Fintech Compliance Cost Estimator

Estimate Your Regulatory Compliance Costs

Based on 2025 global fintech regulation data

For reference: 22% of startup budget is typical for U.S. fintech compliance.

Why Fintech Regulations Are More Complex Than Ever

Five years ago, a fintech startup could launch a payment app and worry mostly about code bugs and user experience. Today, that same app needs a legal team before it even opens its first API. Fintech regulations have shifted from being an afterthought to the core constraint shaping who can operate, where, and how fast.

The problem isn’t just that rules exist-it’s that they don’t agree with each other. The EU demands one thing for crypto platforms. The U.S. applies five different rules depending on whether you’re handling payments, loans, or securities. Hong Kong requires real-time fraud monitoring. South Korea just froze new crypto lending. There’s no global playbook. If you’re building a fintech product today, you’re not just coding-you’re mapping legal landscapes.

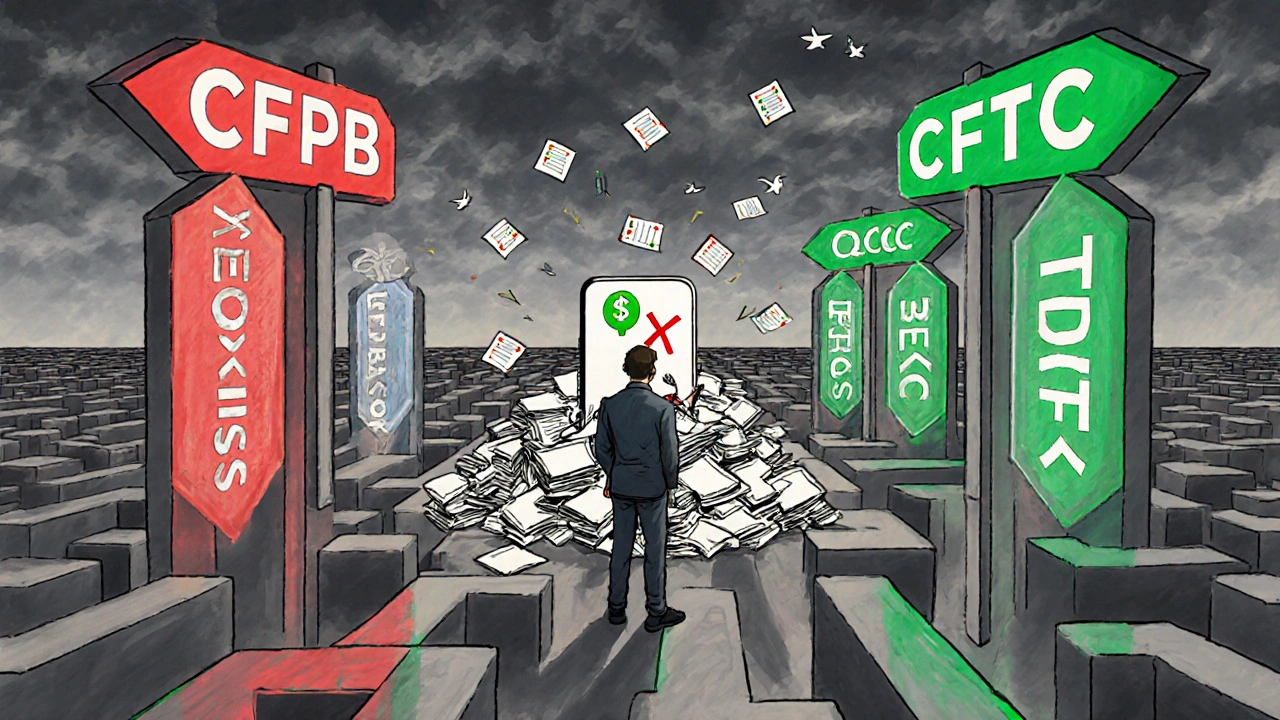

How the U.S. Regulates Fintech: A Patchwork of Agencies

In the United States, there’s no single fintech regulator. Instead, you’re caught in a web of federal and state agencies, each with their own priorities.

- The Consumer Financial Protection Bureau (CFPB) is pushing hard on data rights. Their Section 1033 rule, taking effect in Q3 2025, forces banks to give customers direct, secure access to their financial data via standardized APIs. If you’re a fintech relying on bank data-like a budgeting app or loan matcher-you’ll need to meet strict security protocols and consent rules by October 2025.

- The Securities and Exchange Commission (SEC) treats most crypto tokens as securities. That means if your platform lets users trade anything resembling an investment, you’re likely under SEC scrutiny. Enforcement actions have shut down dozens of unregistered crypto exchanges since 2023.

- The Commodity Futures Trading Commission (CFTC) goes after crypto derivatives and futures, often overlapping with the SEC. This creates confusion: is Bitcoin a commodity or a security? The answer depends on which agency you talk to.

- The Office of the Comptroller of the Currency (OCC) and Federal Reserve now hold banks responsible for their fintech partners. If your startup works with a bank to offer checking accounts or lending, that bank must audit your compliance systems. Poor documentation? You get cut off.

Result? Startups spend 22% of their budget just on compliance. Many never make it to market.

Europe’s MiCA: The First Full Crypto Rulebook

The European Union didn’t tinker around the edges. In December 2024, it launched MiCA-the Markets in Crypto-Assets Regulation. By September 2025, all its technical standards were in force, including strict rules on market abuse, custody, and transparency.

What does MiCA actually require?

- Every crypto exchange must have real-time systems to detect spoofing, layering, and wash trading.

- Wallet providers must use cold storage for 95% of customer assets.

- Token issuers must publish detailed white papers explaining how the asset works, who backs it, and what rights users have.

- Companies must get licensed in at least one EU country to operate across all 27.

Impact? 38% of Europe’s unregulated crypto platforms shut down. The ones that stayed had to hire compliance officers, rewrite their tech stack, and pay for audits. But there’s a silver lining: licensed platforms now have a clear path to scale across the EU. That’s why many U.S. fintechs are setting up EU subsidiaries-not because they want to, but because they have to if they want to serve European customers.

Asia’s Mixed Signals: Hong Kong’s Tight Rules, South Korea’s Pause

Asia isn’t one story. It’s a collection of conflicting signals.

Hong Kong moved fast. In August 2025, its Securities and Futures Commission (SFC) set new rules for virtual asset trading platforms:

- Senior management must be physically located in Hong Kong.

- Third-party wallet providers must be approved and audited.

- Real-time threat monitoring must track hacking attempts, phishing, and insider trading.

These aren’t suggestions. They’re licensing requirements. Companies that don’t comply can’t operate.

South Korea took a different path. In August 2025, its Financial Services Commission ordered all exchanges to stop offering new crypto lending services until final rules are published. Existing services are allowed to continue, but no new customers. Why? Fear of retail investor losses. The regulator didn’t ban lending-it paused it to study the risks.

Japan and Singapore are somewhere in between: open to innovation but with heavy reporting and KYC demands. The takeaway? Don’t assume Asia is a single market. Each country has its own pace, priorities, and pain points.

The Hidden Cost: Compliance Isn’t Just Legal-It’s Operational

Most fintech founders think compliance is about filling out forms. It’s not. It’s about building systems that work every day, under pressure.

Deloitte found that fintechs spent an average of 32% more on compliance in 2025 than in 2024. Why? Because regulators aren’t just asking for policies-they’re asking for proof.

- Can you show logs that your API only shares data after user consent?

- Can you prove your fraud detection system flagged 99% of suspicious transactions last quarter?

- Can you demonstrate that your crypto custody system hasn’t had a single breach in 18 months?

These aren’t audit questions. They’re daily operational demands. Companies that treat compliance as a checklist fail. Those that build it into their engineering, customer support, and risk teams survive.

And it’s getting worse. Banks are pulling back from fintech partnerships. In 2025, 15% fewer bank-fintech deals closed than in 2024. Why? Because banks are now legally liable for their partners’ failures. If your startup can’t show solid, documented controls, you’re out.

AI and RegTech: The New Battleground

Regulators are using AI to catch bad actors. That means you’ll need AI to stay compliant.

The Chambers and Partners Fintech 2025 guide calls AI adoption the biggest trend in regulation. Why? Because:

- AI can scan thousands of transactions for patterns humans miss.

- It can auto-generate compliance reports from internal logs.

- It can monitor customer interactions for misleading claims.

But here’s the catch: if you use AI to make lending decisions or approve accounts, regulators will demand transparency. You can’t say, “The algorithm decided.” You have to explain how it works, why it made that call, and how you test it for bias.

That’s where RegTech (regulatory technology) comes in. Companies like ComplyAdvantage, Trulioo, and Onfido are growing fast-not because they’re flashy, but because they solve real problems: verifying identities, monitoring transactions, and automating reporting. In 2025, RegTech is the fastest-growing segment in fintech, with a 26.8% annual growth rate. If you’re building anything in finance, you’re either building RegTech-or buying it.

What’s Next? The 2026-2027 Horizon

Regulation won’t slow down. It will accelerate-and get more technical.

Here’s what to watch:

- EU’s AI Act: Expected to shape global standards by 2026. If you use AI for credit scoring, fraud detection, or customer service in Europe, you’ll need to meet strict risk tiers and documentation rules.

- Quantum computing: By 2027, regulators will start asking how you’re protecting data against future quantum decryption. Your encryption keys today might be broken tomorrow.

- Debt capital markets on DLT: The ICMA roadmap sets a September 2026 deadline for blockchain-based bond issuance to meet new standards. That’s not science fiction-it’s coming to your bank’s treasury department.

The message is clear: if you’re not thinking about regulation as part of your product design, you’re already behind.

Compliance as a Competitive Edge

The best fintechs in 2025 aren’t the ones with the most funding. They’re the ones with the cleanest compliance records.

Companies that treat regulation as a burden get stuck. Those that treat it as a competitive advantage get faster access to banks, lower insurance costs, and better investor trust. A startup with documented, tested, and audited controls can launch new features in weeks. One without them waits months-or gets rejected entirely.

It’s not about avoiding rules. It’s about mastering them. The companies that win aren’t the ones that fight regulation. They’re the ones that build with it.

Comments (4)

Laura W

Okay but let’s be real-compliance isn’t just a cost center anymore, it’s the new product feature. If your app doesn’t have built-in CFPB 1033-ready APIs by October, you’re not ‘lagging,’ you’re dead in the water. I’ve seen startups burn $2M on dev and then get nuked because their data-sharing flow didn’t pass the consent audit. RegTech isn’t optional-it’s your go-to-market engine now. And yeah, the SEC/CFTC turf war is a circus, but if you’re tokenizing anything that looks like a security, just assume you’re already on their radar. No more ‘we didn’t know’ excuses.

Graeme C

Let me cut through the fluff: the entire U.S. regulatory framework for fintech is a dysfunctional, Kafkaesque nightmare. Five agencies, zero coordination, and yet somehow they all expect you to be perfectly compliant with every contradictory mandate. MiCA at least has the decency to be a single, coherent rulebook. The U.S. doesn’t regulate-it weaponizes ambiguity. And don’t get me started on banks pulling the plug on fintech partners because *they* fear liability. The system is rigged to protect incumbents, not innovation. If you’re building anything in this space without a team of lawyers embedded in your sprint cycles, you’re not a founder-you’re a cautionary tale.

Astha Mishra

It is truly fascinating, if not deeply troubling, how the architecture of financial innovation has become so entangled with legal compliance that the very soul of entrepreneurship-risk-taking, bold experimentation, rapid iteration-is being slowly strangled by the weight of documentation, audit trails, and regulatory risk matrices. One wonders, is this not the inevitable consequence of a global economy that has grown too complex for human governance? We now demand machines to monitor machines, and yet we expect humans to interpret the outputs with perfect clarity. In India, we see similar tensions-where regulators want to encourage digital lending while simultaneously fearing mass defaults among rural borrowers. The paradox is beautiful, in a tragic way. Perhaps the real innovation is not in the code, but in the human capacity to navigate this labyrinth without losing one’s moral compass.

Kenny McMiller

Bro, the real win is RegTech. Not the fintech. The tools that auto-generate your CFPB logs, flag suspicious AML patterns, and auto-file your MiCA disclosures? That’s where the money’s at. I’ve seen two-person shops with $50k in annual SaaS spend outcompete VC-funded startups because they automated compliance before they even wrote their first line of frontend code. It’s not sexy, but neither is breathing. If you’re not buying or building RegTech, you’re just delaying your exit.