Geek to Wealth: Fintech, Investing, and Personal Finance for Tech-Savvy Women

At the heart of this site is fintech, technology-driven financial services that make investing and banking simpler, faster, and more accessible. Also known as financial technology, it’s what powers the apps you use to invest, save, and track your money without a bank branch in sight. You’ll find clear breakdowns of how robo-advisors, automated platforms that build and manage diversified portfolios based on your goals actually work—no fluff, no hype. Whether you’re comparing tax-loss harvesting rules at Betterment or deciding if SoFi’s all-in-one app fits your life, these tools are designed for real people, not Wall Street insiders.

And it’s not just about investing. Your emergency fund, the cash buffer that stops a surprise bill from derailing your financial progress needs more than a vague rule of thumb. We show you how to calculate exactly how much you need based on your income, bills, and risks. From bond ladders that steady your income to behavioral biases that cost you money, every post here cuts through the noise and gives you something you can use tomorrow.

What you’ll find below isn’t a random list of articles—it’s a toolkit. Whether you’re just starting out or fine-tuning your portfolio, you’ll walk away with actionable steps, not theory.

EU EMI vs. PI Licensing: Capital and Safeguarding Rules Explained

Understand the key differences between EU EMI and PI licenses-capital requirements, safeguarding rules, service limits, and regulatory risks. Choose the right license for your fintech business before you invest.

View MorePortfolio Review Process: Systematic Annual Assessment for Better Rebalancing Decisions

A systematic annual portfolio review ensures your investments stay aligned with your goals and risk tolerance. Learn how to conduct a practical review, rebalance effectively, and avoid common mistakes that hurt long-term returns.

View MoreIndex Funds vs Active Funds: Which Is More Tax Efficient?

Index funds are significantly more tax-efficient than active funds due to lower trading activity. Learn how capital gains distributions, ETF structures, and account placement affect your after-tax returns-and what to do now to keep more of your money.

View MoreThe 60/40 Portfolio: Stocks and Bonds Classic Mix

The 60/40 portfolio-60% stocks, 40% bonds-was a reliable investment strategy for decades. But after losses in 2022 and lower expected returns, it's no longer enough. Here's how to adapt it for today's market.

View MoreBRICS Countries: Brazil, Russia, India, China, South Africa and the New Global Investment Landscape

BRICS countries-Brazil, Russia, India, China, and South Africa-now include nine full members and nine partners, controlling 55% of the world’s population and 46% of global GDP. This bloc is reshaping global investment through infrastructure, energy, and trade, offering real alternatives to Western financial systems.

View MoreCentral Bank Digital Currencies: The Future of Money

Central Bank Digital Currencies are the next evolution of money - issued by governments, backed by central banks, and designed to replace cash in the digital age. Learn how they work, where they’re live, and what they mean for you.

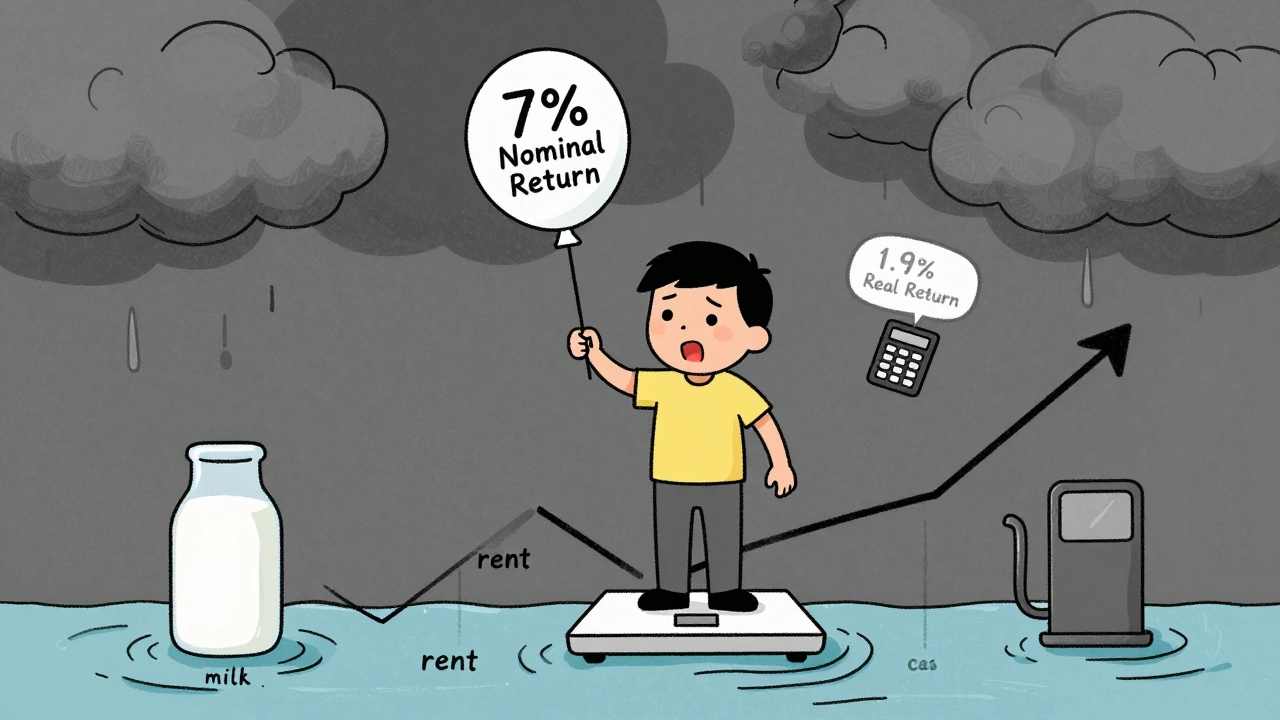

View MoreReal vs Nominal Returns: What Inflation-Adjusted Performance Really Means for Your Investments

Real returns reveal your true investment growth after inflation, while nominal returns can be misleading. Learn why real returns matter more than ever for long-term wealth and how to calculate them correctly.

View MoreEWA ROI Calculators: Measure Retention and Productivity Gains from Wellness Programs

EWA ROI calculators turn wellness program participation into measurable savings on turnover and productivity. Learn how top tools like Wellable quantify retention gains and why most companies are underestimating their true ROI.

View MoreFraud Detection Technology: How AI Identifies Fraudulent Activity

AI fraud detection uses machine learning to spot subtle patterns in transactions, behavior, and device signals-catching fraud that traditional rules miss. With 94% accuracy and fewer false alarms, it's now the standard in fintech.

View MoreQR Code Payments: How Mobile Payments Are Evolving

QR code payments are transforming how money moves globally, offering low-cost, accessible transactions for consumers and small businesses. From India's UPI to PayPal's integration in the U.S., this technology is replacing cards in informal economies and beyond.

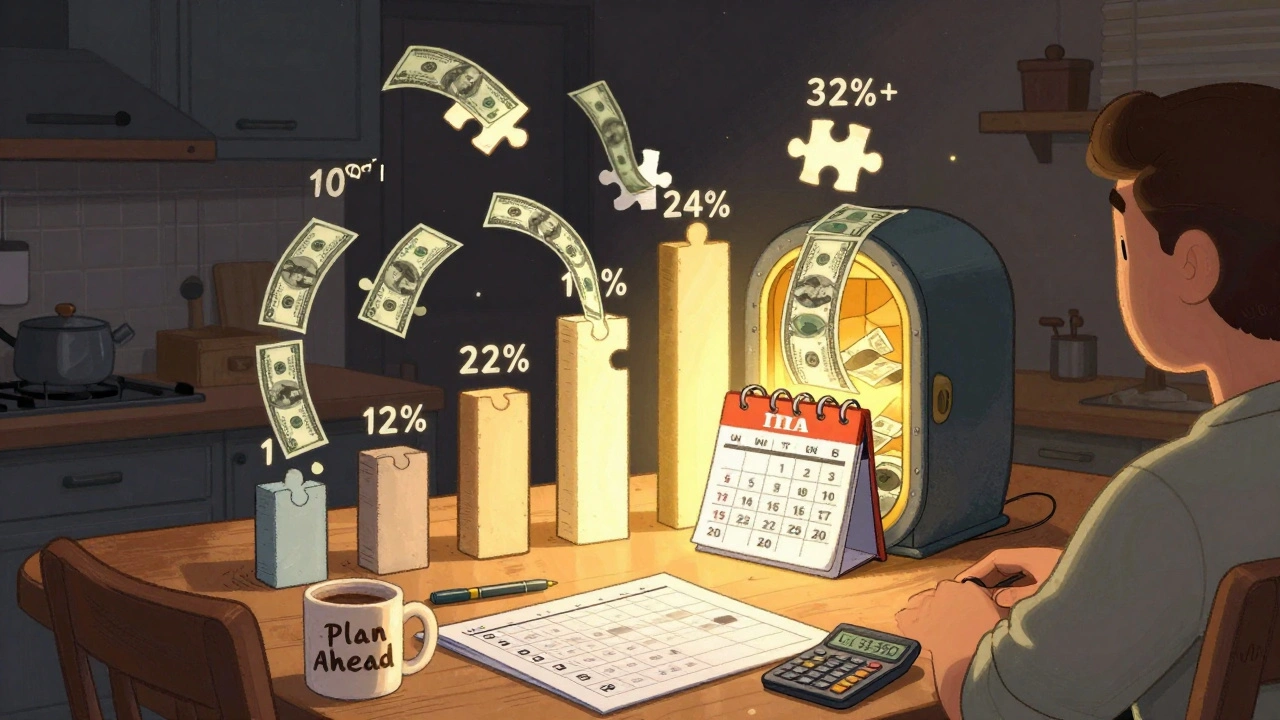

View MoreTax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

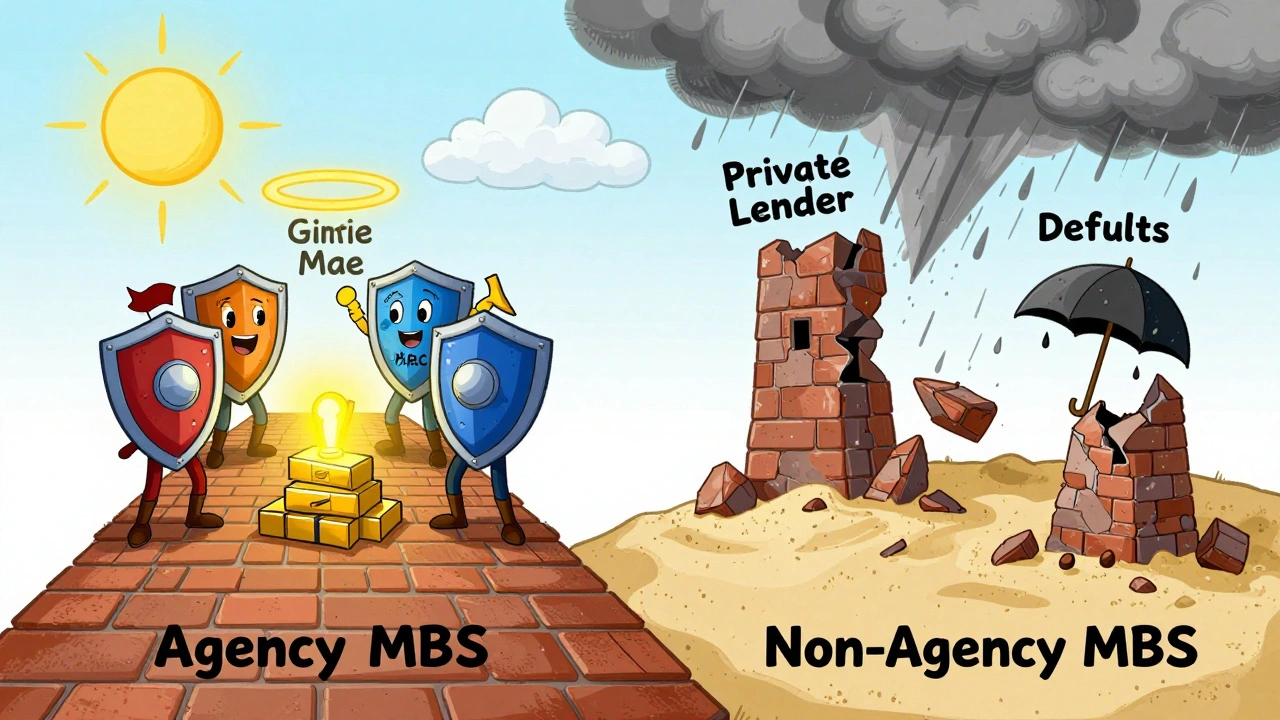

View MoreAgency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More