Bond Ladder Calculator

How Bond Ladders Work

A bond ladder spreads your investment across multiple bonds with different maturity dates. As each bond matures, you reinvest the proceeds at current rates.

Minimum Investment

You typically need at least $10,000 for a meaningful ladder. With fractional Treasuries, you can start with $100 per bond.

Calculate Your Bond Ladder Income

Your Bond Ladder Projection

Ladder Benefits

- Predictable Income ✓

- Reduced Interest Rate Risk ✓

- Principal Protection ✓

- Reinvestment Flexibility ✓

Minimum Investment Note

You need at least $10,000 for a meaningful ladder. With fractional Treasuries, you can start with $100 per bond.

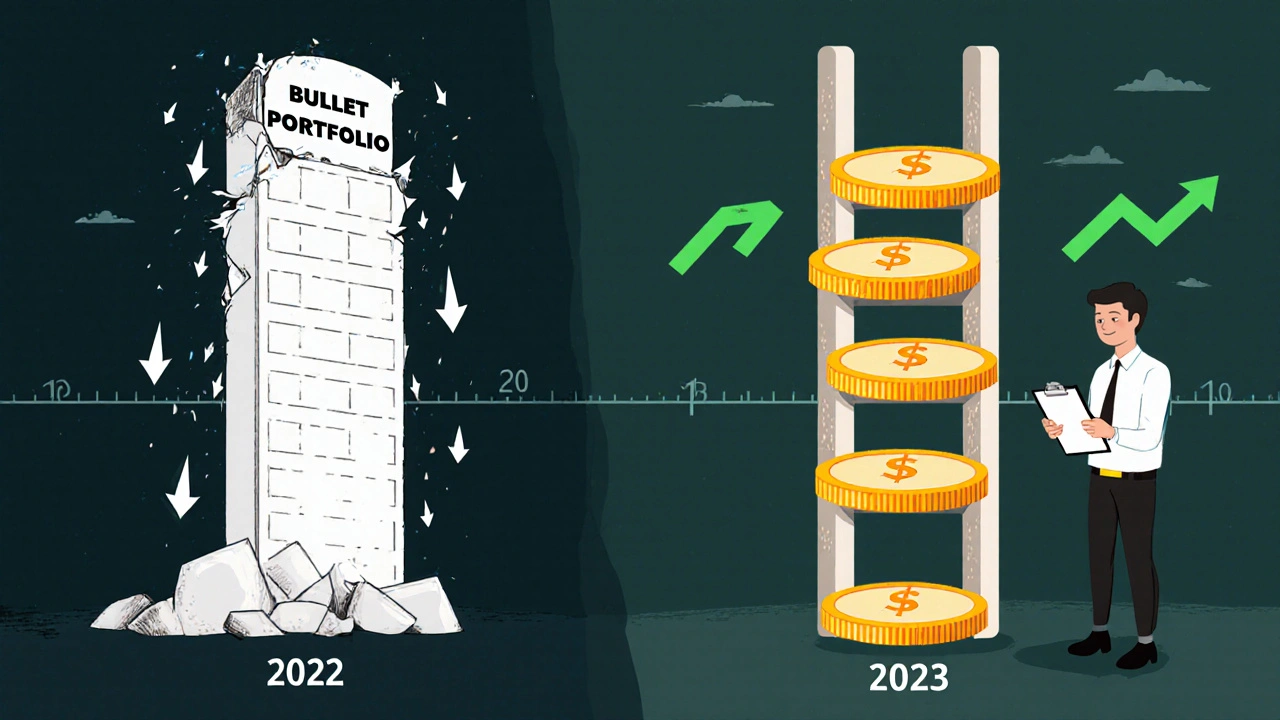

When interest rates climb, many investors panic. Bond prices drop. Portfolios shrink. But there’s a quiet, proven way to turn rising rates from a threat into an advantage: bond ladders. Unlike holding one big bond that matures in ten years, a bond ladder spreads your money across multiple bonds with different maturity dates. Each year, one bond matures, giving you cash to reinvest - often at higher rates. It’s not flashy. But in 2023, when the Federal Reserve pushed rates from near zero to 5.5%, bond ladders outperformed single-bond portfolios by up to 1.8% a year. And they didn’t just make more money - they gave investors peace of mind.

How a Bond Ladder Works

Think of a bond ladder like a staircase. Each step is a bond that matures at a different time. A five-year ladder might have five bonds: one maturing in one year, another in two, and so on up to five. You put the same amount of money into each bond - say, $10,000 per bond for a $50,000 ladder. When the first bond matures, you don’t cash out and spend it. You buy a new five-year bond, putting it back on the top rung. The ladder stays the same length, but the bonds keep rolling forward. This structure does two powerful things. First, it gives you predictable income. Every year, you get back your principal plus interest. No guessing. No market swings affecting your cash flow. Second, it reduces interest rate risk. When rates go up, your old bonds lose value on the open market - but if you hold them to maturity, you still get the full face value. And when they mature, you reinvest at the new, higher rates. That’s the key: you’re not locked in. You’re constantly upgrading.Why Bond Ladders Beat Bullet Portfolios

A bullet portfolio is when you buy one bond that matures in, say, ten years. You get your money back all at once. Sounds simple. But here’s the problem: if rates rise during those ten years, you’re stuck earning the low rate from when you bought it. Meanwhile, new bonds are paying 5%, 6%, even 7%. You miss out. A bond ladder fixes that. In 2022-2023, when the Fed raised rates aggressively, Fidelity found that investors using five-year ladders earned 1.2-1.8% more annually than those holding bullet portfolios. Why? Because every year, a bond matured and was reinvested at the new, higher yield. By the end of the five years, the entire ladder was earning today’s rates - not yesterday’s. Even better, Vanguard’s research shows a five-year ladder gives you 92% of the return of a ten-year bond, but with only 65% of the risk. That’s because shorter-term bonds don’t swing as wildly when rates change. You get most of the yield, with far less volatility.Choosing the Right Bonds

Not all bonds are created equal. For a bond ladder, you need to pick bonds that are safe, predictable, and easy to manage. Here’s what works best:- U.S. Treasuries: Backed by the full faith and credit of the U.S. government. No credit risk. Ideal for beginners. Minimum purchase: $100 with fractional shares now available through Fidelity and Schwab.

- Investment-grade corporate bonds: Issued by strong companies like Coca-Cola or Johnson & Johnson. Higher yield than Treasuries, but watch for callable bonds - these can be paid off early by the issuer, breaking your ladder.

- Municipal bonds: Tax-free income, especially useful if you’re in a high-tax state. But they’re more complex. Some are callable. Others have variable rates. Only use them if you understand the terms.

How to Build Your First Ladder

Building a bond ladder isn’t complicated - but it does require planning. Follow these five steps:- Set your goal. Are you funding retirement income? Saving for a home? Covering college costs? Match your ladder length to your timeline. A 5-year ladder works for near-term needs. A 10-year ladder suits long-term goals.

- Decide on rung spacing. Annual maturities are the sweet spot. Quarterly maturities give you more frequent cash flow but require more bonds and higher minimums. Most investors stick with yearly.

- Divide your money evenly. If you have $60,000 for a six-year ladder, invest $10,000 in each bond. Equal sizing keeps your income steady and simplifies reinvestment.

- Buy high-quality bonds. Stick to bonds rated A or better by S&P or Moody’s. For Treasuries, no rating is needed - they’re the safest.

- Set reminders. Fidelity found that 78% of successful ladder builders set calendar alerts 60 days before each bond matures. That way, you’re ready to reinvest before the cash sits idle.

Minimum Investment and Costs

You can’t build a bond ladder with $5,000 and expect it to work well. Why? Transaction costs. Most bonds cost $1,000-$5,000 each. If you buy five bonds at $1,000 each, and pay $5 per trade, you’re spending $25 in fees - that’s 0.5% of your capital right off the top. Add in bid-ask spreads, and it eats into returns. Vanguard says bond ladders aren’t cost-effective under $50,000. Schwab recommends at least 10-15 bonds for proper diversification. That means $10,000-$50,000 minimum. But here’s the good news: since March 2023, Fidelity and Schwab have offered fractional Treasury purchases. You can now buy $100 chunks of 10-year Treasuries. That lowers the barrier. You can build a $10,000 ladder with ten $1,000 rungs - or even twenty $500 rungs.Bond Ladders vs. Bond Funds

Many investors ask: Why not just buy a bond ETF or mutual fund? It’s easier. You don’t have to pick individual bonds. The fund manager does it for you. But here’s the trade-off. Bond funds don’t mature. Their value floats with the market. In 2022, the Bloomberg U.S. Aggregate Bond Index dropped 13%. Investors in bond funds saw their account balances shrink - even if they never sold. Meanwhile, bond ladder holders who held to maturity got their full principal back, year after year. Bond funds also charge fees. A typical bond ETF charges 0.05%-0.20%. A bond ladder? No ongoing fees - just the one-time purchase cost. The downside? Bond ladders require more work. You need to monitor maturity dates, reinvest cash, and avoid risky bonds. Bond funds handle all that for you. If you don’t have time or interest, a low-cost bond ETF like BND or AGG is a fine alternative. But if you want control, predictability, and principal protection - a ladder wins.Real-World Risks and Pitfalls

Bond ladders aren’t magic. They have real limitations:- Inflation: If inflation runs at 5% and your bonds pay 4.2%, you’re losing purchasing power. Fix this by putting 20-30% of your fixed income into TIPS (Treasury Inflation-Protected Securities).

- Callable bonds: Some issuers can repay your bond early. If rates fall, they’ll do it - and you’re forced to reinvest at lower yields. Avoid bonds with call features unless you’re okay with ladder disruption.

- Too few bonds: If your $20,000 ladder only has three bonds, you’re not diversified. One default could hurt. Aim for at least five issuers.

- Time commitment: Managing a ladder takes 1-2 hours per quarter. If you hate paperwork, this isn’t for you.

Who Should Use a Bond Ladder?

Bond ladders aren’t for everyone. But they’re perfect for:- Retirees who need predictable income and hate market swings.

- Conservative investors who want to preserve capital while earning more than savings accounts.

- People with near-term goals - like paying for a child’s tuition in five years.

- Those who enjoy control and want to understand every holding in their portfolio.

The Future of Bond Ladders

The good news? Bond ladders are getting easier. In 2023, Schwab launched automated rebalancing tools. Fidelity added fractional Treasury purchases. These changes are lowering the entry barrier and reducing management time by 65%. With interest rates likely to stay higher for longer - and inflation still a concern - bond ladders are more relevant than ever. PIMCO and Vanguard both say they’ll remain a core strategy as long as rates fluctuate. And they always do. The key is to start simple. Build a five-year ladder with Treasuries. Use fractional shares if needed. Set reminders. Reinvest. Watch your income grow each year. You won’t get rich quick. But you’ll sleep better. And in investing, that’s often worth more than a few extra percentage points.Can I build a bond ladder with less than $50,000?

Yes, but with limitations. You can now buy fractional U.S. Treasuries starting at $100 through Fidelity and Schwab. A $10,000 ladder with ten $1,000 rungs is doable. But you’ll pay more in fees relative to your investment, and you won’t be as diversified. For portfolios under $25,000, consider a low-cost bond ETF as a simpler alternative.

Are bond ladders safe if the market crashes?

If you hold your bonds to maturity and they’re issued by the U.S. government or high-quality corporations, yes - they’re very safe. Market crashes affect bond prices, but not the amount you get when the bond matures. In 2022, when bond funds lost 13%, bond ladder investors who held to maturity kept their full principal. The risk comes only if the issuer defaults - which is rare with Treasuries and top-rated corporates.

Do I need to reinvest the money when a bond matures?

Yes - that’s how the ladder stays intact. If you spend the cash instead of reinvesting, your ladder shrinks. The goal is to buy a new bond with the same maturity as your longest rung. For example, if your longest bond was five years, buy a new five-year bond when the one matures. This keeps your income stream steady and your interest rate risk managed.

What’s better: annual or quarterly maturities?

Annual maturities are better for most people. They’re simpler, require fewer bonds, and reduce management time. Quarterly maturities give you monthly cash flow, which is helpful if you rely on bond income for living expenses. But you’ll need at least 20 bonds for a 5-year quarterly ladder, raising your minimum investment and complexity. Stick with annual unless you have a clear need for monthly cash.

Can bond ladders protect me from inflation?

Not fully. Fixed-rate bonds lose buying power when inflation rises. For example, if your bond pays 4.2% and inflation is 4.8%, you’re losing 0.6% in real terms each year. To protect against this, allocate 20-30% of your fixed income to TIPS (Treasury Inflation-Protected Securities). These adjust their principal with inflation, so your interest payments rise too.

Should I use a financial advisor to build a bond ladder?

It depends. If you’re comfortable researching bonds, checking credit ratings, and setting up reminders, you can do it yourself. But if you’re unsure about callable bonds, tax implications, or diversification, a fee-only advisor can help avoid costly mistakes. About 29% of ladder investors use advisors - and many say it saved them from poor choices.

Comments (3)

Laura W

Okay but let’s be real - bond ladders are the ultimate adulting flex. I built mine with fractional Treasuries on Fidelity after my broker tried to sell me some dodgy corporate junk. Now I get $800 a year in cash just for sitting there like a rock. No stress. No panic when the market freaks out. I literally set a calendar alert for each maturity and just click ‘buy new 5-year’ - it’s like a savings account that actually pays you. And yeah, inflation’s a pain, but I threw 25% into TIPS and now I’m not losing my mind every CPI report. This isn’t investing - it’s financial yoga.

Graeme C

While I appreciate the pragmatic structure of this exposition, I must register a categorical objection to the assertion that bond ladders ‘outperform’ bullet portfolios by 1.8% annually. The data cited from Fidelity is selectively presented: it ignores transaction costs, reinvestment timing lags, and the opportunity cost of capital sitting idle between maturities. Furthermore, the assumption of perfectly linear rate hikes is a theoretical fantasy - real markets are discontinuous, and callable bonds, as mentioned, introduce non-linear risk. A 5-year ladder may appear stable, but it is not immune to convexity shock or yield curve inversion. If you are not accounting for the full tax treatment of municipal bond interest or the bid-ask spread erosion on small-ticket trades, your ‘peace of mind’ is an illusion masked by arithmetic.

Astha Mishra

It is truly fascinating how something as simple as spreading out bonds across time can become such a profound metaphor for life - patience, consistency, and the quiet dignity of small, repeated actions. In a world obsessed with speed, instant returns, and viral wealth, the bond ladder stands as a quiet rebellion. I, too, have built one - not because I am wealthy, but because I am weary of the noise. My first rung was a $500 Treasury bought with my freelance earnings, and now, three years later, I have six rungs, each one a promise kept. The market may crash, inflation may rage, but when that bond matures, I get back what was promised - not more, not less. And isn’t that what we all crave? A little certainty, a little dignity, a little peace? I do not need to be rich. I need to be steady. And this ladder, with its unglamorous steps, has given me that. Thank you for reminding us that sometimes, the slow path is the only path that truly leads home.