Portfolio Allocation Tracker & Rebalancing Calculator

Your Portfolio Review Tool

This tool helps you track your current asset allocation against your target and identify rebalancing opportunities based on the systematic review process described in the article.

Current Allocation

Enter your current portfolio allocation as percentages

Target Allocation

Enter your target portfolio allocation as percentages

Why Your Portfolio Needs a Systematic Annual Review

Most people think of portfolio rebalancing as a simple math problem: sell what’s too high, buy what’s too low. But if you’re only adjusting weights without stepping back to ask why those weights changed, you’re guessing-not managing. A systematic annual portfolio review isn’t about chasing performance. It’s about ensuring your investments still match your goals, risk tolerance, and life stage. Without it, even well-constructed portfolios drift into misalignment. Data from Morningstar shows that 63% of investors who skip structured reviews end up with asset allocations that are more than 10% off target within two years. That’s not diversification-that’s unintended concentration.

The Core Purpose: Alignment, Not Just Adjustment

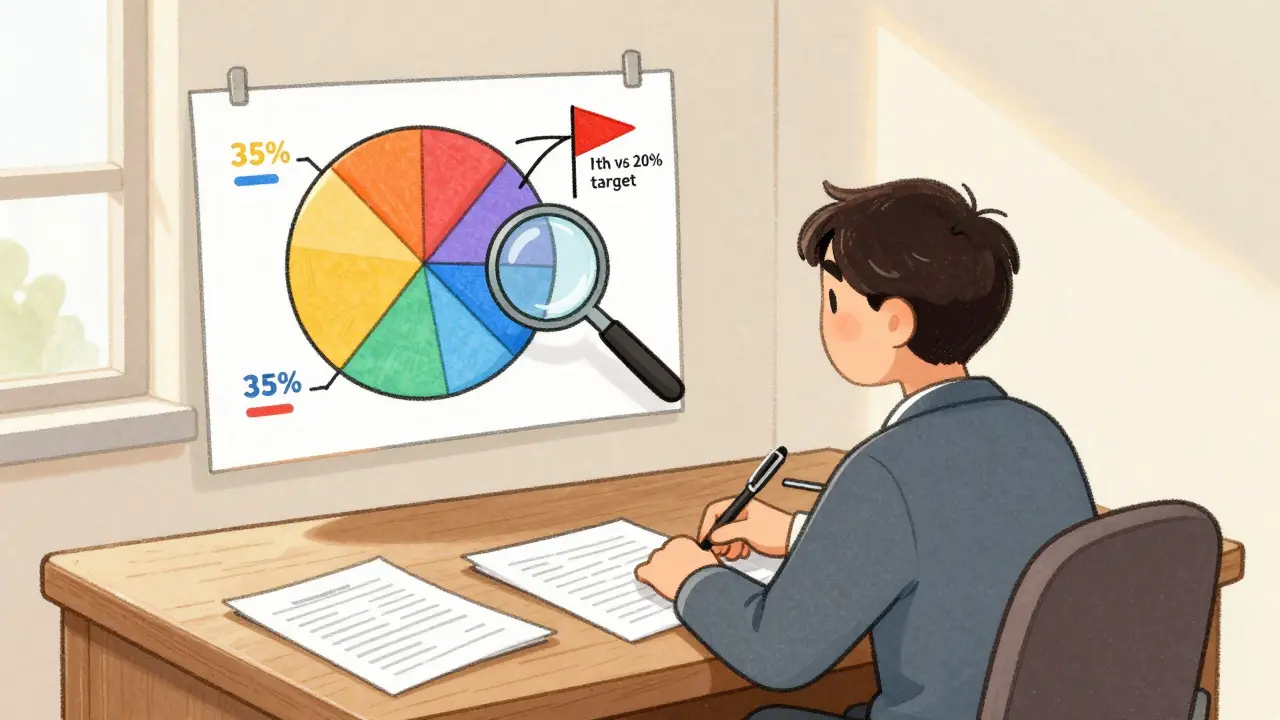

The goal of an annual portfolio review isn’t to find the next hot stock. It’s to answer three simple questions: Are you still on track? Are your risks still acceptable? Are your assets still working for you? The CFA Institute’s 2025 Portfolio Performance Evaluation guidelines emphasize that performance alone doesn’t tell the full story. You need attribution-understanding what drove returns-and appraisal-evaluating whether your decisions were sound. For example, if your tech stocks surged 40% last year and now make up 35% of your portfolio instead of your target 20%, that’s not a win. It’s a risk buildup. Rebalancing without context turns discipline into guesswork.

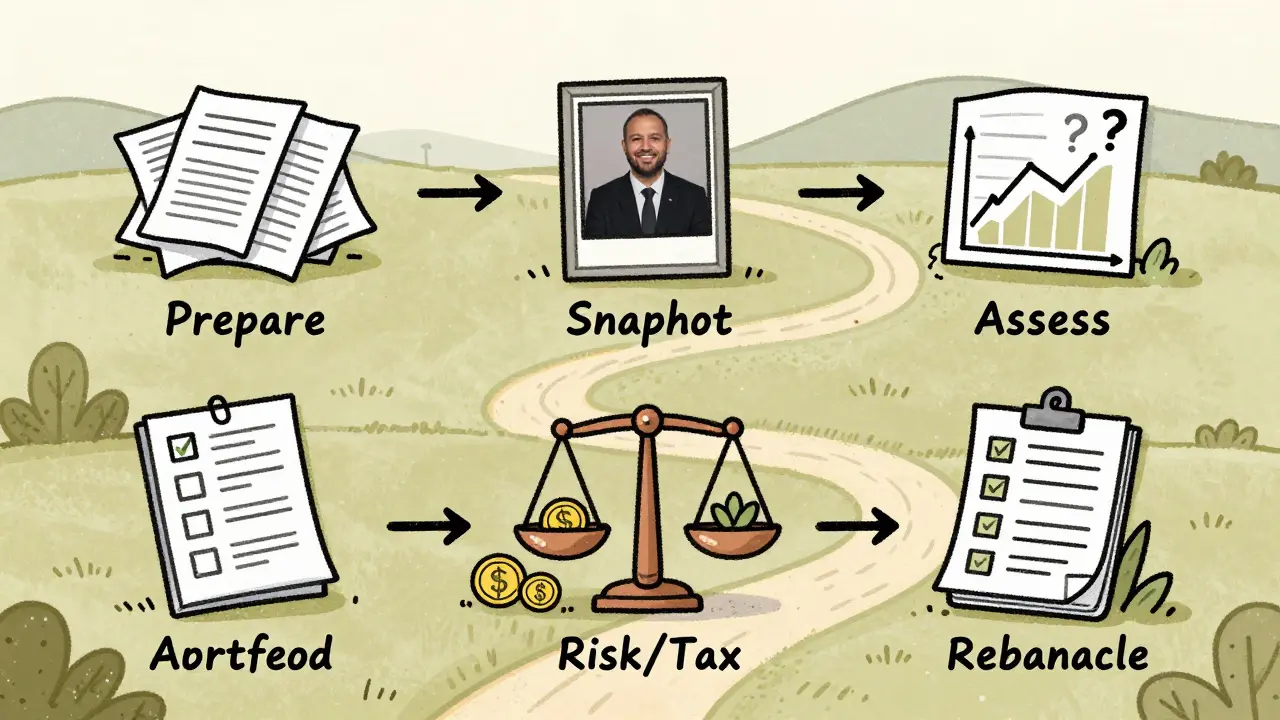

How to Structure Your Annual Review: A Practical Framework

You don’t need fancy software or an MBA to run an effective review. Start with this five-step process, adapted from proven models used by institutional investors and financial advisors:

- Prepare - Gather all account statements, investment summaries, and your original asset allocation plan. Make sure you’re comparing apples to apples. If you’ve added a new 401(k) or closed an old brokerage account, update your total picture.

- Take a Snapshot - Compare your current allocation to your target. Use a simple spreadsheet or free tool like Morningstar’s Portfolio X-Ray. Look for any asset class that’s more than 5% above or below target. That’s your red flag zone.

- Assess Performance and Attribution - Don’t just look at returns. Ask: Did my mutual fund outperform its benchmark? Did my bond holdings protect me during the Q4 market dip? Vanguard’s 2023 analysis found holdings-based attribution is 87% accurate at explaining returns, while returns-based methods miss key drivers. If you can’t explain why an investment did well (or poorly), it’s time to dig deeper.

- Check Risk and Tax Factors - Has your risk profile changed? Are you nearing retirement? Did you have a big tax event? A 2024 Reddit user shared how skipping tax-loss harvesting during their review cost them $1,200 in unnecessary gains. Don’t let tax efficiency fall off your radar.

- Rebalance and Document - Execute trades to bring allocations back to target. Then write down why you made each change. This isn’t bureaucracy-it’s accountability. A 2023 Gartner survey found that organizations with documented review processes were 41% more likely to stick to their rebalancing plan.

What to Watch For: Common Mistakes That Undermine Reviews

Even disciplined investors make the same errors year after year. Here are the top three:

- Ignoring the time it takes - Most people spend under 3 hours on their annual review. Experts recommend 8-12 hours for a thorough assessment. If you’re rushing, you’re missing opportunities.

- Over-relying on historical data - Just because a stock doubled last year doesn’t mean it will again. Nobel laureate Eugene Fama’s research shows most active managers fail to sustain outperformance beyond five years. Your review should question assumptions, not reinforce them.

- Forgetting non-investment factors - Life changes matter. A new child, a job loss, or a move to a different state can alter your risk capacity. A portfolio that worked at 35 might be too aggressive at 55. Rebalancing isn’t just about numbers-it’s about your life.

Tools and Frameworks That Actually Work

You don’t need to build everything from scratch. Here are three proven tools, each suited to different needs:

| Framework | Best For | Time Required | Key Strength | Key Weakness |

|---|---|---|---|---|

| Morningstar’s Inverted Pyramid | Individual investors | 8-12 hours | Clear prioritization: wellness checks first, taxes last | Misses sequence-of-returns risk in volatile markets |

| CFA Institute Tripartite Model | Professional investors | 15-20 hours | Measures performance, attribution, and process quality | Requires training; steep learning curve |

| CGAP DAC Criteria | Project or development portfolios | 150-200 hours | Structured scoring for relevance, impact, sustainability | Too heavy for personal finance |

For most people, Morningstar’s approach is the sweet spot. It forces you to start with the big picture: Are you sleeping well at night? Then it drills down. If you’re managing a small business portfolio or a nonprofit’s endowment, the CGAP model’s five-phase structure brings discipline. But if you’re an individual investor, stick to the basics.

Rebalancing: When and How to Act

Rebalancing isn’t a one-size-fits-all event. The CFA Institute recommends triggering rebalancing when any asset class deviates by more than 5% from target. But timing matters. Don’t sell winners just because they’re up-wait for a tax-efficient window. Consider tax-loss harvesting if you have losing positions. In 2024, one investor on Reddit identified a 12.7% overweight in tech stocks during their review, sold $18,000 in excess, and reinvested in international equities. Their portfolio gained 3.2% over the next year simply by correcting imbalance.

Also, avoid rebalancing too often. Quarterly adjustments increase trading costs and tax bills. Annual reviews with minor adjustments in between (if a major shift occurs) strike the right balance. BlackRock shifted to bi-annual reviews during 2020-2022 because annual checks weren’t enough in a volatile market. But for most, once a year is sufficient.

What’s Changing in 2026: ESG, AI, and the New Normal

Portfolio reviews are evolving. Starting in 2026, the CFA Institute requires all investment firms to integrate ESG metrics into their reviews. That means you’ll need to ask: Do my funds have transparent sustainability reporting? Are they exposed to carbon-intensive industries? Even if you’re not an institutional investor, this trend affects mutual funds and ETFs you own.

AI is also making its mark. BlackRock’s AI system now monitors portfolios continuously, flagging anomalies in real time. While you don’t need AI to review your portfolio, tools like Personal Capital or Betterment now offer automated alerts when your allocations drift. Use them as assistants-not replacements. The human judgment still matters most.

What to Do After Your Review

A review is useless without follow-through. After you rebalance:

- Update your investment policy statement (even if it’s just a one-page note).

- Set calendar reminders for your next review-mark it for January 2027.

- Share the results with your spouse or financial advisor. Accountability improves outcomes.

- Don’t check your portfolio monthly. Let the annual review be your anchor.

Studies show that investors who document their decisions and stick to a schedule outperform those who react emotionally by 2.3% annually. That’s not magic. That’s discipline.

Final Thought: The Illusion of Control

MIT’s Dr. Andrew Lo warns that rigid annual reviews can create an illusion of control in chaotic markets. He’s right. But the alternative-no review at all-is worse. The goal isn’t to predict the future. It’s to build a portfolio that survives it. A systematic annual review doesn’t guarantee returns. But it guarantees you’re not flying blind.

How often should I review my investment portfolio?

Most individual investors should conduct a full portfolio review once a year, typically in January. This gives you time to assess the prior year’s performance, rebalance based on target allocations, and plan for tax strategies. Institutional investors often review quarterly with a deeper annual assessment. If your life changes significantly-like a job loss, inheritance, or retirement-you should review sooner.

What’s the difference between rebalancing and portfolio review?

Rebalancing is a single action: buying or selling assets to return to your target allocation. A portfolio review is the entire process that leads to rebalancing. It includes evaluating performance, checking risk levels, reviewing goals, analyzing tax implications, and deciding whether to adjust your strategy. You can’t rebalance well without a review.

Do I need professional help to review my portfolio?

No, but it helps. If you’re comfortable with spreadsheets, understand your asset classes, and can stay emotionally detached from market swings, you can do it yourself. Use free tools like Morningstar’s Portfolio X-Ray or Vanguard’s Asset Allocation Tool. If your portfolio is complex-multiple accounts, retirement funds, real estate, or business interests-a fee-only financial advisor can save you time and uncover hidden risks.

What’s the best way to track my portfolio’s performance?

Use holdings-based attribution, which looks at the actual securities you own and how they performed relative to their benchmarks. This method is 87% accurate, according to Vanguard. Avoid simple return comparisons. For example, if your S&P 500 fund returned 15% but the index returned 18%, you underperformed. That’s more useful than just seeing a 15% gain.

How do I know if my portfolio is too risky?

Check your asset allocation. If more than 70% of your portfolio is in stocks and you’re within 5 years of retirement, you may be overexposed. Also, look at your bond holdings-are they high-yield or government? High-yield bonds act more like stocks. Use a risk tolerance questionnaire from a reputable source like the CFA Institute or Morningstar. If your portfolio makes you anxious during market drops, it’s likely too aggressive.

Should I rebalance my portfolio during a market downturn?

Yes, if your allocation is off target. Market downturns often cause your stock allocation to drop below target. That’s when rebalancing becomes buying low. For example, if your target is 60% stocks and it dropped to 50%, buying more stocks during the dip brings you back to plan. This is the exact opposite of emotional investing-it’s discipline in action.

Next steps: Schedule your next review for January 2027. Gather your statements now. Update your target allocations if your goals have changed. And remember-your portfolio isn’t a race. It’s a long-term project. The best investors aren’t the ones who pick the hottest stocks. They’re the ones who stick to the plan.

Comments (5)

John Weninger

Just did my annual review last week-used Morningstar’s X-Ray like you suggested, and holy crap, my tech stocks had ballooned to 42%. I didn’t even realize how much I’d drifted. Sold half, moved it into international small caps. Feels way better sleeping at night now. Thanks for the nudge.

Omar Lopez

The notion that ‘annual’ is sufficient is empirically dubious. BlackRock’s shift to bi-annual reviews was not an innovation-it was a corrective measure against systemic cognitive bias in retail investors. Moreover, the CFA Institute’s Tripartite Model is not ‘steep’-it is the minimum standard for fiduciary responsibility. To suggest Morningstar’s inverted pyramid is the ‘sweet spot’ for individuals is to conflate convenience with competence. Your framework lacks rigor.

Jonathan Turner

Oh wow, another ‘systematic review’ guru telling us to ‘stick to the plan’ while the Fed prints money like it’s confetti. You know what actually works? Gold. And cash. And not trusting any ‘portfolio’ that’s tied to a stock market rigged by central bankers. Your ‘annual review’ is just a tax-efficient way to fund the deep state’s inflation machine. I rebalanced by going all-in on silver and Bitcoin. You’re welcome.

Robert Shurte

There’s a quiet, profound tension here: we seek control through structure-annual reviews, target allocations, attribution models-yet the market, by its very nature, resists predictability. Dr. Lo’s ‘illusion of control’ is not a cautionary footnote; it’s the central paradox of modern investing. We build spreadsheets to tame chaos, then cling to them as if they were sacred texts. Perhaps the true discipline isn’t in rebalancing the portfolio-but in rebalancing our relationship to uncertainty. The numbers don’t lie… but they don’t tell the whole truth, either. What if the most important question isn’t ‘Are we on track?’ but ‘Are we still human?’

Mark Vale

did u know the cfa instute is kinda controlled by the fed? they push these ‘systematic reviews’ so we keep investing in stocks while they print money… its all a psyop. i checked my portfolio after the 2024 dip and found 3 of my etfs were owned by the same parent company as the defense contractor that sold missiles to that country we’re ‘supposed’ to hate. i pulled out. now i just hold beans and ammo. trust no one.