2025 August Investing Guides for Tech-Savvy Women

When you’re building wealth online, online investing, the practice of buying and managing investments through digital platforms without a traditional financial advisor. Also known as self-directed investing, it’s how thousands of women are growing their money from their laptops—no finance degree required. In August 2025, the guides here focused on real tools, real results, and real steps you can take this month to make your money work harder. No jargon. No hype. Just what works.

Most posts dug into ETFs, exchange-traded funds that let you own a slice of hundreds of stocks or bonds in one trade. Also known as index funds traded like stocks, they’re the backbone of smart, low-cost portfolios. You’ll find comparisons of the cheapest platforms, how to pick ETFs that match your goals, and why most people overpay for something that doesn’t outperform the market. Then there’s robo-advisors, automated investment services that build and manage your portfolio based on your risk level and timeline. Also known as algorithm-driven investing, they’re perfect if you hate picking stocks but still want control. We tested five of them—looked at fees, minimums, and how easy they were to use if you’re new or just tired of managing things yourself.

For those curious about crypto, the crypto basics, the foundational knowledge needed to safely buy, store, and understand digital assets like Bitcoin and Ethereum. Also known as cryptocurrency入门, it’s not about getting rich quick—it’s about knowing what you’re risking. The posts cut through the noise: how to set up a wallet without getting scammed, which exchanges actually protect your funds, and why you should never put more than a small part of your portfolio into crypto. And behind all of it? The same goal: portfolio strategy, a plan that balances risk, growth, and income based on your life stage and financial goals. Also known as asset allocation, it’s what turns random trades into lasting wealth. Every article tied back to this. No random stock picks. No gambling. Just how to structure your money so it grows quietly, steadily, and on your terms.

What you’ll find below isn’t a list of posts—it’s a month’s worth of clear, practical steps women like you took to get better at investing. Whether you were just starting out or fine-tuning your strategy, these guides helped you cut fees, avoid common mistakes, and make decisions based on data, not emotions. You’re not here to guess what works. You’re here to see what did.

Behavioral Finance Biases: Common Money Mistakes and How to Fix Them

Learn how common psychological biases like loss aversion, overconfidence, and herd behavior lead to costly money mistakes - and how to fix them with simple, proven strategies.

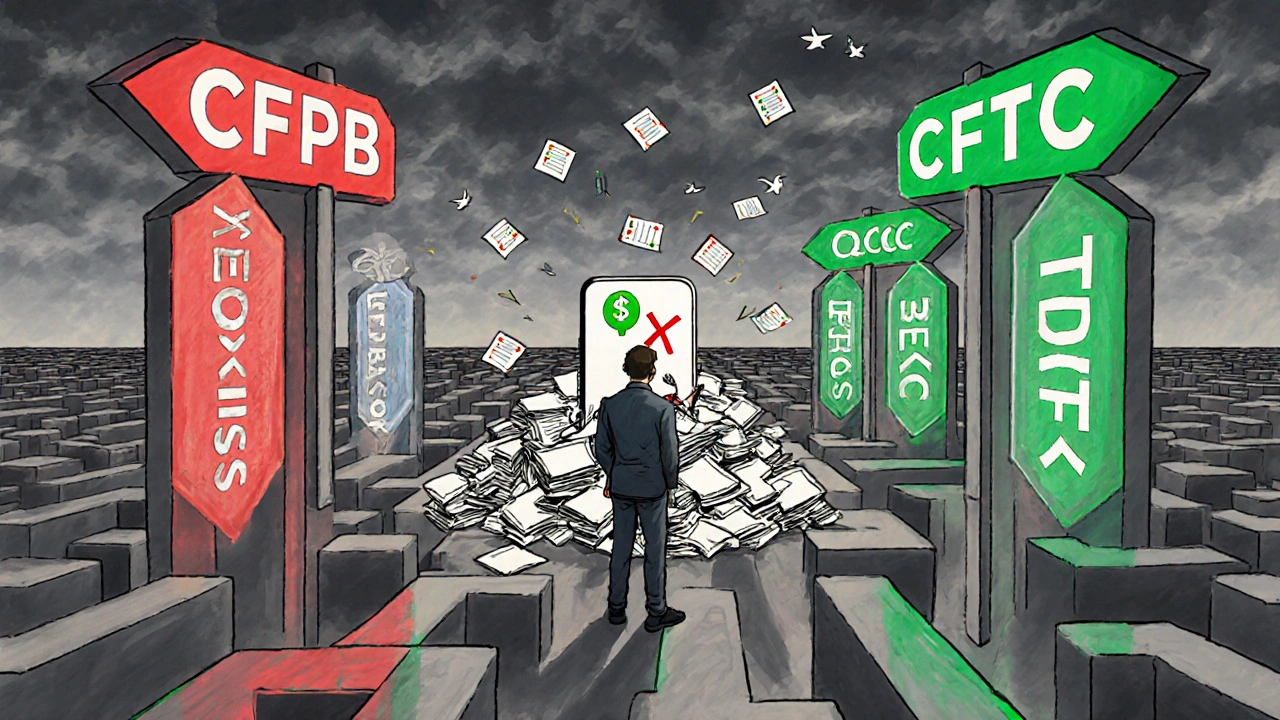

View MoreFintech Regulations: Global Overview and Compliance in 2025

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View MoreEnvelope Budgeting Digitized: How Categories, Caps, and Alerts Control Your Spending

Digital envelope budgeting uses virtual categories, spending caps, and real-time alerts to help you control your money without cash. Learn how to set it up, choose the right app, and avoid common mistakes.

View More