2025/11 Financial Strategies: Tax Efficiency, Fintech, and Investing Tactics

When you're building wealth as a tech-savvy woman, tax-loss harvesting, a strategy that lets you sell losing investments to offset capital gains and lower your tax bill. Also known as tax-efficient rebalancing, it's not just for experts—it’s a simple way to keep more of your money in your pocket every year. In November 2025, we dug into how to do it right without falling into the wash-sale trap, and paired it with asset location strategy, the practice of putting different types of investments in the right accounts—taxable, Roth, or traditional—to maximize after-tax returns. These aren’t abstract ideas. They’re tools you can apply starting Monday morning, whether you manage a $10K portfolio or $100K.

Behind the scenes, the financial system is changing fast. open finance, an expansion of open banking that lets apps access your investment, loan, and insurance data—not just your bank account. Also known as API-driven finance, it’s making it easier to automate budgeting, track spending across accounts, and even get personalized loan offers without applying. That’s why posts this month covered everything from how AI fraud detection systems catch 95% of scams in real time, to how fintech companies work with Visa and Mastercard to move money behind the scenes. You don’t need to be a developer to understand this—you just need to know how it affects your wallet.

And if you’re thinking ahead about the next generation, November’s guides also tackled robo-advisors for teens, custodial accounts like UTMA and UGMA that let parents invest for kids under 18, with platforms that handle the legal and tax stuff automatically. What happens when they turn 18? How do you pick the right one? We broke it down without jargon. Plus, we looked at how small businesses can use BNPL to boost sales without eating into profits, how synthetic data lets fintechs train AI without risking privacy, and why dollar-cost averaging with your paycheck is still the most reliable way to build wealth over time.

There’s no fluff here. No "believe in yourself" pep talks. Just clear, data-backed tactics—whether you’re optimizing your portfolio, protecting your money from fraud, or setting up your kid’s first investment account. What you’ll find below isn’t a random collection of posts. It’s a toolkit for anyone who wants to take control of their money without becoming a finance nerd. Every article here solves a real problem. And they’re all written for people who use apps, track spending on their phones, and want to make smarter moves without spending hours learning.

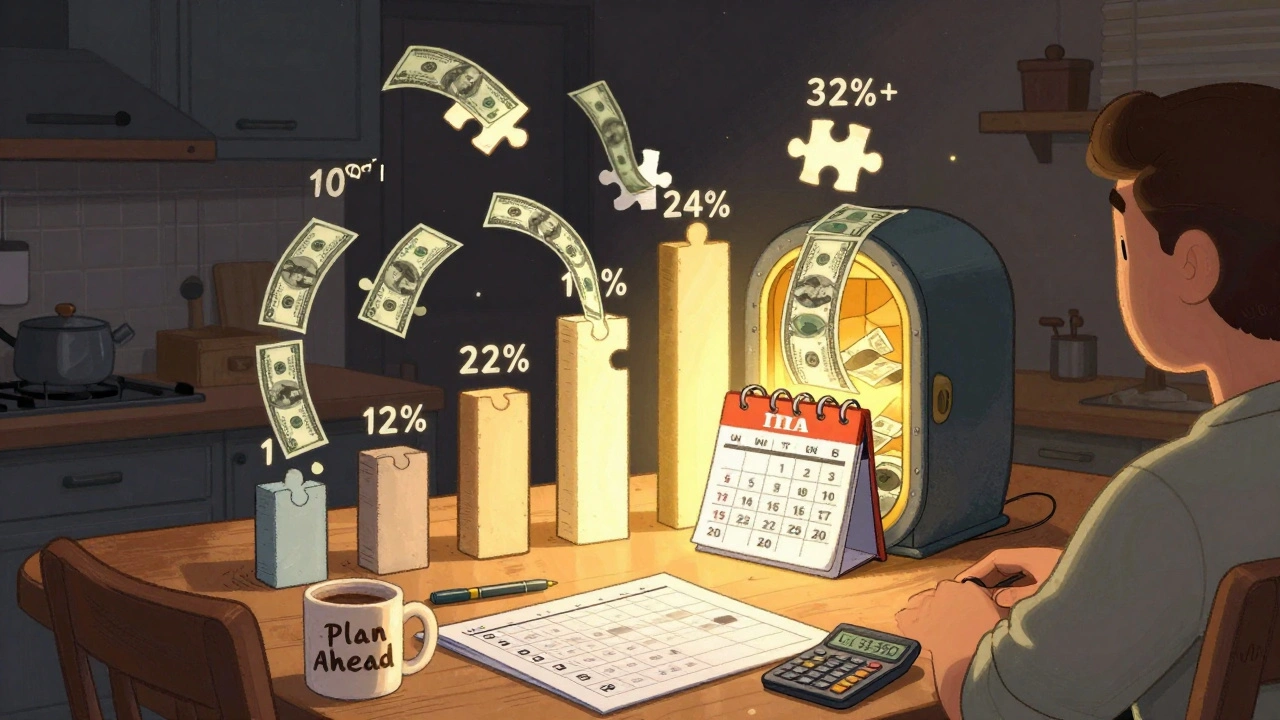

Tax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

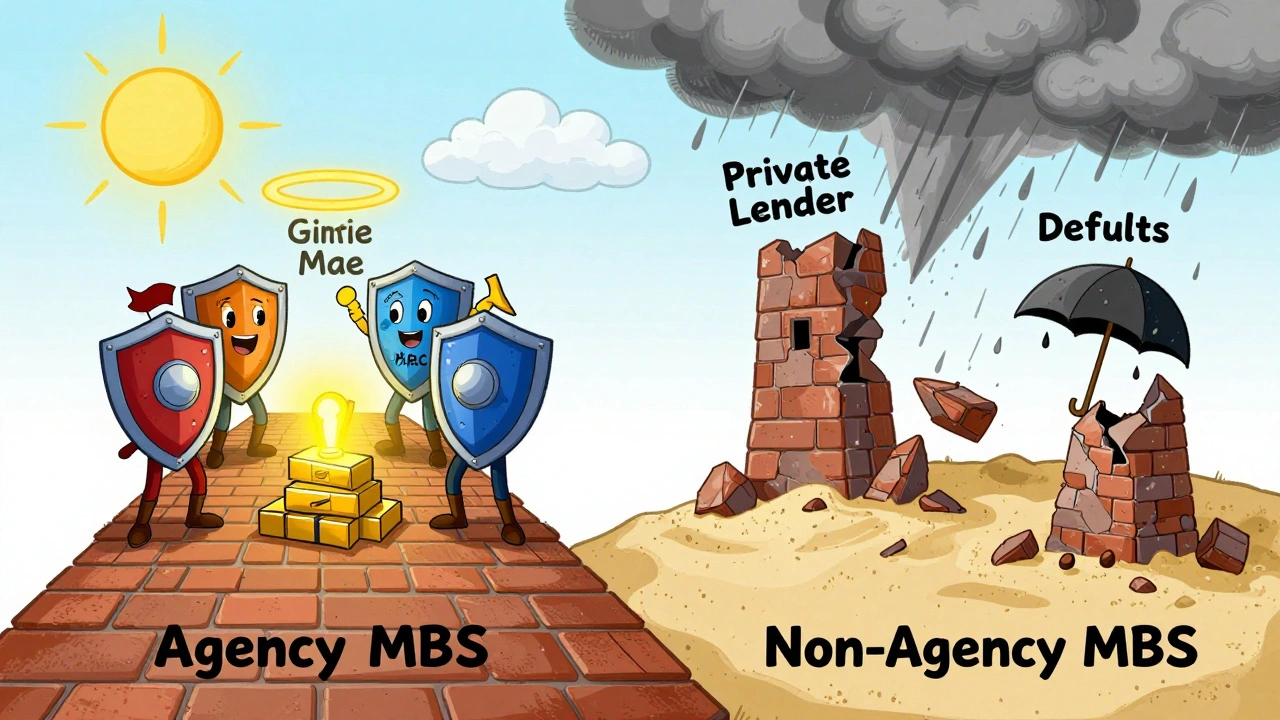

View MoreAgency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View MoreOpen Finance vs. Open Banking: How the Scope Is Expanding

Open banking lets you share bank account data with apps; open finance expands that to investments, loans, crypto, and insurance. Learn how the scope is growing-and why it matters for your money.

View MoreSecondary Offerings and How They Move Stock Prices

Secondary offerings can boost a company’s cash or dilute your ownership. Learn how dilutive and non-dilutive offerings impact stock prices, what to watch for, and how to tell if it’s a sign of strength or weakness.

View MoreTax-Loss Harvesting While Rebalancing: How to Coordinate Moves for Better After-Tax Returns

Tax-loss harvesting while rebalancing lets you cut your tax bill while fixing your portfolio’s allocation. Learn how to do it right, avoid wash-sale traps, and boost after-tax returns by up to 1% a year.

View MoreDollar-Cost Averaging with Paychecks: The Simple Set-and-Forget Way to Build Wealth

Dollar-cost averaging with paychecks is the simplest, most effective way to build long-term wealth without stress or timing the market. Automate your contributions and let compounding do the work.

View MoreStyle Diversification: How to Mix Value and Growth Investments for a Stronger Portfolio

Mixing value and growth investments reduces portfolio volatility and protects against market swings. Learn how to build a balanced portfolio using ETFs and avoid common timing mistakes.

View MoreObservability for Payments: How Metrics, Logs, and Traces Keep Transactions Running

Payment observability uses metrics, logs, and traces to track transaction success, reduce failures, and meet compliance. Learn how top processors cut failures by 37% and why 100% trace coverage is non-negotiable.

View MoreStop-Loss Orders vs Mental Stops: Which One Protects Your Capital Better?

Learn the real difference between stop-loss orders and mental stops, how each affects your risk, and which one works best for your trading style. Discover expert-backed strategies to protect your capital without letting emotions take over.

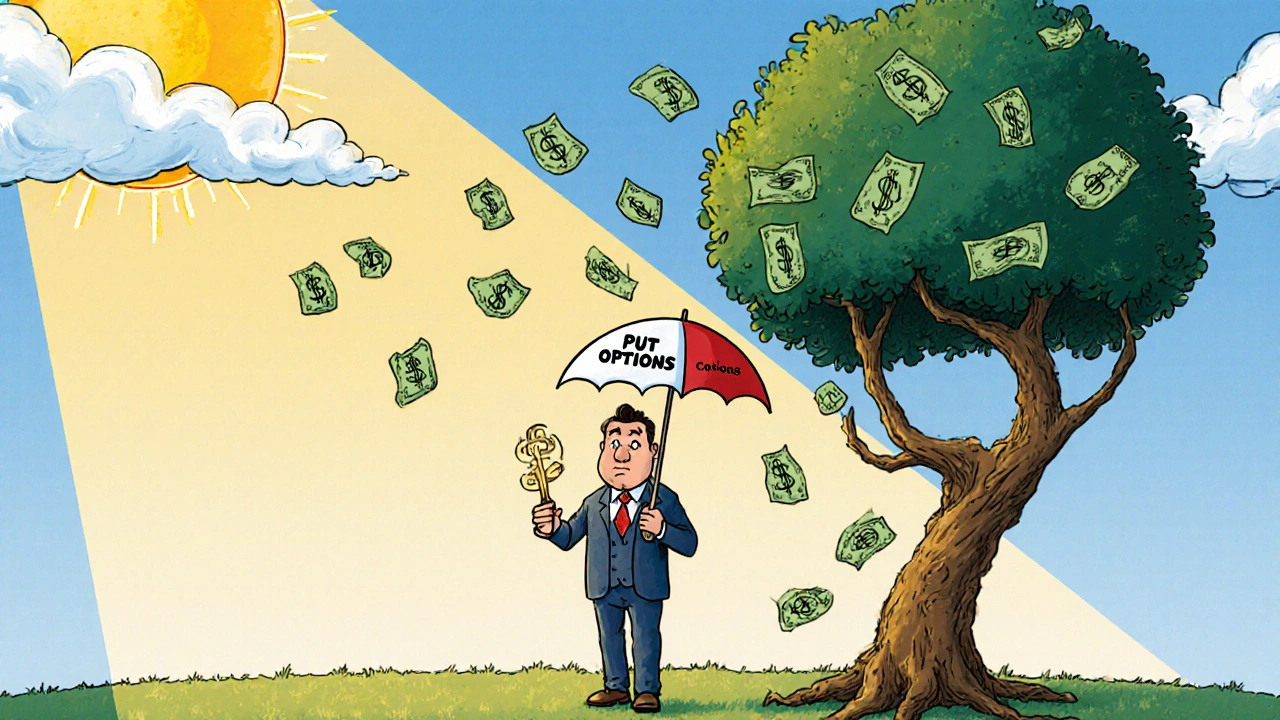

View MorePortfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View MoreFintech Marketing Strategies for Customer Acquisition: Proven Tactics That Work in 2025

Learn proven fintech customer acquisition strategies for 2025 that build trust, reduce costs, and convert users-backed by real data on referral programs, personalization, and compliance.

View MoreBNPL for Small Businesses: How to Accept Installment Payments and Boost Sales

BNPL lets small businesses offer interest-free installment payments while getting paid upfront. Learn how to set it up, which providers to choose, and how to avoid costly mistakes that hurt your margins.

View More