Roth Conversion: How to Turn Traditional IRA Money into Tax-Free Growth

When you do a Roth conversion, the process of moving money from a traditional IRA to a Roth IRA while paying income tax on the amount moved. Also known as a traditional-to-Roth conversion, it’s not a trick—it’s a strategic tax move that lets you lock in today’s tax rates for future tax-free withdrawals. Most people think Roth IRAs are only for people who earn too much to contribute directly. But with a Roth conversion, anyone can get in, no matter their income. You just pay the tax upfront, and then everything that grows inside the Roth account—dividends, interest, stock gains—comes out completely tax-free in retirement.

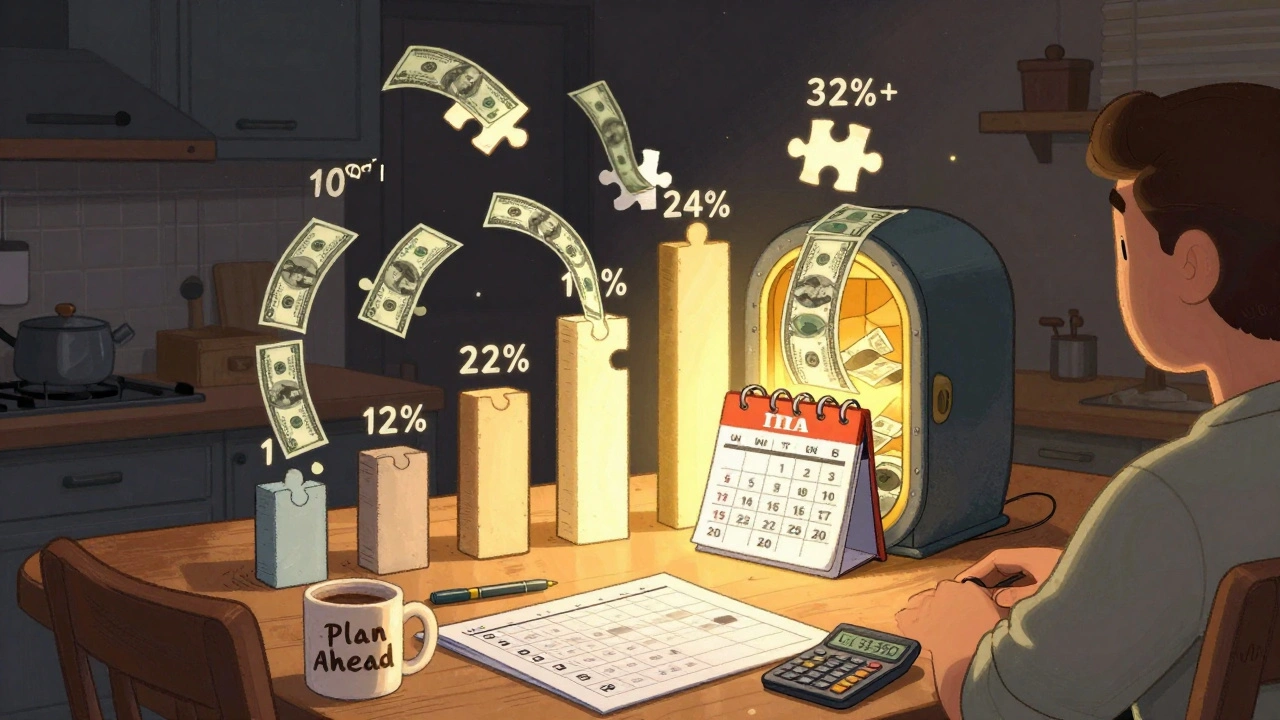

This move connects directly to other key ideas like asset location strategy, where you place different types of investments in different accounts to minimize taxes, and tax-loss harvesting, selling losing investments to offset gains and reduce your tax bill. If you’ve got a traditional IRA full of stocks that have grown a lot, a Roth conversion lets you shift that growth into a tax-free zone. But timing matters. Doing it in a year when your income is low—maybe you’re between jobs, retired early, or had a market dip—can slash your tax bill. And if you’re already in a high tax bracket, waiting until you’re older and forced to take required minimum distributions might push you into an even higher one. That’s why many people use partial conversions over several years to stay in a lower bracket.

It’s not just about the money you convert. It’s also about what you do after. Once the cash is in the Roth, you can’t undo it. You can’t take it back. And if you withdraw earnings before age 59½ or before the account has been open five years, you could owe penalties. But if you hold on, your heirs can inherit the Roth and stretch tax-free withdrawals over their lifetimes. That’s a huge advantage over traditional IRAs, where the government forces you to take money out and pay taxes on it, whether you need it or not. A Roth conversion turns a mandatory withdrawal into a legacy tool.

Below, you’ll find real, practical breakdowns of how people are using Roth conversions today—whether they’re doing a backdoor Roth, converting during market dips, or layering it with tax-loss harvesting to cut their bill even further. No theory. No fluff. Just what works.

Tax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

View More