Real-Time Fraud Detection: How AI Stops Financial Crime Before It Happens

When you swipe your card or send money via app, real-time fraud detection, a system that instantly analyzes transactions to spot illegal activity before it completes. It’s not magic—it’s machine learning working behind the scenes, watching for patterns no human could catch in milliseconds. Every second, millions of transactions flow through banks, fintech apps, and payment networks. Without real-time fraud detection, every other transaction might be a scam. Instead, systems flag suspicious activity with over 95% accuracy, slashing false alarms and keeping your money safe.

This isn’t just about stolen credit cards. AI fraud detection, uses historical data and behavioral signals to learn what normal looks like for each user. If you usually buy coffee at 8 a.m. and suddenly spend $2,000 on a luxury watch at 3 a.m. in another country, the system flags it—before the merchant even gets paid. It’s why you rarely hear about someone losing money to fraud these days. The same tech also protects crypto wallets, peer-to-peer payments, and even small business bank accounts from insider threats and synthetic identity scams.

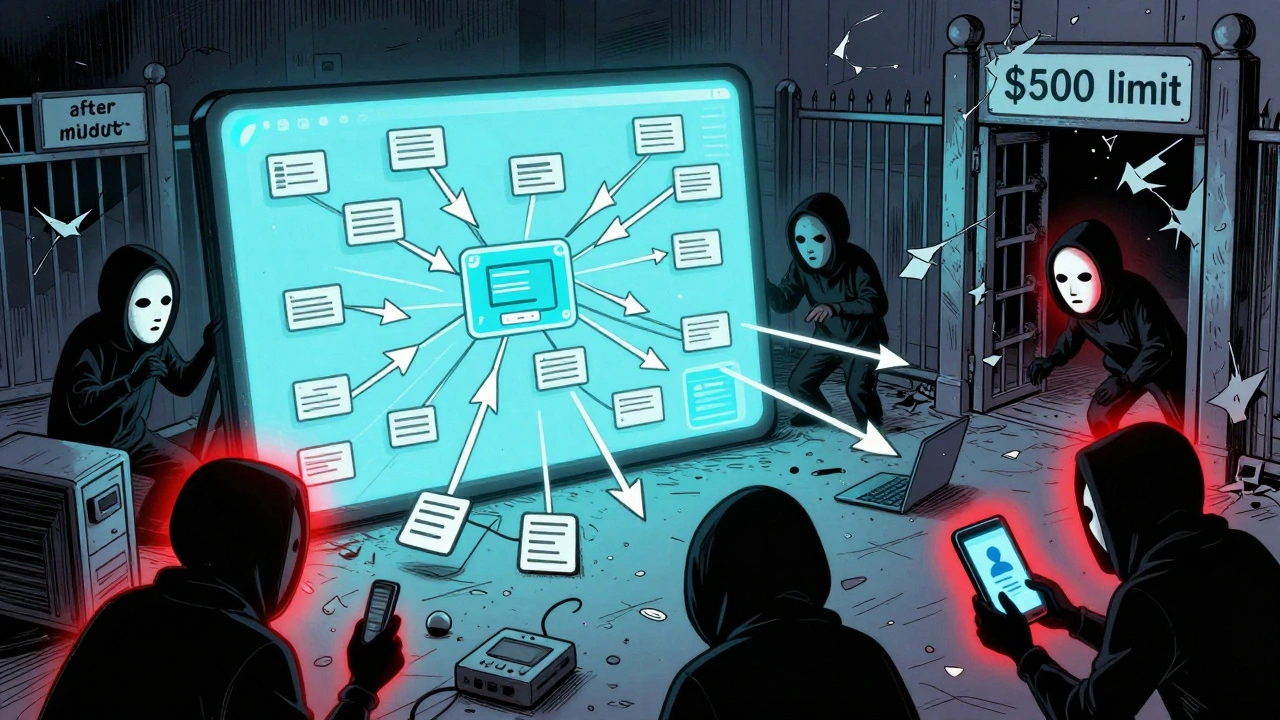

Machine learning fraud, a subset of AI fraud detection that improves over time by learning from new data doesn’t rely on rigid rules like "block transactions over $500." Instead, it adapts. It knows your spending habits, device usage, location patterns, and even typing speed. That’s why a fraudster using your stolen card on your usual phone from your home Wi-Fi might slip through—until they try to change the shipping address. Then the system catches it.

Behind every successful fraud detection system, a combination of algorithms, data feeds, and human oversight designed to stop financial crime are billions of data points. Companies like PayPal, Stripe, and even your local bank use these systems because the cost of fraud is higher than the cost of building them. And it’s not just for big players anymore—small fintech apps and neobanks rely on the same tech to compete and survive.

What you see as a simple "transaction approved" message is actually the result of dozens of checks happening in under 200 milliseconds. Real-time fraud detection doesn’t just prevent losses—it builds trust. That’s why more people feel safe using digital wallets, buying online, or investing through apps they’ve never met in person. It’s the invisible shield keeping your money secure while you focus on growing it.

Below, you’ll find real-world breakdowns of how these systems work, which companies are leading the charge, and how even small investors can spot red flags in their own accounts. No jargon. No fluff. Just clear, practical insights from posts that cut through the hype and show you exactly what’s happening when your money is being watched.

Fraud Detection Technology: How AI Identifies Fraudulent Activity

AI fraud detection uses machine learning to spot subtle patterns in transactions, behavior, and device signals-catching fraud that traditional rules miss. With 94% accuracy and fewer false alarms, it's now the standard in fintech.

View More