Trend-Based Investing: How to Ride Market Moves Without Guessing

When you hear trend-based investing, a strategy that profits by following the direction of price movements over time. Also known as momentum investing, it doesn’t ask if a stock is cheap or expensive—it asks if it’s moving up, and if the momentum is strong enough to keep going. This isn’t about predicting the future. It’s about recognizing what’s already happening and riding it—like catching a wave instead of trying to build a boat out of thin air.

Most people think investing means picking winners. But trend-based investing flips that. It says: let the market tell you who the winners are. If a stock or ETF keeps climbing week after week, it’s likely because more people are buying it. That’s not luck—that’s collective behavior, and it’s measurable. Tools like moving averages and breakout levels help you spot these shifts without needing a crystal ball. You don’t need to know why the trend started—just that it’s real, and you’re not alone in following it.

This approach works best when paired with technical analysis, the practice of using price charts and volume data to identify patterns and predict future movement. It’s not magic—it’s math. A 50-day moving average crossing above a 200-day one? That’s a classic signal. A breakout above a year-long resistance level? That’s confirmation. These aren’t guesses. They’re rules-based triggers that remove emotion from the decision. And when you combine them with portfolio strategy, a systematic plan to allocate assets based on risk, goals, and market conditions, you get something powerful: a way to stay in the game during bull markets and step back before big drops.

Think about it: if you’d followed the trend in 2020, you’d have ridden the tech rally without needing to pick the next Apple or Amazon. If you’d followed the trend in 2022, you’d have shifted to cash or bonds before the big sell-off. Trend-based investing doesn’t guarantee profits every month. But it gives you a repeatable system that works over time—unlike trying to time headlines or chase hot tips.

What you’ll find in these posts isn’t theory. It’s real tactics used by people who trade, invest, and manage money every day. You’ll see how trend-based investing connects to stop-loss orders, partial rebalancing, and event trading. You’ll learn how to spot trends in ETFs, not just stocks. And you’ll see how even conservative investors use trend signals to protect their portfolios—not just to grow them.

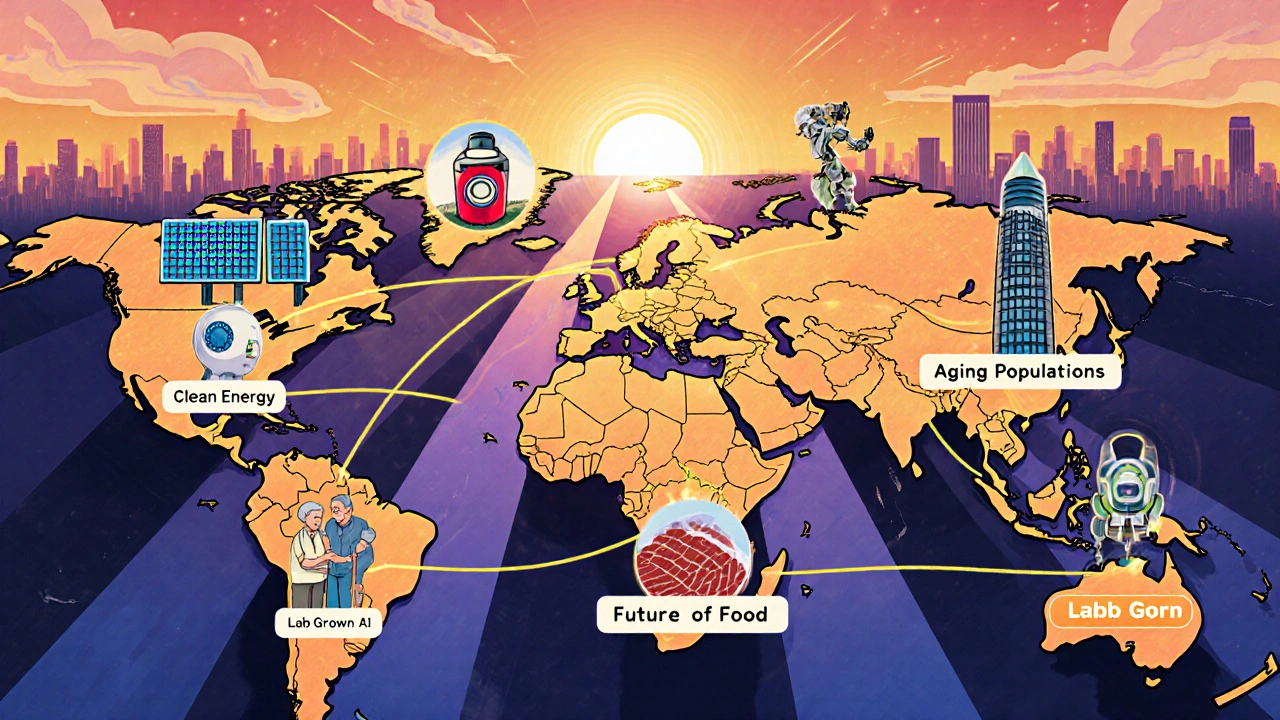

Niche Investing Strategies: Thematic and Trend-Based Approaches

Thematic investing lets you back major global trends like AI, aging populations, and clean energy-not just individual stocks. Learn how to pick the right themes, avoid hype traps, and build a balanced portfolio that aligns with the future.

View More