Fintech Customer Acquisition Cost Calculator

Calculate if your marketing channels are financially viable. Input your current metrics and see which channels will work for your business.

Select Your Marketing Channel

Results

Based on data from the article: McKinsey warns that fintechs spending over 120% of customer lifetime value on acquisition are on a path to collapse.

Getting customers to sign up for a fintech app isn’t like selling a new pair of sneakers. You’re not just asking someone to try something cool-you’re asking them to trust you with their money, their identity, and their financial future. And in 2025, the bar for trust is higher than ever. With customer acquisition costs averaging $1,450 per user and 78% of consumers saying trust is their #1 deciding factor, fintech customer acquisition isn’t about flashy ads or viral TikToks. It’s about clarity, consistency, and credibility.

Why Traditional Marketing Fails in Fintech

Most companies still try to sell fintech products the same way they sell software or streaming services. They focus on features: "Instant transfers!" "Zero fees!" "AI-powered insights!" But here’s the problem: financial decisions aren’t made on features. They’re made on fear, doubt, and past bad experiences. People remember bank fees they couldn’t explain. They remember apps that froze their accounts for "suspicious activity." They remember being told their credit score was "low" without knowing why. Fintechs that win don’t just offer better tech-they offer better communication. A study of 4,217 Trustpilot reviews found that 73% of 5-star reviews mentioned a "transparent fee structure," while 89% of 1-2 star reviews complained about hidden costs or unclear terms. That’s not a product issue. That’s a marketing issue.The Three Pillars of Fintech Customer Acquisition

Successful fintech marketing rests on three non-negotiable pillars:- Trust first - Every message must reduce anxiety, not create it.

- Segment like crazy - A college student and a small business owner don’t want the same thing.

- Prove value fast - If someone doesn’t see the benefit in the first 60 seconds, they’re gone.

Let’s break down how to execute each one.

Build Trust Before You Ask for a Sign-Up

You can’t just say "We’re secure" and expect people to believe you. You need to show it. The 2024 Fintech Trust Index found that campaigns highlighting security features, quick onboarding, or transparent fees converted 34% better than generic feature-focused ads. Take Revolut. Their onboarding flow doesn’t say "We use bank-grade encryption." Instead, it says: "Your money is protected by FDIC insurance up to $250,000. We verify your ID in under 90 seconds. No hidden fees. Ever." Simple. Specific. Reassuring. Here’s what works in practice:- Use real-time security badges during sign-up (e.g., "Your ID is being verified by Jumio, trusted by 500+ financial apps").

- Link to public compliance reports or regulatory licenses on your homepage.

- Embed short explainer videos in your app that show exactly how data is encrypted and who has access.

- Never say "unlimited" or "free forever" unless you can prove it legally. Misleading claims are the #1 reason users churn in the first 90 days.

Companies that embed compliance liaisons directly into their marketing teams cut campaign launch times by 38%. Why? Because they don’t have to wait weeks for legal approval-they build compliance into the message from day one.

Segment Your Audience Like a Pro

"Fintech users" isn’t a real group. There’s no such thing as a "typical" fintech customer. - A 19-year-old college student wants to track coffee spending and avoid overdrafts. - A 42-year-old freelancer needs to invoice clients and split expenses with their partner. - A 58-year-old small business owner cares about payroll automation and tax deductions. Your messaging, channels, and even app UI must change for each group. MVPGrow recommends creating 3-5 detailed customer personas-not just demographics, but behaviors, fears, and digital habits. Here’s how to do it:- Use Google Analytics 4 and Mixpanel to track what pages users visit before signing up.

- Look for patterns: Do users who watch your "How to budget on a side hustle" video convert more than those who click your "Zero fees" banner?

- Build separate landing pages for each persona. One for students, one for freelancers, one for small businesses.

Gen Z (18-24) responds to 15-second AR filters on TikTok that show how much they’d save by switching banks. Millennials (25-40) prefer email nurture sequences with real case studies. Gen X and older users need to see your company’s founding story, team photos, and regulatory licenses before they’ll even click "Download."

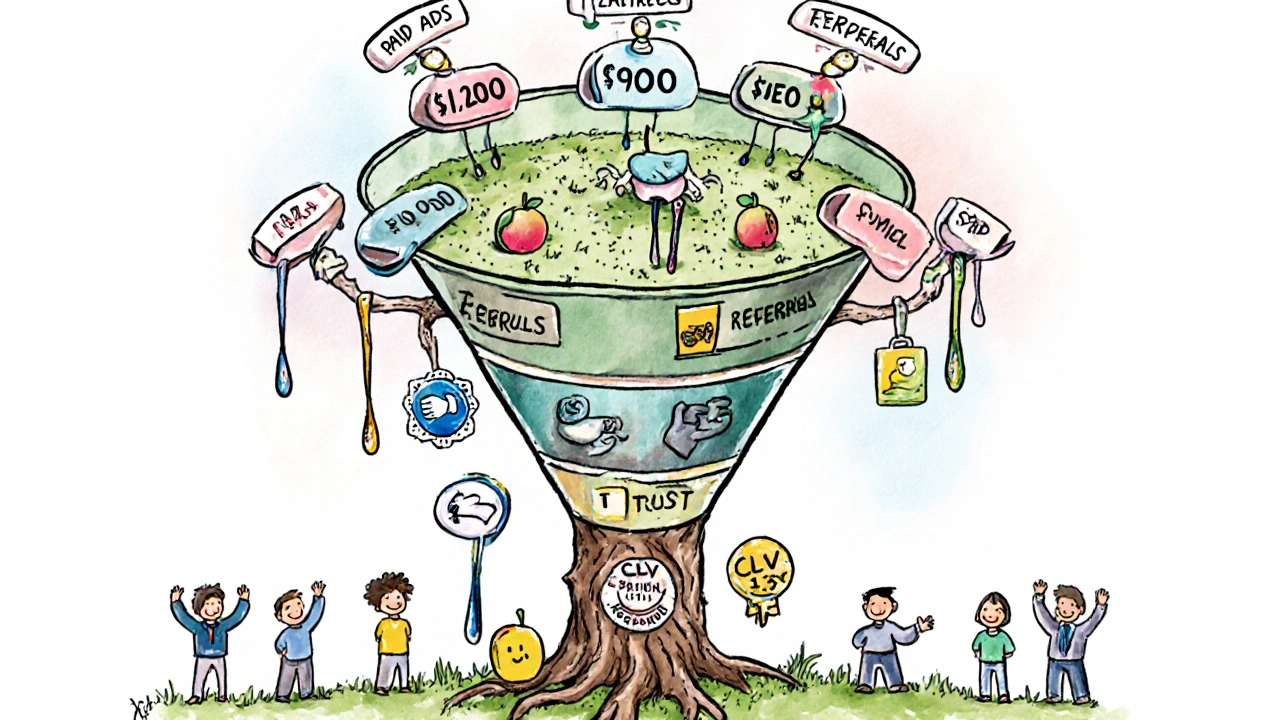

Channel Strategy: Where to Spend Your Budget

Not all channels are created equal. Here’s what the data says about cost and quality:| Channel | Avg. CAC | CLV Multiplier | Speed to Scale | Best For |

|---|---|---|---|---|

| Referral Programs | $200-$350 | 1.3x | Slow (3-6 months) | High-retention users |

| Content Marketing (SEO) | $400-$600 | 1.2x | Medium | Sustainable growth |

| Paid Ads (Meta, Google) | $850-$1,200 | 1.0x | Fast | Quick volume |

| Social Media (TikTok/Instagram) | $500-$900 | 1.1x | Fast | Gen Z, visual learners |

| Partnerships (e.g., accounting software) | $300-$500 | 1.25x | Medium | B2B, small business |

Referral programs are the quiet winners. They cost less than a third of paid ads and bring in users with 30% higher lifetime value. But they take time. Robin Waite’s research shows referral programs need 3-6 months to gain momentum-but once they do, they become self-sustaining. One user on Reddit said: "Revolut’s £25 bonus got me to switch faster than Monzo’s blog posts." That’s the power of social proof.

Content marketing is the slow burn that pays off. A Llama Lead Gen case study showed a 30% increase in acquisition by targeting long-tail keywords like "how to avoid bank fees as a freelancer" or "best app for splitting rent with roommates." These aren’t sexy searches-but they’re made by people ready to act.

Hyper-Personalization Is No Longer Optional

In 2025, if your app sends the same onboarding email to everyone, you’re already behind. AI tools now let you group users by behavior: someone who saves $500/month gets a message about high-yield savings. Someone who makes 12 international transfers a month gets an offer for lower FX fees. Someone who checks their balance 5 times a day gets a nudge to set up spending alerts. Matomo reports that fintechs using real-time transaction data to trigger personalized offers see 33% higher conversion rates. You don’t need a $1 million AI team to start. Use tools like HubSpot or ActiveCampaign to tag users based on actions:- Clicked "budgeting" video? → Send next email: "Here’s how 2,300 people saved $1,200 last year."

- Started but didn’t finish onboarding? → Send a 30-second Loom video: "We noticed you got stuck on ID verification. Here’s how to fix it."

- Used the app 3 times but never sent money? → Offer a $5 bonus for your first transfer.

This isn’t creepy. It’s helpful. As one Reddit user put it: "The app that explained crypto staking in 30 seconds with an AR filter got me to convert when 10 others failed."

What to Avoid at All Costs

Here are the three biggest mistakes fintechs make in customer acquisition:- Overpromising - If your ad says "Instant loans in 60 seconds," but users wait 3 days, you’ll lose them. Sensor Tower found 61% of negative App Store reviews cite "marketing promises not matching reality."

- Ignoring compliance - Gartner reports fintechs that don’t bake compliance into marketing see 3.2x higher churn during onboarding. Don’t say "guaranteed approval" unless you’re licensed to do so.

- Spending more than your CLV - McKinsey warns that fintechs spending over 120% of customer lifetime value on acquisition are on a path to collapse. If your average user stays 18 months and brings in $180 in revenue, don’t spend $250 to get them.

Where Fintech Marketing Is Headed (2026 and Beyond)

The next wave isn’t about more ads. It’s about more integration. - Fintechs will embed themselves into tools people already use: accounting software, e-commerce platforms, payroll systems. - Community-led growth will explode. N26’s Slack group has 12,000 active members. Users get answers from both staff and peers-and that builds trust faster than any ad. - The EU’s new DORA regulation (starting Jan 2025) will require all marketing claims to be backed by real-time data. No more "#1 app in Europe" unless you can prove it with live usage stats. - AR and VR will become mainstream for financial education. Imagine pointing your phone at your bank statement and seeing an animated breakdown of where your money goes.The winners won’t be the ones with the biggest ad budgets. They’ll be the ones who treat marketing as a trust-building engine-not a sales funnel.

What’s the cheapest way to acquire fintech customers?

Referral programs are the cheapest, with average customer acquisition costs between $200 and $350. They also bring in users with 30% higher lifetime value because they’re recommended by friends, not ads. The downside? It takes 3 to 6 months to build momentum. Start early, offer real value (like $25 cash bonuses), and make sharing easy with pre-written messages and social sharing buttons.

How do I make my fintech app feel trustworthy?

Show, don’t tell. Use real security badges (like FDIC insurance, SOC 2 certification), explain compliance in plain language ("We verify your ID using Jumio, trusted by banks"), and link to public regulatory filings. Avoid vague claims like "secure" or "bank-grade." Instead, say: "Your funds are protected up to $250,000 by FDIC insurance. We never sell your data. Period." Transparency reduces fear faster than any logo or badge.

Should I use TikTok for fintech marketing?

Yes-if you’re targeting Gen Z. TikTok and Instagram Reels drive 4.2x higher engagement with users under 25. But your content must be educational, not salesy. Use AR filters to show savings, create 15-second explainers on budgeting, or show real user stories (with permission). Avoid jargon. Don’t say "compound interest"-say "Watch your $100 grow to $150 in a year without doing anything."

How long does it take to see results from fintech marketing?

It depends on the channel. Paid ads can drive sign-ups in days. But sustainable growth takes time. Referral programs take 3-6 months to ramp up. SEO content takes 4-8 months to rank. The key is to run both: use paid ads for quick wins while building long-term channels. Most successful fintechs spend 60% of their budget on paid and 40% on organic-then shift toward organic as they scale.

What’s the biggest mistake fintechs make in marketing?

Spending too much on acquisition and not enough on trust. McKinsey found that fintechs with high CAC but poor onboarding experience see 45% higher churn in the first 90 days. If your app is hard to use, your support is slow, or your fees change without warning, no amount of ads will save you. Fix the product experience first. Then market it honestly.

Comments (5)

Astha Mishra

It's fascinating how trust has become the ultimate currency in fintech-more valuable than any algorithm or UI polish. I've seen people abandon apps not because they were slow, but because a single phrase like 'we may charge fees' triggered a cascade of doubt. The human mind doesn't process financial risk logically; it processes it emotionally. And yet, so many brands still treat users like data points rather than nervous humans holding their life savings in their palms. Maybe the real innovation isn't in blockchain or AI, but in the courage to speak plainly, to admit uncertainty, and to let the customer feel safe before they even tap 'sign up'. We've forgotten that finance was once a conversation, not a transaction.

Kenny McMiller

Look, if you're still using Meta ads to acquire fintech users in 2025, you're basically throwing cash into a black hole wrapped in a TikTok filter. The real play is hyper-segmented content + referral loops + compliance baked into the copy from day zero. CAC under $300? That's not a dream-it's a baseline if you're not being lazy. And don't even get me started on 'free forever' claims. That's not marketing, that's a class-action lawsuit waiting to happen. The winners? The ones who treat compliance like a feature, not a footnote. Jumio badges, FDIC disclosures, real-time verifications-these aren't UX bells, they're trust anchors.

Dave McPherson

Oh wow, another 'trust is key' manifesto. Groundbreaking. I mean, who knew that telling people 'we won't steal your money' might help them feel less anxious? This reads like a MBA student's midterm essay written in 2018. The real insight? Nobody cares about your 'three pillars' unless you're solving a real problem. Most fintechs are just repackaging old bank features with neon colors and a chatbot named 'Finny'. And don't even mention 'AR filters'-that's not financial education, that's a Snapchat filter for people who think 'compound interest' is a type of yoga. If your entire acquisition strategy hinges on 15-second reels explaining budgeting, you're not building a company-you're running a TikTok influencer farm.

RAHUL KUSHWAHA

Thanks for sharing this. Really helpful. :)

Julia Czinna

Dave, you’re right that a lot of fintech marketing is superficial-but dismissing AR and TikTok entirely misses the point. It’s not about gimmicks; it’s about meeting people where they are. Gen Z doesn’t read whitepapers. They watch a 12-second video that shows their coffee money turning into $150 in savings, and suddenly, financial literacy feels less intimidating. That’s not dumbing down-it’s democratizing. And Astha? You nailed it about emotional risk. People don’t fear algorithms. They fear being misunderstood. The best fintechs don’t just explain fees-they explain why they exist, who they protect, and how they help real people sleep better at night. That’s not marketing. That’s empathy with a balance sheet.