Tax Efficiency Calculator

Investment Tax Savings Calculator

See how much you could save in taxes by switching from active funds to index funds in your taxable accounts.

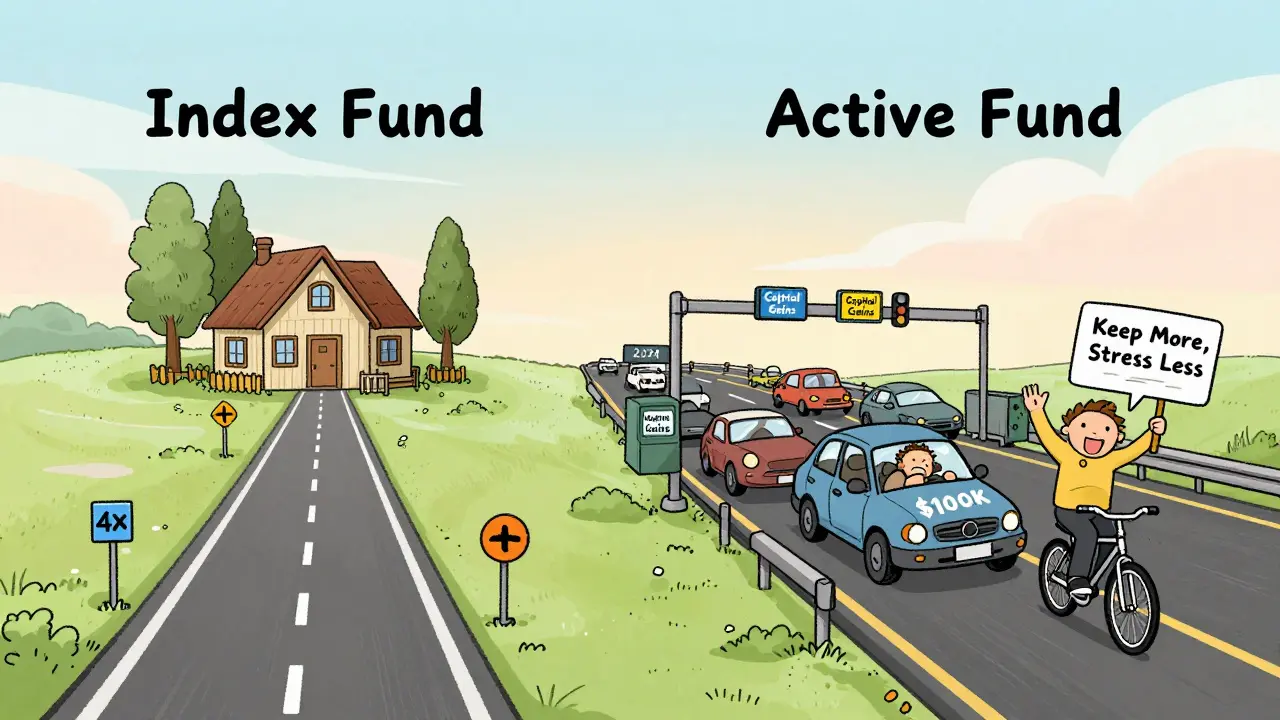

When you invest in a fund, you're not just betting on the market-you're also signing up for a tax bill. And not all funds create the same kind of tax burden. If you're holding investments in a regular taxable account, the difference between an index fund and an active fund isn't just about performance-it's about how much of your returns the IRS takes before you even see them.

Why Tax Efficiency Matters More Than You Think

Most people focus on returns. Did my fund go up 8% this year? Did it beat the S&P 500? But if you're paying taxes every time the fund trades, your real gain might be half of what you think. A fund that returns 8% before taxes might only give you 6% after taxes-if it's constantly buying and selling stocks. That’s the power of tax efficiency. Index funds, which copy a market index like the S&P 500, trade rarely. They only buy or sell when the index changes. That means fewer taxable events. Active funds, on the other hand, are constantly trying to outsmart the market. Their managers buy and sell based on research, predictions, and timing. That sounds smart-until you see the tax bill. In 2023, the average index fund distributed just 0.62% of its assets in capital gains. The average actively managed large-cap fund? 4.27%. That’s nearly seven times more. And that’s not a one-year fluke. Over the last 20 years, index funds distributed 87% less in capital gains than active funds, according to Vanguard’s research.How Index Funds Stay Tax-Efficient

Index funds don’t win because they’re lucky. They win because of how they’re built. First, low turnover. Most index funds turn over less than 10% of their holdings each year. That means they hold stocks for years, not months. Long-term holdings mean long-term capital gains-which are taxed at a lower rate. Active funds? Turnover often hits 80% or higher. That’s like flipping houses every few months. Each flip triggers a tax event. Second, in-kind redemptions. When someone cashes out of an index fund, the fund doesn’t sell stocks to raise cash. Instead, it gives the investor shares of the actual stocks in the fund. This avoids triggering a taxable sale. It’s a legal loophole that only works with certain fund structures-and index funds use it well. Third, ETFs make it even better. Most index funds today are structured as ETFs (like VTI or VOO). ETFs have a unique creation and redemption process that lets authorized participants swap baskets of stocks for shares. This means the fund can shed losing stocks without ever selling them to the public. As a result, 92% of ETFs distributed zero capital gains in 2023, according to BlackRock.Why Active Funds Pay More in Taxes

Active managers are trying to beat the market. That sounds great-until you realize beating the market means buying high and selling higher. And selling means realizing gains. Every time an active manager sells a stock that’s gone up, even if it’s just to make room for a new pick, they create a capital gain. Those gains get passed on to you, the investor-even if you didn’t sell anything. You’re taxed on the fund’s trades, not your own. In 2022, during a brutal market downturn, actively managed funds still distributed 5.8% of their assets in capital gains. That’s right-while your portfolio was losing money, the fund was selling winners and making you pay taxes on gains you never saw. Index funds? They distributed just 0.3%. Even when active funds do well, the tax hit eats into their edge. Morningstar analyzed 4,500 equity funds over 15 years. On a pre-tax basis, index funds beat 79% of active funds. On an after-tax basis? They beat 86%. That gap isn’t about performance-it’s about taxes.

Are There Any Active Funds That Are Tax-Efficient?

Yes. But they’re the exception, not the rule. Some active managers have learned to play the tax game. Fidelity Contrafund (FCNTX), managed by Will Danoff since 1990, has kept turnover under 20% for years. In 2023, it distributed only 1.2% in capital gains-far below the 4.7% average for its category. Then there are tax-managed funds. Vanguard Tax-Managed Capital Appreciation Fund (VTCLX) is designed specifically to minimize taxes. It uses strategies like offsetting gains with losses, holding stocks longer, and avoiding dividend-heavy stocks. In 2024, it distributed just 0.7% in capital gains-right in line with index funds. And now, active ETFs are changing the game. T. Rowe Price launched a series of active ETFs with turnover under 50%. One of them, the T. Rowe Price Blue Chip Growth ETF, distributed only 0.8% in capital gains in 2024. That’s because ETF structures let them avoid taxable sales-even when they’re actively managed. So yes, it’s possible. But these funds are rare. Most active funds still trade like madmen and leave you with a big tax bill.Where to Put Each Type of Fund

The smartest move isn’t just choosing index over active-it’s putting them in the right account. Put index funds in your taxable brokerage account. Their low turnover means you pay little in taxes. That’s why most financial advisors recommend it. Put active funds in tax-advantaged accounts like IRAs or 401(k)s. That way, you avoid taxes entirely-no capital gains distributions, no dividend taxes. The fund can trade as much as it wants, and you won’t see a 1099 at tax time. If you’re holding $100,000 or more in taxable accounts, the annual tax savings from using index funds instead of active funds can be $1,500 to $2,500. That’s not a small amount. That’s a car payment. Or a vacation. Or a big step toward retirement.Real People, Real Tax Bills

Numbers are one thing. Real life is another. On the Bogleheads forum, one investor with $500,000 in a taxable account reported that his index fund (VTSAX) generated $1,250 in capital gains in 2024. His friend, with the same amount in an active fund, got a $18,400 tax bill. That’s over $17,000 in extra taxes-just because of the fund choice. Reddit user ‘AfterTaxAlpha’ shared a 10-year comparison: $100,000 invested in VTI (Vanguard’s total stock market ETF) generated $3,850 in taxable gains. A comparable active fund? $42,700. That’s more than ten times the tax. Fidelity’s 2024 survey found that 68% of investors who held both types of funds in taxable accounts said their tax bills were much lower with index funds. The average savings? $1,842 per year.

The Future of Tax-Efficient Investing

The market is changing. In 2025, BlackRock launched its ‘Tax Advantage’ ETFs-active funds that use algorithms to minimize capital gains. Early results show 75% fewer distributions than traditional active funds. Vanguard now uses machine learning to optimize tax-loss harvesting in its index funds, cutting capital gains by another 0.3-0.5% each year. By 2030, Morningstar predicts 65% of actively managed funds will be structured as ETFs-just to stay competitive on taxes. That’s a huge shift. Even active managers know: if you don’t manage taxes, you lose.What You Should Do Right Now

If you’re investing in taxable accounts:- Use index funds-or index ETFs-for your core holdings. VTI, VOO, or VTSAX are solid choices.

- Check your current active funds’ capital gains distributions. Look at their 1099-DIV forms from the last three years. If they’re over 3%, consider moving them.

- Move any active funds you own into IRAs or 401(k)s. Save the taxable account for low-turnover investments.

- Use tax-loss harvesting if your broker offers it. Selling losing positions to offset gains can save you another 0.5-0.8% annually.

Final Thought: It’s Not About Beating the Market-It’s About Keeping More of It

The goal isn’t to find the next Warren Buffett fund. It’s to make sure you keep every dollar you earn. Most active managers don’t beat the market after fees. And most of them don’t beat it after taxes, either. Index funds don’t promise miracles. They promise consistency. And in the long run, consistency with lower taxes beats high-risk, high-tax bets every time.Are index funds always more tax-efficient than active funds?

Generally, yes. Index funds trade far less, so they generate fewer capital gains. But there are exceptions. Some actively managed funds-especially tax-managed funds or low-turnover ETFs-can match or come close to index fund tax efficiency. Still, over 90% of active funds distribute significantly more in capital gains than index funds.

Do I need to pay taxes on index funds if I don’t sell them?

Yes, you might. Even if you don’t sell your shares, the fund itself can sell stocks and distribute capital gains to shareholders. You’ll receive a 1099-DIV form each year showing those distributions, and you owe taxes on them. That’s why low-turnover index funds are better-they rarely trigger these events.

What’s the difference between an index mutual fund and an index ETF?

Both track the same index, but ETFs use a unique creation/redemption process that allows them to avoid triggering capital gains when investors buy or sell. This makes ETFs more tax-efficient than mutual funds-even if they’re both passive. For example, in 2023, 92% of ETFs distributed zero capital gains, compared to 65% of index mutual funds.

Should I move my active funds to index funds in my taxable account?

If your active fund has generated high capital gains distributions over the past few years (over 3%), and you’re holding it in a taxable account, yes. The tax savings can be substantial. But be careful: if you sell now and have a large gain, you’ll owe taxes on that gain. Consider selling gradually, or move the fund to a tax-advantaged account instead.

Can I use tax-loss harvesting with index funds?

Absolutely. Tax-loss harvesting works well with index funds because they’re stable and predictable. You can sell an index fund at a loss and replace it with a similar one (like switching from VTI to VXUS) to maintain exposure while reducing your tax bill. Fidelity reports this can lower your effective tax rate by 0.5-0.8% annually.

What’s the best index fund for tax efficiency?

For most investors, the Vanguard Total Stock Market ETF (VTI) or the Schwab U.S. Broad Market ETF (SCHB) are top choices. Both have ultra-low expense ratios, minimal turnover, and have distributed capital gains in fewer than 5 years over the past two decades. They’re simple, cheap, and tax-efficient.

Comments (5)

Royce Demolition

Broooooo 😍 I just moved all my active funds to VTI last month and my tax bill dropped by like 80%. I was crying at my tax software last year - now I’m buying a new guitar. Low turnover = low stress. 🎸💰

Sabrina de Freitas Rosa

Ugh. People still fall for this index fund cult? 😒 Active managers actually think. They don’t just copy-paste the S&P like a robot with a spreadsheet. And don’t even get me started on ETFs - they’re basically tax loopholes dressed up as ‘investing.’ If you’re too lazy to research, fine, but don’t act like you’re some financial genius just because you bought VOO.

Erika French Jade Ross

honestly i just read this and felt so seen 😅 i had no idea my active fund was spitting out $2k in gains every year while i was just sitting there. switched to vti last year and my 1099 went from ‘oh god no’ to ‘huh, that’s it?’ 🤷♀️ also… tax-loss harvesting is magic. i’m not smart but i’m not dumb either and this made sense

Geoffrey Trent

Lmao. You guys are hilarious. Index funds are for people who can’t handle real investing. I held an active fund that returned 14% last year and paid $300 in taxes. Meanwhile, my buddy with VTI got 9% and paid $400 because the fund sold some junk he didn’t even know about. Stop drinking the Vanguard kool-aid. Taxes aren’t the enemy - mediocrity is.

John Weninger

I think there’s room for both - honestly. If you’ve got a solid active fund with low turnover and you’re holding it in a 401(k)? Go for it. But if you’re keeping it in a taxable account and it’s flipping stocks every quarter… yeah, you’re leaving money on the table. The key isn’t dogma - it’s awareness. Check your 1099-DIV. Talk to your broker. It’s not about being right - it’s about keeping what’s yours. 🙌