Thematic ETFs: Invest in Trends Like Clean Energy, AI, and Robotics

When you buy a thematic ETF, an exchange-traded fund built around a specific trend or idea, not a broad market index. Also known as trend ETFs, they let you bet on big shifts like artificial intelligence, clean energy, or cybersecurity—without having to pick single stocks. Unlike index funds that track the S&P 500, thematic ETFs focus on companies driving a particular future. They’re not about what’s popular today, but what’s likely to reshape tomorrow.

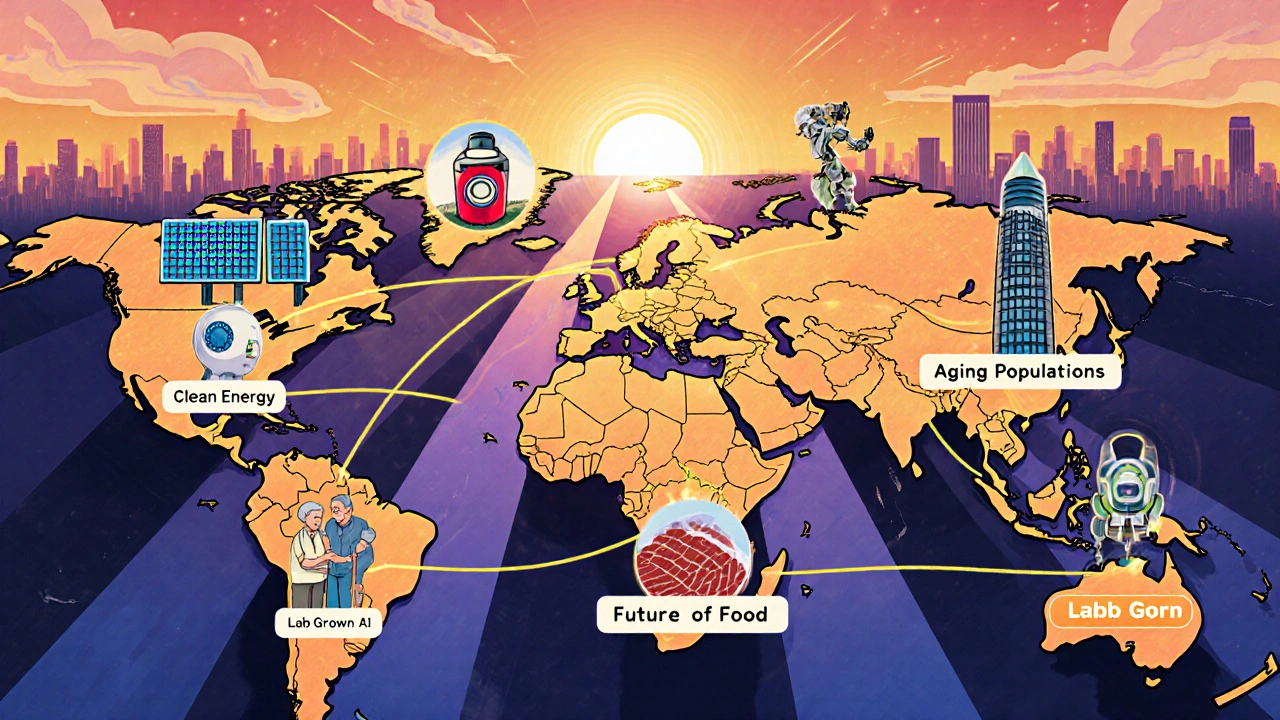

These funds are built on clear themes: clean energy ETFs, funds that invest in solar, wind, battery tech, and electric vehicle makers, AI ETFs, which bundle companies building chips, software, and automation tools, or robotics ETFs, targeting firms making industrial bots, drones, and autonomous systems. Each one pulls together a mix of big names and startups tied to that trend. You’re not just buying a stock—you’re buying into a story that’s playing out across industries.

Thematic ETFs work best when you’re not trying to time the market but want exposure to long-term changes. They’re not for everyone—some swing wildly because they’re concentrated. But if you believe the future is electric, automated, or AI-powered, they give you a simple way to get in. You don’t need to be a tech expert to use them. You just need to pick the trends you trust.

What you’ll find here are real, no-fluff guides on how to choose the right thematic ETFs, what fees to watch for, which ones actually outperformed, and how to avoid the hype traps. You’ll see how they fit into a broader portfolio, how they compare to traditional index funds, and what data shows about their long-term results. No jargon. No sales pitches. Just what works—and what doesn’t—based on actual investor results and market behavior.

Niche Investing Strategies: Thematic and Trend-Based Approaches

Thematic investing lets you back major global trends like AI, aging populations, and clean energy-not just individual stocks. Learn how to pick the right themes, avoid hype traps, and build a balanced portfolio that aligns with the future.

View More