Investing: Build Wealth with Bond Ladders, International Index Funds, and Smart Asset Allocation

When you think about investing, the act of putting money to work so it grows over time instead of sitting idle. Also known as building long-term wealth, it’s not about gambling on crypto trends or chasing hot stocks—it’s about systems that work even when you’re not watching. For tech-savvy women who want control without complexity, investing means choosing tools that match your life, not the other way around.

One of those tools is a bond ladder, a strategy that spreads your fixed income across bonds with different maturity dates. This reduces interest rate risk and gives you predictable cash flow—perfect if you’re planning for retirement or just want to sleep better at night. Another key piece is international index funds, low-cost portfolios that give you exposure to stocks across developed and emerging markets. It’s not about betting on one country; it’s about spreading your bets so no single economy can wreck your portfolio. These aren’t just buzzwords—they’re proven methods used by real investors who’ve cut fees, avoided emotional mistakes, and watched their money grow steadily.

What ties them together? asset allocation, how you divide your money between different types of investments based on your goals and risk tolerance. You can’t build a bond ladder without knowing how much to put in bonds versus stocks. You can’t pick the right international funds without understanding how developed markets like Japan and Germany differ from emerging ones like India or Brazil. And you won’t get far if you don’t know why timing matters less than consistency. This isn’t Wall Street jargon. It’s practical math. It’s about knowing when to hold steady and when to adjust. It’s about using data, not gut feelings.

If you’ve ever felt overwhelmed by investing advice—too technical, too salesy, too vague—you’re not alone. The posts below cut through the noise. You’ll find clear breakdowns of how to build a bond ladder in today’s high-interest environment, and exactly how to weight your international funds between developed and emerging markets in 2025. No fluff. No hype. Just what works for women who manage their own money, one smart decision at a time.

BRICS Countries: Brazil, Russia, India, China, South Africa and the New Global Investment Landscape

BRICS countries-Brazil, Russia, India, China, and South Africa-now include nine full members and nine partners, controlling 55% of the world’s population and 46% of global GDP. This bloc is reshaping global investment through infrastructure, energy, and trade, offering real alternatives to Western financial systems.

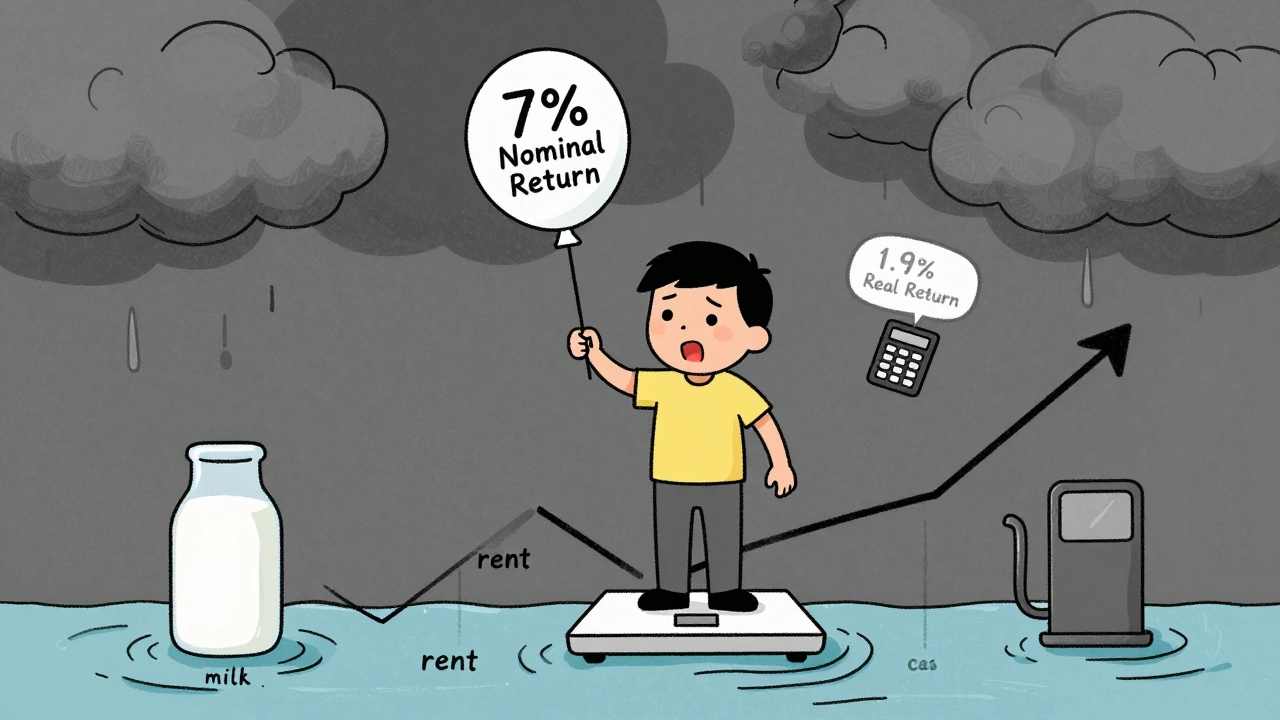

View MoreReal vs Nominal Returns: What Inflation-Adjusted Performance Really Means for Your Investments

Real returns reveal your true investment growth after inflation, while nominal returns can be misleading. Learn why real returns matter more than ever for long-term wealth and how to calculate them correctly.

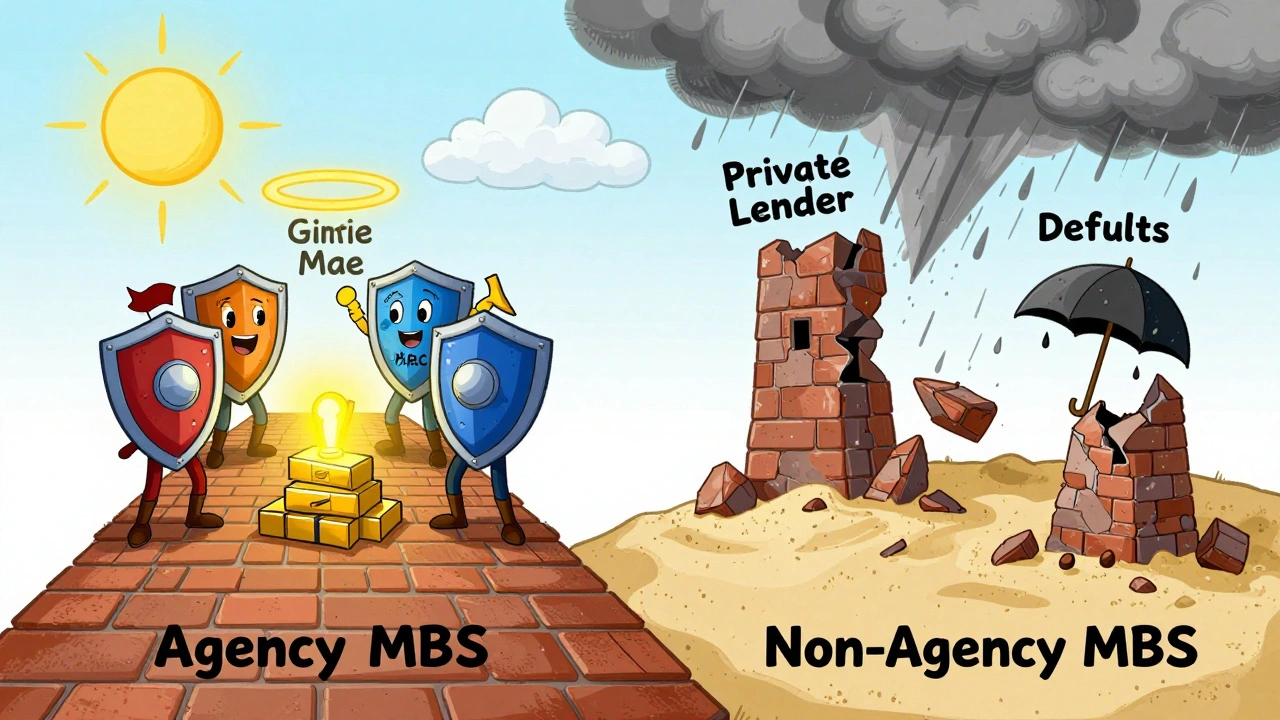

View MoreAgency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View MoreSecondary Offerings and How They Move Stock Prices

Secondary offerings can boost a company’s cash or dilute your ownership. Learn how dilutive and non-dilutive offerings impact stock prices, what to watch for, and how to tell if it’s a sign of strength or weakness.

View MoreBuybacks and Dividends: How Shareholder Yield Beats Traditional Dividend Metrics

Shareholder yield combines dividends, buybacks, and debt reduction to show the full picture of how companies return cash to investors. It outperforms dividend yield alone and is becoming the new standard for valuation.

View MoreREIT Funds and ETFs: How to Get Diversified Real Estate Exposure Without Buying Property

REIT ETFs offer a simple, low-cost way to invest in real estate without owning property. With steady dividends, inflation protection, and broad diversification, they're ideal for long-term investors seeking passive income.

View MoreBond Ladders: How to Build Steady Income and Lower Risk in Today's Market

Bond ladders offer steady income and lower risk by spreading investments across bonds with staggered maturities. Learn how to build one in today’s high-rate environment and why it beats bond funds for retirees and conservative investors.

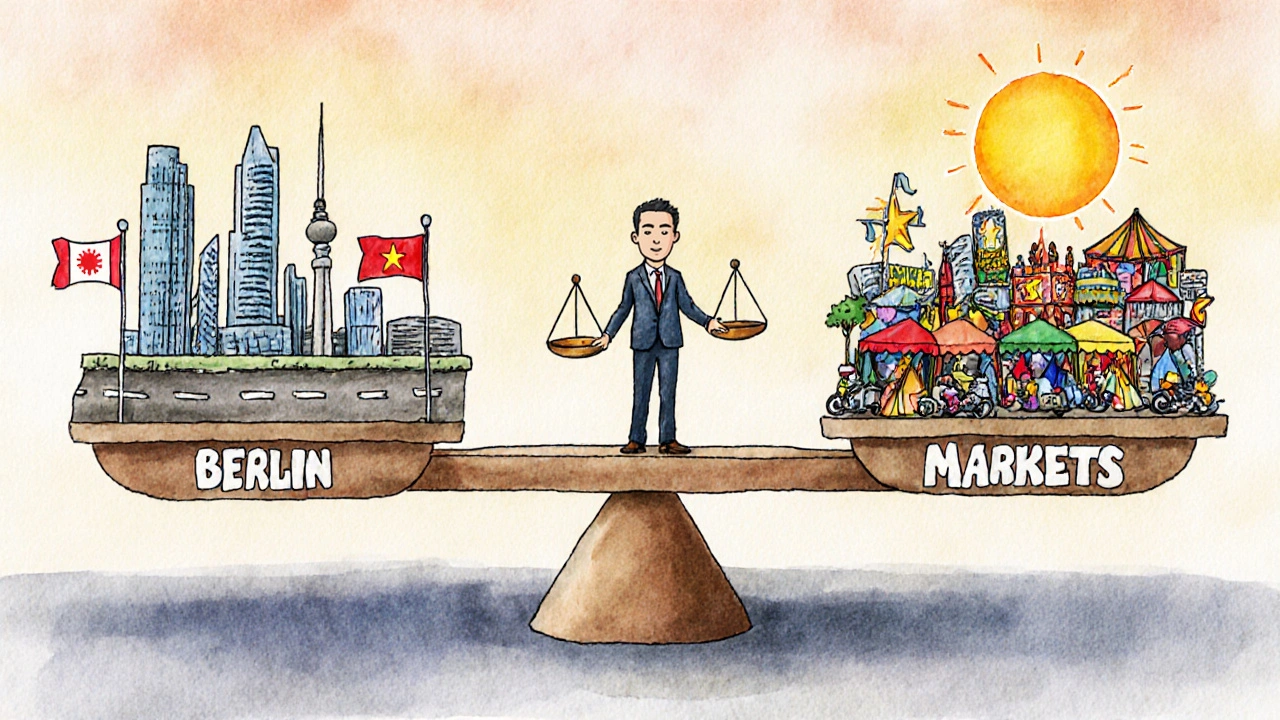

View MoreInternational Index Funds: Developed vs Emerging Markets Weight Allocation Explained

Understand how to allocate between developed and emerging markets in international index funds. Learn the optimal weights, key ETFs, risks, and how to avoid common mistakes in 2025.

View More