Thematic Investing: Build Portfolios Around Trends Like ESG, Tech, and Real Estate

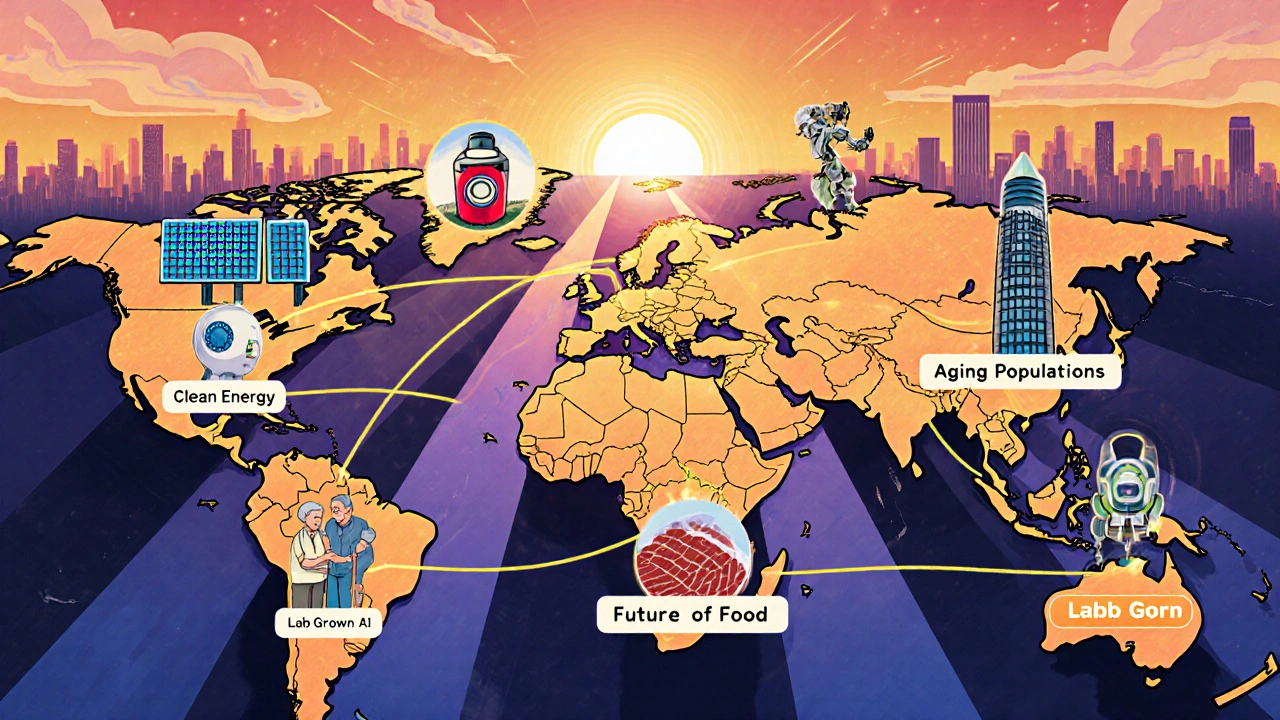

When you invest in thematic investing, a strategy that focuses on long-term structural trends instead of individual companies or sectors. Also known as trend investing, it lets you align your money with shifts like clean energy, aging populations, or AI adoption—without needing to pick winners among dozens of stocks. It’s not about guessing which company will outperform next quarter. It’s about spotting where the world is headed and putting your cash where the momentum is.

Think of it like riding a wave instead of swimming against the current. ESG portfolios, investment strategies that screen companies based on environmental, social, and governance criteria are one of the most popular forms of thematic investing today. Platforms like Carbon Collective and Vanguard ESG use automated rules to build portfolios around sustainability, letting you invest in clean tech, fair labor practices, and ethical governance without doing the legwork. Meanwhile, REIT ETFs, exchange-traded funds that give you exposure to real estate without buying property let you tap into the same trend—rising demand for logistics centers, data centers, and rental housing—through a single fund. These aren’t just ethical choices; they’re smart, data-backed plays that track real economic shifts.

Thematic investing doesn’t require you to be a market guru. You don’t need to time the Fed or decode earnings calls. You just need to identify a trend with staying power and find a simple, low-cost way to ride it. That’s why growth investing, focusing on companies expected to grow faster than the market average often overlaps with thematic approaches—think AI startups, robotics firms, or cloud infrastructure providers. These aren’t random picks. They’re pieces of a bigger puzzle: digital transformation, automation, and the rise of the tech-driven economy. And when you combine thematic investing with tools like dollar-cost averaging or partial rebalancing, you turn a bold idea into a steady, low-stress strategy.

Some people think thematic investing is just hype. But look at the data: REIT ETFs delivered steady dividends through inflation spikes. ESG funds outperformed traditional ones during market crashes. And investors who loaded up on tech themes before the AI boom saw returns that outpaced the S&P 500. It’s not about chasing fads. It’s about recognizing real, measurable changes in how we live, work, and spend—and then building your portfolio around them.

Below, you’ll find real, tested guides on how to use thematic investing without overpaying, overtrading, or overcomplicating things. Whether you’re using robo-advisors for teens, hedging with options, or picking ETFs for real estate exposure, these posts cut through the noise and show you exactly how to make thematic investing work for you—not the other way around.

Niche Investing Strategies: Thematic and Trend-Based Approaches

Thematic investing lets you back major global trends like AI, aging populations, and clean energy-not just individual stocks. Learn how to pick the right themes, avoid hype traps, and build a balanced portfolio that aligns with the future.

View More