Profit Factor Calculator

Profit Factor Calculator

Calculate your trading strategy's profitability potential based on win rate and risk-reward ratio.

Important: A profit factor above 1.0 indicates a profitable strategy. However, backtesting with real-world fees and slippage is crucial for realistic results.

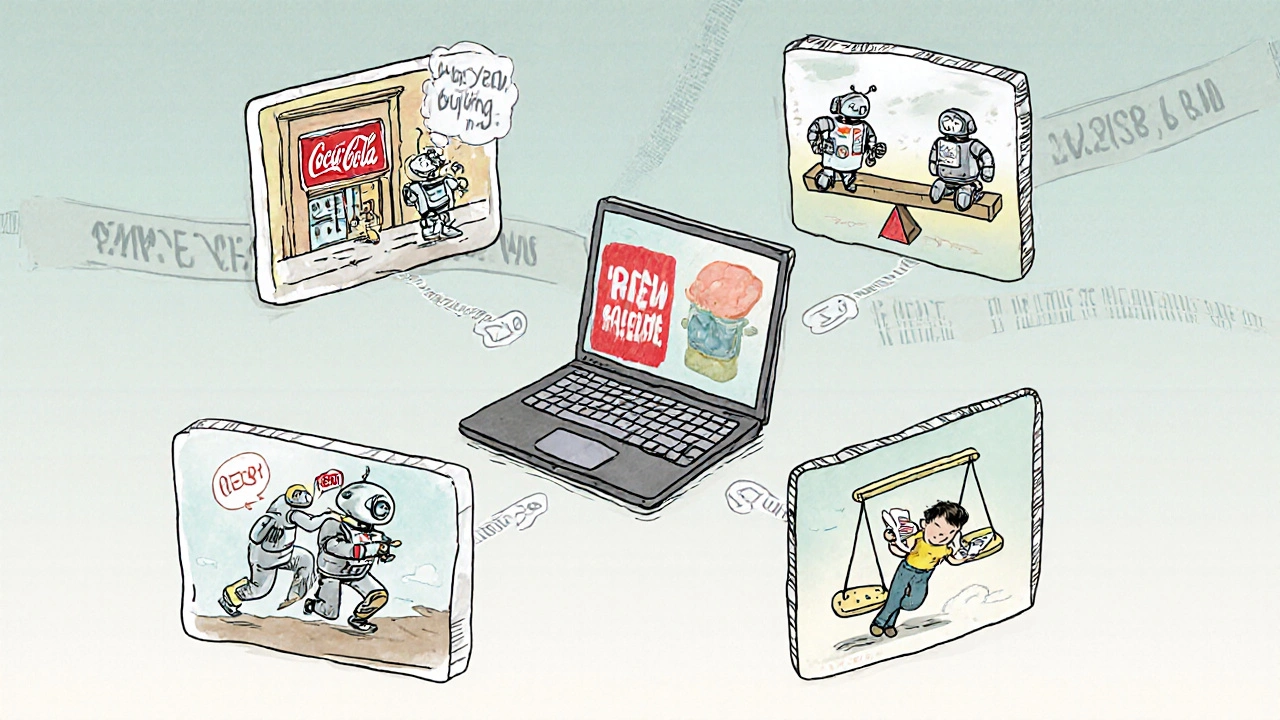

For most people, trading stocks feels like a game of luck - waiting for the right moment, second-guessing every decision, watching your emotions take over when the market dips. But what if you could remove the fear, the hesitation, and the impulsive buys? What if your trades happened automatically, based on cold, hard data - not gut feelings? That’s the promise of algorithmic trading.

It’s not science fiction. It’s happening right now, every millisecond, across Wall Street and in living rooms from Asheville to Austin. Algorithms execute trades faster than any human ever could. They don’t get tired. They don’t panic. And they don’t chase hype. But here’s the catch: most people who try it lose money. Not because the system doesn’t work - but because they misunderstand how it actually works.

What Exactly Is Algorithmic Trading?

Algorithmic trading is when a computer runs a set of rules to buy or sell assets without human input. These rules can be as simple as: “Buy Apple stock if its 20-day average price drops below today’s price.” Or as complex as: “Sell 500 shares of Tesla if volatility spikes, correlation with Bitcoin falls below 0.6, and volume exceeds 10 million shares in the last 15 minutes.”

It’s not just for hedge funds anymore. Thanks to platforms like MetaTrader, QuantConnect, and TradingView, everyday traders can build and test their own strategies. You don’t need a Ph.D. in math or a $10 million server farm. You just need a clear idea, some basic coding, and the discipline to stick with it.

The key difference between algorithmic trading and simple automated trading? Adaptability. Automated systems follow fixed rules - if the price hits X, buy. Algorithmic systems can learn. They can adjust to changing market conditions using machine learning. That’s why 63% of new retail strategies in 2023 included AI components, up from just 29% in 2020.

How Do These Algorithms Actually Make Money?

There are four main ways algorithms profit:

- Market-making: Algorithms place both buy and sell orders simultaneously, capturing the spread. Think of them as digital middlemen - always ready to buy low and sell high, even if only by a penny.

- Statistical arbitrage: They spot price differences between related assets. For example, if Coca-Cola and Pepsi usually move together but suddenly diverge, the algorithm bets they’ll snap back.

- Event arbitrage: They react instantly to news - earnings reports, Fed announcements, or even social media trends - before most humans even see the headline.

- Mean reversion: They assume prices drift away from their average and will eventually return. Buy when it’s cheap, sell when it’s expensive. Simple. Effective. But only if the data supports it.

One common retail strategy? The 20-day moving average crossover. If the current price falls below the 20-day average, buy. If it rises above, sell. It’s not flashy. But backtested on Apple stock from 2015 to 2023, it returned 142% with a 1.8 profit factor - meaning for every dollar lost, you made $1.80 in profit. That’s better than most mutual funds.

Who’s Really Running the Show?

Big firms like Citadel, Jump Trading, and Virtu Financial dominate the market. They own the infrastructure: co-located servers next to exchange data centers, fiber-optic cables with near-zero latency, and teams of PhDs tweaking algorithms 24/7. They account for just 2% of trading firms but execute 73% of all U.S. equity volume.

But here’s the thing: you don’t have to beat them. You just have to find your own edge. Retail traders aren’t competing in the same race. While HFT firms profit from microsecond advantages, most retail strategies run on hourly or daily timeframes. You’re not trying to trade faster than a bullet. You’re trying to trade smarter than your own emotions.

And that’s where the real advantage lies. A 2023 survey by QuantConnect found that 82% of algorithmic traders reported fewer emotional mistakes than when they traded manually. That’s huge. Fear and greed destroy more portfolios than bad strategies.

The Hidden Risks - And Why Most People Fail

Let’s be blunt: 68% of retail algo traders see their backtested strategies perform 30-50% worse in live trading. Why?

- Over-optimization: You test your strategy on 10 years of data, tweak it 200 times, and it looks perfect. Then you run it live - and it fails. That’s curve-fitting. You didn’t build a robust system. You built a mirror of the past.

- Ignoring fees and slippage: Backtests often assume perfect execution. Real trades have commissions, bid-ask spreads, and delayed fills. A strategy that looks profitable on paper can bleed money in practice.

- Black swan events: The 2010 Flash Crash showed how algorithms can amplify panic. When one system starts selling, others follow - and prices collapse in seconds. No human was in control. Just machines reacting to machines.

- Technical overload: 45% of beginners say debugging their code is their biggest headache. A single typo in a Python script can cause your bot to buy 100x more than intended.

Regulators are watching. FINRA now requires firms to keep detailed logs of algorithmic trading activity. ESMA under MiFID II forces traders to identify their algorithms. This isn’t the Wild West anymore. But that doesn’t mean you can’t win - it just means you need to be smarter.

How to Get Started (Without Going Broke)

You don’t need to be a coder to begin. Here’s a realistic path:

- Start simple. Use a visual strategy builder on TradingView or MetaTrader. Try a moving average crossover. No code needed.

- Backtest properly. Use at least 5 years of data. Test across different market conditions - bull, bear, sideways. Don’t just optimize for the best result. Look for consistency.

- Use paper trading. Run your strategy in simulation for 3-6 months. See how it behaves in real-time without risking cash.

- Start small. Put in $100. Not $10,000. Let the algorithm prove itself before you scale.

- Learn Python. Even basic knowledge helps. Libraries like pandas and backtrader make it easy to test strategies. 87% of retail traders use Python now.

Platforms like QuantConnect and Zipline offer free cloud-based backtesting. You don’t need a powerful computer. Just an internet connection and patience.

Is This the Future?

The global algorithmic trading market is projected to hit $18.8 billion by 2027. That’s up from $11.1 billion in 2022. Institutional adoption is still king - 75% of U.S. equity trades are algorithmic. But retail is catching up fast. MetaTrader reported 4.3 million active algorithmic trading accounts in mid-2023 - up 37% in one year.

AI tools are making it easier than ever. One Reddit user said they fed their trading rules to ChatGPT and got a working Expert Advisor for MetaTrader 5 in 20 minutes. That’s not a fluke. It’s the new normal.

But here’s the truth: technology doesn’t replace discipline. It amplifies it. A bad strategy, automated, is still a bad strategy - just faster. A good one, automated, becomes a steady income machine.

The future belongs to those who treat algorithmic trading like a business - not a gamble. Track your results. Document your logic. Kill your worst-performing strategies fast. And never, ever trust a backtest that looks too good to be true.

What Comes Next?

Gartner predicts that by 2025, 40% of retail traders will use AI-assisted strategies. That means more competition - but also more tools. More transparency. More access.

But the Bank for International Settlements warns: if too many traders use the same algorithms, markets could become fragile. Imagine a hundred bots all selling at once because they all spotted the same signal. That’s systemic risk.

So the real question isn’t whether you should use algorithmic trading. It’s whether you’re ready to treat it with the respect it deserves.

It’s not about beating the market. It’s about beating yourself.

Comments (3)

Graeme C

Let’s be real - most retail algo traders treat this like a slot machine with a Python interface. I backtested a moving average crossover for six months, paper-traded it for three, and watched it make 14% in a bull market and lose 22% in sideways. The system wasn’t broken. I was. I kept tweaking it after every drawdown, convinced the market owed me. Turned out, I was just curve-fitting my desperation. The real edge isn’t in the code - it’s in not touching it after you deploy. Discipline > algorithm. Always.

Astha Mishra

It is truly fascinating, if one pauses to consider the metaphysical implications of delegating human decision-making to machines governed by statistical probabilities derived from historical patterns that may never repeat - yet we place our trust, our savings, our hopes, in these silent, tireless entities that do not sleep, do not dream, and do not feel the weight of a lost dollar. We call it ‘algorithmic trading,’ but is it not, in essence, a modern ritual? We sacrifice our emotional turbulence upon the altar of data, hoping that the gods of liquidity and volatility will smile upon us. And yet - what if the algorithm, in its cold logic, is merely reflecting the collective madness of the market? Not correcting it. Amplifying it. The real question is not whether the machine is better - but whether we have become too afraid to be wrong ourselves.

Kenny McMiller

Bro, the real MVP here is backtrader + pandas. I automated a mean-reversion bot on SPY using a 10-day Z-score threshold. Paper trading nailed it. Went live with $200. Slippage ate 12% of my returns in the first week. Then I added a 0.5% min-profit filter and reduced position size. Now it’s churning 0.8% weekly with a 2.1 Sharpe. No PhD needed. Just don’t overfit. And for god’s sake, log every trade. I lost $800 because I typo’d ‘quantity’ as ‘quanity’ and bought 1000 shares instead of 10. Happens. Learn. Move on.