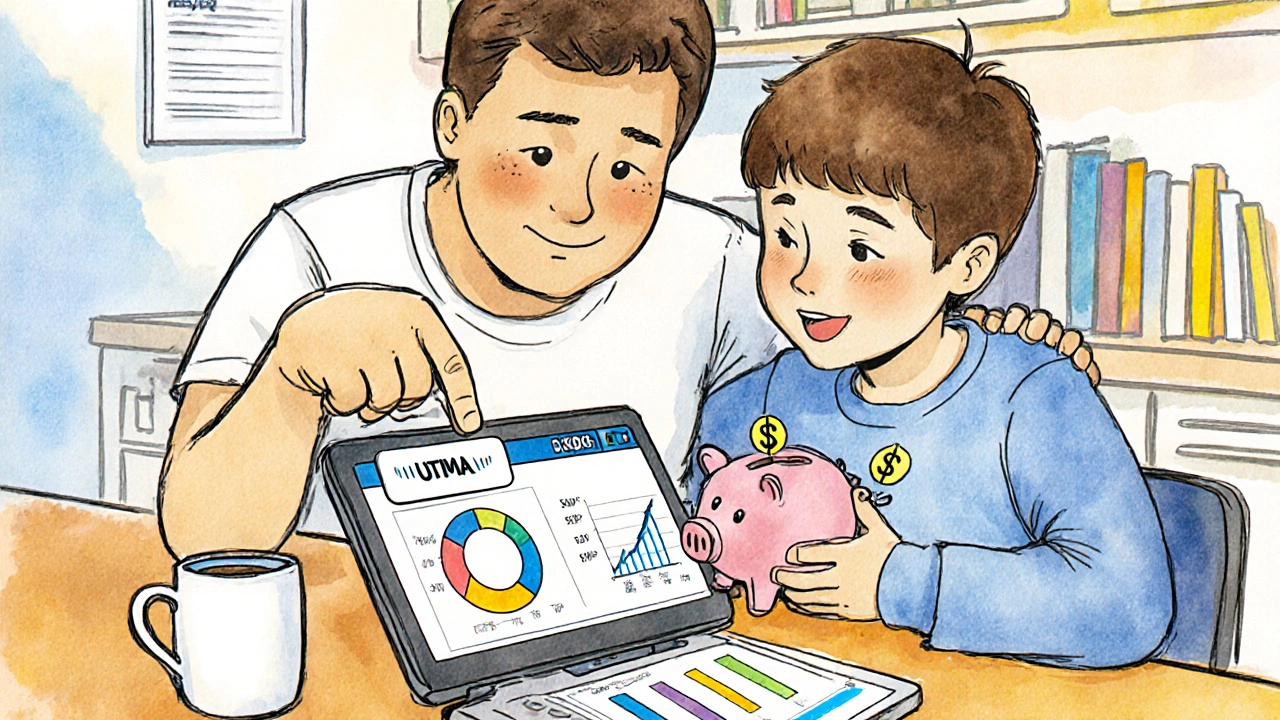

Parents want to teach their kids about money. Teens want to start investing early. But setting up an investment account for someone under 18 isn’t as simple as signing up for a brokerage. You need a custodial account - and not every robo-advisor lets you open one.

As of 2025, only a handful of major robo-advisors offer custodial accounts for teens. And even among those, the rules are strict, the paperwork is real, and the legal responsibilities are heavy. If you’re thinking about opening one, here’s what actually matters - no fluff, no marketing speak, just what you need to do and what to watch out for.

What Is a Custodial Account?

A custodial account lets an adult (the custodian) manage money for a minor until they turn 18 or 21, depending on your state. Two laws govern these accounts: the Uniform Gifts to Minors Act (UGMA) and the Uniform Transfers to Minors Act (UTMA). UTMA is more common now because it lets you hold more types of assets - like real estate or intellectual property - while UGMA is mostly for cash and securities.

The key thing to understand: the money legally belongs to the minor. The custodian can’t use it for themselves. No buying a car, no paying rent, no funding a vacation. It’s for the kid’s benefit only - education, medical needs, even a first car if it’s reasonable. Once the kid hits the age of majority, the account flips to them. No warning. No extension. Just full control.

Which Robo-Advisors Offer Custodial Accounts?

As of 2025, only three major robo-advisors in the U.S. offer custodial accounts for teens:

- Charles Schwab - Offers both UGMA and UTMA accounts. No minimum investment. Free trades. Easy-to-use app. Custodians get full access to statements and controls.

- Betterment - Only UTMA accounts. $0 minimum to open. Automated tax-loss harvesting included. Custodians must sign electronically using ESIGN-compliant tools.

- Wealthfront - Only UTMA accounts. $500 minimum. Offers direct indexing for larger balances. Requires custodian to complete a detailed onboarding form.

Other popular robo-advisors like SoFi, Ellevest, or Acorns don’t offer custodial accounts at all. You won’t find them on their websites - not because they’re hiding it, but because the compliance costs are too high.

Why so few? Because the SEC treats custodial accounts differently. When a robo-advisor manages money for a minor, they’re not just serving one client - they’re serving two: the minor (the beneficiary) and the adult (the legal custodian). That means double the disclosure, double the recordkeeping, and double the risk if something goes wrong.

The SEC Rules That Make This Complicated

The SEC’s Custody Rule (Rule 206(4)-2) is the big reason why robo-advisors don’t jump into teen accounts. It says if you have access to client money or securities, you must follow strict safeguards:

- Keep assets with a qualified custodian - like Schwab, Fidelity, or Apex Clearing. You can’t hold the money yourself.

- Send quarterly statements directly from the custodian - not from the robo-advisor.

- Get surprise audits or, as of the 2023 proposed rules, an annual internal control report from an independent accountant.

- Verify that the custodian’s system sends statements to the custodian, not the teen - because the teen can’t legally receive them yet.

And here’s the kicker: robo-advisors must prove they’ve tested their systems for edge cases. What happens when the kid turns 18? How do you transfer the account? What if the custodian dies? The SEC’s 2022 Risk Alert found that 22% of robo-advisors failed to handle these scenarios correctly.

That’s why smaller platforms avoid custodial accounts entirely. Compliance costs can hit $125,000 a year - for a service that might only have a few hundred teen accounts. It’s not worth it unless you’re already big.

How to Open a Custodial Account (Step-by-Step)

If you’ve picked Schwab, Betterment, or Wealthfront, here’s what to expect:

- Choose the account type - UTMA or UGMA. UTMA is more flexible. Go with that unless you’re only depositing cash or stocks.

- Provide your info - Your name, SSN, address. You’re the custodian. You’ll sign everything.

- Provide the minor’s info - Full legal name, SSN, date of birth. No nicknames. No initials. Exact match to their Social Security card.

- Complete the disclosure - You’ll be forced to scroll through Form ADV Part 2A (the firm’s brochure). You can’t skip it. The system won’t let you click “Agree” until you’ve read it all.

- Sign electronically - The ESIGN Act requires a digital signature that’s legally binding. You’ll need to confirm you understand the rules, including that you can’t withdraw money for personal use.

- Fund the account - Schwab has no minimum. Betterment and Wealthfront require $0 or $500. You can link a bank account or send a check.

After you open it, you’ll get quarterly statements from the custodian - not from the robo-advisor’s app. You’ll need to compare them. If they don’t match, call the custodian immediately. The SEC requires this check.

What You Can’t Do

Here are the most common mistakes parents make:

- Using the money for yourself - Even if you think it’s “just for now.” If the kid finds out later, they can sue you. Courts have ruled in favor of minors in these cases.

- Assuming the kid can take over at 18 - The account doesn’t auto-transfer. You have to initiate the change. If you don’t, the account stays frozen until you do.

- Thinking it’s tax-free - The first $1,350 of unearned income (dividends, interest, capital gains) is tax-free. The next $1,350 is taxed at the kid’s rate. Anything over that is taxed at your rate - the “kiddie tax.”

- Forgetting about estate planning - If the minor dies before turning 18, the account becomes part of their estate. That means probate. That means delays. That means legal fees. Make sure your will covers this.

Why This Matters for Teens

Starting to invest at 15 isn’t just about growing money. It’s about building habits. A teen who sees their $500 grow to $1,200 over five years because of compound returns learns more than any class ever could. They learn patience. They learn risk. They learn that markets go up and down - and that’s okay.

But if the account is set up wrong - if the statements don’t come, if the fees are hidden, if the transition at 18 is messy - it can create distrust. Not in the market. In the system.

The best custodial accounts don’t just invest money. They teach. Schwab’s app has a “Learn” tab with short videos on diversification and compound interest. Betterment shows the kid’s projected balance at 18, 21, and 65. Wealthfront sends annual reports that break down gains and taxes in plain language.

These aren’t just features. They’re tools for financial literacy.

What’s Changing in 2025?

The SEC’s 2023 Custody Rule overhaul is still pending, but its impact is already being felt. By 2025, you’ll see:

- More robo-advisors drop teen accounts - compliance is too expensive.

- Those that stay will require more documentation - digital ID verification, custodian training modules, and mandatory disclosures.

- Smaller custodians like Apex Clearing will become more common - big robo-advisors are outsourcing custody to cut costs.

- State regulators will start enforcing the NASAA Model Rule more strictly - that’s the one that says you must compare statements from the custodian and the adviser.

Bottom line: if you’re opening a custodial account now, you’re getting in before the rules get tighter. Don’t wait.

What Happens When They Turn 18?

This is where most parents fail.

At exactly midnight on the day the minor turns 18 (or 21, depending on your state), the account legally becomes theirs. No notice. No grace period. No “let me help you set it up.”

Here’s what you need to do:

- Start talking to your teen about the account at least 6 months before their birthday.

- Walk them through the app. Show them the balance, the holdings, the tax history.

- Explain what they can and can’t do - withdrawals, transfers, selling assets.

- Help them update contact info - phone number, email, password.

- Submit the transfer request through the robo-advisor’s portal - you can’t skip this step.

If you don’t, the account stays locked. The teen can’t log in. They can’t trade. They can’t even see the balance. You have to call customer service. You have to prove you’re the custodian. You have to prove they’re now an adult. It’s a mess.

Don’t let that be you.

Can a teen open a robo-advisor account on their own?

No. Minors under 18 (or 21, depending on state) can’t sign legal contracts. All custodial accounts must be opened and managed by a parent or legal guardian. The teen is the beneficiary, but the adult is the legal owner until they reach the age of majority.

Are custodial accounts taxed?

Yes. The first $1,350 of unearned income (like dividends or capital gains) is tax-free. The next $1,350 is taxed at the child’s lower rate. Anything over $2,700 is taxed at the parent’s higher rate - this is called the “kiddie tax.” You’ll get a 1099 form each year. File it with your tax return.

What’s the difference between UGMA and UTMA?

UGMA only allows cash, stocks, bonds, and mutual funds. UTMA lets you hold almost anything - real estate, patents, art, even cryptocurrency in some states. UTMA is more flexible and is now the standard choice for most parents.

Can I withdraw money from a custodial account for my own expenses?

No. The law requires that all withdrawals benefit the minor - things like education, medical care, extracurricular activities, or a first car. Using the money for your own rent, vacation, or debt is illegal. If discovered, you could face legal penalties and be forced to repay the money.

What happens if the custodian dies?

If the custodian dies, the account doesn’t disappear. A new custodian must be appointed - either someone named in your will or a court-appointed guardian. The minor still owns the assets. Make sure your estate plan includes a backup custodian for any custodial accounts.

Do I need to report custodial accounts on FAFSA?

Yes. Custodial accounts are counted as the student’s asset on the FAFSA. That means they can reduce financial aid eligibility by up to 20% of the account’s value. 529 plans owned by parents are treated more favorably. If college aid is a concern, consider a 529 instead - or wait until after college applications are submitted to fund the custodial account.

Comments (4)

Graeme C

Let’s be real - most parents don’t even know what a UTMA is, let alone how to file a 1099 for kiddie tax. Schwab’s the only one that makes this feel human. Their app shows you exactly where the money’s going, and the custodian portal doesn’t make you jump through 17 hoops just to add $50. I opened one for my 14-year-old last year. She checks it every Sunday like it’s a game. That’s the win - not the returns, the habit.

Astha Mishra

It is truly fascinating, is it not, how our societal structures have evolved to the point where financial literacy is now being outsourced to algorithms - and yet, the fundamental human responsibility of stewardship remains entirely unaltered. The child, though legally the beneficiary, is still a being in formation, not merely a vessel for compound interest. The robo-advisor may calculate risk with precision, but it cannot teach patience, nor can it console when the market crashes and the teenager’s heart does too. I wonder, then - are we investing in their future, or merely in our own peace of mind? And if the latter, are we not, in essence, using them as mirrors for our own anxieties?

Kenny McMiller

Bro, the SEC’s custody rule is a total dumpster fire. They’re treating teen accounts like hedge funds. $125K/year just to handle a few hundred kids? That’s not compliance - that’s extortion. No wonder only the giants can afford it. Apex Clearing’s gonna be the new default custodian - big robo-advisors are just gonna white-label their backend. Meanwhile, parents are stuck reading Form ADV like it’s War and Peace. Honestly, if you’re not using Schwab, you’re overcomplicating your life. Just open it, fund it, and don’t touch the damn money.

Dave McPherson

Wow. Just… wow. You wrote an entire essay on how to not screw up your kid’s money, and you still missed the point. The real problem isn’t the robo-advisors - it’s the fact that you’re even trying to ‘teach’ them finance through an app. You think a 15-year-old cares about tax-loss harvesting? Nah. They care about Fortnite skins and TikTok trends. This whole system is a performative parenting ritual. You’re not raising a future investor - you’re raising a walking FAFSA liability with a brokerage account. If you want them to learn money, give ‘em a debit card and make them pay for their own damn sneakers. Real-world consequences > algorithmic portfolios. Also, UTMA? Please. That’s just a fancy way of saying ‘I’m gonna regret this when they turn 18 and buy a Tesla with their $1,200.’