Financial Advisor Fee Calculator

Calculate your annual financial advisor fees based on your portfolio size and fee structure. This tool shows how different fee models compare, helping you make informed decisions about financial advice costs.

When you hire a financial advisor, you're not just paying for advice-you're paying for time, expertise, and peace of mind. But how much does that actually cost? The answer isn't simple. Some advisors charge a percentage of your investments. Others charge a flat fee, an hourly rate, or even commissions on products they sell. And those numbers can vary wildly depending on how much money you have, what services you need, and where you live.

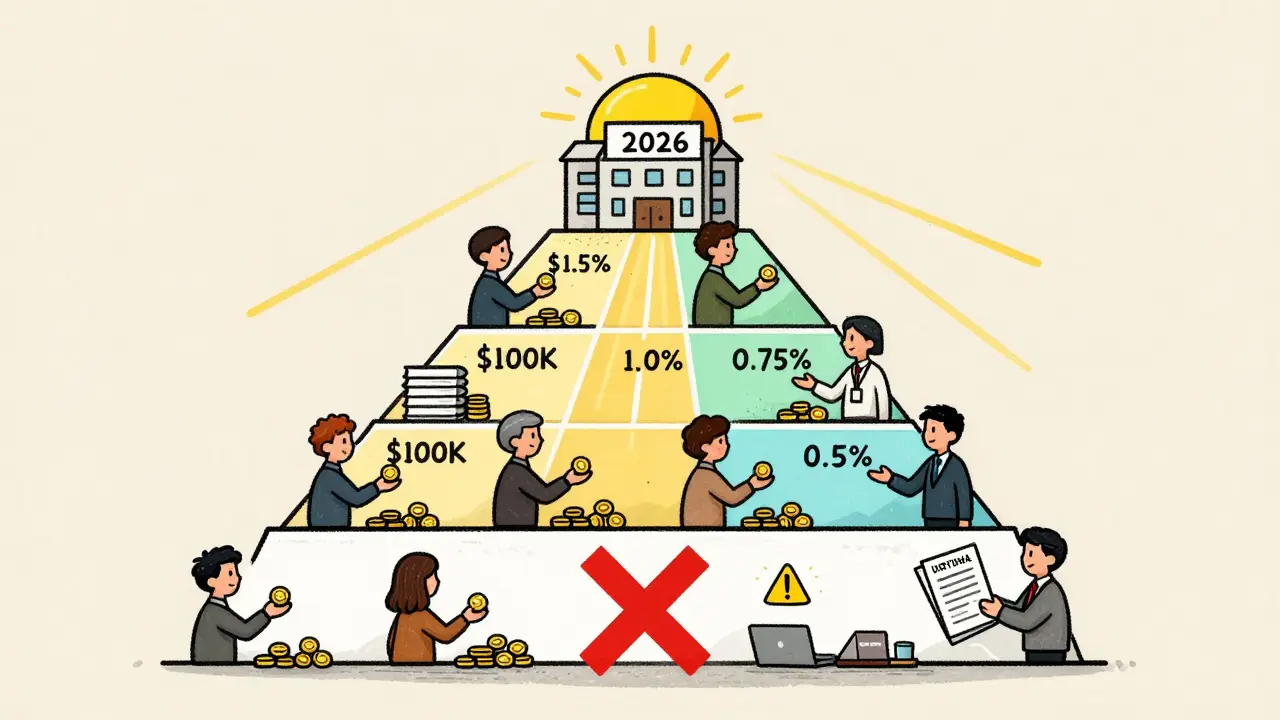

The most common way advisors get paid is through assets under management (AUM) fees. This means they take a percentage of the total value of your investment accounts each year. For most people, that’s around 1%. But that number isn’t fixed. If you have $500,000 in investments, you might pay 1.25%-so $6,250 a year. If you have $2 million, that rate could drop to 0.8%. By the time you hit $5 million or more, many advisors charge just 0.5% to 0.75%. This tiered system rewards larger portfolios with lower rates, which makes sense: managing $10 million takes about the same effort as managing $1 million, but the fee scales down.

Here’s how AUM fees typically break down based on portfolio size, according to Domain Money’s February 2026 fee guide:

- $100,000-$500,000: 1.25%-1.5% annually

- $500,000-$1,000,000: 1.0%-1.25% annually

- $1,000,000-$5,000,000: 0.75%-1.0% annually

- $5,000,000+: 0.50%-0.75% annually

For example, a $1 million portfolio at a 1% fee costs $10,000 per year. That might sound steep, but over 20 years, a 1% fee on a portfolio growing at 6% annually adds up to nearly $200,000 in fees. That’s why understanding how fees compound over time matters just as much as the rate itself.

Flat-Fee Advisors: Pay for a Plan, Not a Percentage

If you don’t have a large portfolio-or if you just want help with one specific goal like retirement planning or tax optimization-a flat fee might make more sense. Instead of paying a percentage of your assets every year, you pay one upfront price for a complete financial plan.

According to Bankrate’s December 2025 analysis and Domain Money’s 2026 guide, flat fees vary by scope:

- Basic investment management: $2,000-$4,000/year

- Comprehensive financial planning: $4,000-$8,000/year

- High-net-worth planning (complex taxes, estate, business ownership): $8,000-$15,000/year

- Ultra-high-net-worth (multi-generational planning, international assets): $15,000-$50,000+/year

Many clients switch to flat fees because they want more control. One Reddit user, 'InvestorJourney87', shared their experience: they were paying $1,250 a year on a $125,000 portfolio at 1%, but switched to a flat-fee advisor for $2,500/year who gave them a full retirement plan, tax strategy, and insurance review-something their old advisor never offered.

Flat-fee advisors usually provide a detailed service menu. You know exactly what you’re getting: how many meetings, what reports, whether they’ll help with estate documents, or coordinate with your CPA. That transparency is why demand for flat fees jumped 47% in 2024, according to the Kitces Report.

Hourly Rates: Pay Only for What You Use

Not everyone needs ongoing advice. Maybe you just need help setting up a Roth IRA, reviewing your insurance coverage, or figuring out how to withdraw from your 401(k) without getting hit with penalties. That’s where hourly advisors come in.

Hourly rates depend heavily on experience. New advisors might charge $200-$300/hour. Certified Financial Planners (CFP®) with 5+ years of experience typically charge $350-$500/hour. Specialists in tax law or estate planning can charge $500-$750/hour because they bring niche expertise.

But here’s the catch: most hourly advisors spend two extra hours behind the scenes for every hour they bill. They’re researching your situation, updating spreadsheets, emailing your broker, or reviewing tax forms. So if you book a one-hour consultation, you’re really getting about three hours of work.

The 2024 Kitces Report found that the median hourly rate across the industry is $300. That’s a good benchmark if you’re comparing options. If you only need 5-10 hours of advice over a year, you’ll likely spend less than you would with an AUM fee.

Commission-Based Advisors: The Model to Avoid

Some advisors still earn money by selling you insurance policies, annuities, or mutual funds. They get a commission-usually 3% to 6% of the transaction value-each time you buy something. That creates a conflict of interest: their income depends on what you buy, not what’s best for you.

The CFP Board and SEC both warn against this model. Bankrate’s analysis quotes certified planner Sarah Johnson: “They make their money from selling you products that may not necessarily be in your best interest.”

Commission-based advisors are becoming rare. In 2020, only 33% of advisors were fee-only or fee-based. By 2025, that number jumped to 83%, and it’s expected to hit 85% by 2027. The shift is driven by regulation, client demand, and industry standards. If someone pushes you toward a product because “it’s perfect for your situation,” ask: “Do you get paid more if I buy this?”

Robo-Advisors: The Low-Cost Alternative

If you’re comfortable managing your own investments with a little help, robo-advisors like Betterment or Wealthfront offer automated portfolios at 0.25%-0.50% annually. They’re great for beginners or people with simple goals. But they don’t offer personalized tax strategies, estate planning, or emotional coaching during market crashes.

Robo-advisors are a good entry point. But if you have complex needs-like owning a business, supporting aging parents, or navigating divorce-they won’t cut it. That’s when human advice becomes worth the extra cost.

What You’re Actually Paying For

It’s easy to focus on the dollar amount. But what’s the value? Research from Savvy Wealth and SmartAsset shows that good financial advisors add value beyond just picking stocks. On average, they help clients:

- Save 1.0495% in taxes over their lifetime

- Gain 2.47% more in annual investment returns through smarter allocations

- Avoid costly emotional mistakes (like selling during a crash) that cost most investors 2-5% annually

That’s a total added value of 1.8% to 5.1% per year. For a $500,000 portfolio, that’s $9,000 to $25,500 in extra value annually. If you pay $5,000 for advice and gain $15,000 in returns or tax savings, you’re ahead.

The right advisor doesn’t just manage money-they help you avoid mistakes, reduce stress, and stay on track. That’s why clients with $3 million portfolios often say things like: “My blended fee is 0.62%, saving me over $12,000 a year versus a flat 1% structure.” They’re not just paying for advice. They’re paying for outcomes.

How to Choose the Right Fee Structure

There’s no one-size-fits-all fee. Your choice should depend on:

- Your portfolio size: Under $250,000? Consider flat or hourly. Over $1 million? AUM or flat fee both work.

- Your needs: Do you need ongoing management? Or just a one-time plan? Hourly or flat fee makes more sense for one-time help.

- Your comfort level: Do you want someone checking in quarterly? Or do you prefer to reach out only when something changes?

- Transparency: Ask for a written fee schedule. No hidden commissions. No vague promises.

Start by asking potential advisors: “How are you paid?” Then: “Can you show me exactly what I’ll pay each year?” If they hesitate, walk away. The best advisors don’t hide their fees-they proudly explain them.

What’s Coming in 2026 and Beyond

The industry is moving fast. By 2026, 78% of advisors will use fee-based models (up from 72.4% in 2025). More firms are testing value-based pricing-where fees are tied to results, like hitting a retirement target or reducing tax liability.

Regulations are tightening too. The SEC’s Regulation Best Interest and the DOL’s 2025 fiduciary rule expansion mean advisors must now prove they’re acting in your best interest. That’s good news for clients. It means fewer sales pitches and more personalized advice.

Don’t assume all advisors are the same. The right one for you isn’t necessarily the cheapest. It’s the one who charges clearly, listens deeply, and helps you make better decisions-not just better investments.

How much do financial advisors typically charge for a $500,000 portfolio?

For a $500,000 portfolio, most financial advisors charge between 0.75% and 1.5% annually. That means you’d pay $3,750 to $7,500 per year. The exact rate depends on the advisor’s fee structure. AUM-based advisors often charge 1.25% at this level, while flat-fee advisors might offer the same services for a fixed $4,000-$6,000/year. Some robo-advisors charge as low as 0.25% ($1,250/year), but provide limited personal guidance.

Are hourly financial advisors worth it?

Yes-if you only need help with specific issues. Hourly advisors typically charge $300-$500/hour, and you pay only for the time you use. This works well if you’re building a retirement plan, reviewing insurance, or preparing for a major life event. Most clients need 5-10 hours total over a year. Compared to a 1% AUM fee on $500,000 ($5,000/year), hourly can be cheaper if you’re not actively managing investments. Just confirm what’s included: prep time, follow-ups, and document reviews often aren’t billed but still take time.

What’s the difference between fee-only and commission-based advisors?

Fee-only advisors get paid only by you-through AUM fees, flat rates, or hourly charges. They don’t earn commissions from selling financial products. Commission-based advisors earn money when you buy insurance, annuities, or mutual funds they recommend. This creates a conflict: they may push products that pay them more, not what’s best for you. Fee-only is the industry standard today, with 83% of certified planners using it. Always ask: “Do you get paid if I buy this product?” If the answer isn’t a clear no, reconsider.

Can I negotiate a financial advisor’s fee?

Absolutely. Many advisors, especially those using AUM or flat-fee models, are open to negotiation. If you have a large portfolio, you can ask for a lower percentage. If you’re starting with less than $250,000, ask about a discounted flat rate or a trial period. Some firms offer a free initial consultation and then propose a customized fee structure. Don’t assume the first quote is final. Advisors compete for clients-especially in a market where transparency is expected.

Do I need a financial advisor if I have a robo-advisor?

Not necessarily-but it depends on your complexity. Robo-advisors are great for simple portfolios: automatic investing, low fees, and basic asset allocation. But they don’t handle taxes, estate planning, debt strategies, or behavioral coaching. If you own a business, have kids in college, or are nearing retirement, a human advisor adds more value than a robot. Many people use both: a robo-advisor for core investing and a human advisor once a year for planning. The key is knowing what you’re missing-and whether it’s worth paying for.

Comments (4)

Geoffrey Trent

Ugh, another article that treats financial advisors like some kind of sacred priesthood. 1%? That's highway robbery. I've seen people pay that on $500k and then wonder why their returns are trash. The real scam? Advisors who act like they're doing you a favor by not charging 2%. Honestly, if you need someone to tell you to 'diversify' or 'stay the course,' you're already behind. Just buy index funds and stop giving strangers your money.

Also, 'peace of mind'? That's just code for 'I'm too lazy to learn this stuff myself.'

Mark Vale

I’ve been digging into this whole financial advisor thing, and honestly? I think it’s all a front. You ever notice how every ‘fee-only’ advisor suddenly has a ‘partner’ at a brokerage that pays them kickbacks under the table? The SEC says one thing, but the real system? It’s all smoke and mirrors. I know a guy who works at a ‘transparent’ firm - turns out, they steer clients toward funds that give them ‘consulting fees’ that aren’t even listed on the disclosure docs.

And don’t get me started on ‘value-added’ claims. That 2.47% return boost? Probably just cherry-picked data. I’ve seen advisors lose money in bear markets and still charge full fees. It’s like paying a personal trainer who gets you fatter.

Also, ‘robo-advisors’? Yeah, right. They’re just algorithms owned by the same banks that created the 2008 crash. Coincidence? I think not.

Sabrina de Freitas Rosa

OMG I’m so done with this. People are just handing over their cash like it’s a magic wand. 1%? That’s a MONTHLY fee for some folks! I had a cousin pay $8k a year for ‘planning’ and then she got hit with a $1200 fee for ‘rebalancing’ - no one told her that was extra.

And don’t even get me started on commission guys. They’re basically sales reps in blazers. I had one try to sell me an annuity that had a 7% surrender charge. I asked, ‘Why would I lock my money up for 10 years?’ He said, ‘Because it’s safe.’ Safe? Like a bank that went bust in 2008?

Just use a damn spreadsheet. Or better yet, go to a nonprofit credit counselor. They don’t charge you a dime. Why are we all so scared to do this ourselves? It’s not brain surgery.

Also, ‘peace of mind’? Honey, if you need someone to hold your hand while you check your 401(k), maybe you’re not ready for money. Just sayin’.

Royce Demolition

YESSSS this is the truth bomb we all needed 🙌🔥

Let’s be real - financial advisors aren’t here to help you get rich. They’re here to help YOU pay THEM. But guess what? You CAN do better. I started with a robo-advisor, then hired a flat-fee planner for ONE HOUR. Got my estate plan, tax strategy, and debt payoff roadmap. Paid $1,200. Saved $9k in fees over the next year.

Stop overpaying for hand-holding. You don’t need someone to ‘manage’ your money. You need someone to teach you how to manage it. And guess what? That’s free on YouTube. Or Reddit. Or a library book.

Also - if your advisor says ‘trust me’? RUN. 🏃💨

PS: I’m now managing my own portfolio and sleeping like a baby. No advisor. No stress. Just me, my spreadsheets, and a whole lotta peace. 💪💰