BNPL Profit Calculator

Calculate how Buy Now, Pay Later payments can impact your business profitability. Enter your current metrics to see if BNPL makes sense for your business.

Results

Based on your inputs and 2024 industry benchmarks

Example from Article

In the article, we saw a business with:

100 sales/month, $87 AOV, 30% margin → $2,610 profit

After BNPL: 120 sales/month, $142 AOV, 25% margin → $4,260 profit

More than 41% of U.S. small businesses with online sales now offer Buy Now, Pay Later (BNPL) at checkout. If you’re not offering it yet, you’re losing sales - and fast. Customers aren’t just asking for it; they’re walking away when they don’t see it. A 2024 Shopify study found that adding BNPL converts 68% of abandoned carts. That’s not a nice-to-have. It’s table stakes.

How BNPL Actually Works for Small Businesses

Here’s the simple version: Your customer buys a $200 jacket. At checkout, they pick BNPL. They pay $50 now. The rest is split into three more $50 payments over six weeks. You get the full $200 in your account within 24 hours, minus a fee. The BNPL company (like Klarna or Affirm) handles the rest - the credit check, the reminders, the collections. You don’t worry about late payments. You don’t chase customers. You just get paid, fast.

This isn’t layaway. In layaway, the customer pays first, then gets the item. With BNPL, they walk out with it immediately. That’s why conversion rates jump. People aren’t waiting. They’re buying.

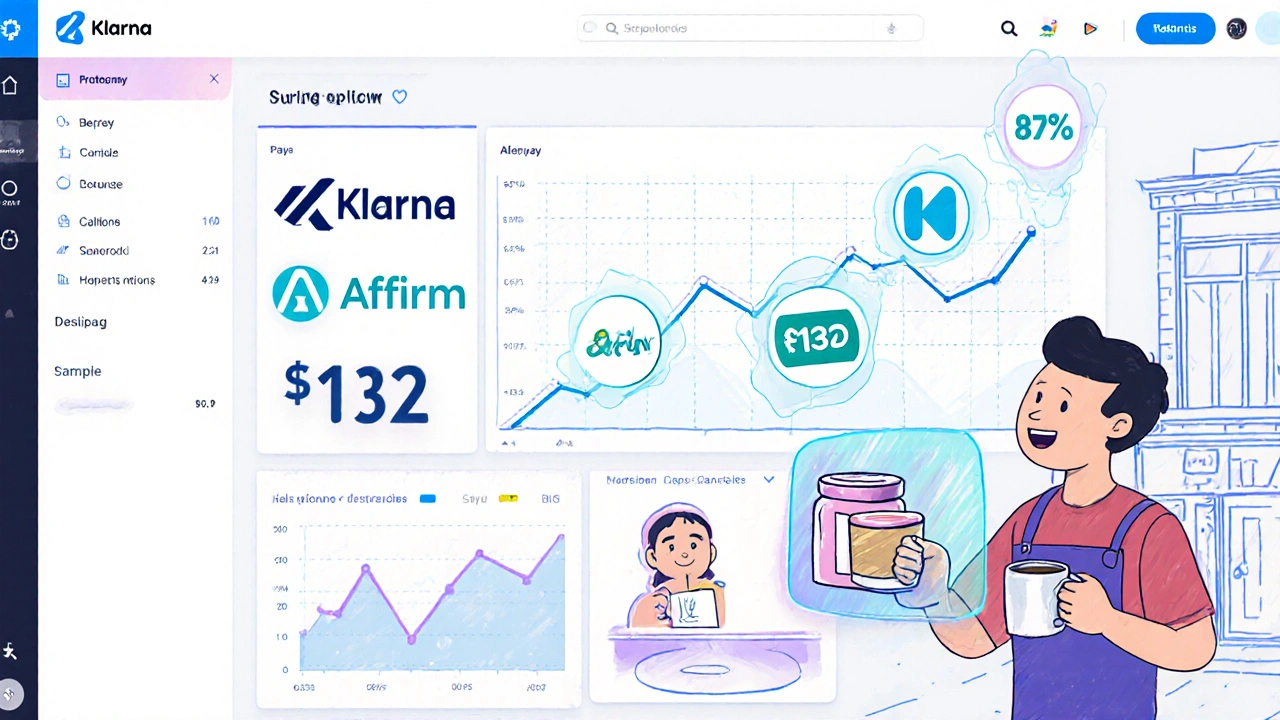

According to Affirm’s 2023 data, stores using BNPL see a 20% increase in conversions and an 87% spike in average order value. A boutique in Portland saw their AOV jump from $78 to $132 after adding Klarna. That’s not magic. It’s psychology. When $200 feels like $50 now, people buy more.

Who’s Leading the BNPL Market in 2025?

You’ve probably heard of Klarna, Afterpay, and Affirm. They dominate the U.S. market. Here’s how they break down:

| Provider | Fee Range | Installment Structure | Best For | Approval Rate |

|---|---|---|---|---|

| Klarna | 4%-6% | 4 payments over 6 weeks | Fashion, home goods | 80% |

| Affirm | 3.5%-6% | 3, 6, 12 months (flexible) | Higher-ticket items ($150+) | 85% |

| Afterpay (Block Inc.) | 6% | 4 payments over 6 weeks | Gen Z shoppers, mobile-first stores | 75% |

Klarna has the biggest market share - about 45% - and is easiest to integrate with Shopify and BigCommerce. Affirm stands out because they let customers choose longer terms (up to 12 months) for bigger purchases, which works great for electronics or furniture. Afterpay is popular with younger shoppers and has the highest fee, but their integration is super simple.

There’s a new player: Affirm Direct, launched in early 2024. It’s designed specifically for small businesses with lower base fees (3.5%) and faster approval. If you’re doing $100K+ in annual sales, this is worth a look.

Who Should Use BNPL? (And Who Should Skip It)

BNPL isn’t for every business. It works best when your average order value is between $50 and $500. That’s the sweet spot.

- Great fits: Clothing, shoes, jewelry, home decor, electronics, beauty products, fitness gear.

- Weak fits: Products under $30 (too low to justify fees), services (consulting, coaching), digital downloads (many providers ban these), or items over $1,000 (customers turn to traditional financing).

Also, your profit margin matters. If you’re running on 15% margins, a 6% BNPL fee eats up 40% of your profit. That’s dangerous. Most successful merchants have margins above 30%. If you’re below 25%, test BNPL on a small batch of products first. Don’t roll it out across your whole store.

One store owner in Ohio, who sold handmade candles, tried BNPL on their $45 sets. Their margin was 32%. Afterpay’s 6% fee dropped that to 26%. Still profitable. Sales jumped 40%. They kept it.

A different store, selling $120 tech gadgets with 42% margins, saw BNPL fees eat 37% of their profit. They pulled it after six months. The sales boost wasn’t worth the margin erosion.

How to Set Up BNPL in 5 Steps

Getting started takes less than a week. Here’s how:

- Choose your provider. Start with Klarna or Affirm if you’re on Shopify or WooCommerce. They’re the most reliable.

- Apply as a merchant. You’ll need your business license, bank details, and sales history. Approval usually takes 1-3 days.

- Install the plugin. If you use Shopify, go to Apps > Search “Klarna” > Install. That’s it. For WooCommerce, use the official Affirm plugin. Most integrations take 2-5 days.

- Test the checkout. Buy something yourself using BNPL. Make sure the payment splits show correctly. Check that you get the full amount in your account.

- Promote it. Add a banner on your homepage: “Pay in 4 interest-free installments.” Put it on product pages. Mention it in your email newsletters. If customers don’t see it, they won’t use it.

You’ll need SSL encryption and PCI compliance - most platforms already have this. No extra tech work needed.

What It Costs (And How to Handle the Fees)

Most providers charge between 2% and 8% per transaction. Affirm averages 4-6%. Afterpay is 6%. Klarna is usually 4-5%.

That’s higher than credit card fees (1.5%-3%). But here’s the trade-off: BNPL drives more sales. A 20% sales increase can easily offset a 2% higher fee.

Here’s a real example:

- Before BNPL: 100 sales/month, $87 AOV, $8,700 revenue, 30% margin → $2,610 profit

- After BNPL: 120 sales/month, $142 AOV, $17,040 revenue, 25% margin (after 6% fee) → $4,260 profit

Profit went up 63%. The fee didn’t kill you. The sales lift did.

Track your numbers. Use your platform’s analytics. If your AOV doesn’t rise, or your conversion rate stays flat, you’re not getting value. Adjust your product mix or reconsider.

Common Mistakes (And How to Avoid Them)

Most businesses mess up in three ways:

- Not promoting it. One merchant hid BNPL under a tiny “Pay Later” link. Only 3% of customers saw it. They moved it to the main checkout button. Usage jumped to 41%.

- Ignoring declined transactions. If a customer’s payment gets declined, you don’t get paid. That’s normal - approval rates are 70-85%. But if you’re seeing more than 20% declines, your customers might be overextended. Consider lowering your minimum order value.

- Using it on low-margin items. Don’t offer BNPL on $20 t-shirts if you only make $3 profit. The fee eats your entire margin. Save it for items with real breathing room.

Also, don’t forget to train your team. Customers will ask, “What happens if I miss a payment?” Answer: “You’re not late to us. You’re late to Klarna. We got paid upfront.” Clear communication prevents angry calls.

The Future of BNPL (What’s Coming in 2026)

BNPL isn’t slowing down. By 2026, Gartner predicts 75% of small businesses with over $250K in online sales will offer it.

Here’s what’s next:

- Flexible terms: Instead of just 4 payments, you’ll offer 3, 6, 9, or 12 months - chosen at checkout.

- AI-powered offers: If you’ve bought a $300 camera before, the system might suggest “Pay in 6 months” next time - even if you didn’t ask.

- Loyalty integration: BNPL providers will start paying you referral fees when their customers sign up for your rewards program.

- POS integration: Square and Clover will roll out BNPL in physical stores by early 2025.

And yes - regulation is tightening. Starting January 2025, the CFPB requires BNPL providers to report missed payments to credit bureaus. That means stricter lending. Fewer approvals. But it also means more trust from consumers. BNPL is becoming a real financial product, not just a gimmick.

Final Verdict: Should You Add BNPL?

If you sell physical goods between $50-$500, have margins above 30%, and get at least 50 online orders a month - yes. Do it now.

If you’re a service provider, sell digital products, or operate on razor-thin margins - wait. Test it on one product line first.

BNPL isn’t free money. But it’s the closest thing small businesses have to a sales multiplier. The customers are ready. The tech is simple. The data doesn’t lie.

Don’t ask if you should offer BNPL. Ask: How soon can I get it live?

Do I need a business bank account to use BNPL?

Yes. All BNPL providers require a business bank account for deposits. Personal accounts won’t work. You’ll also need to provide your EIN and business license during the application process.

Can I use BNPL on Etsy or Amazon?

No. Etsy and Amazon don’t allow third-party BNPL providers at checkout. You can only use their own payment systems. BNPL is for independent e-commerce stores using Shopify, WooCommerce, BigCommerce, or Magento.

What if a customer returns an item bought with BNPL?

The BNPL provider handles the refund. If the customer returns the item, you get the full amount back from the provider, and the customer’s future payments are canceled. You don’t have to do anything extra - just process the return like normal.

Is BNPL bad for my customers’ credit?

Starting in 2025, missed BNPL payments are reported to credit bureaus. On-time payments usually aren’t. So it’s not inherently bad - but if customers miss payments, it can hurt their credit. That’s why providers now screen more carefully. It’s actually making BNPL more responsible.

Can I offer BNPL in my physical store?

Not yet with most providers - but it’s coming fast. Square and Clover are rolling out in-store BNPL in early 2025. If you have a brick-and-mortar shop, keep an eye on your POS provider’s updates. For now, BNPL is mostly online.

Comments (5)

Astha Mishra

It's fascinating how BNPL has subtly rewired consumer psychology-not just as a payment option, but as a cognitive shortcut. The brain doesn’t compute $200 as a single outlay; it fragments it into manageable, almost imaginary chunks. This isn’t just retail-it’s behavioral economics in action. And yet, we rarely pause to ask: are we empowering customers, or conditioning them toward perpetual fragmentation of value? The data shows sales rise, but what’s the long-term cost to financial literacy? I’ve seen young adults juggle five BNPL obligations at once, convinced they’re ‘budgeting’-when really, they’re just delaying the reckoning. Maybe the real innovation isn’t the tech, but our collective willingness to ignore the debt spiral beneath the shiny ‘pay in 4’ button.

Kenny McMiller

Let’s be real-BNPL is the ultimate arbitrage for SMBs. You’re trading 5-6% in fees for 20% higher conversion and 87% AOV lift. That’s not a cost center, that’s a growth lever. Affirm Direct’s 3.5% base fee? That’s the new sweet spot for mid-tier merchants. And don’t get me started on the checkout friction drop-once you embed it as a primary CTA instead of a footer footnote, your conversion skyrockets. The only people losing are the ones still thinking in credit card paradigms. If your margin’s under 30%, you’re not ready for BNPL. Not because it’s risky-because you’re pricing wrong.

Dave McPherson

Ugh. Another ‘BNPL is magic’ thinkpiece. Let’s cut through the venture-capital fog. Klarna and Affirm aren’t philanthropists-they’re predatory lenders dressed in Shopify themes. The ‘85% approval rate’? That’s just the algorithm letting people borrow until they drown, then selling the debt to vulture funds. And you call that ‘responsible’ because they’ll now report to credit bureaus? Congrats, you’ve turned impulse buying into a credit score disaster with a cute UI. I’ve watched three local boutiques go under after BNPL ate their margins. The real ‘table stakes’? Not offering BNPL. It’s offering it *wisely*. Or not at all. Your candle shop made 26% margin? Lucky. Most aren’t. And no, ‘test it on one product’ isn’t a strategy-it’s a death sentence with a dashboard.

Julia Czinna

I appreciate how thorough this breakdown is-especially the part about margin erosion. I run a small jewelry store and added Klarna last year. Our AOV jumped from $68 to $112, but I was nervous about the 5% fee on $85 items. I only enabled it on pieces over $90, and kept it off anything under $70. Sales increased 35%, and I actually saw fewer returns-people felt more confident committing to higher-value items. The key? Don’t just turn it on everywhere. Be surgical. Also, customers love seeing ‘interest-free’ on the product page. It’s not just a payment option-it’s a reassurance. And yes, train your team. One customer called screaming because she thought *you* were collecting the installments. You’re not. Klarna is. That simple clarification saved my sanity.

RAHUL KUSHWAHA

thanks for sharing. 😊