Digital Budget Cap Calculator

Calculate Your Spending Cap

Determine your realistic budget limit for any category using your past spending data.

Your Budget Cap

$0.00

Alert Thresholds

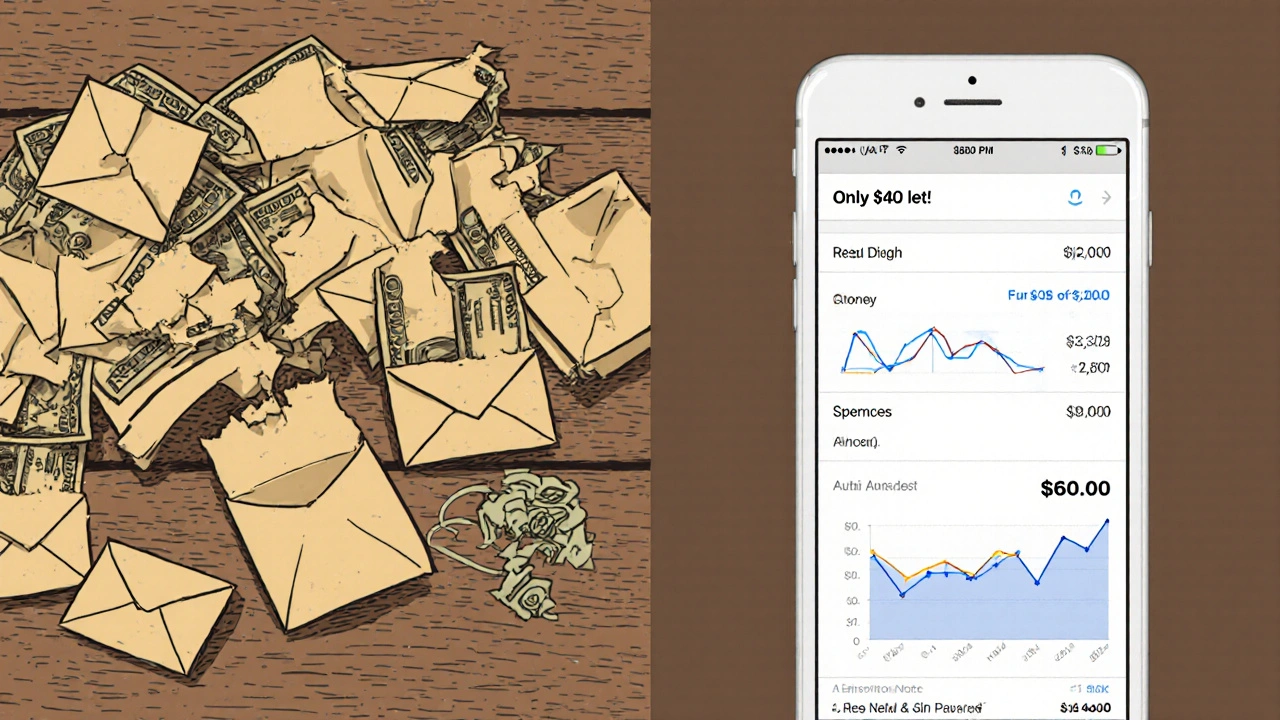

Remember when you’d stuff cash into envelopes labeled "Groceries," "Entertainment," and "Gas"? You’d hand over the last dollar in the dining-out envelope and say no to pizza night-not because you were being strict, but because there was literally nothing left to spend. That’s the power of envelope budgeting. Now imagine that same system, but without the physical cash, the mess, or the risk of losing money. That’s digital envelope budgeting.

What Digital Envelope Budgeting Actually Does

Digital envelope budgeting takes the old-school cash method and turns it into a smart, real-time system. Instead of tearing open a physical envelope, you assign a monthly limit to a virtual category in an app. When you spend, the app deducts it instantly. When you hit 90% of your cap, you get a push notification. When you hit 100%, you’re blocked-or at least strongly warned.This isn’t just a fancy spreadsheet. It’s behavioral design. The goal is to make your spending feel as tangible as handing over cash. Studies show people spend less when they can see their money disappearing in real time. A 2022 Journal of Financial Therapy study found digital envelope users had 32% greater spending awareness than those who didn’t use any budgeting method. That’s not magic. That’s psychology.

Your Categories: The Foundation of Control

The magic starts with your categories. These aren’t random. They’re based on your actual spending. Look at your bank statements from the last three months. What keeps blowing up your budget? Groceries? Dining out? Subscription services? Those are your first envelopes.Most people start with 5-8 core categories:

- Groceries

- Dining Out

- Entertainment (movies, streaming, events)

- Utilities (electricity, water, internet)

- Transportation (gas, public transit, car maintenance)

- Personal Care (haircuts, toiletries)

- Gifts & Donations

- Emergency Fund (yes, this counts as an envelope too)

Don’t overcomplicate it. If you have 15 categories and only track 3 of them, you’re setting yourself up to quit. Start small. Pick the areas where you lose control. One Reddit user cut their grocery bill by 40% in two months just by creating a single envelope for groceries and turning on alerts at 70%.

Caps: Setting Realistic Limits

Your cap isn’t a guess. It’s a number based on reality. If you spent $600 on groceries last month, don’t set your cap at $400 right away. That’s unrealistic. Set it at $550. Give yourself a 10% buffer to adjust. The goal isn’t to punish yourself-it’s to create space for awareness.Here’s how to set your caps:

- Look at your last 3 months of spending for each category.

- Average the numbers.

- Subtract 10-15% to create a cushion.

- Round to the nearest $25 or $50 for simplicity.

For example: You spent $420, $480, and $450 on dining out. That’s an average of $450. Set your cap at $400. Now you’re forcing yourself to think before ordering that $25 appetizer. That’s the point.

Alerts: The Invisible Enforcer

This is where digital beats physical. With cash, you only know you’re out when the envelope is empty. With digital, you get warned before you cross the line.Top apps let you set multiple alert levels:

- 70% alert: "You’ve spent $280 of your $400 dining budget. Time to start thinking about home-cooked meals."

- 90% alert: "Only $40 left. If you go out tonight, you’ll be out of money for the rest of the month."

- 100% alert: "Budget exhausted. No more spending in this category until next month."

Some apps, like NorthOne and YNAB, now go further. They’ll block transactions outright if your envelope hits zero-just like the physical envelope. Mastercard’s pilot program showed this feature reduced overspending by 58% because it removed the temptation to "just this once."

Apps That Do This Well

Not all apps are built the same. Here’s what’s actually working for real people in 2025:| App | Price | Key Features | Best For |

|---|---|---|---|

| YNAB (You Need A Budget) | $14.99/month or $99/year | Predictive caps, real-time sync, zero-based budgeting, detailed reports | People who want deep control and are willing to pay |

| Mint | Free (with ads); $9.99/month for premium | Auto-categorization, basic alerts, bank syncing | Beginners who want free setup |

| Citizens Savings Tracker® | Free (for account holders) | Bank-integrated, automatic transaction tracking, simple interface | Customers of Citizens Bank |

| Actual Budget | $5/month or $50/year | Offline mode, customizable envelopes, no ads | Privacy-focused users |

| NorthOne | Free for small business accounts | Overspend protection, transaction blocking, business expense tracking | Freelancers and small business owners |

Consumer Reports found that 63% of free budgeting apps sell your spending data to advertisers. Paid apps? Only 12% do. If you care about privacy, pay for it. Your data is worth more than you think.

What You’ll Lose (and Gain)

Digital envelope budgeting isn’t perfect. It has trade-offs.Here’s what you give up:

- The tactile feeling: Dave Ramsey’s team says handing over cash creates a psychological barrier. You don’t feel that with a tap on your phone.

- Cash transactions: If you pay for gas with cash or give your kid $20 in birthday money, you have to manually log it. If you forget, your numbers are off.

- App glitches: In 2023, one user lost $1,200 when a budgeting app failed to sync during a bank outage. It’s rare, but it happens.

Here’s what you gain:

- Time: You save 47% of the time you’d spend manually tracking cash envelopes, according to Main Street Bank.

- Consistency: 78% of users stick with digital budgeting long-term. Only 34% stick with cash envelopes after six months.

- Insight: You see patterns. You notice you spend $300 more on takeout every December. You adjust before it happens.

How to Start (Without Getting Overwhelmed)

You don’t need to rebuild your whole life in one weekend. Here’s how real people do it:- Pick one category where you overspend. Groceries? Eating out? Subscriptions?

- Set a cap at 10% below your average spending.

- Turn on alerts at 70% and 90%.

- Link your bank account or manually log transactions for 14 days.

- At the end of two weeks, ask: Did you stick to it? Did you feel more in control?

If yes, add another category. If no, adjust the cap or try a different app. This isn’t about perfection. It’s about progress.

Who It Works For (And Who It Doesn’t)

Digital envelope budgeting thrives with:- People with irregular income (freelancers, gig workers)

- Those who struggle with impulse buys

- Anyone who’s tried other budgeting methods and failed

- Millennials and Gen Z (42% and 38% adoption rates, respectively)

It struggles with:

- People who hate logging transactions

- Those who pay mostly in cash and won’t track it

- Anyone who expects automation to do all the work

Dr. Sarah Newcomb, a behavioral economist, found that while digital envelopes improve awareness, they don’t match the emotional impact of cash. If you need that gut-check feeling, try hybrid: keep a small cash envelope for one category (like dining out) and digitize the rest.

The Future: Where This Is Headed

This isn’t just a trend. It’s becoming infrastructure. By 2025, 73% of major U.S. banks will have digital envelope tools built into their apps. Mastercard is testing direct payment blocking-so if your "Entertainment" envelope is empty, your card just won’t work at the movie theater.Apps are getting smarter too. YNAB’s predictive caps now adjust your limits based on your 90-day spending. If you’ve been under-spending on groceries, it nudges your cap up. If you’ve been blowing through your entertainment budget, it suggests a reduction.

But here’s the real win: the Consumer Financial Protection Bureau reports a 28% year-over-year growth in digital envelope usage. People aren’t just trying it. They’re sticking with it.

Final Thought: It’s Not About the App. It’s About the Habit.

The best digital envelope system is the one you’ll actually use. You can have the fanciest app with AI alerts and transaction blocking-but if you don’t check it weekly, it’s just another app collecting dust.Start small. Pick one category. Set one cap. Turn on one alert. See what happens. You might be surprised how much control you gain when you stop guessing and start knowing.

Do I need to use an app for digital envelope budgeting?

No, but it’s much harder without one. You can use a spreadsheet or even a notebook, but you lose real-time tracking, alerts, and automatic syncing. Apps like YNAB, Actual Budget, or your bank’s built-in tool automate the hard parts so you can focus on spending less.

What if I go over my envelope budget?

You have a few options. You can take money from another envelope (if you have a buffer), wait until next month, or treat it as a learning moment. The goal isn’t perfection-it’s awareness. If you’re over, ask why. Was it a one-time event? Or a pattern? Adjust your cap next month based on what you learned.

Can I use digital envelope budgeting if I get paid irregularly?

Yes-this is actually where digital envelope budgeting shines. You can assign income as it comes in, not on a fixed monthly schedule. Apps like YNAB and NorthOne let you roll over unused funds and adjust caps dynamically. Freelancers and gig workers who use this method report 37% better budget adherence than those using traditional monthly budgets.

Is digital envelope budgeting safe?

Most reputable apps use 256-bit encryption, biometric login, and tokenized data-same as your bank. But free apps often sell your spending data. Stick to paid apps or bank-integrated tools. Avoid apps that ask for unnecessary permissions. Always enable two-factor authentication. Security isn’t optional-it’s part of the system.

How long does it take to see results?

Most people see changes in spending habits within 30 days. A NorthOne survey found 68% of users reported improved discipline within three months. The key is consistency. Don’t wait for a "perfect" setup. Start with one category. Track for two weeks. Adjust. Repeat.

What if my bank doesn’t offer digital envelopes?

You don’t need your bank to offer it. Apps like YNAB, Actual Budget, and Mint connect to any U.S. bank account via secure APIs. Just link your accounts, and the app pulls in transactions automatically. You’ll still get all the envelope features-just through the app, not your bank’s interface.

Comments (4)

Laura W

OMG YES. I started with YNAB last year after blowing through $800 on takeout in one month. Turned on the 70% alert for dining out and suddenly I’m cooking like my life depends on it. The app doesn’t judge-it just shows you the truth. Now I’m down to $200/month and actually enjoying my meals because I’m not guilt-snacking after overspending. This isn’t budgeting. It’s behavioral hacking.

Graeme C

Let me be brutally honest: most people who preach this method have never lived paycheck to paycheck. Setting caps based on averages assumes stability. What if your car breaks down? What if your freelance gig vanishes? This system is built for middle-class fantasy economics. And don’t get me started on ‘transaction blocking’-you think a bank app will stop you from using your credit card? Please. The only thing that stops spending is discipline. Not push notifications.

Astha Mishra

While I deeply admire the intention behind digital envelope budgeting, I find myself reflecting on the deeper philosophical implications of this shift-from tangible, physical constraint to algorithmic guidance. In the past, one held cash in one’s hand, felt its weight, understood its finality; now, we delegate our financial will to a screen, trusting a system that may glitch, misreport, or simply disappear with a server outage. Is this progress, or merely a more convenient form of denial? I do not dismiss the utility-indeed, the data shows improved awareness-but I wonder: have we traded the soul of money for its efficiency? And if so, at what cost to our relationship with value itself?

Kenny McMiller

Bro, the real win is the 90% alert. That’s when your brain goes from ‘I’ll just get coffee’ to ‘wait, I have $37 left for the whole month?’ It’s not about the app-it’s about the friction. You’re forcing your dopamine-driven self to pause. That’s behavioral economics in action. And yeah, I use Actual Budget because I don’t want some ad-tech startup selling my pizza habit to DoorDash. Pay the $5. Your privacy is worth more than your last burrito.