Machine Learning Fraud: How AI Detects and Prevents Financial Scams

When your bank blocks a strange charge you didn’t make, it’s not a human reviewing your account—it’s machine learning fraud, a system that learns normal spending behavior and flags anything that breaks the pattern. Also known as AI-driven fraud detection, it works silently in the background, analyzing millions of transactions every second to catch criminals before they cash out. This isn’t sci-fi. It’s running right now in your PayPal, Chase, or Robinhood account.

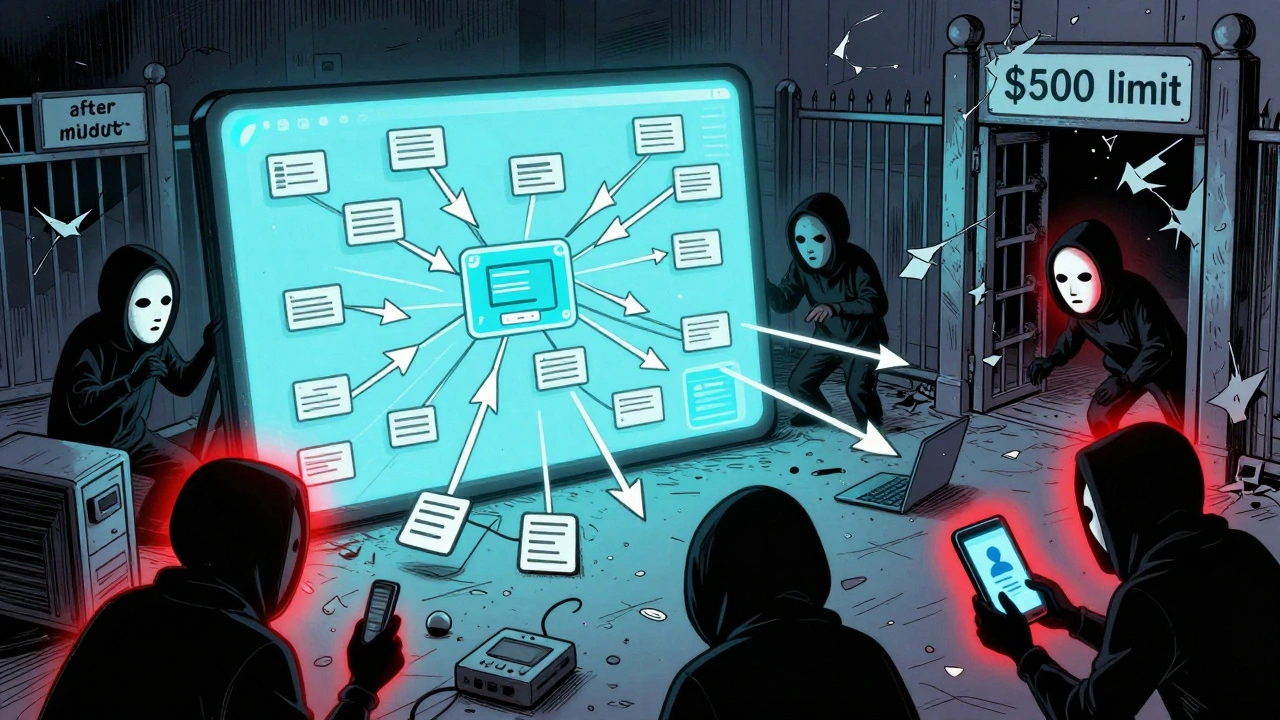

How does it actually work? transaction monitoring, the real-time tracking of payment flows to spot deviations from typical behavior is the core. If you usually spend $30 at Starbucks on Tuesdays and suddenly buy a $2,000 gadget in another country, the system notices. It doesn’t just look at the amount—it checks the time, location, device, merchant type, and even how fast you typed your password. anomaly detection, the method that identifies rare or unusual patterns in data is what makes this possible. It’s like your brain knowing something’s off about a face in a crowd—even if you can’t explain why.

And it’s not just about stolen cards. financial fraud, any illegal act designed to steal money or personal data through digital systems has gotten smarter—fake invoices, synthetic identities, account takeovers. That’s why modern systems don’t just react. They predict. They learn from every false alarm and every caught scam to get better. Companies like Stripe and Plaid use these models to protect small businesses. Even your robo-advisor uses similar logic to spot unusual login attempts or withdrawal requests.

You don’t need to understand the math behind it. But you should know this: the more you use digital finance, the more you rely on this tech to keep your money safe. It’s faster than any human, never sleeps, and gets smarter every day. The bad guys are using AI too—but right now, the defenders are winning.

Below, you’ll find real guides on how these systems work behind the scenes, what tools fintechs use to stop fraud, and how you can spot the red flags before they cost you. No fluff. Just what matters.

Fraud Detection Technology: How AI Identifies Fraudulent Activity

AI fraud detection uses machine learning to spot subtle patterns in transactions, behavior, and device signals-catching fraud that traditional rules miss. With 94% accuracy and fewer false alarms, it's now the standard in fintech.

View MoreFraud Detection Systems: How AI Identifies Suspicious Activity

AI fraud detection systems use machine learning to spot suspicious activity in real time, catching 95%+ of fraud with far fewer false alarms than old rule-based systems. Learn how it works, who benefits, and why it's becoming essential.

View More