RegTech: How Technology Is Fixing Financial Compliance for Real Investors

When you hear RegTech, regulatory technology that automates compliance for financial firms using software and data. Also known as regulatory technology, it's not just about avoiding fines—it's about building trust, protecting your money, and making sure your investments aren’t at risk because of sloppy bookkeeping. Most people think compliance means paperwork, audits, and lawyers. But today, RegTech is replacing stacks of spreadsheets with algorithms that track every dollar, flag mismatches in real time, and auto-generate reports for regulators.

This isn’t theory. Firms that handle client money—like robo-advisors, brokers, and digital banks—must follow strict rules like CASS 7, the UK’s Client Assets Sourcebook requiring daily reconciliation and segregation of client funds or ASIC Client Money, Australia’s rules that force firms to keep client cash separate from their own. If they fail, clients lose money. And we’ve seen it happen. RegTech tools now automate reconciliation, monitor fund flows, and trigger alerts before errors become disasters. That means your money stays safe, even when the firm grows fast or the market gets wild.

RegTech doesn’t just help firms—it helps you. When a platform uses automated reconciliation, it means fewer delays, fewer mistakes, and less chance your cash gets tangled up in internal chaos. It’s why platforms like Betterment or Schwab can offer fast withdrawals and clear statements: behind the scenes, RegTech is running checks 24/7. And it’s not just about money. RegTech also handles ESG reporting, tax rules, and anti-fraud systems—all part of the same digital compliance engine.

What you’ll find here aren’t abstract tech talks. These are real stories: how firms mess up client money rules, how automation fixes them, why some platforms fail audits, and what you should ask before trusting your cash to any digital service. No fluff. Just what works, what doesn’t, and how to spot the difference.

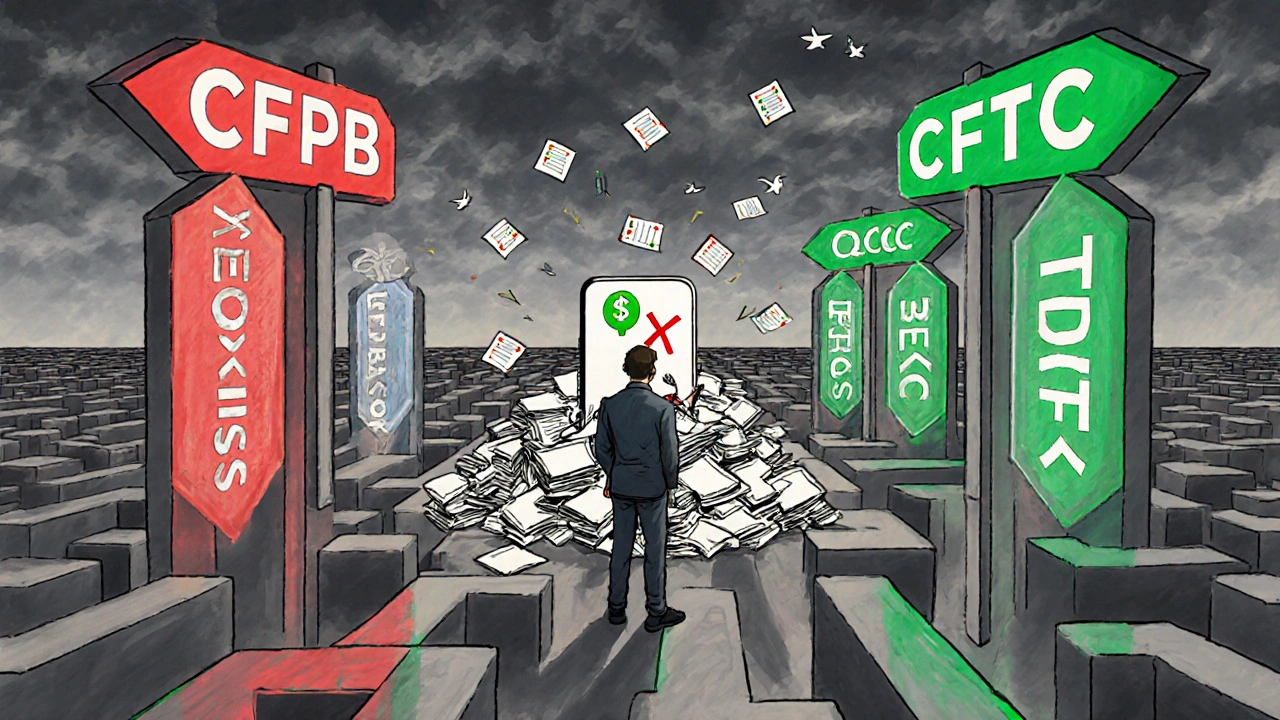

Fintech Regulations: Global Overview and Compliance in 2025

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More