Asset Location Tax Calculator

Calculate Your Tax Savings

Your Tax Savings

Annual Tax Savings

Potential Growth

Optimal Placement Recommendation

Why Your Investments Are Losing Money in the Wrong Accounts

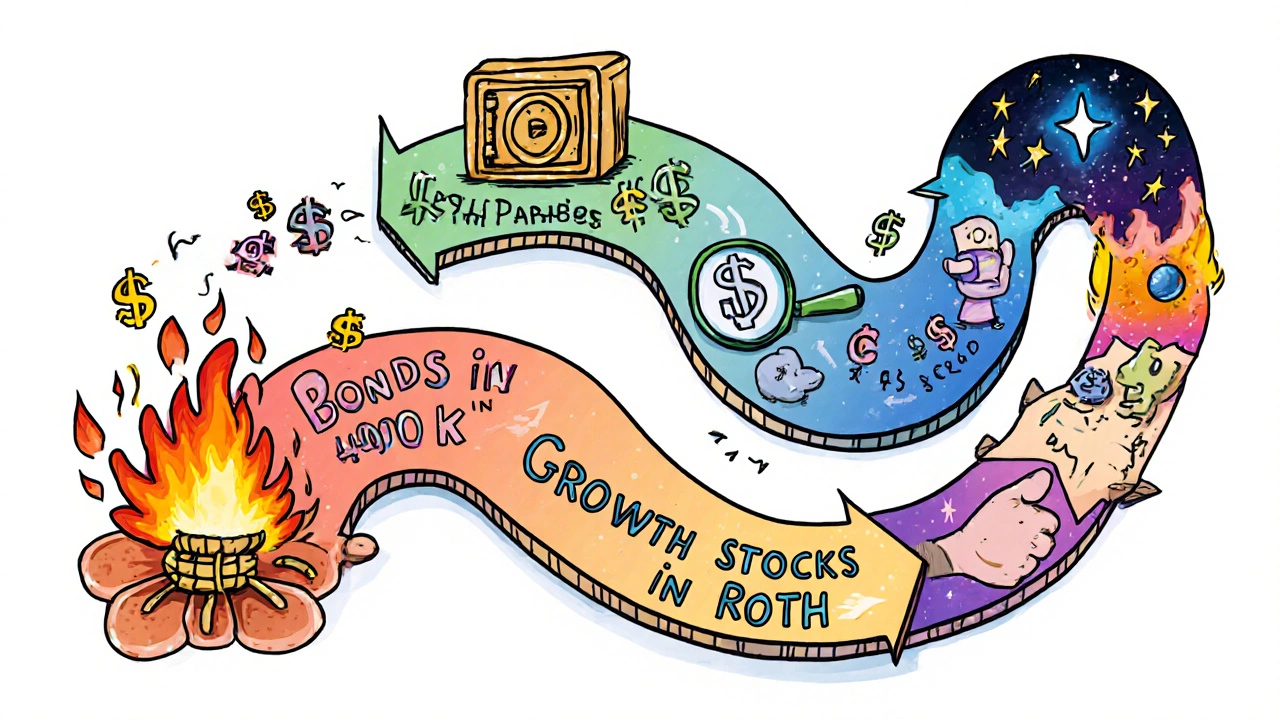

You’ve got a solid portfolio. Stocks, bonds, maybe a few ETFs. You rebalance yearly. You keep fees low. But if you’re holding bonds in your taxable brokerage account or growth stocks in your traditional IRA, you’re leaving money on the table-possibly thousands of dollars every year. It’s not your allocation that’s the problem. It’s your location.

Asset location strategy isn’t about picking better funds. It’s about putting the right funds in the right accounts. Think of it like parking your car: you wouldn’t leave a convertible out in a hailstorm. You wouldn’t store your winter tires in the garage all summer. Same with investments. Some assets are built to thrive in tax-advantaged spaces. Others do fine in plain sight. Get it wrong, and taxes silently eat your returns-year after year.

How Tax Accounts Work (And Why It Matters)

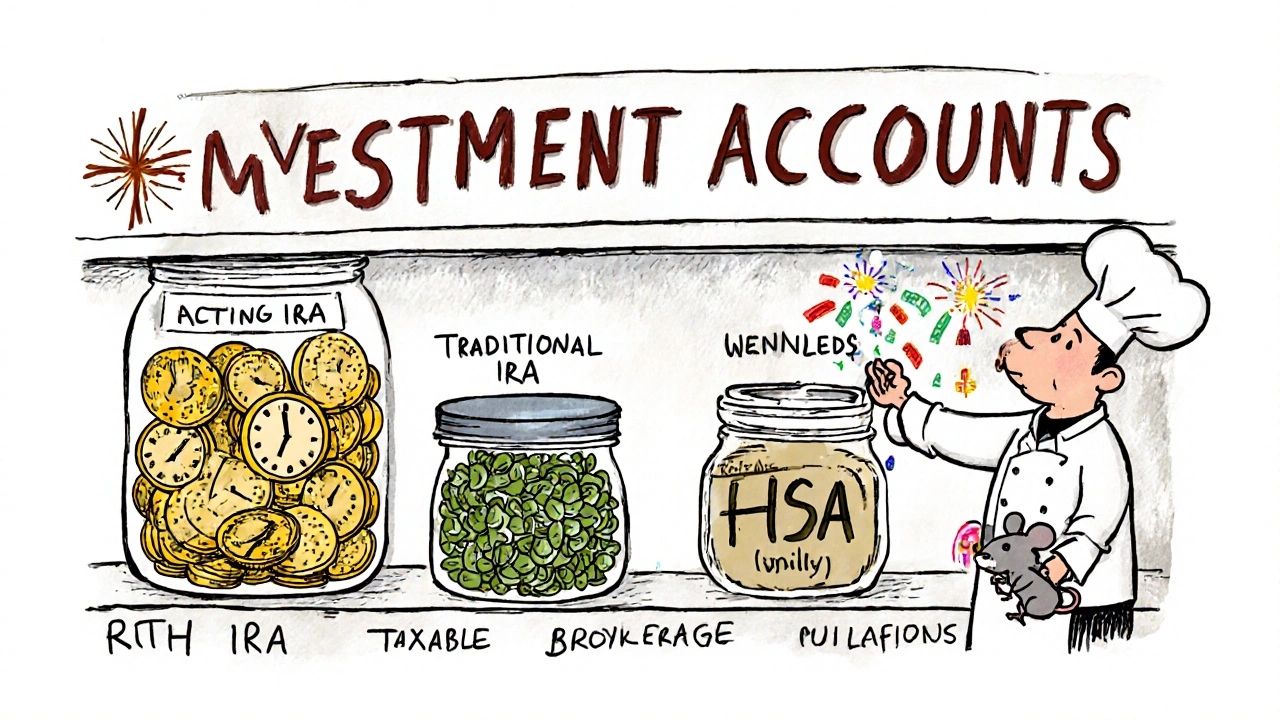

There are three main types of investment accounts, each with its own tax rules:

- taxable accounts: Brokerage accounts you open with any bank or platform. You pay taxes every year on dividends, interest, and capital gains. Short-term gains (held less than a year) are taxed as ordinary income-up to 37%. Long-term gains (held over a year) get lower rates: 0%, 15%, or 20%.

- tax-deferred accounts: Traditional IRAs and 401(k)s. You get a tax break when you contribute, but you pay full ordinary income tax when you withdraw-no matter if it came from dividends, interest, or stock gains.

- tax-exempt accounts: Roth IRAs and Roth 401(k)s. You pay taxes upfront on contributions, but everything that grows inside-dividends, interest, stock appreciation-is completely tax-free when withdrawn after age 59½ and holding the account for five years.

There’s also the Health Savings Account (HSA), which is the only triple-tax-free account: contributions are deductible, growth is tax-deferred, and withdrawals for medical expenses are tax-free. If you’re eligible, treat this like a supercharged Roth IRA.

Which Assets Belong Where?

Not all investments are created equal when it comes to taxes. Some generate lots of taxable events. Others barely make a ripple. Here’s how to sort them:

- Tax-inefficient assets (put these in tax-deferred accounts): These create regular income that’s taxed at your top rate. Think bonds, REITs, and actively managed mutual funds. A corporate bond paying 5% interest? That’s 5% taxed at your income rate-maybe 32% or 37%. A REIT paying 6% in dividends? Also taxed as ordinary income. These should live in your 401(k) or traditional IRA, where the taxes are deferred.

- Tax-efficient assets (put these in taxable accounts): These grow mostly through price appreciation, not income. Buy-and-hold index funds, growth stocks, and municipal bonds are perfect here. Municipal bonds pay interest that’s exempt from federal tax-and sometimes state tax too. Growth stocks held long-term? You pay just 15% or 20% on gains, and only when you sell. Plus, you can use tax-loss harvesting to offset gains.

- High-growth assets (put these in Roth accounts): These are the ones you expect to multiply the most-small-cap stocks, emerging market funds, tech ETFs. Since Roth accounts let everything grow tax-free, you lock in the biggest gains without ever paying a dime in taxes. A $10,000 investment that grows to $100,000? In a Roth, you walk away with the full $100,000. In a taxable account, you’d owe capital gains tax. In a traditional IRA, you’d pay income tax on the whole thing.

Dr. Jim Dahle of White Coat Investor estimates that getting this right can add up to 0.75% per year to your returns. Sounds small? On a $500,000 portfolio over 30 years, that’s $175,000 extra. That’s not a bonus. That’s a second retirement.

Who Benefits the Most?

Asset location isn’t for everyone. It’s most powerful when three things line up:

- You have a lot of money in taxable accounts

- Your investment horizon is 10+ years

- You’re in a high tax bracket (32% or higher)

If you’re single and making $180,000 a year, you’re in the 32% bracket. That means every dollar of bond interest you earn in a taxable account loses 32 cents to taxes. Move that bond fund to your 401(k), and you delay that hit-possibly until you’re retired and in a lower bracket.

But if you’re in the 12% bracket and only have a single Roth IRA? The benefit is minimal. You’re better off focusing on maxing your contributions and keeping things simple.

Also, if you’re under 50 and haven’t maxed your 401(k) or IRA, don’t overcomplicate things. First, fill those accounts with whatever you can. Then, worry about where to put the rest.

What About International Stocks and ETFs?

International funds are tricky. They often pay foreign taxes, which you can claim as a credit on your U.S. return-but only if you hold them in a taxable account. If you hold them in a Roth or traditional IRA, you lose that credit. So, if you’re in a high tax bracket, it’s usually better to hold international stocks in your taxable account to capture the foreign tax credit.

But here’s the catch: if those international funds are actively managed and churn frequently, they’ll generate taxable distributions anyway. So you’re trading one tax headache for another. The sweet spot? Low-turnover international index funds in taxable accounts. That way, you get the credit and keep turnover low.

Common Mistakes (And How to Avoid Them)

Most people mess this up without even realizing it. Here are the top errors:

- Holding bond funds in taxable accounts: This is the #1 mistake. A bond fund paying 4% interest? That’s 4% taxed at your top rate. Move it to your 401(k).

- Putting growth stocks in traditional IRAs: You’re wasting the preferential capital gains rate. Let those stocks grow in a Roth or taxable account.

- Ignoring the HSA: If you have a high-deductible health plan, your HSA is a hidden gem. Max it out. Use it for medical expenses now, or let it grow for retirement. Either way, it’s tax-free.

- Trying to do this with only one account: If you only have a 401(k), asset location doesn’t help much. You can’t move assets around. Focus on maxing your contributions instead.

Another trap: chasing tax-efficient mutual funds that charge higher fees. A fund that’s 0.5% cheaper but less tax-efficient can cost you more in the long run. Always compare total cost: fees + tax drag.

How to Start (Step by Step)

You don’t need a financial advisor to do this. Here’s how to begin:

- List all your accounts: Brokerage, Roth IRA, traditional IRA, 401(k), HSA. Write down what’s in each.

- Categorize your investments: Use the tax-efficiency guide above. Mark each fund as tax-inefficient, tax-efficient, or high-growth.

- Compare where they are vs. where they should be: Are bonds in your taxable account? Move them. Are growth stocks in your traditional IRA? Consider shifting them to Roth or taxable.

- Make the moves gradually: Don’t sell everything at once. Spread changes over a year or two to avoid big tax bills. Use new contributions to shift allocations instead of triggering sales.

- Review annually: As your accounts grow and tax laws change, your optimal location might shift. Revisit this every year.

Charles Schwab says most people can complete this review in 2-4 hours. The payoff? Years of extra compounding.

What’s Changed in 2025?

Tax rules evolve. Here’s what matters now:

- 401(k) contribution limits are $23,000 ($30,500 if you’re 50+)

- Roth IRA income limits are $146,000 (single) and $230,000 (married)

- Required Minimum Distributions (RMDs) start at age 73

- Employer 401(k) matches can now go into Roth accounts-so if your employer offers this, you can get tax-free growth on matching dollars

- High-income earners (over $200,000 single / $250,000 married) pay a 3.8% Net Investment Income Tax (NIIT) on top of capital gains

The SECURE Act 2.0 also made it easier to use 401(k) funds to buy annuities, which could affect how you structure income in retirement. But for asset location? The core rules haven’t changed. The goal is still: defer taxes on income-heavy assets, lock in tax-free growth on high-potential assets, and keep low-tax assets in plain sight.

Final Thought: It’s Not About Timing the Market

Asset location isn’t flashy. It doesn’t make headlines. But it’s one of the few strategies that works every single year, no matter what the market does. You don’t need to predict the next recession. You just need to know where your bonds belong.

Most people spend hours researching the next hot stock. But the real edge? Keeping more of what you already have. That’s asset location. It’s the quiet, powerful way to turn a good portfolio into a great one.

Can I use asset location if I only have a 401(k)?

You can, but the benefits are limited. Asset location works best when you have multiple account types-taxable, tax-deferred, and tax-exempt. If you only have a 401(k), you can’t move assets between account types, so you can’t optimize placement. Focus instead on maximizing your 401(k) contributions and choosing tax-efficient funds inside it, like index funds or ETFs with low turnover.

Should I put REITs in my Roth IRA?

Yes, if you can. REITs generate high dividends taxed as ordinary income, which makes them very tax-inefficient. Placing them in a Roth IRA lets them grow completely tax-free. This is especially valuable if you expect them to appreciate over time. If your Roth is full, then a traditional IRA is the next best option to avoid annual tax bills.

Do municipal bonds belong in taxable accounts?

Generally, yes. Municipal bonds pay interest that’s exempt from federal taxes, and sometimes state taxes too. If you’re in a high tax bracket (32%+), munis can give you a better after-tax yield than taxable bonds. But if you’re in a low bracket (12% or below), you’re better off with taxable bonds because munis typically offer lower nominal yields. Always compare the taxable equivalent yield before deciding.

What if I’m close to retirement?

Asset location still matters. Even in retirement, you can control which accounts you withdraw from first. For example, withdraw from taxable accounts first to let your Roth and traditional IRAs keep growing. Then, use Roth funds for larger or unexpected expenses to avoid pushing yourself into a higher tax bracket. The goal is to manage your taxable income each year to stay in the lowest possible bracket.

Is asset location worth it if I’m not rich?

It depends. If you’re in a low tax bracket and have limited accounts, the gains are small. But if you’re in the 24% bracket or higher and have both a 401(k) and a taxable brokerage account, even a modest portfolio can benefit. Moving a $20,000 bond fund from your taxable account to your 401(k) could save you $600-$800 in taxes annually. That’s not nothing. Start simple: put your bonds in your retirement account. That’s the biggest win for most people.

Comments (3)

Julia Czinna

I’ve been doing this intuitively for years but never knew it had a name. Moved my REITs to my Roth last year after reading this-my tax bill dropped by $1,200. No fancy trading, no timing the market. Just moving stuff around. Sometimes the best investment is just rearranging what you already own.

Laura W

OMG YES. This is the secret sauce no one talks about. Bond funds in taxable accounts? That’s like leaving cash on the sidewalk in a sketchy neighborhood. I had a 5% yielding bond fund in my brokerage-$2000/year in taxes. Moved it to my 401(k). Now I’m keeping every penny. And don’t even get me started on HSAs-my HSA is my secret retirement weapon. Triple tax-free? That’s not an account, that’s a cheat code. If you’re eligible, max it. Like, right now. Your future self will send you a thank you note.

Graeme C

This is the single most underappreciated strategy in personal finance. People obsess over alpha, over ETF selection, over crypto trends-while ignoring the fact that their portfolio is being quietly cannibalized by tax drag. I’ve seen clients lose 1-1.5% annually just because they held bond ETFs in taxable accounts. That’s not a small leak-it’s a geyser. And the HSA point? Absolute gold. It’s the only account where you get deduction, growth, and tax-free withdrawal. If you’re in the U.S. and have access to one, treat it like a Swiss bank account for medical expenses. I’ve got clients who’ve turned $5k into $80k over 15 years just by never touching it. Asset location isn’t sexy. But it’s the quiet, unglamorous, mathematically brutal edge that turns average investors into wealthy ones. Stop chasing returns. Start preserving them.