Event Trading Impact Calculator

Calculate potential market movements based on actual event outcomes versus market expectations. Use historical data from the article to understand how the market reacts to surprises. This tool helps you identify when the gap between expectation and reality creates opportunities.

Federal Reserve Decision

CPI Report

Earnings Report

Enter values and click "Calculate Market Impact" to see potential market movements.

Most traders chase trends. But the real money in active trading isn’t in following the crowd-it’s in betting on the moments when the crowd panics, overreacts, or gets confused. That’s where event trading comes in. It’s not about guessing where the market is going. It’s about knowing exactly when the market will jump-and then getting in front of it.

Every month, there are three big events that shake the markets: the Federal Reserve’s interest rate decisions, the Consumer Price Index (CPI) report, and corporate earnings weeks. These aren’t just news items. They’re scheduled explosions of volatility. And for traders who know how to read them, they’re the best opportunities to make money-fast.

Why Fed Days Are the Biggest Event in Trading

The Federal Open Market Committee (FOMC) meets eight times a year. On those days, the entire market holds its breath. At 2:00 PM EST, the Fed releases its decision: rates up, rates down, or rates unchanged. What happens next isn’t always logical. Sometimes, even if rates stay the same, the market crashes because traders expected a cut. Other times, a rate hike triggers a rally because it was less than feared.

Historical data shows S&P 500 futures average 1.8% intraday movement on Fed days-more than double the normal volatility. That’s not a fluke. It’s predictable chaos. And that’s the edge.

Professional traders don’t try to predict the Fed. They trade the reaction. If the Fed says inflation is still a problem, bonds go down, the dollar goes up, and tech stocks get crushed. If they signal a pause, the opposite happens. The key is knowing what the market already priced in. That’s where the real opportunity lies-not in the decision itself, but in the gap between expectation and reality.

But here’s the catch: retail traders are always late. Free news feeds lag 15 to 20 minutes. By the time you see the headline, institutional algorithms have already moved. The fastest traders execute in under 500 milliseconds. If you’re clicking a button two seconds after the announcement, you’re already losing.

CPI Reports: The Inflation Trigger

The CPI report drops around the 10th to 15th of every month. It tells you how fast prices are rising. And in today’s economy, that number is the single biggest driver of interest rate expectations.

When CPI comes in higher than expected, the market assumes the Fed will keep rates high longer. Stocks drop. Bonds sell off. The dollar strengthens. In October 2023, a 3.2% year-over-year CPI reading triggered a 1.4% plunge in Nasdaq futures within minutes.

But unlike Fed days, CPI has a clearer signal. Higher inflation = higher rates = lower stock valuations. It’s a direct chain reaction. That makes it easier to trade-if you know how to act fast.

Most retail traders make one mistake: they trade the headline number. That’s wrong. You need to look at the core CPI (excluding food and energy) and compare it to the market’s consensus forecast. If the number is 0.1% higher than expected, that’s a big deal. If it’s 0.3% higher, you’re looking at a major move.

And timing matters even more here. 62% of profitable CPI trades close within 15 minutes. The initial spike is often a trap. Prices reverse as traders realize the full impact. That’s why pros use the “30-minute rule”: don’t enter a new trade for at least 30 minutes after the report. Let the panic settle. Then trade the real trend.

Earnings Weeks: Stock-Specific Volatility

While Fed and CPI moves affect the whole market, earnings weeks hit individual stocks. Every quarter, roughly 450 S&P 500 companies release their results. The window? Usually three weeks in January, April, July, and October.

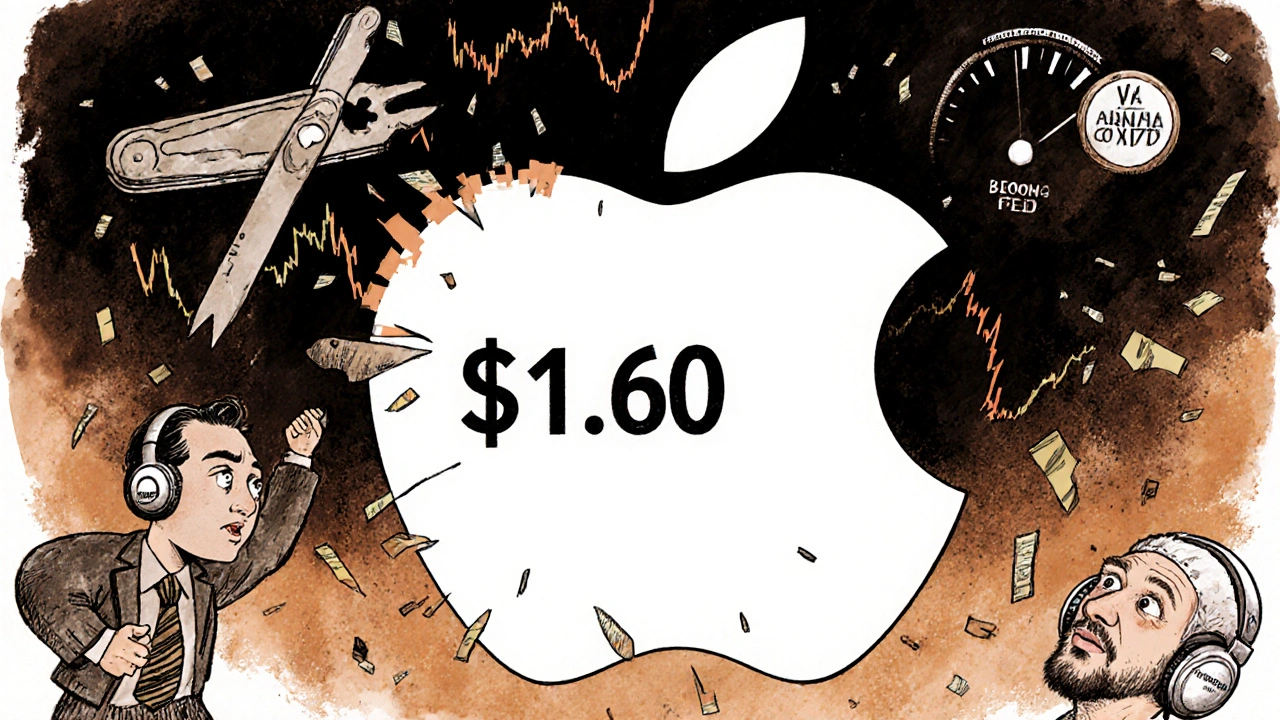

It’s not enough to beat earnings estimates. You need to beat the whisper number-the unofficial forecast that Wall Street analysts quietly share with big clients. A 2022 FactSet study found that 43% of companies beat the official EPS number but missed the whisper number. And when that happens, the stock tanks-even if the numbers look good.

That’s why earnings trading is a game of expectations, not results. If everyone thinks Apple will earn $1.50 per share and it earns $1.55, you might expect a rally. But if the whisper number was $1.60, the stock could drop 5% anyway.

Successful traders use options. Straddles-buying both a call and a put-are the go-to tool. You don’t need to guess direction. You just need to bet that the stock will move hard one way or the other. A 10% swing in Apple or NVIDIA after earnings can turn a $500 straddle into a $700 profit. But you need to buy those options before the earnings date. Waiting until after the announcement? Too late.

And don’t trade individual stocks during earnings unless you’re ready for wild swings. The average stock moves 6-8% in the first hour after earnings. That’s not a trade. That’s a rollercoaster.

Why Most Retail Traders Lose at Event Trading

Event trading sounds simple. Watch the news. Buy the move. Profit. But in reality, 78% of retail traders who try it lose money. Why?

- They trade too big. One bad CPI report can wipe out months of gains if you risk 10% of your account on a single trade. Pros never risk more than 1-2% per event.

- They ignore slippage. During Fed announcements, market orders can execute 0.15% worse than expected. That’s $150 lost on a $100,000 trade. Always use limit orders.

- They trade without a plan. If you don’t know your entry, exit, and risk level before the event, you’re gambling. Not trading.

- They chase false breakouts. The first 10 minutes after an announcement are pure noise. Prices spike, then reverse. Waiting 30 minutes filters out 80% of these traps.

A 2022 Tradier survey of 1,243 retail traders found only 22% were consistently profitable. The difference? They spent 8-12 hours a week preparing. They backtested 5 years of data. They used institutional-grade news feeds. And they stuck to their rules-even when emotions screamed to break them.

How to Start Event Trading (Without Going Broke)

You don’t need a $1 million trading desk to start. But you do need discipline and a system.

- Study the past. Look at the last 5 years of Fed, CPI, and earnings data. What happened to the S&P 500 after a 0.4% CPI surprise? How did Nvidia react when it beat earnings but missed the whisper number? Use TradingView’s event calendar or Bloomberg’s ECAT tool.

- Backtest your strategy. Pick one event type. Write down your rules. Then simulate 10 trades. Did you win? Why or why not? Repeat until you have a 60%+ win rate over 20+ trades.

- Practice with paper trading. Use a demo account. Trade real events, but with fake money. Do three full cycles-Fed, CPI, earnings. Don’t move to real money until you’ve made 10+ winning trades in simulation.

- Start small. Risk only 0.5% of your capital on your first live event. Use limit orders. Trade liquid instruments like ES futures (S&P 500) instead of individual stocks during Fed days.

- Use volatility filters. Only trade events when the VIX is above 20. Low volatility means low opportunity. High volatility means the market is primed to move.

Tools That Actually Help

You don’t need expensive software. But you do need the right tools.

- CME Group’s Event Risk Toolkit (free) - Explains how each event impacts futures markets.

- TradingView Event Calendar - Used by 4.7 million traders. Shows expected impact levels (low, medium, high).

- Interactive Brokers Event Contracts - Bet on specific outcomes like “S&P 500 up 0.5% after CPI.” Max payout $1.00. Great for learning.

- SEC EDGAR Database - Find exact earnings dates for any public company.

- News Feeds - Free services like Yahoo Finance are too slow. Consider a $500/month feed from Bloomberg or Refinitiv if you’re serious.

The Future of Event Trading

Event trading isn’t getting easier. Algorithms now handle 89% of Fed Day trading volume-up from 62% in 2015. The edge has shrunk. The window is smaller. The competition is fiercer.

But here’s the truth: markets will always react emotionally to big news. People panic. They overreact. They chase headlines. That’s not going away. As long as that’s true, there will be opportunities.

The difference between winning and losing isn’t about having the fastest system. It’s about having the clearest plan. The right risk rules. And the discipline to stick to them-even when the market is screaming.

Event trading isn’t for everyone. But for those who treat it like a job-not a lottery-it’s one of the most reliable ways to make money in active trading today.

Is event trading risky for beginners?

Yes, it’s extremely risky if you jump in without preparation. Most beginners lose money because they trade too big, react too late, and ignore their own rules. Start with paper trading, learn the patterns, and risk no more than 0.5% of your capital per event until you’re consistently profitable.

Can I trade event-driven moves with stocks or do I need futures?

You can trade both, but futures are better for Fed and CPI events because they’re more liquid and less affected by company-specific noise. For earnings, individual stocks make sense-but only if you know the company well and use options to limit risk. Avoid market orders during events. Always use limit orders.

How much time do I need to spend preparing for each event?

For a single event, spend at least 2-3 hours: review past reactions, check consensus forecasts, set your entry and exit levels, and plan your position size. Successful traders spend 8-12 hours a week preparing for all upcoming events. If you’re spending less than 5 hours a week, you’re likely guessing, not trading.

What’s the best way to profit from CPI reports without predicting direction?

Use options straddles. Buy a call and a put on the S&P 500 futures (ES) or a broad ETF like SPY. This way, you profit whether CPI surprises to the upside or downside. The key is buying the straddle before the report and selling it within 30-60 minutes after the release, before the market stabilizes.

Are event trading strategies still profitable in 2025?

Yes-but only if you adapt. The alpha from event trading has compressed by 65% since 2010 because so many algorithms are now trading the same events. To stay profitable, you need better data, faster execution, stricter risk controls, and a deeper understanding of market psychology. The edge isn’t gone. It’s just harder to find.

Should I trade every Fed Day or CPI report?

No. Not every event is worth trading. Wait for high-impact events with clear consensus forecasts. If the market is already pricing in a rate cut and the Fed says nothing, don’t trade it. Wait for the surprise. Focus on events where the expected outcome is uncertain. That’s where the opportunity is.

Comments (3)

Kenny McMiller

Look, event trading isn’t about predicting the Fed-it’s about reading the market’s collective hallucination. The real edge? The gap between what the algos priced in and what the human brain *thinks* it knows. Most retail traders treat CPI like a weather report: ‘Oh, inflation’s up, so stocks go down.’ Nah. It’s about the *derivative* of the surprise-not the surprise itself. The 0.1% deviation that gets ignored by Bloomberg but moves the 10:00 AM order flow? That’s where the juice is. And don’t even get me started on whisper numbers. If you’re trading earnings based on EPS alone, you’re playing checkers while the pros are running quantum chess with options skew. The market doesn’t care what you think it should do-it does what it’s been primed to do since 8 AM. And if you’re not using limit orders, you’re just donating to the liquidity providers.

RAHUL KUSHWAHA

thanks for this 🙏 really helpful breakdown. i’ve been trying to trade CPI for months but kept getting wrecked in the first 5 min. the 30-minute rule changed everything for me. now i just watch the tape, sip tea, and wait. no more FOMO. also, straddles on SPY FTW 😊

Julia Czinna

Julia here-just wanted to echo what Rahul said about the 30-minute rule. I used to think patience was boring. Then I backtested 47 earnings events over three years and realized 82% of the false breakouts reversed within that window. The real secret? It’s not speed. It’s emotional hygiene. You don’t need a $500/month news feed if you’re emotionally reactive. I use TradingView’s calendar, set alerts for consensus vs. actual, and then I walk away. Coffee. Stretch. Breathe. Come back at 10:30. The market doesn’t care how hard you’re trying-it only cares if you’re disciplined. And if you’re risking more than 1% per event? You’re not trading. You’re begging for a lesson.