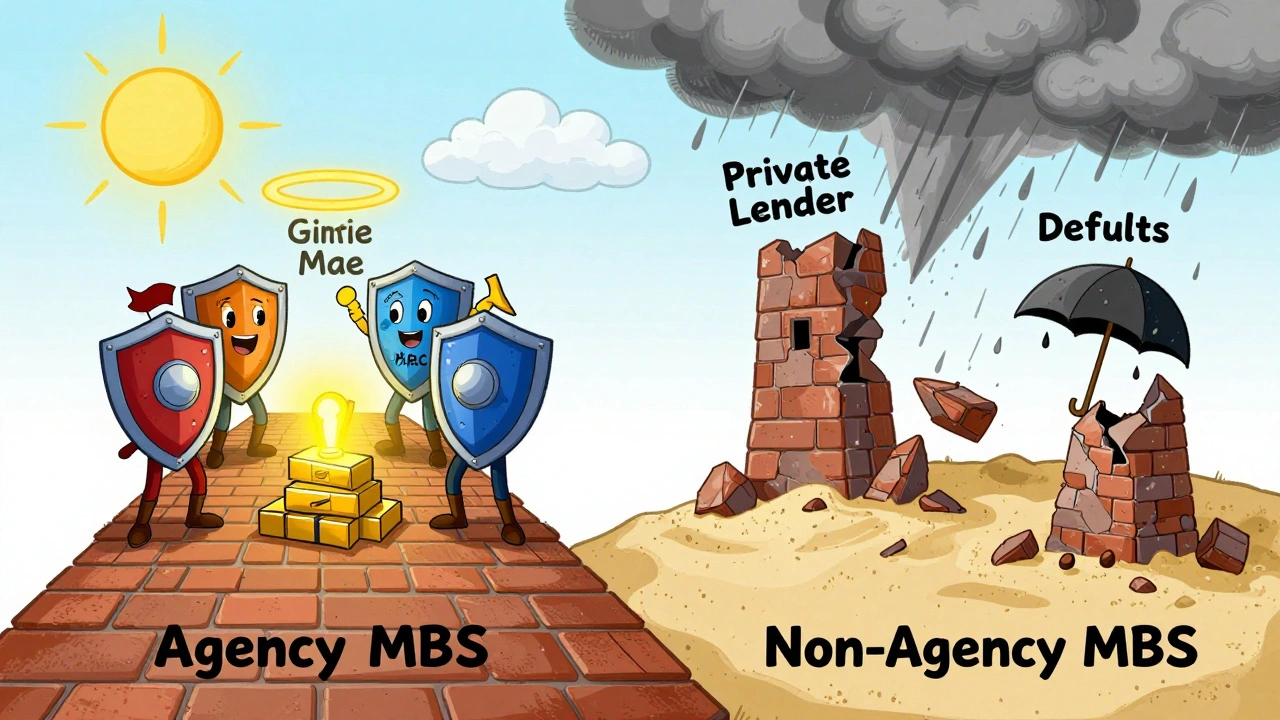

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View MoreOpen Finance vs. Open Banking: How the Scope Is Expanding

Open banking lets you share bank account data with apps; open finance expands that to investments, loans, crypto, and insurance. Learn how the scope is growing-and why it matters for your money.

View MoreSecondary Offerings and How They Move Stock Prices

Secondary offerings can boost a company’s cash or dilute your ownership. Learn how dilutive and non-dilutive offerings impact stock prices, what to watch for, and how to tell if it’s a sign of strength or weakness.

View MoreTax-Loss Harvesting While Rebalancing: How to Coordinate Moves for Better After-Tax Returns

Tax-loss harvesting while rebalancing lets you cut your tax bill while fixing your portfolio’s allocation. Learn how to do it right, avoid wash-sale traps, and boost after-tax returns by up to 1% a year.

View MoreDollar-Cost Averaging with Paychecks: The Simple Set-and-Forget Way to Build Wealth

Dollar-cost averaging with paychecks is the simplest, most effective way to build long-term wealth without stress or timing the market. Automate your contributions and let compounding do the work.

View MoreStyle Diversification: How to Mix Value and Growth Investments for a Stronger Portfolio

Mixing value and growth investments reduces portfolio volatility and protects against market swings. Learn how to build a balanced portfolio using ETFs and avoid common timing mistakes.

View MoreObservability for Payments: How Metrics, Logs, and Traces Keep Transactions Running

Payment observability uses metrics, logs, and traces to track transaction success, reduce failures, and meet compliance. Learn how top processors cut failures by 37% and why 100% trace coverage is non-negotiable.

View MoreStop-Loss Orders vs Mental Stops: Which One Protects Your Capital Better?

Learn the real difference between stop-loss orders and mental stops, how each affects your risk, and which one works best for your trading style. Discover expert-backed strategies to protect your capital without letting emotions take over.

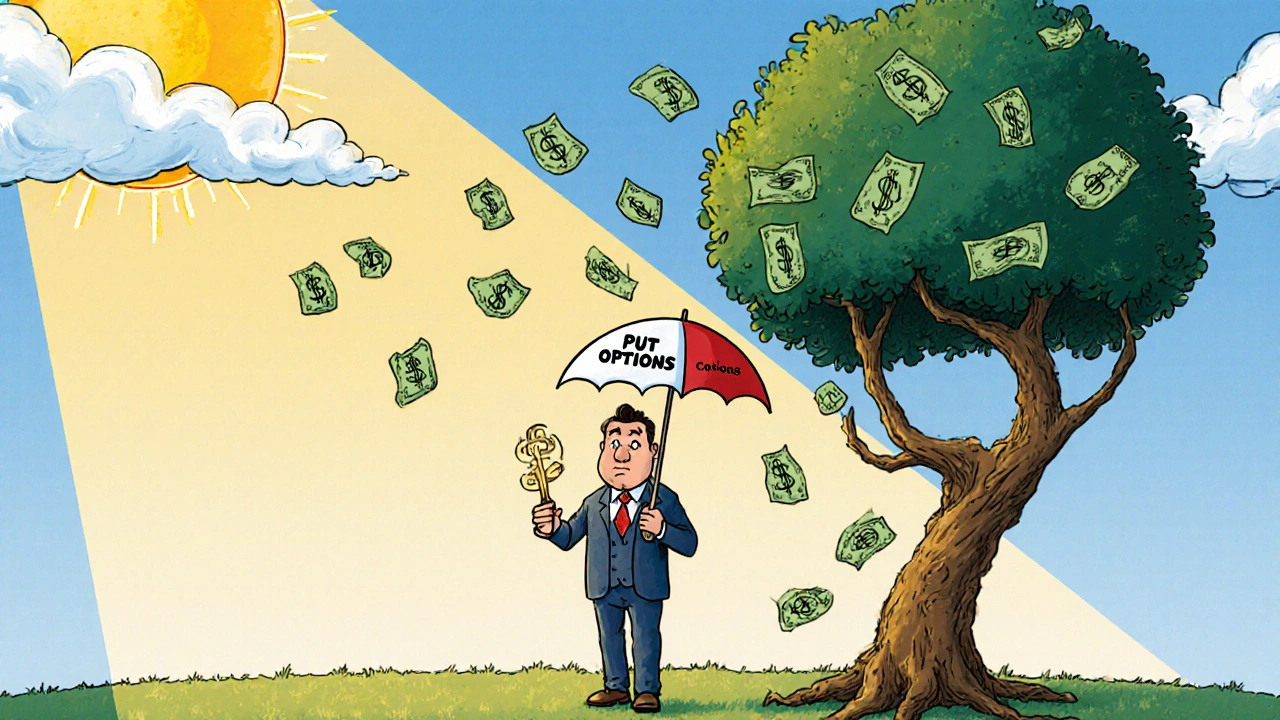

View MorePortfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View MoreFintech Marketing Strategies for Customer Acquisition: Proven Tactics That Work in 2025

Learn proven fintech customer acquisition strategies for 2025 that build trust, reduce costs, and convert users-backed by real data on referral programs, personalization, and compliance.

View MoreBNPL for Small Businesses: How to Accept Installment Payments and Boost Sales

BNPL lets small businesses offer interest-free installment payments while getting paid upfront. Learn how to set it up, which providers to choose, and how to avoid costly mistakes that hurt your margins.

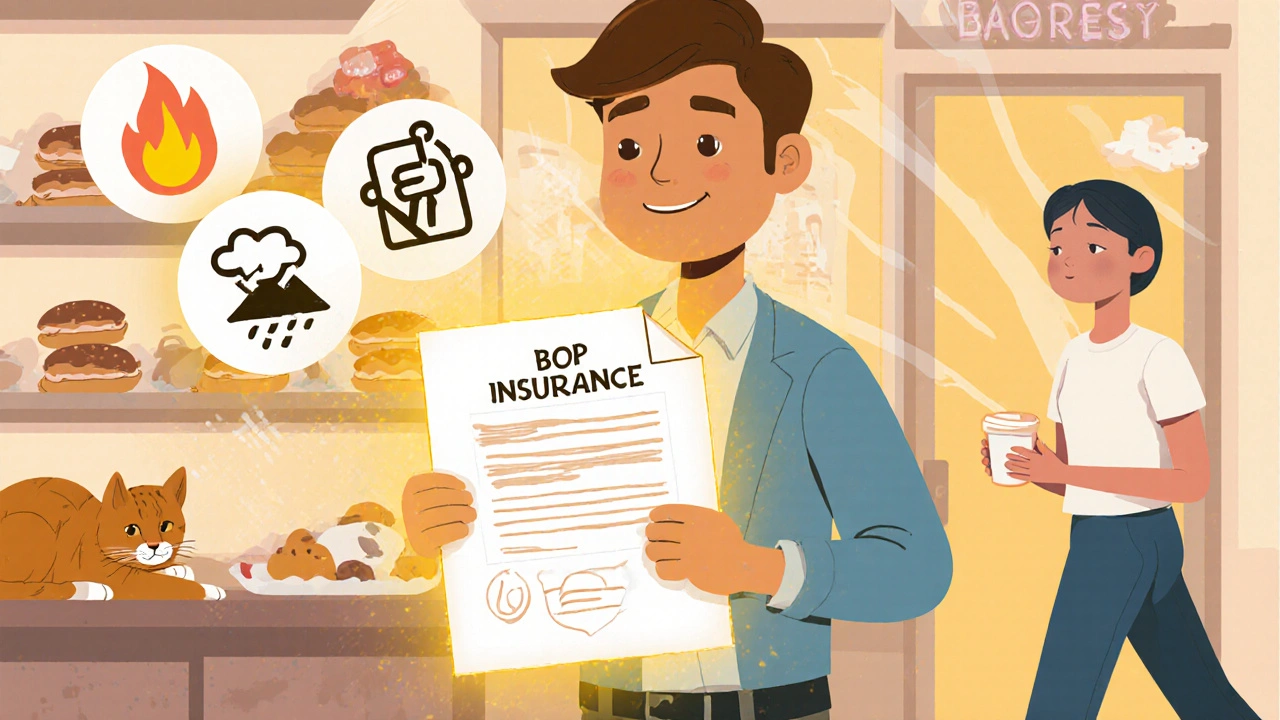

View MoreSmall Business Insurance Bundles: BOPs for Startups

A Business Owner's Policy (BOP) bundles property and liability insurance into one affordable plan for startups. Learn what it covers, what it doesn't, and how to choose the right one for your business.

View More