Tax-Loss Harvesting Calculator

Calculate Your Tax Savings

See how much you could save by coordinating tax-loss harvesting with rebalancing.

Your Tax Savings

Gains Offset:

Income Offset:

Total Savings:

$0.00

$0.00

$0.00

- Up to $3,000 of losses can reduce your ordinary income each year

- Unused losses carry forward indefinitely

- Ensure replacement assets aren't substantially identical to avoid wash-sale rule

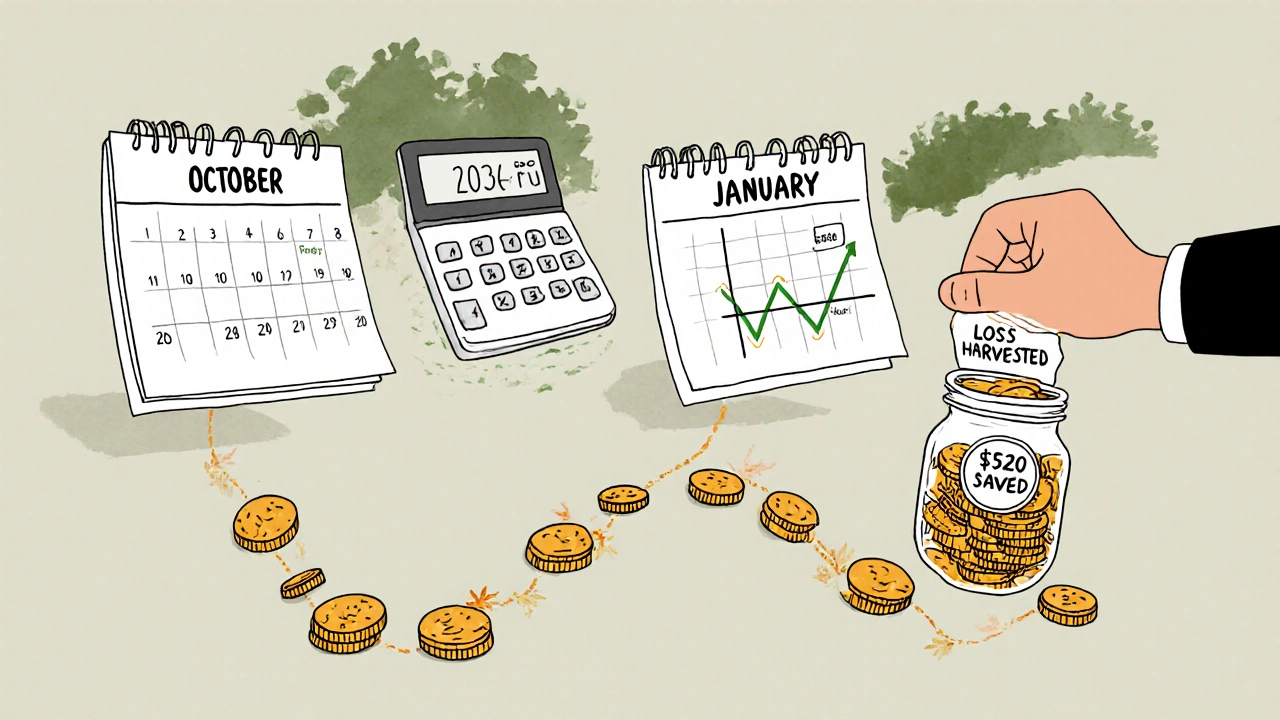

- Best done during October-January window

Imagine selling a stock that’s dropped in value-not because you’re giving up on it, but because you’re turning a loss into a tax break. Now imagine doing that at the exact same time you’re fixing your portfolio’s balance. That’s tax-loss harvesting while rebalancing, and it’s one of the most powerful, underused moves in personal investing.

Most people rebalance their portfolios once a year. They sell what’s grown too big and buy more of what’s fallen behind. Simple. Mechanical. But if you’re only doing that, you’re leaving money on the table. Tax-loss harvesting turns those necessary sales into tax-saving opportunities. When you combine the two, you don’t just fix your allocation-you reduce your tax bill.

How Tax-Loss Harvesting and Rebalancing Work Together

Rebalancing is about risk control. If your target is 60% stocks and 40% bonds, and stocks surge, your portfolio might shift to 70/30. That’s riskier than you planned. Rebalancing brings you back. Tax-loss harvesting is about tax efficiency. If something in your portfolio has dropped, you sell it to lock in a loss. That loss can cancel out capital gains you’ve made elsewhere.

Here’s the magic: when you rebalance, you’re already selling some assets. If those assets are down, you can harvest the loss. If you’re buying more of something else that’s down, you can use that purchase to replace the sold asset-without breaking the rules.

Let’s say you own an S&P 500 ETF that’s dropped 15% since you bought it. Your portfolio is now overweight in bonds because stocks fell. You need to sell some bonds and buy more stocks to get back to 60/40. Instead of just buying the same S&P 500 ETF, you buy a Russell 1000 ETF instead. Same exposure. Different index. Not substantially identical. You’ve harvested the loss, rebalanced your portfolio, and avoided the wash-sale rule.

The Wash-Sale Rule: The One Mistake That Can Cost You Thousands

This is where most people mess up. The IRS says you can’t claim a loss if you buy a “substantially identical” security within 30 days before or after the sale. That’s the wash-sale rule (Internal Revenue Code Section 1091).

Buying the same S&P 500 ETF from the same company? Wash sale. Triggered. Loss disallowed.

Buying a different S&P 500 ETF from another provider? Still a wash sale. The IRS doesn’t care who makes it-what matters is the underlying index.

But buying a Russell 1000 ETF? That’s fine. It holds mostly the same large-cap stocks, but not all of them. It’s not substantially identical. Same goes for switching from a total stock market fund to a large-cap growth fund, or from a U.S. bond fund to an investment-grade corporate bond fund.

Pro tip: Keep a list of 2-3 replacement options for every holding in your portfolio. That way, when you need to sell, you’re not scrambling. Fidelity and Schwab both offer tools that suggest non-identical alternatives. Use them.

Real Numbers: How Much Money Are We Talking About?

According to Charles Schwab’s 2023 backtesting, investors who coordinated tax-loss harvesting with rebalancing gained an extra 0.5% to 1.0% in after-tax returns each year compared to those who just rebalanced mechanically.

Here’s a real example:

- You have $250,000 in a taxable account.

- You realize $20,000 in capital gains from selling appreciated stocks during rebalancing.

- You also harvest $25,000 in losses from underperforming holdings.

You use $20,000 of those losses to offset the gains. That wipes out your tax bill on those gains. You still have $5,000 in leftover losses. You can use up to $3,000 of that to reduce your ordinary income this year. The remaining $2,000 carries forward to next year.

If you’re in the 24% tax bracket, you just saved $4,800 on the gains ($20,000 × 24%) and $720 on the income offset ($3,000 × 24%). Total savings: $5,520.

That’s not theoretical. Investor ‘InvestorJourney87’ on Reddit reported saving $2,145 in one year by doing this with an $185,000 portfolio. Someone with a $750,000 portfolio saved $14,200 over five years.

When This Strategy Doesn’t Work (And Why)

This isn’t a magic bullet. It works best in volatile markets with big swings.

Think 2022: Tech stocks dropped 28%. Energy jumped 58%. Perfect conditions. You could sell your losing tech shares, harvest the loss, and buy energy to rebalance. Win-win.

Now think 2021: Markets went up steadily. Most portfolios stayed within 0.5% of target allocation. No big drops. No big losses to harvest. The strategy added only 0.2% in extra returns-barely worth the effort.

It also doesn’t make sense for small portfolios. If you have less than $50,000, the time, complexity, and potential transaction costs often outweigh the tax savings. Vanguard’s 2023 research found the net benefit for portfolios under $100,000 was often less than 0.2%.

And if you’re in a low tax bracket-say, 10% or 12%-the value of harvesting losses shrinks. You’re not saving much on gains anyway.

Timing Matters: When to Do This

October through January is the sweet spot. Why?

- You get a full year to harvest losses before year-end tax deadlines.

- Markets often dip in December, creating harvesting opportunities.

- You can use the losses to offset gains you’ve already realized in the year.

Don’t wait until December 15th. If you wait too long, you risk triggering a wash sale by accident. Give yourself at least two weeks to research replacements and execute trades.

Also, avoid doing this during market panics. If everything’s falling, you won’t have gains to offset. The point isn’t to sell everything that’s down-it’s to sell the ones you’re already planning to sell for rebalancing.

Tools That Make This Easier

You don’t need to do this manually. Fidelity’s Tax-Coordinated Portfolios and Betterment’s Tax Impact Preview automatically suggest harvestable losses during rebalancing. They even flag potential wash-sale risks.

These tools cut the time needed from 5 hours to under 30 minutes a year. But they cost extra-usually 0.25% in advisory fees. For portfolios over $200,000, that’s often worth it.

If you’re DIYing, make sure your brokerage lets you use specific identification for tax lots. That means you can choose exactly which shares to sell-not just the oldest ones (FIFO). This alone can boost your tax savings by 18%, according to Schwab’s analysis.

What About IRAs and 401(k)s?

You can’t harvest losses in tax-advantaged accounts. No point. You don’t pay taxes on gains there anyway.

But here’s the smart move: put your most tax-inefficient assets-like bond funds or REITs-in your IRA or 401(k). Put your most tax-efficient assets-like broad-market ETFs-in your taxable account. That way, when you rebalance and harvest losses, you’re doing it in the right place.

It’s not just about harvesting losses. It’s about where you hold the assets that might generate them.

Common Pitfalls and How to Avoid Them

- Buying the same ETF back too soon. Solution: Use a different index or sector fund as a replacement.

- Not tracking tax lots. Solution: Turn on specific identification in your brokerage account.

- Harvesting in a bull market. Solution: Wait for volatility. Don’t force it.

- Ignoring the $3,000 income offset cap. Solution: Carry forward unused losses. They never expire.

- Trying to do this across multiple accounts. Solution: Coordinate sales between taxable and retirement accounts. Don’t sell a losing stock in your taxable account and buy it in your IRA within 30 days. That’s still a wash sale.

A 2023 Schwab survey found 34% of investors accidentally triggered wash sales. Most did it because they didn’t know the rule applied across accounts.

Is This Worth the Effort?

For investors with $100,000+ in taxable accounts, yes. Especially if you’re in the 22% tax bracket or higher. The data is clear: coordinated tax-loss harvesting and rebalancing adds real, measurable value.

It’s not about chasing every penny. It’s about stacking small advantages. Rebalancing keeps your risk in check. Tax-loss harvesting keeps more of your returns. Do them together, and you’re not just managing your portfolio-you’re optimizing it.

The biggest mistake? Thinking you need to be a tax expert. You don’t. You just need a plan, a list of replacements, and the discipline to act during the right window.

And if you’re still unsure? Talk to a fee-only financial planner who understands tax-loss harvesting. Most charge by the hour. One session could pay for itself.

Can I harvest losses in my Roth IRA?

No. You cannot harvest tax losses in any tax-advantaged account, including Roth IRAs, traditional IRAs, or 401(k)s. These accounts are designed to grow tax-free or tax-deferred, so capital gains and losses inside them don’t affect your tax return. Tax-loss harvesting only applies to taxable brokerage accounts.

What if I don’t have any capital gains to offset?

That’s fine. You can still use up to $3,000 of your capital losses to reduce your ordinary income each year (like wages or interest). Any losses above that can be carried forward indefinitely to future tax years. So even if you have no gains, harvesting losses still gives you a tax benefit.

Do I have to sell the exact same fund to rebalance?

No. In fact, you shouldn’t. To avoid the wash-sale rule, you must replace the sold asset with something that’s not “substantially identical.” For example, sell an S&P 500 ETF and buy a Russell 1000 ETF. Or sell a U.S. total market fund and buy a large-cap growth fund. They’re similar enough to maintain your exposure but different enough to comply with IRS rules.

How often should I check for tax-loss harvesting opportunities?

Most investors review their portfolios quarterly, but the best time to harvest is during your annual rebalancing window-typically October through January. Some automated platforms now monitor portfolios continuously, but for DIY investors, once a year is sufficient unless there’s a major market shift.

Can I use tax-loss harvesting on cryptocurrencies?

Yes. Since IRS Revenue Ruling 2023-14, cryptocurrency sales qualify for tax-loss harvesting just like stocks and ETFs. You can sell a losing crypto position and use the loss to offset gains from other crypto sales or capital gains from stocks. The wash-sale rule still applies-so don’t buy back the same cryptocurrency within 30 days.

Is tax-loss harvesting worth it if I’m not in a high tax bracket?

It depends. If you’re in the 10% or 12% tax bracket, the benefit is smaller because you pay less on capital gains anyway. But if you have large losses and no gains to offset, you can still use up to $3,000 to reduce your ordinary income. For portfolios over $100,000, even a small tax saving adds up over time. It’s not about being rich-it’s about being smart with what you’ve got.

Comments (4)

Julia Czinna

I’ve been doing this for three years now, and honestly, it’s the quietest win in my portfolio. I don’t brag about it, but that $4,200 I saved last year? That’s a weekend trip paid for. The key is having your replacements mapped out ahead of time-no last-minute panic when the market dips. I keep a Google Sheet with tickers, indexes, and why they’re non-identical. Simple, but it saves headaches.

Also, don’t ignore the carryforward. I’ve got $11k in unused losses from 2020 still ticking away. They’ll pay off someday, even if I’m retired by then.

Laura W

Bro. This is the alpha move. Rebalancing without tax-loss harvesting is like wearing a Rolex while giving away your cash to the IRS. You’re not just optimizing-you’re weaponizing your portfolio. Russell 1000 over S&P? Genius. Wash-sale traps? Avoided. And yes, crypto counts now-so if your Solana’s in the toilet, sell it, buy Ethereum, and laugh all the way to the tax deduction. This isn’t finance-it’s financial warfare.

Tools like Betterment? Worth every penny if you’re over $150k. Otherwise, DIY with specific identification turned ON. No excuses.

Dave McPherson

Oh wow. Another amateur with a spreadsheet thinking they’ve cracked the code. Let me guess-you think buying a Russell 1000 instead of an S&P 500 is some kind of tax loophole genius? Newsflash: the IRS doesn’t care if you swap tickers. If the underlying holdings are 90% the same, you’re still playing with fire.

And let’s not pretend this strategy works in real life. I’ve seen 90% of people who ‘harvest’ losses end up buying back the same fund three weeks later because they panicked. Then they get audited and have to pay penalties plus interest. The 0.5% annual return boost? That’s backtested fantasy. Real markets don’t care about your ETF swaps.

Also, you mention Vanguard’s research but ignore that 70% of retail investors can’t even define ‘tax lot.’ If you’re not using a professional platform, you’re just gambling with Form 8949.

And don’t even get me started on crypto. The IRS treats it as property, but half the people doing this don’t even know how to track cost basis. Pathetic.

RAHUL KUSHWAHA

This is really helpful 😊 I tried it last year with my small portfolio and saved $180. Not much, but still better than nothing. Will keep doing it every Jan. Thank you for sharing!