Geek to Wealth - Page 5

Event Trading: How to Trade Fed Days, CPI Reports, and Earnings Weeks

Learn how to trade Fed Days, CPI reports, and earnings weeks with a proven strategy that targets predictable market volatility. Discover what separates profitable traders from those who lose money.

View MoreGamification in Financial Education: Making Learning Fun and Effective

Gamification in financial education turns budgeting and saving into engaging, game-like experiences that boost motivation, improve financial literacy, and lead to real behavior change - backed by science and used by millions.

View MoreESG Portfolios in Robo-Advisors: How Values-Based Automation Works Today

ESG robo-advisors let you invest with your values using automated, low-cost portfolios. Learn how they work, who uses them, and whether they deliver real impact without sacrificing returns.

View MoreFlat Fee Financial Planning: How Project-Based Pricing Works for Clients and Advisors

Flat fee financial planning lets you pay a fixed price for specific financial projects-like retirement or college planning-instead of a percentage of your assets. It’s transparent, fair, and growing fast.

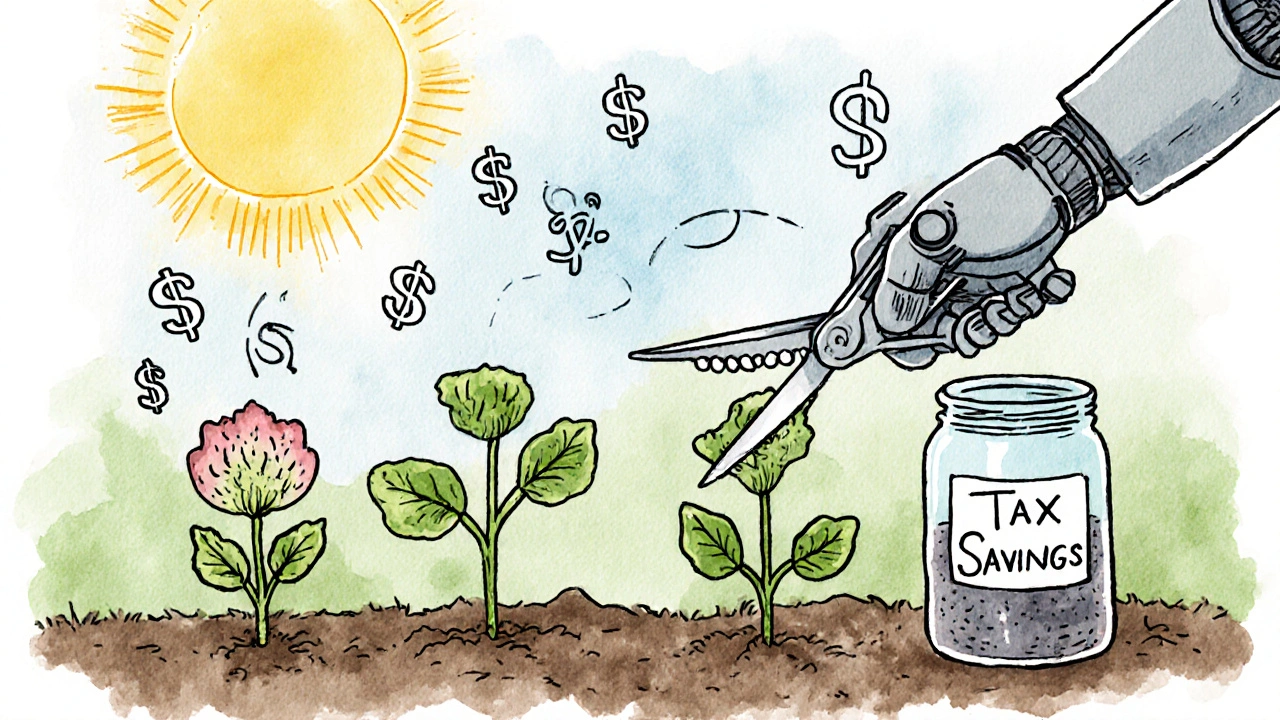

View MoreComparing Tax-Loss Harvesting Thresholds Across Robo Platforms

Learn how tax-loss harvesting thresholds vary between top robo-advisors like Betterment, Wealthfront, and Schwab-and which platform gives you the most tax savings based on your portfolio size and market conditions.

View MoreCash as a Strategic Asset: Why Keeping Dry Powder Is the Smartest Move in Today’s Market

Dry powder-cash held for strategic investments-isn't just safety. It's a powerful tool to buy assets at deep discounts during market crashes. Learn how top investors use it to outperform, and why holding cash is smarter than ever.

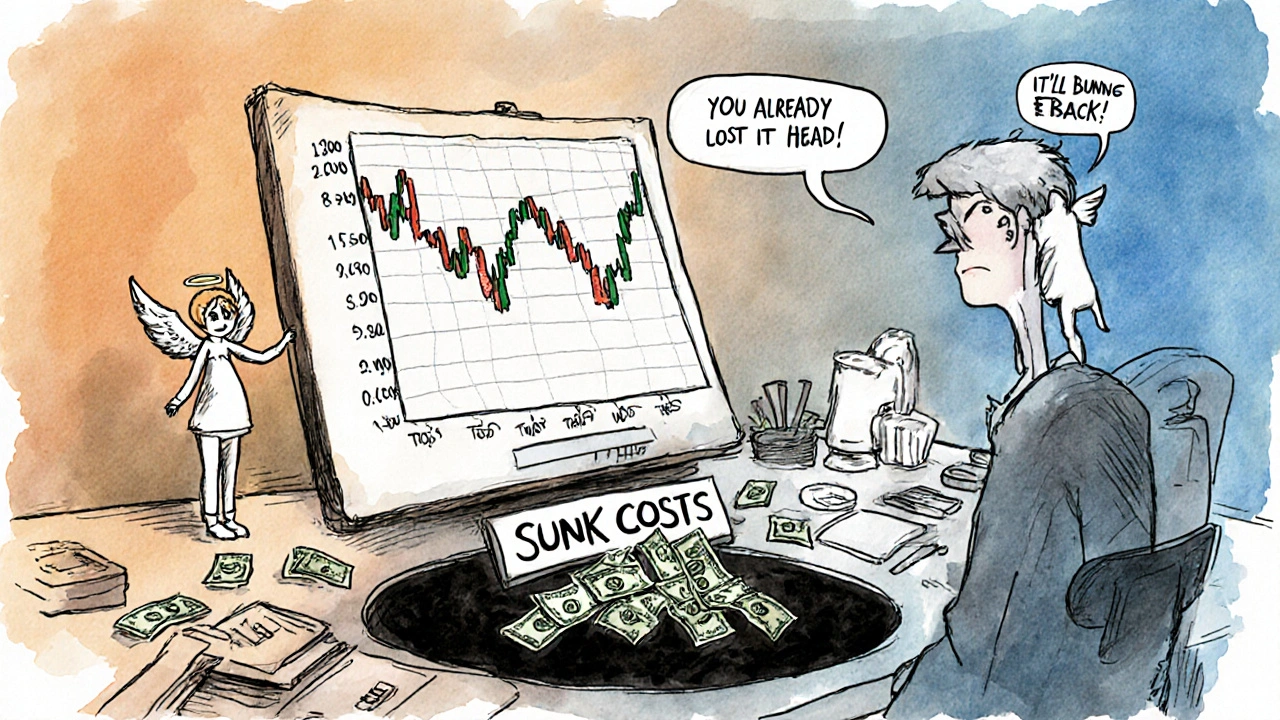

View MoreWhy You Keep Holding Losing Investments: Hope Bias and Sunk Costs Explained

Why do investors hold losing stocks too long? It's not about the market-it's about hope bias and the sunk cost fallacy. Learn how your brain tricks you and what to do instead.

View More