AI Fraud Detection: How Machines Spot Scams Before You Even Notice

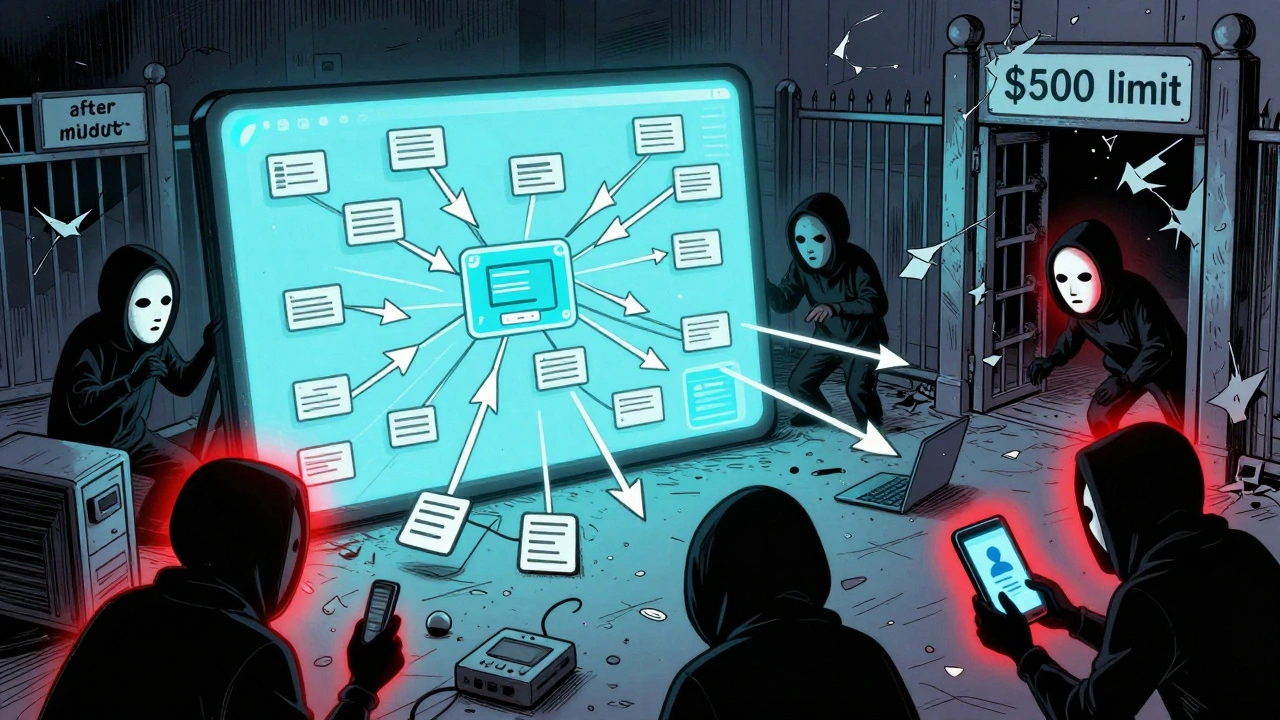

When your bank blocks a weird charge you didn’t make, or your credit card app sends a quick alert about a strange transaction, that’s not luck—it’s AI fraud detection, a system that uses machine learning to spot unusual patterns in financial behavior and flag potential scams in real time. Also known as anomaly detection, it’s the invisible shield behind nearly every digital payment you make today. Unlike old-school rules like "block transactions over $500," modern AI learns what normal looks like for you—your usual spending times, locations, amounts—and sounds the alarm when something breaks that pattern.

This isn’t just for big banks. Fintech apps, crypto exchanges, and even BNPL services use machine learning fraud, algorithms trained on millions of transaction histories to recognize subtle signs of identity theft or account takeover. It works by analyzing dozens of signals at once: device fingerprint, typing speed, IP location, time since last login, even how you hold your phone. A hacker might copy your password, but they can’t copy your behavior—and that’s where AI wins. The same tech that powers your budgeting app to categorize your coffee runs also spots when someone tries to drain your account from another country in the middle of the night.

And it’s not just about stopping fraud after it starts. Systems now predict it before it happens. payment fraud, a growing threat as more transactions move online, is being reduced by up to 40% in companies that use real-time AI monitoring. That’s why your app might ask you to verify a purchase even if it’s under your usual limit—it’s not doubting you, it’s protecting you. The models keep learning too. Every false alarm you clear, every legitimate transaction you confirm, helps the system get smarter. It’s a feedback loop that gets better the more you use it.

You won’t see the code, but you’ll feel the safety. Whether it’s a sudden spike in online shopping, a transfer to a new recipient, or a login from a device you’ve never used, AI fraud detection is working behind the scenes to keep your money safe. And because it adapts to you, not just to rules, it’s far more accurate than anything humans could build manually. No more waiting for fraud alerts days after the damage is done—this system acts in seconds.

Below, you’ll find real guides on how these systems connect to your daily finance tools—from budgeting apps that flag odd spending to payment processors that cut fraud losses by half. You’ll learn how fintechs build these defenses, why some tools fail, and how to spot when your own system is working—or when it’s not enough.

Fraud Detection Technology: How AI Identifies Fraudulent Activity

AI fraud detection uses machine learning to spot subtle patterns in transactions, behavior, and device signals-catching fraud that traditional rules miss. With 94% accuracy and fewer false alarms, it's now the standard in fintech.

View MoreFraud Detection Systems: How AI Identifies Suspicious Activity

AI fraud detection systems use machine learning to spot suspicious activity in real time, catching 95%+ of fraud with far fewer false alarms than old rule-based systems. Learn how it works, who benefits, and why it's becoming essential.

View More