Real Return Calculator

Calculate your actual investment performance after adjusting for inflation. The nominal return you see on your statement is often misleading—this tool shows you your real return, which reflects what you can actually buy with your money.

Your real return:

--

--

Why this matters: If your nominal return is 7% but inflation is 3%, your real return is about 3.9%. This is the actual value you're gaining in purchasing power.

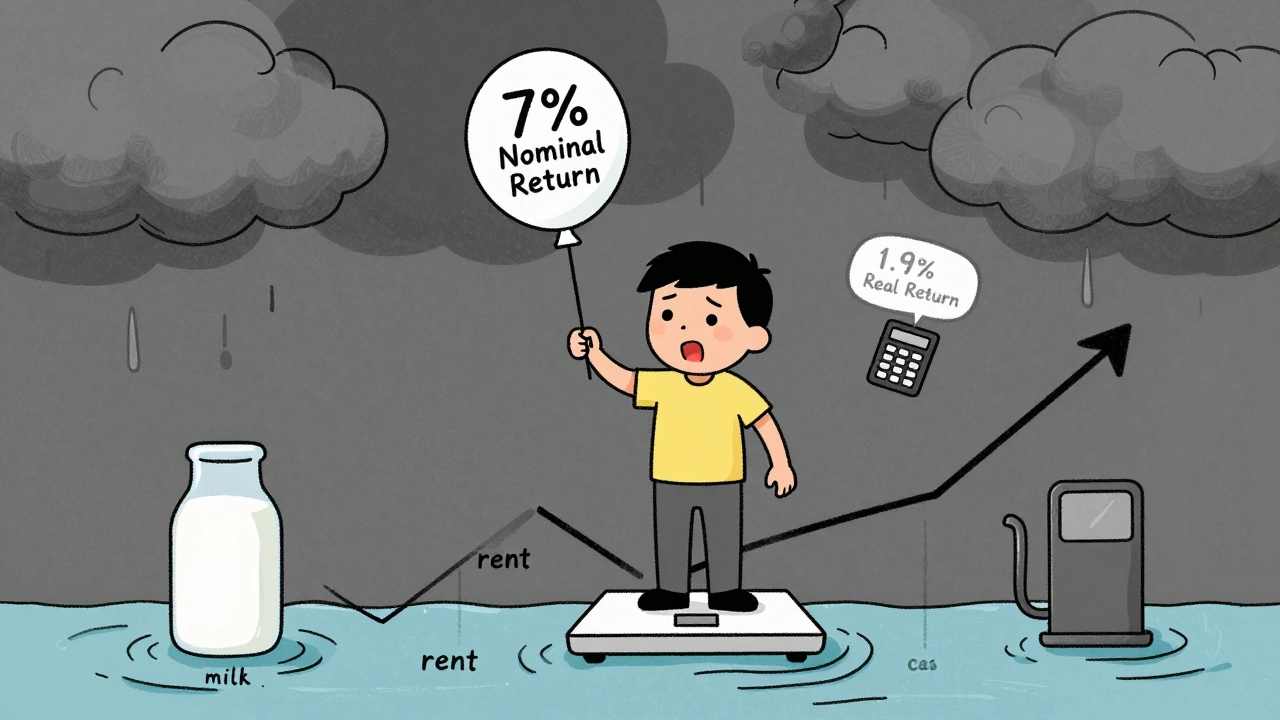

Imagine your portfolio grew 7% last year. Your broker sends a happy email. You feel like you’re winning. But then you walk into the grocery store and see a gallon of milk costs $5.50 instead of $4.75. Your rent went up. Your car insurance jumped. Suddenly, that 7% doesn’t feel so good. Why? Because you’re looking at the wrong number.

Most people track nominal returns-the raw percentage your investment grew on paper. But that number lies. It ignores the biggest force shaping your financial future: inflation. What you really need to know is your real return. That’s the number that tells you if you’re actually getting richer-or just falling behind.

What’s the Difference Between Nominal and Real Returns?

Nominal return is simple math. You bought a stock for $10,000. A year later, it’s worth $10,700. Your nominal return? 7%. No tricks. No adjustments. Just the dollar amount you gained.

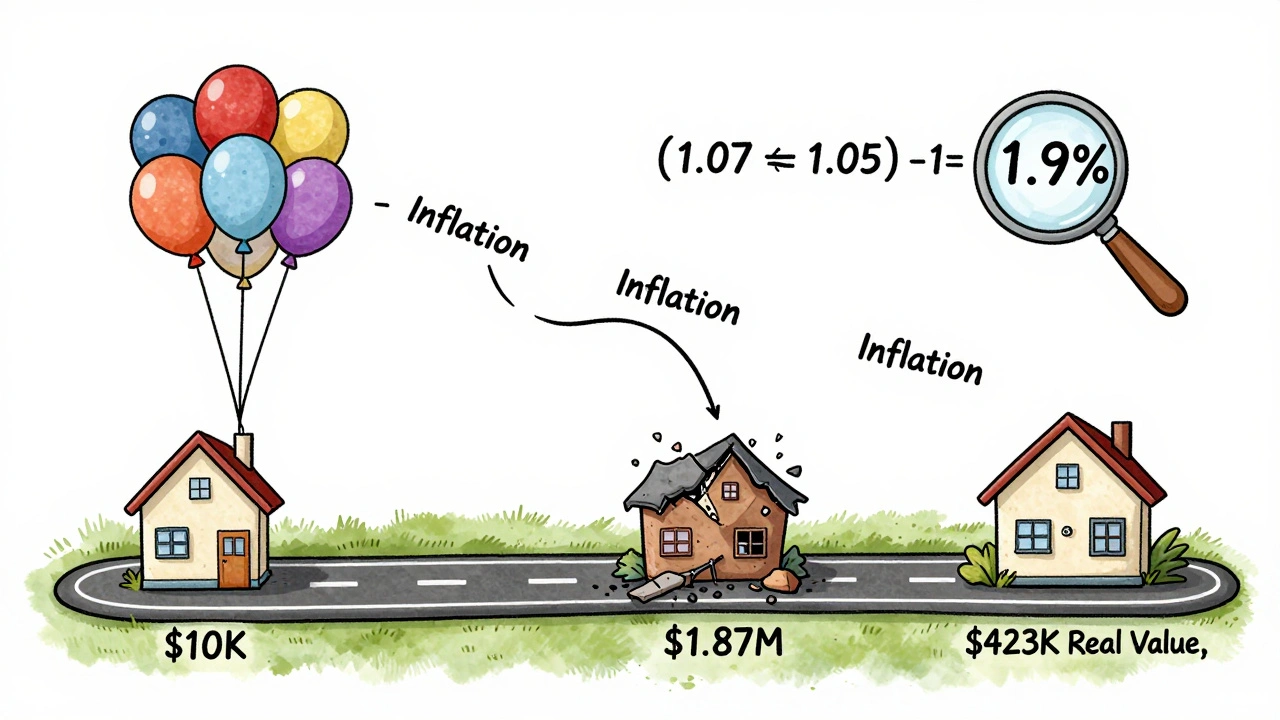

But here’s the catch: that $10,700 isn’t worth the same as it was a year ago. Prices rose. Your money bought less. So if inflation was 5% that year, your real return isn’t 7%. It’s 1.9%. That’s the actual increase in what you can buy with your money.

The formula for real return is more precise than most people realize. The quick version is: Nominal return minus inflation rate. So 7% minus 5% = 2%. But the exact formula is: (1 + nominal return) ÷ (1 + inflation rate) - 1. For that same 7% and 5% example, it’s (1.07 ÷ 1.05) - 1 = 0.019, or 1.9%. It’s a small difference-but it adds up fast over time.

Why does this matter? Because if you think you’re earning 7% and inflation is 5%, you might feel safe. But if you’re actually only gaining 1.9% in real terms, you’re not keeping up. And if inflation hits 8% while your portfolio grows 7%, you’re losing purchasing power-even though your account balance went up.

Why Nominal Returns Are a Trap

Wall Street loves nominal returns. They make performance look better. Mutual funds report nominal returns in ads. Brokers highlight them in statements. It’s easier to say “we beat the market with a 12% return” than “we beat the market with a 4% real return after inflation.”

But this isn’t just marketing. It’s misleading. A 2023 analysis of 10,000 retail portfolios by Funding Souq found that investors who only looked at nominal returns overestimated their financial progress by an average of 2.7% per year. That’s not a typo. They thought they were ahead-when they were actually falling behind.

Consider the S&P 500 from 1970 to 2023. Nominal returns averaged 10.5% per year. Sounds great. But inflation averaged 4.3% over that same period. Real returns? Just 6.2%. On a $10,000 investment, that difference turns $1.87 million into $423,000 in today’s buying power. That’s $1.4 million in lost purchasing power-because people were chasing the wrong number.

Fixed income is even worse. A 10-year Treasury bond might pay 2.4% interest. Sounds safe. But if inflation is 3%, your real return is negative 0.6%. You’re losing money every year-even though you’re not losing principal. You’re losing what that money can buy.

The 2021-2022 period was a brutal wake-up call. The S&P 500 posted a 15.3% nominal return. But inflation hit 17.4% in essential goods like food, fuel, and rent. Real returns? Negative 2.1%. People saw their portfolios grow and thought they were fine. Meanwhile, their ability to live comfortably shrank.

Real Returns Are the Only Metric That Matters for Long-Term Goals

If you’re saving for retirement, buying a house, or funding your kid’s education, your goal isn’t to grow a number. It’s to grow your ability to pay for things. That’s why real return is the only number that counts.

Vanguard’s 2023 retirement calculator shows that using nominal returns for a 30-year projection overestimates your final portfolio value by 37.2% on average. That means if you think you’ll have $1.5 million in 30 years based on nominal returns, you’ll actually have less than $950,000 in buying power. That’s not a small miscalculation. That’s retirement failure.

Real estate, stocks, bonds-they all behave differently under inflation. A 2022 study of commercial real estate found nominal returns averaged 8.7% from 2000 to 2020. But after inflation (3.6%), real returns dropped to 5.1%. In New York City, real returns were only 3.2%. In Austin, they were 6.8%. Location matters. Inflation isn’t the same everywhere. Your portfolio’s real return depends on what you own and where you live.

Equities have historically delivered the best real returns. Since 1926, U.S. stocks have returned an average of 6.7% in real terms, according to the Dimson-Markowitz-Staunton Global Investment Returns Yearbook. Real estate follows at 4.3%. Bonds? Just 2.1%. If your portfolio is mostly bonds and cash, you’re not just earning low returns-you’re actively losing ground to inflation.

How to Calculate Real Returns (And What Data to Use)

You don’t need a finance degree to calculate real returns. You need two things: your investment’s nominal return and the inflation rate.

For most people in the U.S., the Consumer Price Index (CPI) from the Bureau of Labor Statistics is the standard. It tracks the price changes of a basket of goods-food, housing, transportation, medical care. Over 87% of U.S. institutions use CPI for inflation calculations.

Here’s how to do it step by step:

- Find your investment’s nominal return over a period (e.g., 1 year).

- Find the CPI inflation rate for the same period. Go to BLS.gov and look up the annual change.

- Use the exact formula: (1 + nominal return) ÷ (1 + inflation rate) - 1.

- Multiply by 100 to get the percentage.

Example: You earned 8% on your portfolio. CPI rose 4.5%.

Real return = (1.08 ÷ 1.045) - 1 = 0.0335 → 3.35%.

Some investors use the Personal Consumption Expenditures (PCE) index instead. It’s the Fed’s preferred measure. It’s slightly different-more flexible, includes more spending categories. But for personal use, CPI is fine. It’s what you feel in your wallet.

Tools like Vanguard’s free real-return portfolio tracker or the BLS online inflation calculator make this easy. No spreadsheets needed.

Why Even Experts Get Real Returns Wrong

Even smart investors mess this up. A 2023 Duke University study found that when people calculate real returns, they often use the national CPI-but their personal inflation rate is higher. If you’re retired and spend 60% of your budget on healthcare, you’re not experiencing 3% inflation. You’re experiencing 5.8%-the rate healthcare costs rose in 2023.

That’s a 1.8% error right there. And it’s enough to derail a retirement plan.

Dr. Jeremy Siegel, finance professor at Wharton and author of Stocks for the Long Run, calls nominal returns a “financial hallucination.” He’s right. If you think your 7% return means you’re getting ahead, you’re fooling yourself. The market doesn’t care about your paper gains. It cares about what you can buy.

Nobel laureate Eugene Fama’s research shows real returns explain 92.7% of long-term consumption growth. Nominal returns? Only 63.4%. In other words, your real return determines whether you’ll be able to afford your lifestyle in 10, 20, or 30 years.

What You Should Do Right Now

Here’s what to do today:

- Look at your latest investment statement. Find the nominal return.

- Go to BLS.gov. Find the latest 12-month CPI change.

- Use the formula. Calculate your real return.

- Ask yourself: Am I actually ahead-or just pretending?

If your real return is below 3%, you’re not growing wealth-you’re barely holding on. If it’s negative, you’re losing ground. That’s not normal. That’s a red flag.

Adjust your portfolio. If you’re sitting in cash or low-yield bonds, you’re being eaten alive by inflation. Shift toward assets that historically outpace inflation: stocks, real estate, commodities. Rebalance. Increase contributions. Don’t wait for a crisis to wake you up.

The SEC now requires mutual funds to report real returns alongside nominal ones. The CFA Institute has made real return analysis a core skill for all investment professionals. In 2024, it’s no longer optional. It’s basic financial literacy.

Real returns aren’t a fancy academic concept. They’re your financial truth. Ignore them, and you’re flying blind. Track them, and you finally see where you stand.

Frequently Asked Questions

What’s the difference between nominal and real return?

Nominal return is the percentage your investment grew on paper, without adjusting for inflation. Real return is what you actually gained in purchasing power after accounting for inflation. For example, if your portfolio gained 8% but inflation was 4%, your real return is about 3.8%, not 8%.

Why is inflation so important for investment returns?

Inflation erodes your money’s value. Even if your portfolio grows, if prices for food, housing, and gas rise faster, you can’t buy more than you could before. Real return tells you if you’re truly building wealth-or just keeping up with rising costs.

Which inflation rate should I use for personal calculations?

Use the U.S. Bureau of Labor Statistics’ Consumer Price Index (CPI) for general purposes. It’s the standard for most investors and reflects the cost of everyday goods. If you spend heavily on healthcare or education, consider adjusting for those higher inflation rates, since they may be rising faster than CPI.

Do I need to calculate real returns every year?

You don’t need to do it monthly, but you should check it annually-especially if you’re saving for retirement or a major goal. Inflation changes year to year. A 2% inflation year feels very different from a 6% year. Your real return tells you how your portfolio is performing in the real world, not just on paper.

Are real returns always lower than nominal returns?

Yes, unless inflation is negative (deflation). Inflation is almost always positive, so real returns are almost always lower than nominal returns. Sometimes they’re even negative-meaning your investments lost purchasing power even if their dollar value went up.

Can I rely on my broker’s performance report?

Most broker reports show only nominal returns. They’re designed to make you feel good. Don’t assume they’re giving you the full picture. Always check the inflation-adjusted number yourself using the CPI and the real return formula. It’s the only way to know your true financial progress.

Comments (5)

Robert Shurte

It’s funny-how we treat money like it’s a scoreboard, not a tool. We cheer when the number goes up, but never ask: ‘Up relative to what?’ The real question isn’t ‘How much did I earn?’ It’s ‘How much less can I buy now than I could last year?’ Inflation isn’t some abstract Fed chart-it’s the milk you used to buy for $3.50 now costing $5.75. And your 7% ‘gain’? It’s just a placebo. You didn’t get richer. You just got better at lying to yourself. The market doesn’t care about your feelings. It only cares about what you can actually afford. And if you’re not measuring that-you’re not investing. You’re just gambling with a spreadsheet.

Mark Vale

you know what’s really scary? they dont even tell you this on purpose. wall street? the banks? the brokers? they WANT you to chase nominal returns. why? because if you knew your real return was negative, you’d pull your money out. and then what? they’d lose their fees. their bonuses. their yachts. the CPI is manipulated. they exclude food and fuel from the ‘core’ index. so they say inflation is 3%… but your rent, your gas, your insulin? 8%. they’re not just hiding the truth-they’re engineering it. and you’re still trusting their ‘performance reports’ like it’s gospel. wake up. this isn’t finance. it’s a psychological trap. and you’re the mark.

Royce Demolition

OKAY BUT JUST THINK ABOUT THIS 😤

YOU THINK YOU’RE WINNING WITH 7%...

BUT YOUR GROCERY BILL JUST HIT YOU LIKE A TRUCK 🛒💸

REAL RETURN IS THE ONLY THING THAT MATTERS.

IF YOU’RE NOT BEATING INFLATION, YOU’RE LOSING.

STOP LOOKING AT THE NUMBER. START LOOKING AT YOUR WALLET.

GET INTO STOCKS. GET INTO REAL ESTATE. STOP LETTING YOUR MONEY SIT LIKE A CUSHION IN A DUMPSTER.

YOU GOT THIS 💪📈 #RealReturnsRule

Sabrina de Freitas Rosa

Oh sweetie. You think you’re smart because you read a blog post? You’re still using CPI like it’s the Bible. Honey, if you’re retired and your meds cost 12% more a year? CPI doesn’t care. You’re not getting 3.8% real return-you’re getting -4%. And your ‘balanced portfolio’? It’s just a fancy name for a slow-motion financial suicide. You’re not investing-you’re just hoping the system won’t eat you alive. Wake up. Stop trusting brokers. Stop trusting ‘experts.’ Start tracking what YOU spend. That’s your real inflation. That’s your real return. And if it’s negative? Then you’re not ahead. You’re just delaying the crash.

Erika French Jade Ross

I just checked my portfolio. Real return was 1.2%. Feels like running on a treadmill… backwards. 😅