Dry Powder Deployment Calculator

Strategic Cash Allocation

Calculate your optimal dry powder percentage based on risk tolerance and market conditions.

Optimal dry powder should be 5-15% for individuals or 25-35% for institutions

Recommended Dry Powder:

-

Current Cash Position:

-

Potential Return (at 30% discount):

-

Deploying at - discount will yield optimal returns when market conditions align with your strategy.

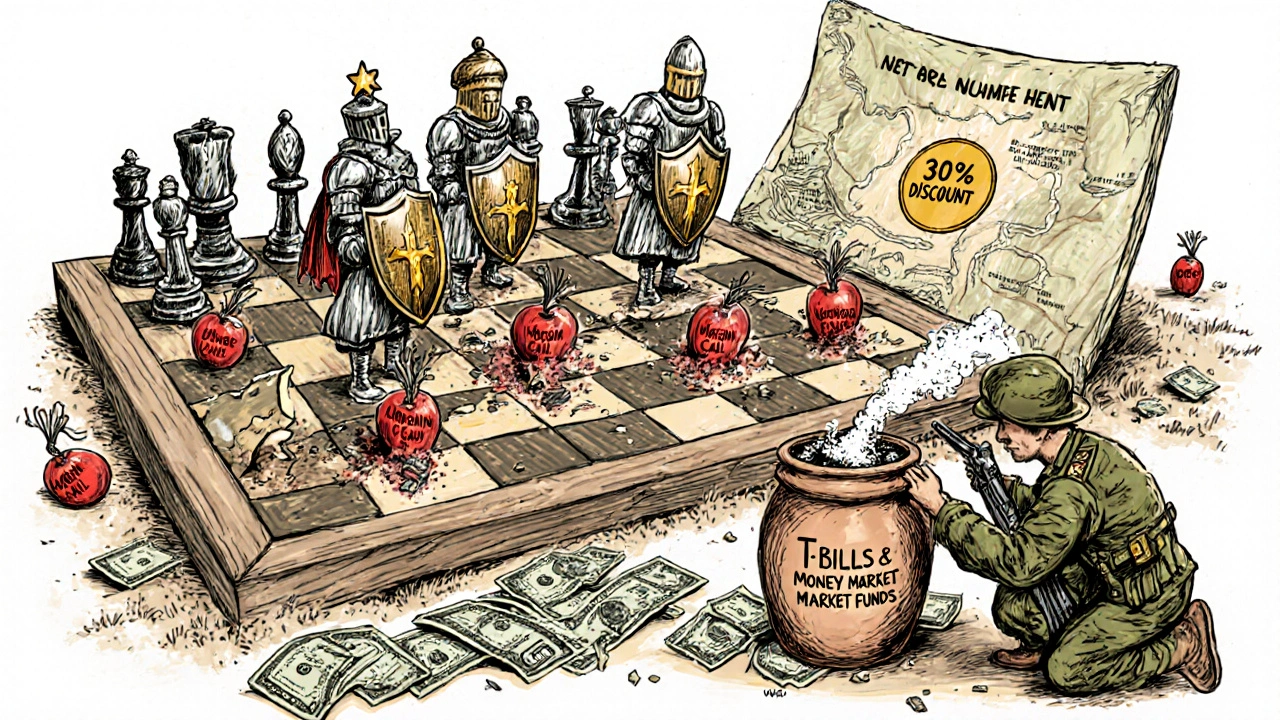

Most people think cash is dead money. If you’re sitting on it, you’re missing out on returns. But that’s not true anymore. In today’s market, holding cash isn’t being cautious-it’s being strategic. The term dry powder isn’t just jargon. It’s the difference between surviving a downturn and thriving in it.

What Exactly Is Dry Powder?

Dry powder is cash-or near-cash-that’s kept aside on purpose. Not for bills. Not for emergencies. Not for spending. It’s held to buy when others are forced to sell. The name comes from old battlefield tactics: soldiers kept their gunpowder dry so their weapons would fire when needed. In finance, it’s the same idea. You don’t want your capital dampened by market noise. You want it ready to ignite when prices drop. As of December 2023, global private equity and venture capital funds held $3.9 trillion in dry powder. That’s more than the entire GDP of Germany. And it’s still growing. Why? Because smart investors know the next big opportunity won’t come in a bull market. It’ll come when panic hits.Where Does Dry Powder Come From?

It’s not just about keeping cash in a checking account. Dry powder has structure. Here’s how it works across different players:- Private equity funds: 85-90% of their dry powder comes from committed but uncalled capital. Investors promise money upfront but don’t pay it all at once. The fund calls it in when a deal is ready. This keeps the cash liquid and ready to deploy.

- Corporate treasuries: Big companies like Apple held $162.3 billion in cash and equivalents in Q3 2023. That’s not idle-it’s insurance. When a competitor goes under or a tech startup collapses, they move fast.

- VC funds: Top venture firms set aside 30-50% of their fund for follow-on rounds. If your first bet turns into a winner, you need cash to double down. Without it, you lose control.

- Individual investors: Most advisors recommend 5-15% of your portfolio in cash. If you’re aggressive, you might go lower. If you’re risk-averse, you might hold more. But skipping it entirely? That’s playing with fire.

Why It Beats Leveraging or Holding Stocks

Some investors think leverage is the answer. Borrow more. Buy more. Push returns. But leverage amplifies losses too. When markets crash, margin calls wipe out portfolios. In March 2020, firms with dry powder like KKR bought assets at 30-40% discounts. They didn’t borrow. They didn’t panic. They just paid cash-and made returns over 35% on those deals. Compare that to hedge funds. They lock up money for 90-180 days. If you need cash fast, you’re stuck. Dry powder doesn’t work that way. It’s not locked. It’s not subject to redemption gates. It’s yours to use, whenever you decide. Even corporate cash reserves-averaging 12.7% of assets for S&P 500 companies-are nowhere near the 40-60% levels seen in top PE funds. Why? Because corporations are forced to keep cash for operations. Investors don’t have that constraint. They can wait. And when the moment comes, they strike.

The Cost of Holding Too Much Cash

But dry powder isn’t magic. There’s a price. During bull markets, cash drags on returns. Bain & Company found that funds holding more than 35% dry powder lost 1.8-2.3% in annual IRR between 2015 and 2019. That’s because their money wasn’t working. It was sitting. And in a rising market, sitting means falling behind. That’s why timing matters. The best investors don’t just hold cash. They have triggers. When the S&P 500 drops 30%? Deploy. When credit spreads widen by 150 basis points? Deploy. When a competitor’s stock crashes on bad earnings? Deploy. These aren’t guesses. They’re rules. One PE fund manager on Reddit said his LPs were pressuring him to deploy faster. His fund had 35% dry powder, and they wanted it down to 20%. But he knew the market was still overheated. He held. Six months later, three deals fell into his lap at 40% discounts. His LPs stopped complaining.Who’s Doing It Right?

Mark Suster, a venture capitalist, keeps 40% of his fund dry for follow-on investments. His firm’s 2015-2020 portfolio returned 28.7% net. Why? Because they didn’t chase every deal. They waited for the winners-and then poured fuel on them. Apollo Global Management spent $10 billion during the pandemic buying distressed assets. Gross IRR? 27%. They didn’t have to borrow. They didn’t have to sell other holdings. They just used their dry powder. Even individuals can use this. In 2022, during the regional banking crisis, a Fortune 500 company held 15% cash. When a rival collapsed, they bought it for 30% below book value. The acquisition generated $420 million in synergies. That’s not luck. That’s strategy.The Dark Side: When Dry Powder Fails

Dry powder doesn’t work if you’re waiting for a crash that never comes. From 2021 to 2022, the average deployment rate fell to 12.3%-well below the historical 15-18% range. Why? Because prices stayed high. No good deals. No fires to put out. Cash sat. And LPs got restless. One family office complained their PE fund had 52% dry powder four years in. They were promised 20% net returns. Instead, they got 2.1% drag from cash. That’s the risk. If you don’t have a plan, dry powder becomes a liability. The worst case? Too much dry powder concentrated in too few hands. BlackRock warns that $1.7 trillion is held by just the top 25 PE firms. If they all try to sell at once during the next crisis, they’ll flood the market. Prices crash. Liquidity dries up. And everyone loses.

How to Build Your Own Dry Powder Strategy

You don’t need to be a billionaire to use this. Here’s how to start:- Set your target. For individuals, 5-15% of your portfolio. For institutions, 25-35% is the sweet spot. Above 40%, you risk cash drag. Below 15%, you won’t have enough firepower.

- Define your triggers. What event makes you pull the trigger? A 20% drop in tech stocks? A 200-basis-point jump in 10-year yields? Write it down. Don’t rely on gut feelings.

- Keep it liquid. Money market funds. T-bills. No ETFs with hidden illiquidity. No long-term bonds. If you can’t access it tomorrow, it’s not dry powder.

- Track deployment rates. If you’ve held cash for two years and haven’t deployed, ask why. Is the market still expensive? Or are you just scared?

- Communicate with your team. If you’re an investor, make sure your LPs understand why you’re holding cash. If you’re a fund manager, document your strategy. Only 37% of firms do this. The top 10% do.

Comments (5)

Astha Mishra

There's something almost poetic about holding cash in a world that worships growth at all costs. We've been conditioned to believe that idle capital is sin, that every dollar must be working, compounding, climbing. But what if the deepest wisdom lies not in chasing the tide, but in waiting for the undertow? Dry powder isn't stagnation-it's sovereignty. It's the quiet confidence of knowing you don't need to dance when the music is off-key. The battlefield metaphor is apt: gunpowder that gets wet is useless, but dry powder? That’s the difference between a war lost and a war won. And right now, with valuations stretched thin and leverage everywhere, I’d rather be the one with the unlit match than the one holding a sparking fuse.

Kenny McMiller

Bro, this whole dry powder thing is just alpha for ‘I’m too scared to invest.’ 3.9T sitting idle? That’s not strategy, that’s FOMO-induced paralysis. PE firms are just using it as a tax shield and a way to inflate their fee base. ‘Deploy triggers’? Sounds like someone wrote a LinkedIn post after reading a McKinsey slide. If you’re not deploying at 15% dry powder, you’re just a rentier with a spreadsheet. And don’t get me started on ‘T-bills and money markets’-that’s not powder, that’s a savings account with a fancy name. Real alpha is buying when the VIX is 40 and everyone’s screaming. Not waiting for a 30% S&P drop like it’s a scheduled sale.

Dave McPherson

Oh wow, what a revolutionary insight. Cash is good. Who knew? This reads like a Bloomberg Terminal version of a fortune cookie. 3.9 trillion in dry powder? Cool. And yet, here we are-still in a bull market, still overvalued, still no ‘crash’ in sight. Meanwhile, your ‘strategic’ cash is losing 5% to inflation while you pat yourself on the back for being ‘disciplined.’ The only thing more predictable than this article is the fact that every single PE fund that held 40%+ dry powder between 2021-2023 just got their LPs screaming into Zoom calls. You don’t need triggers. You need a time machine. And if you’re still holding T-bills thinking you’re Warren Buffett… maybe go read some actual history. The 2008 crash didn’t come with a calendar alert. It came when nobody was ready. Including you.

RAHUL KUSHWAHA

Interesting... I think holding cash is like waiting for the right moment to plant seeds. Not rushing, not fearing. Just watching. 🌱

Julia Czinna

RAHUL KUSHWAHA said it perfectly-there’s a quiet grace in patience. But I’d add this: dry powder isn’t about timing the market. It’s about preserving optionality. The real skill isn’t in knowing when to deploy-it’s in knowing when not to panic when others are deploying poorly. The funds that got crushed in 2020 didn’t lack cash; they lacked discipline. And the ones that thrived? They didn’t wait for a perfect moment. They waited for a *probable* one. The 15% cash rule for individuals? Spot on. Most people treat cash like a failure. It’s not. It’s insurance. And the best insurance policies are the ones you never have to use… but are glad you had when you did.