MBS Risk-Reward Calculator

Investment Parameters

Risk Assessment Report

Projected Annual Return

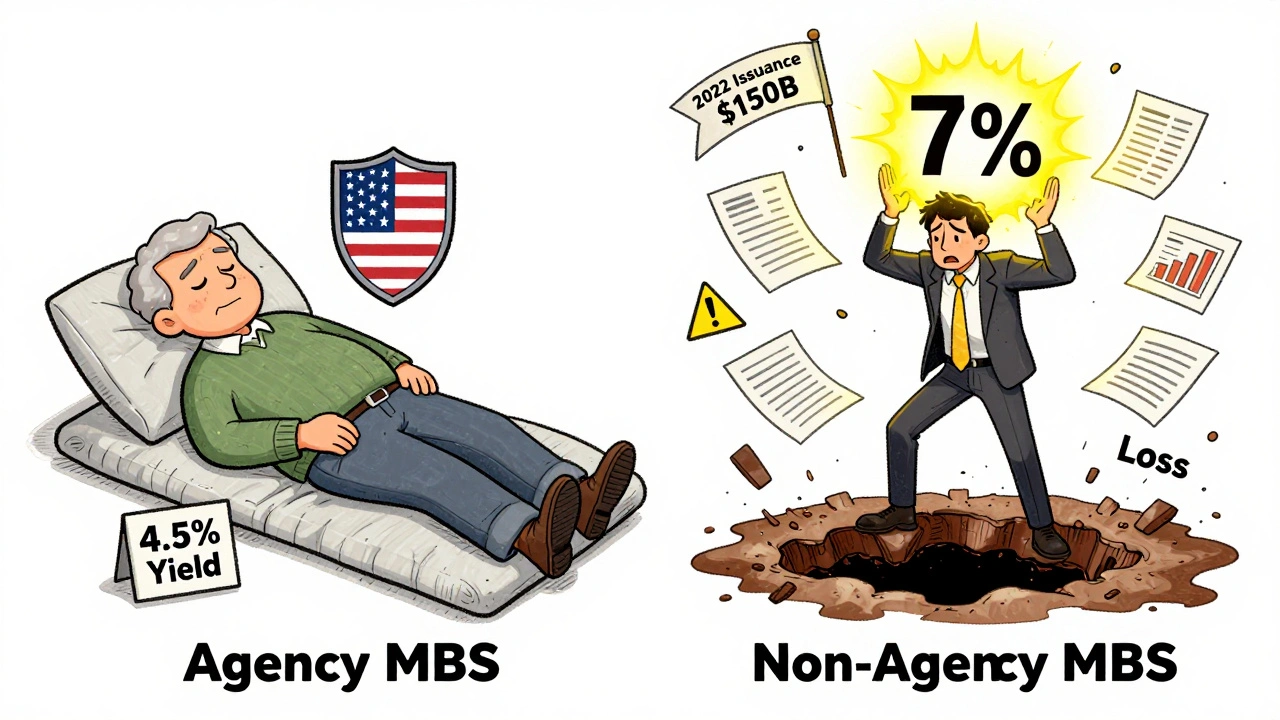

Agency MBS: ~4.5% yield with minimal risk

Non-Agency MBS: ~7.0% yield with high risk

Worst-Case Scenario

Non-Agency MBS: 50-90% loss during market stress

When you hear "mortgage-backed securities," you might think of one thing: bonds backed by home loans. But there’s a huge difference between agency MBS and non-agency MBS-and it all comes down to who’s guaranteeing the money. If you’re investing in fixed income, this isn’t just a technical detail. It’s the difference between sleeping well at night and worrying about defaults during a housing downturn.

What Exactly Is Credit Backing?

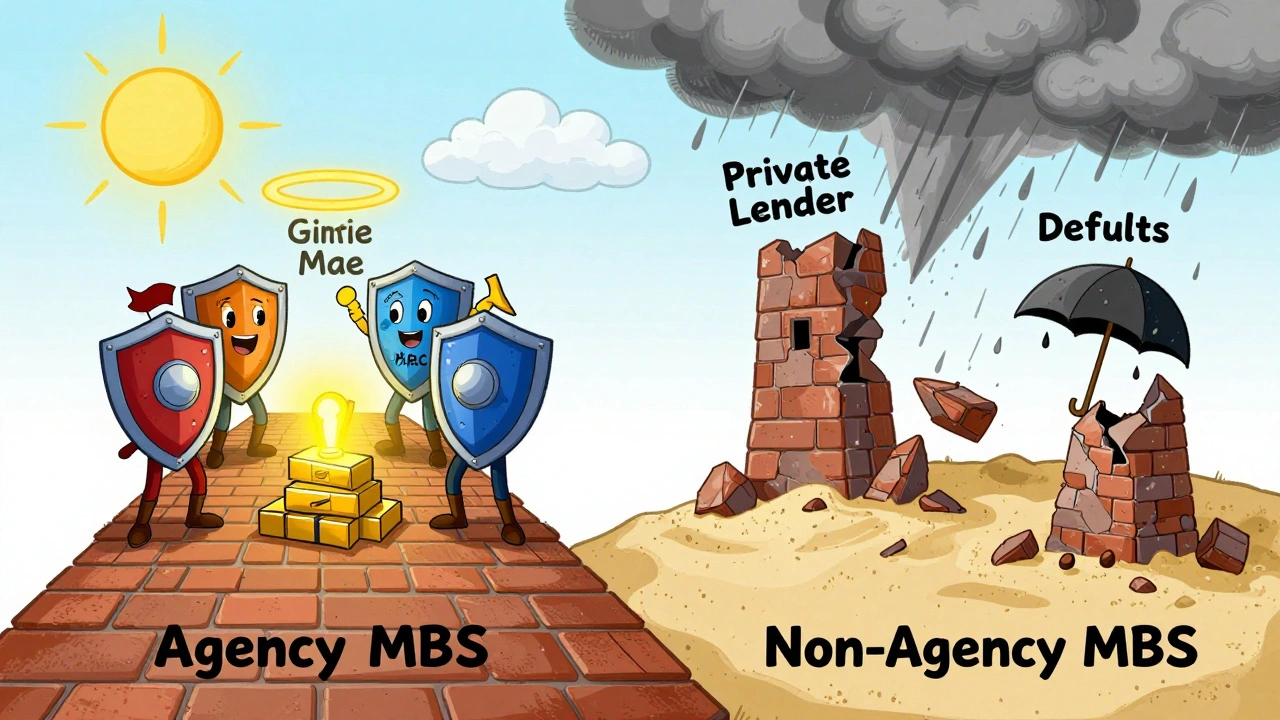

Credit backing means someone promises to pay you if the borrowers stop making their mortgage payments. In agency MBS, that promise comes from a government-backed entity. In non-agency MBS, it comes from… well, no one official. Just the issuer. And that’s the whole story.Agency MBS are issued by three big players: Fannie Mae, Freddie Mac, and Ginnie Mae. Ginnie Mae is the only one with an explicit U.S. government guarantee. That means if homeowners default, the federal government steps in to make investors whole. Fannie and Freddie? Their backing is implicit. The government never signed a legal document saying they’d pay, but after the 2008 crash, they bailed them out anyway. Investors trust that they’ll do it again if needed.

Non-agency MBS? No government anywhere is on the hook. These are created by private banks, lenders, and investment firms. If a borrower defaults, you-the investor-take the loss. Some non-agency deals used to have private insurance, but those insurers collapsed during the 2008 crisis. Now, the only protection comes from the structure of the deal itself-things like subordination and credit tranches. It’s like building a house on sand and hoping the foundation holds.

Why Does This Matter for Your Portfolio?

The credit backing directly affects risk and return. Agency MBS have almost zero credit risk. That’s why they trade with yields barely above U.S. Treasuries. In late 2023, agency MBS yields were near the top of their 15-year range-offering spreads of 80-100 basis points over Treasuries. That’s high by historical standards, but still low compared to other fixed-income assets.Non-agency MBS, on the other hand, pay significantly more. You’re looking at spreads of 200 to 500 basis points wider than agency MBS. That sounds great-until you remember that during the 2008 crisis, many non-agency securities lost 50% to 90% of their value. Agency MBS? They barely blinked.

Here’s the trade-off: agency MBS give you safety and stability. Non-agency MBS give you yield-but only if you’re ready to dig into the fine print. You need to understand the quality of the underlying loans, the structure of the tranches, and the likelihood of prepayments. It’s not a buy-and-hold investment. It’s a research-heavy, active strategy.

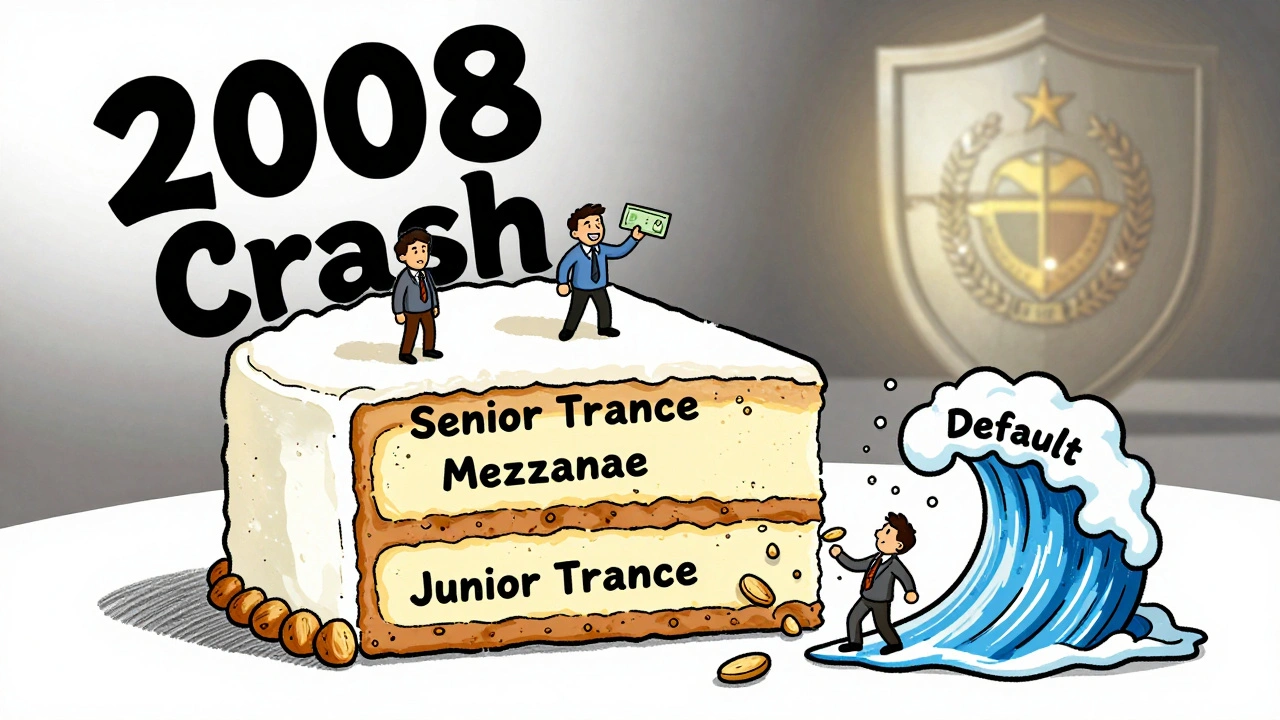

Structure: How Risk Is Built Into Non-Agency MBS

Non-agency MBS don’t just have higher risk-they’re built differently. They’re sliced into tranches. Think of it like a cake. The top slice (senior tranche) gets paid first. If borrowers default, the bottom slices (junior tranches) take the hit first. Investors who buy the senior tranches get lower yields but more protection. Those who buy the junior tranches get higher yields but risk losing everything.This structure is meant to make non-agency MBS safer, but it’s not foolproof. During the housing crash, even senior tranches got wiped out because the underlying loans were so bad. Many were made to borrowers with low credit scores, no income verification, or teaser rates that reset higher after two years. When rates jumped, payments exploded-and defaults followed.

Agency MBS don’t have this complexity. They’re standardized pools of conforming loans-loans that meet Fannie and Freddie’s rules. Borrowers have to have decent credit, steady income, and a reasonable down payment. The loans are consistent. That’s why agency MBS are so easy to price and trade.

Market Size and Liquidity

The agency MBS market is massive-over $9 trillion as of 2023. The non-agency market? Around $2 trillion. That’s not just a difference in scale. It’s a difference in accessibility.Agency MBS are in almost every bond fund, ETF, and retirement portfolio. Schwab’s Bloomberg US MBS Index is made up almost entirely of agency MBS. Retail investors can buy them through mutual funds with as little as $1,000. The Federal Reserve owns about 31% of the entire agency market. That’s not just a footnote-it’s a stabilizing force.

Non-agency MBS? You won’t find them in your 401(k). They’re mostly held by hedge funds, insurance companies, and private credit funds. Minimum investments are often $250,000 or more. And even if you can afford it, you need specialized tools and expertise. Analyzing a non-agency deal means reviewing loan-level data, running prepayment models, and understanding underwriting standards from dozens of different lenders. It takes months of training to do it right.

Regulations and Capital Treatment

Banks and insurers don’t just pick MBS because they’re profitable. They pick them because of how regulators treat them. Under Basel III, agency MBS backed by GSEs get a risk weight of just 1.6%. That means banks need to hold almost no capital against them. Non-agency MBS? They get a 100% risk weight. That’s the same as a risky corporate bond. So if a bank wants to keep capital free for lending, they’ll pick agency MBS every time.This regulatory advantage isn’t just about rules-it’s about market structure. It’s why agency MBS dominate. Banks are the biggest buyers. They need safe, low-risk assets to meet capital requirements. Non-agency MBS? They’re niche products for investors who can handle the risk.

Who Should Invest in Each?

If you’re a retail investor looking for steady income with minimal stress, agency MBS are your best bet. They’re in most bond ETFs. You get the yield without having to worry about defaults. They’re ideal for retirees, endowments, or anyone who can’t afford to lose principal.Non-agency MBS? Only if you’re a professional investor with a team of analysts. You need to understand credit risk, prepayment risk, and structural risk. You need access to loan-level data. You need to monitor housing markets, unemployment trends, and lending standards. Even then, you’re taking on risk that can’t be fully modeled.

That said, non-agency MBS aren’t going away. In 2022, issuance hit $150 billion-up from near zero after 2008. Why? Because traditional banks won’t lend to certain borrowers anymore: self-employed people, those with non-traditional income, or those buying second homes. That gap is being filled by non-bank lenders-and those loans get bundled into non-agency MBS. The non-QM (non-qualified mortgage) market alone grew from $5 billion in 2012 to over $80 billion in 2022.

The Bottom Line

Agency MBS are the backbone of the U.S. housing finance system. They’re safe, liquid, and backed by government trust. Non-agency MBS are the high-yield gamble-offering big returns but demanding deep expertise and tolerance for loss.Don’t confuse yield for value. A non-agency MBS with a 7% yield might look better than an agency MBS at 4.5%. But if the economy slows and defaults rise, that 7% could turn into a 30% loss. The agency MBS? You’ll still get your 4.5%, and your principal will still be there.

The credit backing isn’t just a footnote. It’s the whole story. Choose agency MBS if you want reliability. Choose non-agency MBS only if you’re prepared to treat them like private equity-active, complex, and risky.

Comments (4)

Astha Mishra

It's fascinating how the entire architecture of mortgage-backed securities reflects deeper societal trust structures-agency MBS are essentially a social contract, where the state, though not legally bound, is morally obligated to uphold its role as the silent guarantor. This isn't just finance; it's political theology in bond form. Non-agency MBS, by contrast, are a market experiment in individual responsibility, where the investor becomes both judge and jury, bearing the full weight of human fallibility in loan underwriting. The fact that we still tolerate this duality speaks volumes about our collective ambivalence toward risk and institutional authority. I wonder if, in a post-climate, post-banking world, this distinction will even survive-or if we’ll need a third category: ‘community-backed MBS’ where local cooperatives assume liability, not the Fed.

Graeme C

Let’s be brutally honest-any retail investor buying non-agency MBS without a PhD in structured credit is either a fool or a gambler. The ‘tranches’ are a magician’s distraction. You think you’re buying senior debt? You’re buying a lottery ticket labeled ‘investment-grade.’ The 2008 crisis didn’t just expose bad underwriting-it exposed the entire fantasy that risk can be sliced, diced, and sold like a gourmet cheese platter. And now? Banks are still playing this game with ‘non-QM’ loans to self-employed people who file taxes on a napkin. This isn’t innovation. It’s recursion. The system never learned. It just rebranded.

Dave McPherson

Oh wow. A 2,000-word essay on MBS like I’m supposed to care. Let me grab my monocle and monocle-shaped coffee. Look, if you need a 12-page breakdown to understand that Ginnie Mae = safe, private MBS = risky, then maybe you shouldn’t be investing. I mean, come on. It’s like reading a 500-page manual on how to not get hit by a bus. The answer is: don’t stand in the road. Agency MBS = don’t stand in the road. Non-agency = you’re juggling chainsaws while skydiving. The yield premium? That’s just the price of being an idiot who thinks they’re smarter than the last 15 people who lost their shirts on this. Also, ‘subordination’? That’s just Wall Street’s way of saying ‘I’ll let you take the first 50% of the loss.’ How poetic.

RAHUL KUSHWAHA

Thanks for this. 😊