Geek to Wealth - Page 4

Fraud Detection Systems: How AI Identifies Suspicious Activity

AI fraud detection systems use machine learning to spot suspicious activity in real time, catching 95%+ of fraud with far fewer false alarms than old rule-based systems. Learn how it works, who benefits, and why it's becoming essential.

View MoreBond Ladders: How to Build Steady Income and Lower Risk in Today's Market

Bond ladders offer steady income and lower risk by spreading investments across bonds with staggered maturities. Learn how to build one in today’s high-rate environment and why it beats bond funds for retirees and conservative investors.

View MoreHow Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View MoreSurprise and Delight Credits: How Unexpected Gestures Build Lasting Brand Love

Surprise and delight marketing builds real brand love by creating unexpected, personal moments that turn customers into loyal fans. Learn how small, thoughtful gestures beat discounts and loyalty points every time.

View MoreEmergency Fund Rules of Thumb: How Much You Really Need to Save

Learn how much you really need in an emergency fund-3 months, 6 months, or more-based on your income, expenses, and lifestyle. Practical, real-world advice for building savings without overwhelm.

View MoreInternational Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View MoreClient Money Rules: Reconciliation and Audit Explained for Financial Firms

Client money rules require financial firms to segregate, reconcile daily, and audit client funds to protect assets. Learn how UK's CASS 7 and Australia's ASIC rules work, why firms fail, and how automation is changing compliance.

View MoreBehavioral Finance Biases: Common Money Mistakes and How to Fix Them

Learn how common psychological biases like loss aversion, overconfidence, and herd behavior lead to costly money mistakes - and how to fix them with simple, proven strategies.

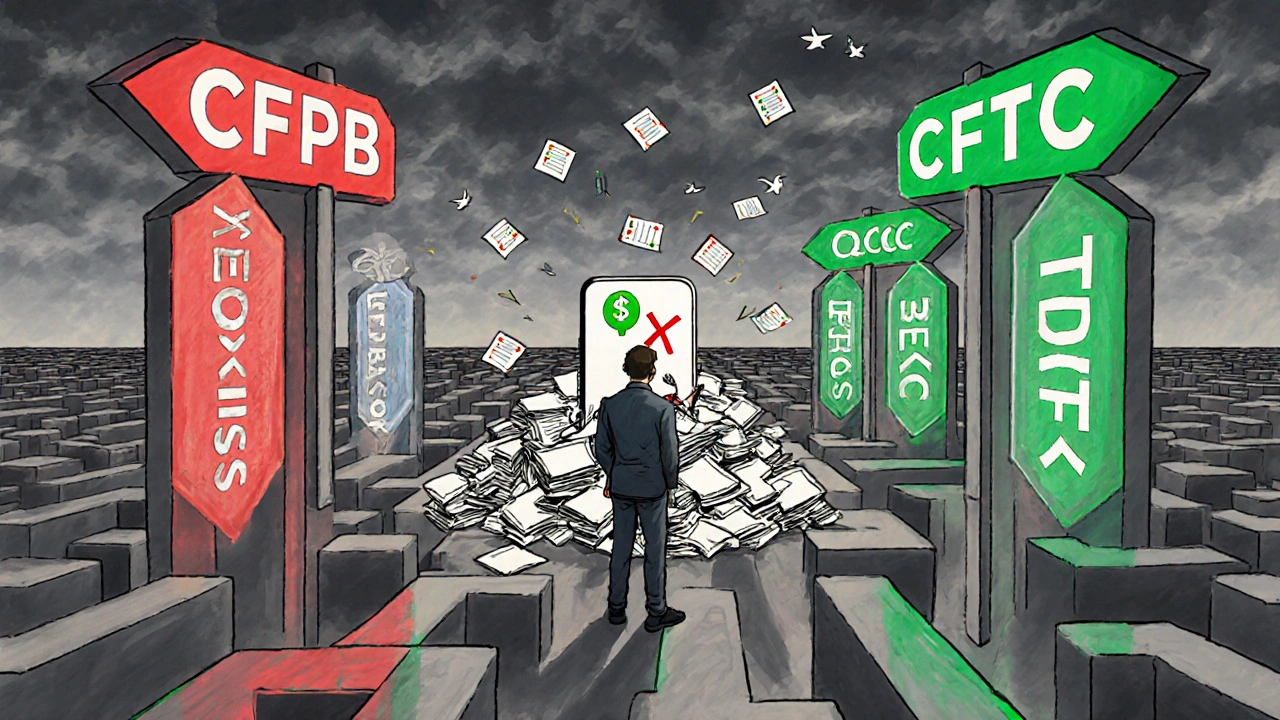

View MoreFintech Regulations: Global Overview and Compliance in 2025

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View MoreEnvelope Budgeting Digitized: How Categories, Caps, and Alerts Control Your Spending

Digital envelope budgeting uses virtual categories, spending caps, and real-time alerts to help you control your money without cash. Learn how to set it up, choose the right app, and avoid common mistakes.

View MoreSoFi: From Student Loans to Full-Service Finance

SoFi began as a student loan refinancing platform and grew into a full-service digital bank offering checking, savings, investing, mortgages, and more - all in one app. Here's how it works, who it's for, and whether it's right for you.

View MoreBroker Ratings and Reviews: How to Evaluate Online Trading Platforms

Learn how to cut through broker marketing hype and pick the right online trading platform based on your trading style, fees, research tools, and customer service - not just ratings.

View More