Most investors think diversification means spreading money across stocks, bonds, and real estate. But there’s another layer most ignore-style diversification. It’s not about what you own, but how you own it. Mixing value and growth stocks isn’t just a fancy strategy; it’s one of the most effective ways to reduce risk without giving up returns. If your portfolio got crushed in 2022 while everyone else was bragging about tech gains, or if you missed the 2020-2021 rally because you were too scared of high-priced stocks, this is for you.

What Exactly Is Value Investing?

Value investing is buying companies that are undervalued by the market. Think of it as shopping during a sale. These stocks often have low price-to-earnings (P/E) ratios-usually under 15-and low price-to-book (P/B) ratios, often below 1.5. They pay dividends, have steady cash flow, and are usually in industries like banking, energy, or manufacturing. They’re not glamorous. You won’t see them on CNBC. But they’re cheap relative to what they actually earn or own.

Benjamin Graham, the father of this approach, taught that the market is often wrong in the short term. Value investors bet that the market will eventually realize the true worth of these companies. In 2022, when interest rates rose and growth stocks collapsed, value stocks held up. The Russell 1000 Value Index gained 12.7% more than growth that year. Why? Because investors fled expensive tech stocks and rushed to companies with solid balance sheets and predictable earnings.

What Exactly Is Growth Investing?

Growth investing is the opposite. You’re not looking for bargains-you’re looking for companies that are going to explode. These are firms with high revenue and earnings growth, often in tech, biotech, or cloud services. They typically have P/E ratios over 25, P/B ratios above 3, and little to no dividends. You’re paying for future potential, not current earnings.

Companies like Amazon in the early 2000s or NVIDIA in 2020 were classic growth plays. They didn’t make much profit yet-but investors believed they would. Between 2010 and 2021, growth stocks crushed value. The Russell 1000 Growth Index returned 14.3% annually versus just 6.1% for value. That 8.2% gap was massive. But here’s the catch: growth stocks don’t just rise slowly. They fall fast. When rates went up in 2022, many growth stocks lost 30-50% in months. That’s not a correction. That’s a bloodbath.

Why Mixing Them Works Better Than Picking One

Here’s the truth: no one can consistently predict when value or growth will win. Even the best fund managers fail at timing it. Vanguard found that investors who tried to rotate between styles underperformed a simple 60/40 value/growth mix by 1.2% per year. Why? Because they bought high and sold low-just like everyone else.

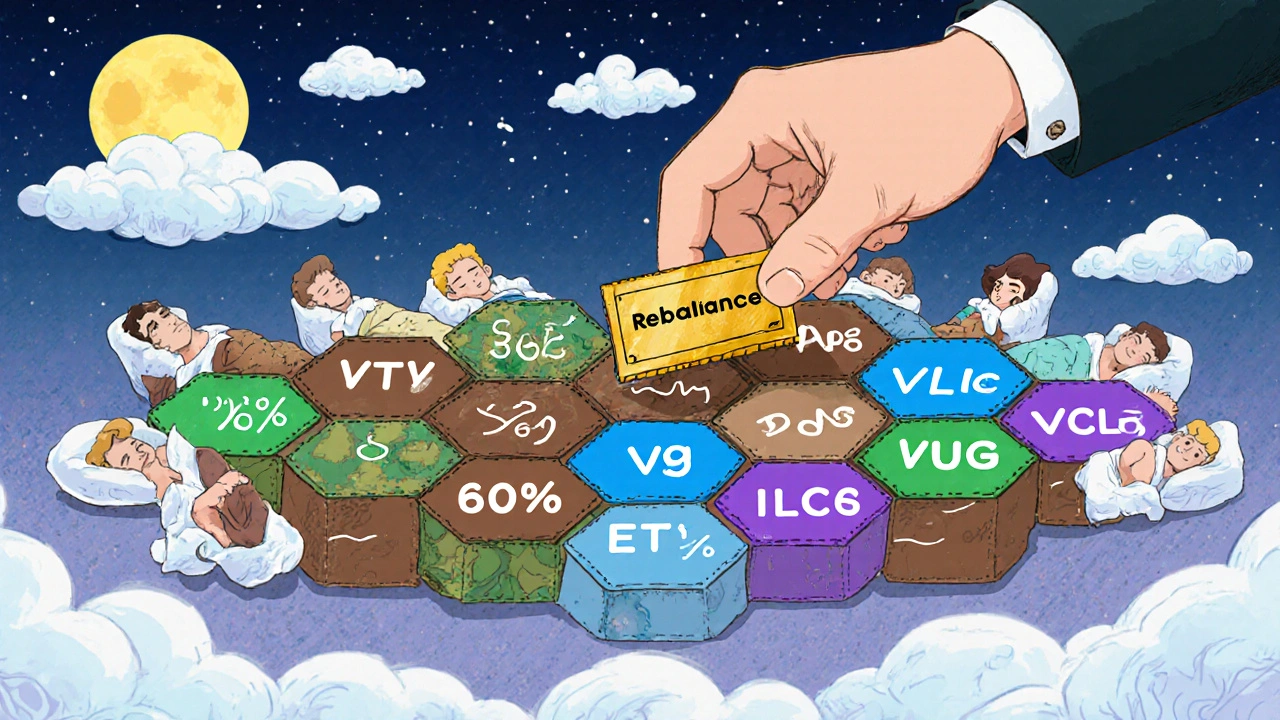

Style diversification isn’t about maximizing returns. It’s about reducing pain. A portfolio that’s 60% value and 40% growth, for example, won’t outperform a pure growth portfolio in a tech boom. But it won’t get wrecked in a crash either. During the 2022 market drop, blended portfolios had 18% less volatility than pure growth portfolios. That means less sleepless nights, fewer panic sales, and more staying power.

And the data backs this up. Morningstar tracked funds over 15 years and found that 83% of blend-style funds survived, compared to just 66% of pure value or pure growth funds. Funds that go all-in on one style are more likely to underperform for long stretches-and get shut down by investors who bail out.

How to Actually Build a Blended Portfolio

You don’t need to pick 50 individual stocks. You don’t need to calculate intrinsic value or forecast earnings growth for every company. You can do this with ETFs.

- For value exposure: Vanguard’s VTV (expense ratio: 0.04%) or iShares’ VLUE (0.15%)

- For growth exposure: Vanguard’s VUG (0.04%) or iShares’ ILCG (0.18%)

Start simple. Allocate 60% to value, 40% to growth. Rebalance once a year. If one side grows too big, sell a little and buy more of the other. This forces you to buy low and sell high-without emotion.

Or go even simpler: use a target-date fund or robo-advisor that already does this for you. Vanguard’s Target Retirement Funds now adjust their value/growth mix automatically when interest rates rise above 3.5%. That’s smart investing without the homework.

What to Avoid

Don’t fall into the trap of thinking you need to be 100% in one style. I’ve seen investors swear by growth because they made 45% in 2021-then lose it all in 2022. I’ve seen others cling to value because they avoided the crash, then miss the next bull run because they never bought tech.

Also, don’t try to time it. If you wait for value to look “cheap enough” or growth to “turn around,” you’ll miss the move. Style rotation isn’t a signal-it’s a cycle. And cycles don’t care about your gut feeling.

And don’t go too light on either side. Vanguard’s research shows allocations below 20% to either style provide almost no diversification benefit. If you’re only putting 10% in value, you’re not diversified-you’re just hedging.

Real People, Real Results

One Reddit user, InvestorJourney87, split his portfolio 60/40 between value and growth in 2021. In 2022, his growth ETFs dropped 35%. His value holdings? Down only 22%. He didn’t make the most money-but he didn’t panic. He kept contributing. By 2024, he was back to even. He didn’t need to be right. He just needed to stay in the game.

Another investor on Seeking Alpha, TechGrowthBull, went all-in on growth through 2021. He made 45%. Then in 2022, he lost 40%. He said he didn’t lose money-he lost confidence. Now he’s got 30% in value ETFs. “I’m not trying to win the lottery anymore,” he wrote. “I’m trying not to lose everything.”

That’s the goal.

The Bigger Picture

Style diversification is the second most powerful form of diversification after asset class diversification. That’s according to Dr. Roger Ibbotson, a Yale professor who literally wrote the book on portfolio theory. He says the correlation between value and growth is low-below 0.6. That means when one is down, the other often isn’t. That’s the definition of diversification.

And it’s not just for individuals. Institutional investors are catching on. In 2019, only 52% of pension funds used style diversification. By 2023, that number jumped to 68%. BlackRock, Vanguard, and Fidelity all now offer ETFs and funds built around this idea. The market’s telling you something: this isn’t a fad. It’s a framework.

Yes, AI might change things. Goldman Sachs warns that artificial intelligence could keep growth stocks priced high even when rates rise. Maybe the old rules don’t apply anymore. But here’s the thing: even if they don’t, you still need a plan that doesn’t rely on perfect predictions. That’s what style diversification gives you: resilience, not perfection.

You don’t need to be the smartest investor. You just need to be the most consistent one.

What’s the difference between value and growth stocks?

Value stocks trade at low prices relative to their earnings, assets, or sales-think banks, energy firms, or industrial companies. They often pay dividends. Growth stocks have high valuations because investors expect big future earnings-like tech or biotech firms. They usually don’t pay dividends and have high price-to-earnings ratios.

Is it better to invest in value or growth?

Neither. Trying to pick the winner every time leads to underperformance. Value outperforms during economic slowdowns and rising rates. Growth wins during strong economies and falling rates. Mixing both gives you exposure to both environments without betting everything on one outcome.

How much of my portfolio should be value vs. growth?

A common starting point is 60% value and 40% growth, but 50/50 works too. The key is to allocate at least 20% to each style-anything less doesn’t provide meaningful diversification. Rebalance annually to keep your allocation on track.

Can I do this with mutual funds or ETFs?

Yes. For value, use VTV or VLUE. For growth, use VUG or ILCG. These ETFs have low fees (as low as 0.04%) and track clear style benchmarks. You can also use blended funds like Vanguard’s Target Retirement Funds, which adjust the mix automatically.

Why did value stocks outperform in 2022?

When the Federal Reserve raised interest rates to fight inflation, expensive growth stocks fell because their future earnings became less valuable in today’s dollars. Value stocks, with their current earnings and lower prices, became more attractive. This is a classic pattern-value rebounds when rates rise.

Does style diversification limit my returns?

Yes, slightly. A pure growth portfolio can outperform during a tech boom. But it also crashes harder. Style diversification reduces your upside in strong rallies-but it also protects you from big losses. Over the long term, that balance leads to more consistent results and fewer emotional mistakes.

Comments (4)

Graeme C

Finally, someone gets it. I watched my portfolio get slaughtered in 2022 because I was all-in on growth-NVDA, TSLA, you name it. Then I read Graham and realized I wasn’t investing, I was gambling. I shifted to 60/40 value/growth last year. My returns aren’t flashy, but I’ve slept better than I have in five years. Rebalancing once a year is the quietest form of alpha out there.

Astha Mishra

It is truly fascinating, isn't it, how human psychology so often overrides rational economic principles? We are wired to chase the shiny object-the latest AI startup, the hyped-up biotech-that glitters in the market’s spotlight. Yet, the ancient wisdom of value investing-buying what is undervalued, patient, grounded-is not merely a strategy, it is a philosophy of restraint. I have seen friends lose their life savings chasing momentum, while those who held steady, who trusted the math over the media, emerged not just unscathed, but stronger. The market may be irrational in the short term, yes-but over time, it tends to correct, and those who remain anchored to principle, not emotion, are the ones who endure. I do not seek to outperform the crowd; I seek to outlast it.

Kenny McMiller

Bro, the 60/40 split is basically the Fed’s version of a low-risk crypto staking pool. Value stocks are the stablecoin, growth is the meme coin. You don’t need to pick winners-you just need to keep your allocation tight and let the cycle do the work. Vanguard’s target funds? That’s just auto-pilot for people who don’t wanna think. And honestly? That’s the whole point. The market doesn’t reward genius. It rewards consistency. Stop trying to time it. Just set it and forget it. You’re not Warren Buffett-you’re just trying not to go broke before retirement.

Dave McPherson

Ugh. Another ‘balanced portfolio’ cultist. Let me guess-you also drink kombucha and think ‘rebalancing’ is a form of mindfulness? Look, if you’re not 80% growth in 2025, you’re already behind. AI is rewriting every rulebook. Value stocks? They’re relics of the analog era-banks with brick-and-mortar branches, energy companies still using spreadsheets. The future belongs to companies with zero tangible assets and infinite upside. If your portfolio can’t handle a 50% drawdown, you shouldn’t be investing-you should be managing a 401(k) for your cat. And don’t even get me started on those ETFs-VTV? VLUE? Those are just glorified index funds for people who think ‘diversification’ means not putting all their money in one meme stock. Pathetic.