Fraud Risk Calculator: AI vs Traditional Detection

Enter transaction details to see how AI and traditional systems would evaluate risk. Based on Experian's 2024 data showing AI detects 95-98% of fraud with 1-2% false positives versus traditional systems' 70-80% detection and 5-10% false positives.

Risk Assessment

Every second, thousands of transactions flash across digital networks-online purchases, bank transfers, app payments. Most are harmless. But a small fraction? They’re scams. And they’re getting smarter. Traditional fraud detection systems, built on simple rules like "block transactions over $10,000," are crumbling under the weight of modern fraud. Enter AI. Not as a magic fix, but as the only tool fast and smart enough to keep up.

Why Old Systems Fail Against Modern Fraud

Five years ago, a fraudster might have tried one big purchase with a stolen card. Today, they spread it out. Five $199 charges across three different websites. One from a VPN in Latvia, another from a device that’s never been used before. All under the radar of old rules. That’s called "smurfing." And it’s everywhere. Rule-based systems can’t see patterns. They only see numbers. If a transaction doesn’t break a fixed rule, it gets approved. That’s why false positives are so high-legit customers on vacation get flagged because they bought a $2,000 camera in Bali. Meanwhile, the real fraud slips through. Experian’s 2024 data shows traditional systems catch only 70-80% of fraud. And for every 100 transactions they flag, 5 to 10 are innocent people. That’s not just annoying-it’s expensive. Customer service calls, chargebacks, lost trust. Businesses lose money every time they mistake a real customer for a fraudster.How AI Sees What Humans Can’t

AI doesn’t look at transactions one at a time. It watches behavior. Over time. Across devices. Across locations. It builds a profile-not of the card, but of the person behind it. Think of it like recognizing a friend’s voice. You don’t memorize every word they say. You notice their rhythm, their pauses, how they say "uh" before a thought. AI does the same with digital behavior. It tracks how fast someone types their password. Where their mouse hovers before clicking. How long they spend on a checkout page. Bots can’t mimic that. Not perfectly. Machine learning models-both supervised and unsupervised-learn from millions of past transactions. Supervised models learn from labeled fraud cases: "This one was fake. This one was real." Unsupervised models find strange patterns on their own. A sudden spike in logins from a new country. A device that’s been used by 12 different accounts in the last week. A user who suddenly starts buying luxury watches after only ever buying socks. NVIDIA’s 2024 research found the best systems analyze over 100,000 data points per transaction. Not just location and amount. Device fingerprint, network latency, time since last login, even how the screen was tilted when the app was opened. That’s the "whole picture"-and it’s why AI catches 95-98% of fraud, according to Experian.Speed That Outpaces Fraudsters

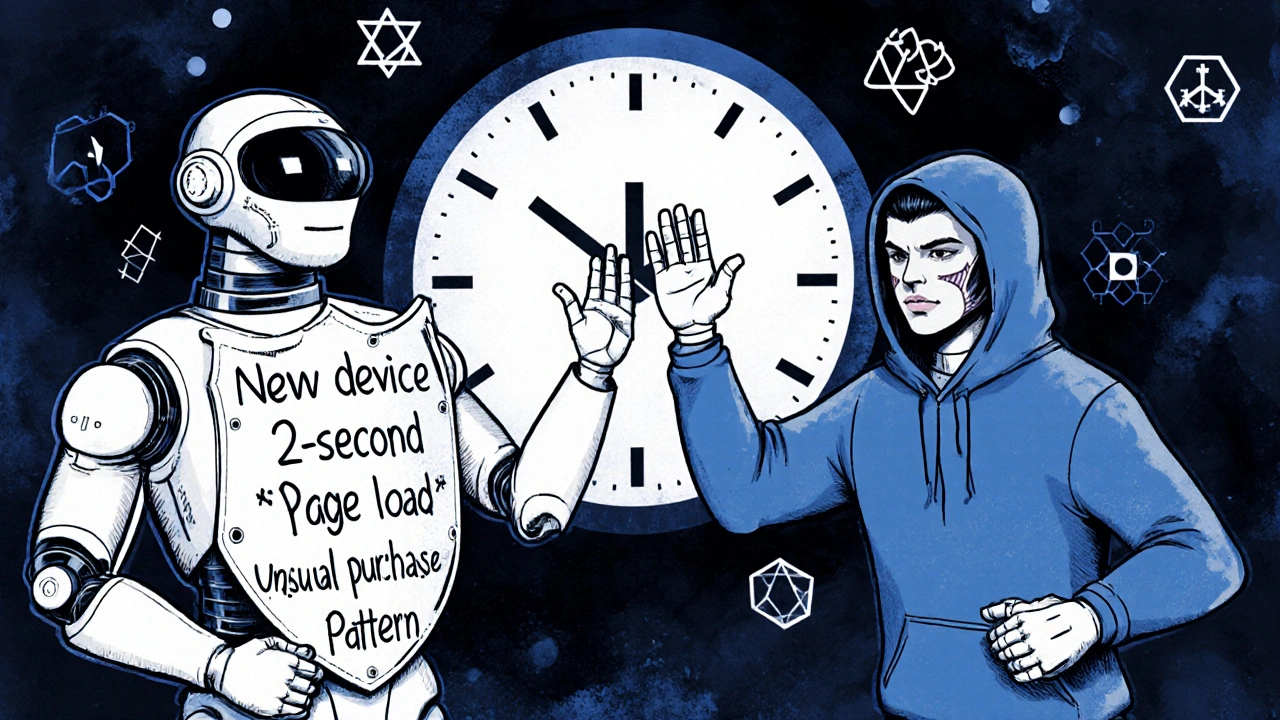

Time matters. A lot. A rule-based system might take minutes to flag a suspicious transaction. A human reviewer might take hours. By then, the money’s gone. AI doesn’t wait. Modern systems make decisions in under 200 milliseconds. That’s faster than your phone loads a webpage. As a transaction hits the server, AI is already comparing it against billions of past behaviors. If something feels off, it blocks it before the user even sees a confirmation screen. This isn’t theoretical. Sift, DataDome, and MindBridge-all leaders in the space-report real-time blocking rates of 99% for high-risk transactions. That means fraudsters don’t get a second chance. Their attack fails before it even starts. And it scales. A single analyst can review 200 transactions a day. AI can review 100,000 per second. For an e-commerce site processing millions of sales daily, that’s the difference between staying open and collapsing under fraud.

The Hidden Cost: Data, Expertise, and Time

AI isn’t plug-and-play. You can’t just buy it and turn it on. First, you need data. At least six to twelve months of clean, labeled transaction history. Without it, the model has nothing to learn from. Small businesses with low volume? They’re stuck. They don’t have enough fraud examples to train the system. That’s why adoption is only 22% among small businesses, compared to 78% among large e-commerce platforms. Then there’s the tech stack. You need data pipelines that can handle high-speed, high-volume streams. You need engineers to build them. You need data scientists to tune the models. And you need fraud experts to interpret what the AI is seeing. Gartner’s 2024 report says initial setup costs range from $150,000 to $500,000. That’s not a software license. That’s hiring talent, integrating systems, testing, and training. And it takes 3-6 months to go live. Even after launch, the system doesn’t stop learning. Fraud changes weekly. New scams emerge. So models need retraining-every quarter. That’s 10-20 hours of data science work every month. If you don’t keep up, the system gets lazy. And fraudsters know it.AI Doesn’t Replace Humans-It Empowers Them

A common myth: AI will make fraud investigators obsolete. That’s not true. The best systems use AI to handle the easy 80-90% of cases. Then, they escalate the weird ones. The ones where a user’s behavior is almost normal-but just off enough to raise a red flag. Maybe they logged in from a new city, but used their usual password pattern. Maybe they bought a high-value item, but spent 12 minutes reading product reviews. That’s where humans step in. A fraud analyst looks at the full context. Did the customer just return from a trip? Did they update their shipping address last week? Did they call customer service to confirm the purchase? Dr. Emily Chen from DataDome put it simply: "Modern AI doesn’t just detect actions. It detects intent." And intent is messy. It’s emotional. It’s human. That’s why AI needs humans-and humans need AI.What’s Next? AI vs. AI

The arms race is accelerating. Fraudsters are using AI too. They’re generating synthetic identities with deepfakes. They’re crafting phishing emails so realistic, even seasoned users fall for them. They’re training bots to mimic human typing patterns. Some are even using AI to test their own scams against detection systems before launching them. In response, fraud detection platforms are fighting fire with fire. MindBridge now uses generative AI to simulate thousands of fake fraud attempts-each one slightly different-so their models get stronger. DataDome’s 2025 update added behavioral biometrics that track 200+ micro-interactions per session. Even mouse tilt and finger pressure. Gartner predicts that by 2027, 80% of enterprise systems will use explainable AI (XAI). That means instead of saying "this transaction is risky," the system will say: "This transaction is risky because the user logged in from a new device, used a different browser, and spent 2 seconds on the payment page-unlike their usual 15-second behavior." Transparency matters. Not just for compliance, but for trust. And then there’s the long-term threat: quantum computing. It could break current encryption in years, not decades. That means even if your AI catches every fraud attempt today, the data it relies on could become readable to attackers tomorrow. The industry is already exploring quantum-resistant encryption and blockchain-backed ledgers for immutable audit trails.

Who Should Use AI Fraud Detection?

If you’re a large e-commerce brand, a fintech app, a digital bank, or a platform processing more than 10,000 transactions a day-AI fraud detection isn’t optional. It’s survival. If you’re a small business with under 1,000 transactions a month? The cost and complexity may outweigh the benefit. Stick with basic rule-based tools for now. Focus on strong authentication. Monitor chargebacks. Train staff to spot red flags. The EU’s DORA regulation, effective January 2025, now legally requires financial institutions to use advanced fraud detection. In the U.S., the CFPB is cracking down on Venmo scams and fake warranty fraud. Compliance isn’t just about avoiding fines-it’s about protecting your customers.Getting Started: Realistic Steps

Don’t try to boil the ocean. Start small.- Pilot first. Pick one product line or payment type. Run AI on 10-20% of transactions. Compare results to your current system.

- Set clear thresholds. Decide what false positive rate you can tolerate. A 1% false positive might be fine for a luxury retailer. Not for a grocery delivery app.

- Build feedback loops. Every time a human investigator overrides an AI flag, record why. Use that data to retrain the model.

- Choose vendors with clear docs. Sift scores 4.7/5 on G2 for documentation. Many others score below 3.8. Clarity saves time.

Final Thought: The Only Constant Is Change

Fraud isn’t going away. It’s evolving. Faster than ever. AI fraud detection systems aren’t perfect. They’re expensive. They’re complex. But they’re the only thing keeping digital commerce alive. The goal isn’t to stop every single fraud attempt. That’s impossible. The goal is to make fraud so hard, so slow, so expensive for criminals that they give up and move on. AI doesn’t just detect suspicious activity. It makes fraud a losing game.How accurate are AI fraud detection systems compared to traditional ones?

AI systems detect 95-98% of fraud, according to Experian’s 2024 analysis, while traditional rule-based systems catch only 70-80%. AI also reduces false positives from 5-10% down to 1-2%, meaning fewer legitimate customers get blocked. The difference comes from AI analyzing hundreds of behavioral signals instead of relying on fixed rules like "block transactions over $10,000."

Can AI fraud detection work for small businesses?

It’s possible, but difficult. Most AI systems need at least 6-12 months of historical transaction data to train properly. Small businesses with low volume often don’t have enough fraud examples. Implementation costs range from $150,000-$500,000, which is usually not feasible. For now, small businesses are better off using affordable rule-based tools, strong password policies, and manual review for unusual transactions.

What’s the biggest weakness of AI fraud detection?

The biggest weakness is data dependency. If you don’t have enough clean, labeled fraud data, the AI won’t learn well. It also requires ongoing maintenance-models drift over time and need quarterly retraining. And because AI decisions can be hard to explain (the "black box" problem), fraud investigators may struggle to justify why a transaction was blocked, especially for compliance or customer disputes.

Do AI systems replace human fraud investigators?

No. The most effective systems use AI to handle 80-90% of routine cases and escalate only the most complex or ambiguous ones to human analysts. Humans bring context-like knowing a customer just returned from vacation-that AI can’t guess. AI is a force multiplier, not a replacement.

How long does it take to implement an AI fraud detection system?

It depends on your existing tech. Companies with strong data pipelines can integrate basic AI in 4-8 weeks. Those starting from scratch-needing new data storage, APIs, and engineering teams-face 3-6 months. The biggest delays come from integrating with legacy systems, cleaning up messy transaction data, and hiring the right talent.

Are AI fraud detection systems vulnerable to being hacked or fooled?

Yes. Fraudsters are using AI to create synthetic identities, deepfake voices, and bots that mimic human behavior. Some even test their scams against detection systems first. To fight back, top platforms now use adversarial training-intentionally feeding the AI fake fraud attempts so it learns to spot them. This is becoming standard, but it’s an ongoing arms race.

What’s the future of AI fraud detection?

By 2027, most enterprise systems will include explainable AI (XAI) to show why a transaction was flagged. Many will integrate blockchain for tamper-proof audit trails. Generative AI will be used more for simulating fraud scenarios than for creating them. But the biggest looming threat is quantum computing, which could break current encryption within 5-7 years, forcing a complete overhaul of how transaction data is protected.

Comments (5)

Astha Mishra

It’s fascinating how AI doesn’t just detect anomalies-it interprets intention. We’ve spent centuries trying to quantify human behavior through rules and statistics, yet here we are, teaching machines to recognize the quiet hesitations, the micro-delays, the almost imperceptible shifts in rhythm that make us who we are. Isn’t it poetic? The same digital footprints we fear being tracked are now the very things preserving our integrity. The machine learns not to punish deviation, but to understand context. In a world increasingly obsessed with control, perhaps the most radical act is to trust nuance.

Kenny McMiller

Let’s be real-AI fraud detection is just glorified behavioral clustering with a fancy API. The real win isn’t the 98% detection rate-it’s that now banks can outsource accountability to a black box. ‘Sorry your card got blocked, it was the algorithm.’ No one’s accountable. No one’s liable. Just a bunch of engineers tweaking hyperparameters while real people get locked out of their accounts because their cat walked across the keyboard. We’re automating frustration, not solving fraud.

Dave McPherson

Oh wow, another breathless tech bro manifesto about how AI is ‘saving commerce.’ Please. You cite Experian and Gartner like they’re holy texts, but you gloss over the fact that 78% of enterprises using these systems still have internal fraud rings because the AI can’t detect collusion. And don’t get me started on the ‘explainable AI’ fairy tale-XAI is just lipstick on a pig. If you need to explain why a transaction was flagged, your model’s already failed. Real security isn’t about transparency-it’s about obscurity. The best systems don’t tell you why they blocked something. They just block it. And you’re too busy drinking your oat milk latte to care.

Julia Czinna

I appreciate how you highlighted the human-AI collaboration. It’s not about replacing investigators-it’s about elevating them. I’ve worked in fraud ops, and nothing beats the quiet moment when an analyst notices a customer’s tone in a support chat that matches their usual phrasing, even though the login came from a new IP. That’s the magic. AI flags the weird. Humans understand why it’s weird. We need more systems that honor that balance, not ones that treat humans as backup error handlers.

RAHUL KUSHWAHA

Thanks for sharing this. 😊