Tax Efficiency: How to Keep More of Your Investment Returns

When you hear tax efficiency, the practice of minimizing taxes on investment gains to maximize your net returns. Also known as after-tax investing, it's not about hiding money—it's about placing it in the right spot at the right time. Most people focus on how much their portfolio grows, but the real win? How much you actually get to keep after the IRS takes its cut.

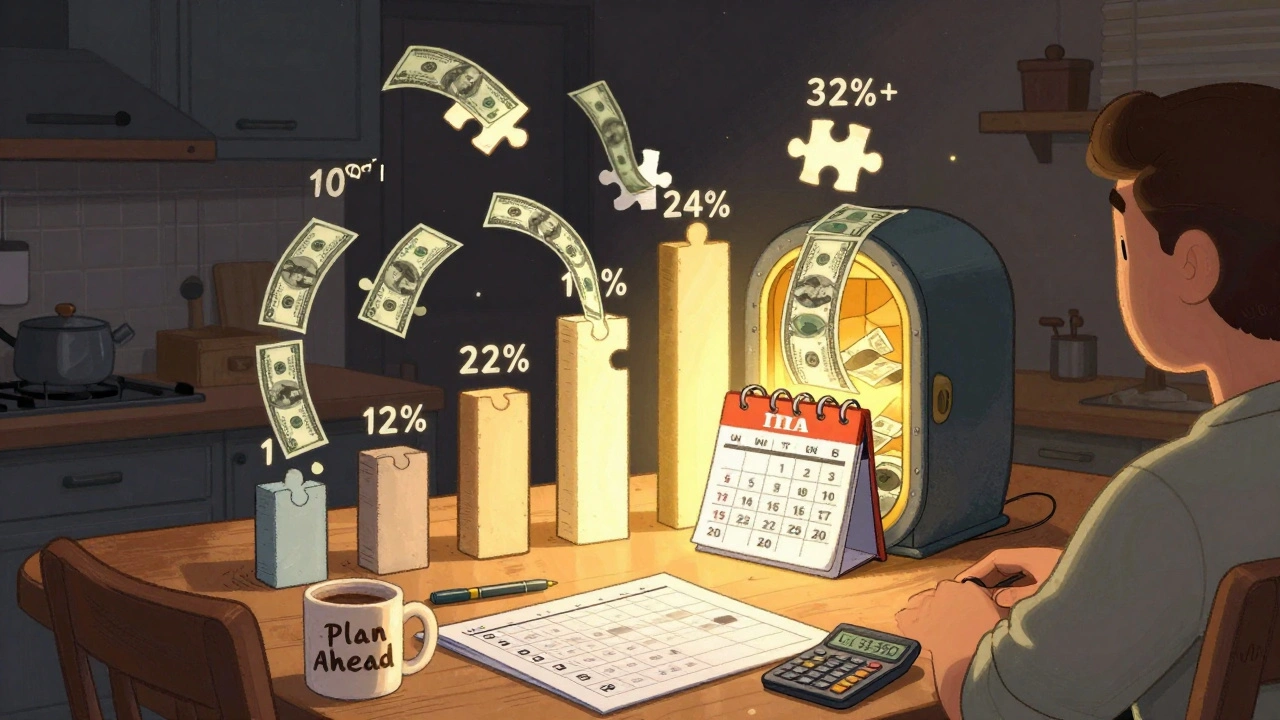

That’s where asset location strategy, putting different types of investments in different kinds of accounts to reduce your tax burden comes in. Think of it like packing a suitcase: you don’t put your heaviest, bulkiest stuff in the overhead bin—you save the cabin space for what you need most. Same with your money. High-growth stocks and REITs? Save those for your Roth IRA. Bonds and dividend funds? Those are better off in tax-deferred accounts like a 401(k). And if you’ve got a taxable brokerage account? Stick with low-turnover ETFs that generate fewer taxable events. This isn’t theory—it’s a tactic that can add up to 1% or more to your annual returns, compounding over time.

Then there’s tax-loss harvesting, selling investments at a loss to offset gains and reduce your tax bill. It sounds complicated, but it’s just smart timing. If your tech stock dropped 20% this year and your energy fund gained 15%, you can sell the loser to cancel out the winner’s taxes. Do it while rebalancing, and you fix your portfolio’s risk level while saving money. Just watch out for the wash-sale rule—you can’t buy the same thing back within 30 days. But you can swap into a similar ETF, like switching from VTI to VXUS, and keep your exposure without triggering a penalty.

And here’s what most guides miss: tax efficiency isn’t just for high earners. Even if you’re just starting out with a $500 monthly investment, where you put that money matters. A $10,000 gain in a taxable account could cost you $1,500 or more in taxes. The same gain in a Roth IRA? Zero. That’s not a small difference—it’s the gap between retiring on time and having to work longer.

These aren’t niche tricks. They’re tools used by people who’ve learned that the best investment isn’t always the one with the highest return—it’s the one that leaves you with the most after taxes. Below, you’ll find real, actionable guides that show you exactly how to do this without guesswork: how to coordinate tax-loss harvesting with rebalancing, how to pick the right accounts for your holdings, and how to avoid the mistakes that cost people thousands. No fluff. No jargon. Just what works.

Index Funds vs Active Funds: Which Is More Tax Efficient?

Index funds are significantly more tax-efficient than active funds due to lower trading activity. Learn how capital gains distributions, ETF structures, and account placement affect your after-tax returns-and what to do now to keep more of your money.

View MoreTax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

View More