Retirement Tax Planning: How to Keep More of Your Savings in Retirement

When you think about retirement, you probably imagine stopping work, traveling, or finally having time to breathe. But if you haven’t thought about retirement tax planning, the strategic use of taxable, tax-deferred, and tax-free accounts to minimize taxes in retirement. You could be leaving thousands—maybe tens of thousands—on the table. It’s not enough to just max out your 401(k). How and where you withdraw money matters just as much as how much you saved.

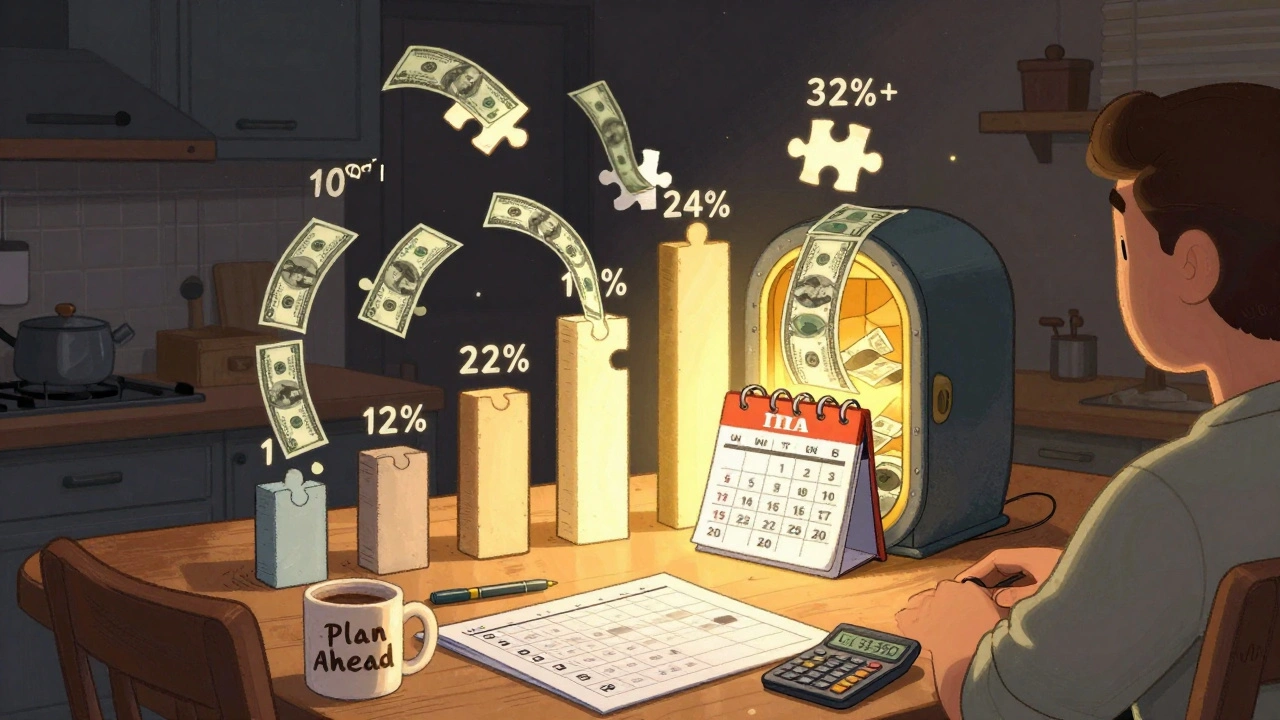

Tax-deferred accounts, like traditional IRAs and 401(k)s, let your money grow without annual taxes, but you pay ordinary income tax when you take it out. That’s fine if you’re in a lower tax bracket in retirement—but what if you’re not? Meanwhile, Roth IRA, a retirement account funded with after-tax dollars, lets you withdraw money tax-free in retirement. The real trick? Using both. Smart investors don’t just pick one—they use a mix so they can control their tax bill year by year. And it’s not just about IRAs. Asset location strategy, placing high-growth assets in Roth accounts and income-heavy ones in taxable accounts. can boost your after-tax returns by up to 1% annually over time. That’s not a small win—it’s hundreds of thousands over decades.

Then there’s the timing. Selling stocks in retirement? If you’ve held them for over a year, you pay capital gains tax, a lower rate than ordinary income tax, often 0%, 15%, or 20% depending on your income. That’s way better than pulling from a traditional IRA where every dollar is taxed as income. And don’t forget required minimum distributions (RMDs)—they force you to take money out at 73, bumping your tax bracket and possibly triggering higher Medicare premiums. Planning ahead lets you avoid that surprise.

Most people think retirement is about saving more. But the real game-changer is knowing where your money lives and how to move it without paying extra taxes. The posts below show you exactly how to do that—whether you’re just starting out or already in your 60s. You’ll find real strategies for using tax-loss harvesting with rebalancing, how to coordinate withdrawals across accounts, and why some people pay almost nothing in taxes during retirement—not because they’re rich, but because they planned smarter.

Tax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

View More