Thematic Investment Portfolio Allocator

This tool helps you determine the optimal percentage of your portfolio to allocate to thematic investments based on your investment goals, risk tolerance, and time horizon. Based on industry research from Charles Schwab and BlackRock, thematic investments should typically make up 10-15% of your total portfolio for the best risk-adjusted returns.

Portfolio Allocation Calculator

Recommended Allocation

Based on your selected goals, risk tolerance, and time horizon.

Research shows thematic investments should typically represent 10-15% of your portfolio for the best risk-adjusted returns. Going beyond 20% can increase volatility significantly.

Recommended themes for your profile:

- Artificial Intelligence (41% of advisors recommend)

- Clean Energy Transition (38%)

- Aging Populations (33%)

Most people think investing means buying stocks in big companies like Apple or Amazon, or dumping money into an S&P 500 index fund. But what if you could bet on the future-really bet on it-not just what’s happening today, but what’s coming next? That’s where thematic investing comes in.

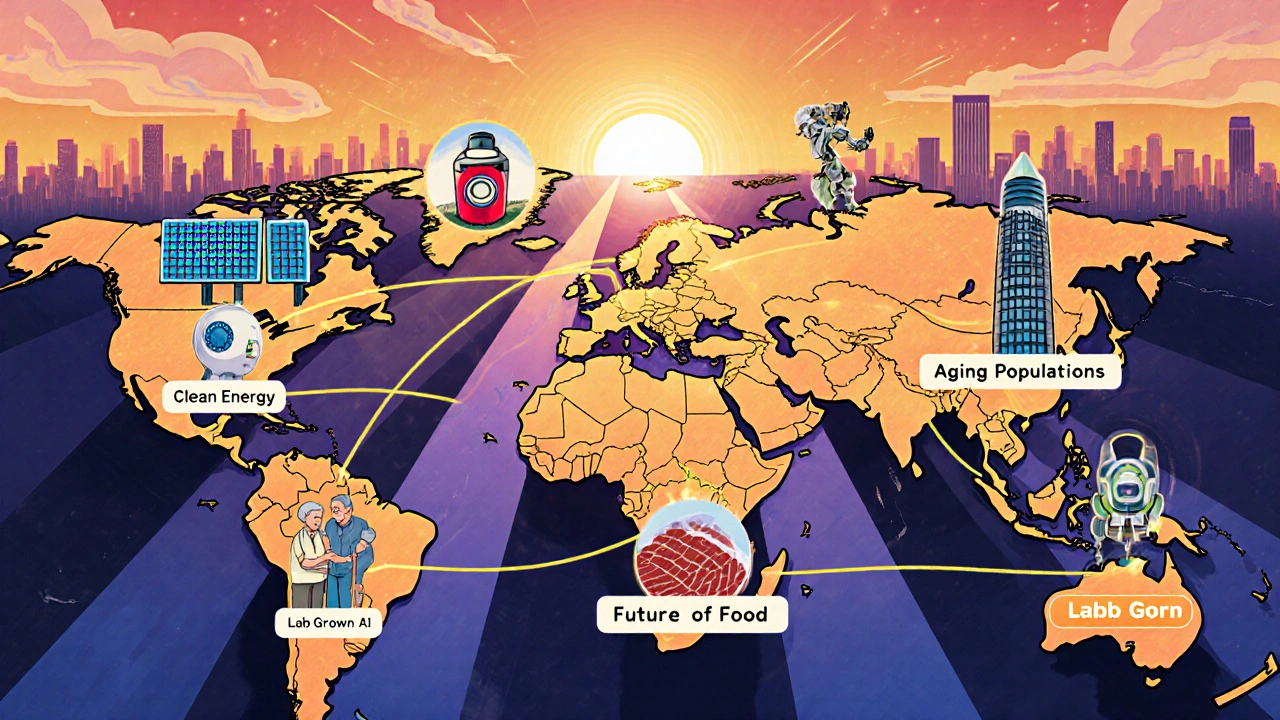

It’s not about picking the best-performing tech stock this quarter. It’s about spotting big, lasting shifts in how we live, work, and interact with the world-and then putting your money where those changes are happening. Think AI, aging populations, clean energy, cybersecurity, or even the future of food. These aren’t industries you can find on a traditional sector chart. They’re ideas. Movements. Forces.

What Makes Thematic Investing Different?

Traditional investing sorts companies into boxes: tech, healthcare, energy, finance. Thematic investing throws those boxes out. Instead, it looks at the story behind the companies. A clean energy theme might include solar panel makers, battery startups, electric vehicle charging networks, and even companies that make the rare earth metals needed for those batteries. None of them are in the same sector, but they’re all part of the same big trend.

According to Morningstar, as of 2022, over 23% of all thematic funds focused on sustainable development. Another 18% were tied to aging populations. That’s not a coincidence. These aren’t fads. They’re structural shifts. The global population over 65 is expected to hit 2.1 billion by 2050. That’s not a stock pick-that’s a demographic earthquake. And companies that serve that shift-home care tech, pharmaceuticals for chronic conditions, robotics for elderly assistance-are all part of the same theme.

BlackRock’s research shows thematic funds have grown from $127 billion in 2018 to over $843 billion by mid-2023. That’s not just noise. It’s money moving because people are seeing real opportunities outside the old categories.

Why People Are Jumping In

Let’s be honest-most people don’t get excited about buying shares in a utility company. But they get excited about AI. Or space travel. Or plant-based meat. Thematic investing gives them a way to align their values with their portfolios. You’re not just making money. You’re backing the future you believe in.

Charles Schwab found that investors who used thematic strategies to support personal values-like clean energy or gender diversity in leadership-reported higher satisfaction, even when returns were flat. Why? Because they felt like they were part of something bigger. And that emotional connection keeps them invested through the ups and downs.

But here’s the catch: it’s not just about passion. The numbers back it up. AllianceBernstein found that top-performing thematic strategies returned 14.2% annually from 2015 to 2022-compared to 10.8% for traditional approaches. That’s not magic. It’s exposure. When a trend like AI explodes, it doesn’t just help one company. It lifts dozens: chipmakers, cloud providers, software firms, even logistics companies using AI for delivery routes. Thematic funds capture all of them.

The Dark Side: Too Many Choices, Too Little Discipline

But here’s the problem. There are now over 1,200 thematic ETFs and mutual funds globally. In 2018, there were fewer than 200. That’s a lot of options. And not all of them are created equal.

Galilee Asset Management found that 37% of thematic ETFs launched between 2018 and 2022 underperformed their benchmarks by more than 2% per year. Why? Because some funds just slapped a trendy name on a basket of stocks and called it a theme. A “metaverse” fund might include a video game company, a VR headset maker, and a random social media stock that has nothing to do with virtual worlds. That’s not investing. That’s marketing.

And volatility? Don’t ignore it. Thematic funds are 25-40% more volatile than broad market indexes. That’s because they’re concentrated. One bad quarter in AI chip demand can tank a whole fund. If you’re not ready for that kind of ride, you’ll bail at the worst time.

BlackRock’s research says the biggest challenge isn’t finding themes-it’s knowing when to get in and when to get out. Trends don’t last forever. The metaverse hype peaked in 2022. Now, it’s cooling. The right strategy doesn’t just pick a trend-it monitors its maturity, adoption rate, and regulatory risks.

How to Do It Right

So how do you avoid the traps and actually benefit from thematic investing?

- Start small. Charles Schwab recommends keeping thematic investments to no more than 15-20% of your total portfolio. Treat them like satellites-supplementing your core holdings, not replacing them.

- Choose 3-5 themes, not one. Don’t go all-in on AI. Mix it with aging populations, cybersecurity, and clean energy. That way, if one theme cools off, others might be heating up.

- Look for depth, not buzzwords. A good thematic fund doesn’t just list companies with the word “AI” in their press releases. It shows how each company is directly involved-whether it’s revenue tied to the theme, R&D spending, or patents filed. Check the fund’s holdings. Do they make sense?

- Think long-term. Nutmeg’s analysis of 12,000 portfolios showed thematic strategies need at least 5-7 years to overcome early volatility. If you’re checking your balance every month, you’re setting yourself up for failure.

- Rebalance quarterly. Trends evolve. A fund that was heavy on electric vehicles in 2022 might now be overexposed. Rebalancing keeps your exposure aligned with the real momentum, not the hype.

Take BlackRock’s iShares U.S. Thematic Rotation Active ETF (THRO). It doesn’t just hold a static list of AI and clean energy stocks. It uses algorithms to rotate between eight themes every quarter based on which ones are showing the strongest momentum. That’s institutional-grade discipline. You don’t need the same tech-but you can copy the mindset: stay active, stay objective, stay diversified.

What Are the Best Themes Right Now?

Based on 2023 data from BlackRock, Vanguard, and Morningstar, here are the most compelling themes with real staying power:

- Artificial Intelligence (41% of advisors recommend it): From chipmakers like NVIDIA to software firms automating customer service, AI isn’t going away. It’s embedding itself everywhere.

- Clean Energy Transition (38%): Not just solar and wind. Think grid modernization, battery storage, hydrogen fuel cells, and critical mineral mining.

- Demographic Shifts (Aging Populations) (33%): Healthcare tech, home monitoring systems, retirement planning tools, and even robotics for elder care.

- Cybersecurity (15%): As everything goes digital, the threats grow. This isn’t just about software-it’s about hardware, cloud security, identity verification, and even insurance.

- Future of Food (7%): Lab-grown meat, vertical farming, food waste reduction tech, and plant-based alternatives. It’s not just health-it’s sustainability and supply chain resilience.

These aren’t speculative fads. They’re backed by government policy, consumer behavior shifts, and trillion-dollar infrastructure spending. The U.S. Inflation Reduction Act alone poured $370 billion into clean energy. China is investing heavily in AI. Europe is forcing companies to report on aging workforce impacts. These aren’t guesses. They’re policy-driven trends.

Final Thought: Don’t Chase the Hype

Thematic investing is powerful. But it’s not a shortcut. It’s not a get-rich-quick scheme. It’s a disciplined way to position your portfolio for the next decade-not the next quarter.

The best thematic investors aren’t the ones who bought the most viral ETF. They’re the ones who picked themes with real economic drivers, kept their exposure balanced, held through the noise, and didn’t let emotion override strategy.

If you’re going to invest in the future, make sure you’re investing in the right one. Not the one that sounds cool on TikTok. The one that’s actually changing the world.

Is thematic investing the same as sector investing?

No. Sector investing focuses on traditional industry groups like technology, healthcare, or energy. Thematic investing cuts across sectors to target broad trends-like AI, aging populations, or clean energy-that involve multiple industries. A healthcare sector fund might only include drug makers. A health and wellness theme fund could include telemedicine apps, fitness trackers, organic food brands, and mental health platforms.

How much of my portfolio should I allocate to thematic investments?

Most experts recommend keeping thematic investments between 10% and 15% of your total portfolio. Going beyond 20% increases volatility and can undermine your core diversification. Charles Schwab’s data shows portfolios with 10-15% allocated to themes achieved the best risk-adjusted returns (Sharpe ratio of 0.85), while those with over 25% saw returns drop due to overconcentration.

Are thematic ETFs risky?

Yes, they tend to be more volatile than broad market funds-often 25-40% more. That’s because they’re concentrated in specific trends, not diversified across hundreds of companies. Some thematic ETFs are poorly constructed, too, with weak methodology or just trendy names. Always check the fund’s holdings, expense ratio, and historical performance versus its benchmark.

How long should I hold thematic investments?

Thematic investing is a long-term strategy. Nutmeg’s analysis of 12,000 portfolios found that thematic strategies typically need 5-7 years to overcome early volatility and deliver consistent returns. If you’re trading in and out based on quarterly news, you’re likely to miss the real growth and end up buying high and selling low.

Can I build my own thematic portfolio instead of buying ETFs?

Yes, but it’s harder. You’d need to identify companies across multiple sectors that truly align with your chosen theme, monitor their exposure to the trend, and rebalance regularly. Most retail investors are better off using well-managed ETFs from firms like BlackRock, Vanguard, or iShares, which have the research teams and data tools to do this effectively.

What’s the biggest mistake people make with thematic investing?

The biggest mistake is confusing hype with substance. Just because a theme sounds exciting-like the metaverse or space tourism-doesn’t mean it’s investable. Look for real revenue, clear adoption curves, and supporting infrastructure. Avoid funds that use buzzwords without showing how companies are actually benefiting from the trend.

Thematic investing isn’t for everyone. But for those who want to move beyond the old rules and build a portfolio that reflects the world we’re heading into-it’s one of the most powerful tools available today. Just don’t forget the basics: diversify, stay patient, and always ask why.

Comments (5)

RAHUL KUSHWAHA

Man, I just started dipping my toes into thematic stuff last year after seeing how AI stocks blew up. Not gonna lie, I lost money on that metaverse ETF-total scam. But I kept 5% in clean energy and aging population funds, and honestly? They’ve been quiet but steady. Still holding. No panic selling. 🤞

Julia Czinna

I appreciate how you emphasized discipline over hype. Too many people treat thematic investing like a lottery ticket-buy the flashiest name and hope for the best. But the data shows real returns come from patience, diversification across themes, and checking actual company exposure. I’ve been using BlackRock’s THRO as a model for my own 12% allocation. It’s not sexy, but it works.

Laura W

Okay but let’s be real-AI isn’t just a theme anymore, it’s the infrastructure layer of everything. Like, if you’re not invested in the chips, the cloud, the data pipelines, or even the cooling systems for data centers-you’re missing the whole damn stack. And don’t even get me started on cybersecurity. Every time a company gets breached, their stock jumps. That’s not luck, that’s structural demand. We’re living in the AI gold rush, folks. Grab your pickaxe.

Graeme C

Let me cut through the fluff: 1,200 thematic ETFs? That’s not innovation-that’s financial snake oil on steroids. I’ve reviewed 17 of them. Half had zero revenue linkage to their supposed theme. One ‘future of food’ fund included a candy company. A CANDY COMPANY. That’s not investing, that’s a marketing department on caffeine. And yes, volatility is brutal-I watched a robotics fund drop 38% in six weeks because someone tweeted ‘robots will steal jobs.’ Don’t be that guy. Do your homework-or stay out.

Astha Mishra

It’s fascinating how we’ve moved from investing in companies to investing in narratives-and yet, the fundamental truth remains: value is created not by buzzwords, but by tangible shifts in human behavior, resource allocation, and technological adoption. The aging population isn’t a trend-it’s a mathematical certainty. AI isn’t a fad-it’s the new electricity. But here’s the quiet paradox: the more we chase these grand ideas, the more we risk losing sight of the individual companies actually building the future. We must remember that behind every theme are people-engineers, caregivers, farmers, coders-working quietly to make the vision real. So while we allocate our capital, let us also allocate our attention wisely. Not every headline deserves a portfolio position. Some truths unfold slowly, and those are the ones worth holding.