ESG Investment Cost Calculator

Fees Comparison

Imagine investing in companies that match your values-clean energy, fair wages, ethical leadership-without ever picking a stock yourself. That’s what ESG robo-advisors do. They combine the low-cost, hands-off automation of robo-advisors with the ethical clarity of environmental, social, and governance (ESG) criteria. No more guessing if your mutual fund supports fossil fuels or child labor. The algorithm does the digging. And it’s not just for millionaires anymore. Today, anyone with $500 can start an ESG portfolio that’s automatically rebalanced, tax-optimized, and aligned with their ethics.

How ESG Robo-Advisors Actually Work

ESG robo-advisors don’t just avoid bad companies-they actively seek out the good ones. Platforms like Carbon Collective, a specialized sustainable robo-advisor founded in 2019 that uses algorithm-driven ESG screening to build portfolios focused on climate action and social equity, and Betterment, a leading robo-advisor that launched ESG portfolios in 2017 and now offers multiple sustainability tiers to its 700,000+ clients, use data from providers like MSCI and Sustainalytics to score companies on hundreds of ESG factors. These scores feed into algorithms that build diversified portfolios using ETFs like the Vanguard ESG U.S. Stock ETF (ESGV), a low-cost index fund tracking U.S. companies with high ESG ratings, with an expense ratio of 0.12% or the iShares ESG Aware MSCI USA ETF (ESGU), a widely held ESG ETF that excludes companies involved in tobacco, weapons, and coal mining.

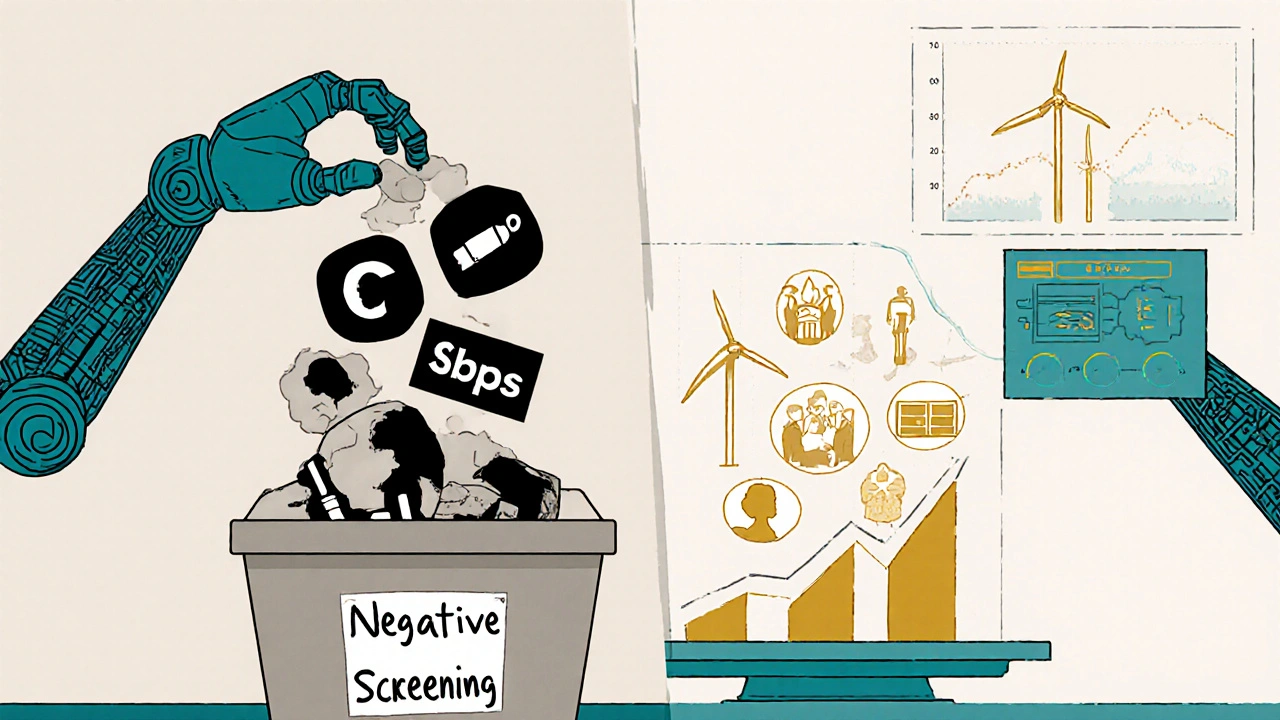

The process isn’t magic. It’s three steps: screening, weighting, and monitoring. First, negative screening removes companies with poor ESG records-think tobacco, weapons, or companies with major pollution violations. Then, positive screening picks out leaders in areas like renewable energy, gender diversity on boards, or supply chain transparency. Finally, the portfolio is weighted using Modern Portfolio Theory (MPT), which balances risk and return by mixing assets that don’t move in lockstep. The result? A portfolio that’s not just ethical, but optimized.

Costs and Performance: Is It Worth the Premium?

Traditional robo-advisors like Wealthfront and Betterment charge around 0.25% annually. ESG versions? Usually 0.30% to 0.50%. That extra 0.05% to 0.25% covers the cost of deeper data analysis, proprietary ESG scoring models, and impact reporting. But here’s the thing: you’re still paying a fraction of what a human advisor charges-typically 1% or more.

And performance? Don’t assume ESG means lower returns. Carbon Collective’s portfolios matched or beat traditional index funds by 0.8% to 1.2% annually between 2020 and 2022. Vanguard’s ESG funds have consistently tracked their non-ESG counterparts with minimal tracking error. In fact, many studies now show ESG-focused portfolios are less volatile during market downturns because they avoid companies with high governance risks-like those with poor leadership or fraud scandals.

But it’s not all wins. Some ESG funds still hold companies with mixed records. A company might score high on carbon emissions but low on labor practices. That’s why transparency matters. Platforms like Carbon Collective now offer Impact Transparency Dashboards, a feature launched in September 2023 that shows users exactly how much CO2 their portfolio avoids and how many women are on boardrooms of the companies they own. Vanguard and Schwab have followed with similar tools.

ESG Robo-Advisors vs. Human Advisors

Human financial advisors who specialize in ESG can do things algorithms can’t. They can ask: “Do you care more about climate change or racial equity?” They can adjust your portfolio if you want to exclude all defense contractors-even if they’re top ESG scorers. They can help you connect your values to your retirement goals, estate plan, or even your child’s education fund.

But they cost more. A human advisor charging 0.75% to 1.5% might be worth it if you have complex needs-like owning a business, planning for a family with special needs, or navigating international assets. For most people, though, robo-advisors are the smarter choice. They’re faster, cheaper, and more consistent. And they’re getting better. In 2023, Carbon Collective started using natural language processing to read corporate sustainability reports-not just rely on third-party scores. That’s the next frontier: AI that understands context, not just numbers.

Who’s Using ESG Robo-Advisors-and Why

It’s not just millennials. According to Charles Schwab’s 2023 Modern Wealth Survey, 68% of investors under 35 want ESG options. That’s nearly double the rate of those over 55. But it’s not just about age. It’s about awareness. People are tired of pretending their money doesn’t matter. They don’t want to fund companies that pollute rivers or suppress union votes. They want their money to reflect their conscience.

Reddit threads like “Has anyone tried ESG robo-advisors? Worth the slight premium?” show real people weighing the trade-offs. One user, u/EcoInvestor42, wrote: “I used to feel guilty about my 401(k). Now I check my dashboard every month and see my portfolio helped reduce 12 tons of CO2 this year. That’s peace of mind.”

Trustpilot reviews for Carbon Collective average 4.3 out of 5 stars. Common praise: “Easy setup,” “No jargon,” “I finally feel like my money is doing good.” But the complaints? “I don’t know why Company X is included.” “Can I exclude palm oil?” “Why is this fund holding a company with a bad record on Indigenous rights?”

That’s the gap. ESG scoring isn’t perfect. Different providers use different metrics. One firm might say a company is “green” because it uses solar panels. Another might say it’s not because it sources rare earth minerals from a country with forced labor. That’s why platforms are starting to explain their methodology-not just show a score.

What’s Next for ESG Robo-Advisors

The next few years will bring three big changes. First, regulation. The EU’s SFDR rules force firms to be clearer about what ESG means. The SEC in the U.S. is moving in the same direction. By 2026, you’ll see standardized labels-like “Climate Leader” or “Gender Equity Focused”-instead of vague terms like “sustainable.”

Second, integration. ESG won’t stay in its own box. By 2025, robo-advisors will link your ESG choices to your retirement timeline, tax strategy, and even your risk tolerance. Want to retire early? The algorithm will adjust your ESG exposure to balance impact and growth.

Third, customization. Vanguard announced in August 2023 that it’s rolling out granular ESG sliders in 2024. You’ll be able to say: “I want to prioritize clean energy over diversity,” or “Exclude all companies with ties to China’s surveillance tech.” That’s the future: personalized ethics, automated.

By 2027, Gartner predicts 40% of all robo-advised portfolios will include ESG as standard-not as an add-on. That’s not a trend. It’s a transformation. Investing isn’t just about returns anymore. It’s about responsibility. And automation is making that responsibility accessible to everyone.

How to Get Started

Here’s how to begin in under 20 minutes:

- Choose a platform: Start with Vanguard Digital Advisor (minimum $500), Betterment (no minimum), or Carbon Collective (no minimum, focused on climate).

- Complete the risk quiz: Answer questions about your timeline, risk tolerance, and income goals.

- Select your ESG level: Most platforms offer “Standard,” “Advanced,” or “Impact” tiers. Start with Standard if you’re new.

- Connect your bank account: Use Plaid for instant, secure linking.

- Review your portfolio: Look for the ETFs you’re invested in. Check the fund’s ESG criteria on the provider’s website.

- Check your impact dashboard: See your portfolio’s carbon footprint, gender diversity score, and other metrics.

Don’t worry if you don’t understand every metric right away. The goal isn’t to become an ESG expert. It’s to feel confident your money isn’t working against your values. After one month, 82% of Carbon Collective users say they feel confident in their choices-compared to just 45% of people who try to build ESG portfolios on their own.

Common Pitfalls to Avoid

- Assuming all ESG is the same. One fund’s “ESG” might exclude oil companies. Another might still hold a fossil fuel pipeline operator if it scores well on governance. Always check the holdings.

- Ignoring fees. Paying 0.50% for ESG is fine. Paying 1.25% for a “sustainable” fund that’s just a regular mutual fund with a green label? That’s greenwashing.

- Thinking it’s perfect. ESG scoring is flawed. No algorithm can capture every ethical nuance. But it’s better than nothing.

- Waiting for “perfect” data. The market won’t wait. Start now. You can always adjust later.

Are ESG robo-advisors really better for the planet?

They’re not a silver bullet, but they’re a real step forward. By shifting trillions of dollars away from polluting industries and toward clean energy and ethical labor practices, ESG portfolios create real market pressure. Carbon Collective’s clients, for example, have collectively avoided over 2 million metric tons of CO2 since 2019-equivalent to taking 450,000 cars off the road. It’s not activism, but it’s financial activism.

Can I customize my ESG portfolio beyond what the platform offers?

Most platforms offer preset themes: climate, diversity, human rights. You can’t hand-pick individual stocks. But Vanguard and Carbon Collective are adding sliders in 2024 that let you prioritize certain issues over others. If you need extreme customization-like excluding all companies with ties to a specific country-you’ll still need a human advisor.

Do ESG portfolios underperform during market downturns?

No. In fact, studies show they often outperform. Companies with strong governance and social practices tend to be more resilient during crises. During the 2022 market sell-off, ESG-focused ETFs like ESGV held up better than the S&P 500. Why? They avoided companies with high debt, poor leadership, or reputational risks.

Is ESG investing just a trend for young people?

It started with younger investors, but it’s spreading. In 2023, 42% of investors aged 35-54 said they’d consider switching to an ESG portfolio. As wealth transfers to younger generations, and as climate impacts become more visible, ESG is becoming mainstream-not niche. By 2027, it’ll be the norm, not the exception.

What’s the difference between ESG and SRI?

ESG stands for Environmental, Social, and Governance-it’s about risk and performance. SRI, or Socially Responsible Investing, is more about values: “I won’t invest in guns or tobacco.” ESG robo-advisors use both. They screen out bad actors (SRI) and favor good ones (ESG). Most platforms today blend the two.

Final Thoughts

You don’t need to be an expert to make your money matter. ESG robo-advisors give you the tools to align your investments with your values-without the complexity, the cost, or the guilt. The technology isn’t flawless. The data isn’t perfect. But it’s better than the alternative: blindly trusting a portfolio that might be funding the very problems you care about.

The future of investing isn’t just about growing wealth. It’s about building a world you believe in. And for the first time, automation is making that possible for everyone-not just the wealthy, not just the activists, but regular people with a 401(k) and a conscience.

Comments (5)

Astha Mishra

It's fascinating how automation has democratized ethical investing-once a privilege for the wealthy or the deeply informed, now accessible to anyone with a smartphone and a conscience. I find myself reflecting on the philosophical weight of this shift: our money, once a neutral tool, has become an extension of our moral identity. Does this mean capitalism is evolving toward accountability, or are we simply packaging guilt into ETFs? The algorithms don’t judge, but we do-and that’s the real innovation. I’ve been using Carbon Collective for a year now, and while I don’t pretend to understand every scoring metric, I feel less complicit in systems I despise. That’s not nothing. Maybe ethics in finance isn’t about perfection, but about intentionality. And intentionality, however imperfect, is the first step toward change.

Kenny McMiller

Look, ESG robo-advisors are just beta-phase virtue signaling wrapped in MPT. The data providers like MSCI? Half their metrics are scraped from corporate PR fluff and CSR reports written by interns. And don’t get me started on ‘impact dashboards’-showing me how many tons of CO2 I ‘avoided’ is like bragging you didn’t litter on your way to the gas station. The real alpha is in passive indexing with low fees. ESG adds 0.2% for emotional comfort, not performance. Also, ‘gender diversity on boards’? Cool, but if your portfolio’s overweight in tech, you’re still funding surveillance capitalism. Wake up. This isn’t activism-it’s financial cosplay with a side of ESG-washing.

Dave McPherson

Oh sweet merciful Jesus, another ‘ethical investing’ post. Let me guess-you’re the guy who buys organic kale but still uses Amazon Prime? ESG portfolios are just Wall Street’s way of charging you extra to feel good about funding Chinese solar panels while your local factory closes. And don’t even get me started on Vanguard’s ‘ESG’ funds-they still hold Nestlé, for chrissake. The whole thing’s a gilded cage of greenwashing with a prettier UI. If you really care about the planet, sell your iPhone, ride a bike, and invest in yourself. Or better yet-just put your money in a T-bill and stop pretending your 0.12% expense ratio is saving the world. You’re not a climate warrior. You’re a consumer who bought a sticker.

RAHUL KUSHWAHA

Thanks for this. 😊 I started with Betterment’s ESG option last year. Still learning, but I like that I can see how much CO2 my portfolio avoids. Not perfect, but better than ignoring it. 🙏

Julia Czinna

Kenny and Dave, I hear your skepticism-and honestly, you’re right to call out the flaws. ESG scoring is messy, inconsistent, and sometimes just marketing. But dismissing it entirely ignores the real shift happening: trillions are moving away from harmful industries because ordinary people demanded it. That pressure changes corporate behavior, even if imperfectly. Julia here: I used to think ESG was just feel-good nonsense. Then I saw how my portfolio excluded companies with documented labor abuses. That wasn’t magic-it was data. And yes, it costs a little more. But so does paying for clean water or fair wages. Maybe the real question isn’t whether it’s perfect, but whether we’re willing to accept the alternative: indifference. And for me? Indifference costs more.