Put Options Explained: How to Use Them for Protection and Profit

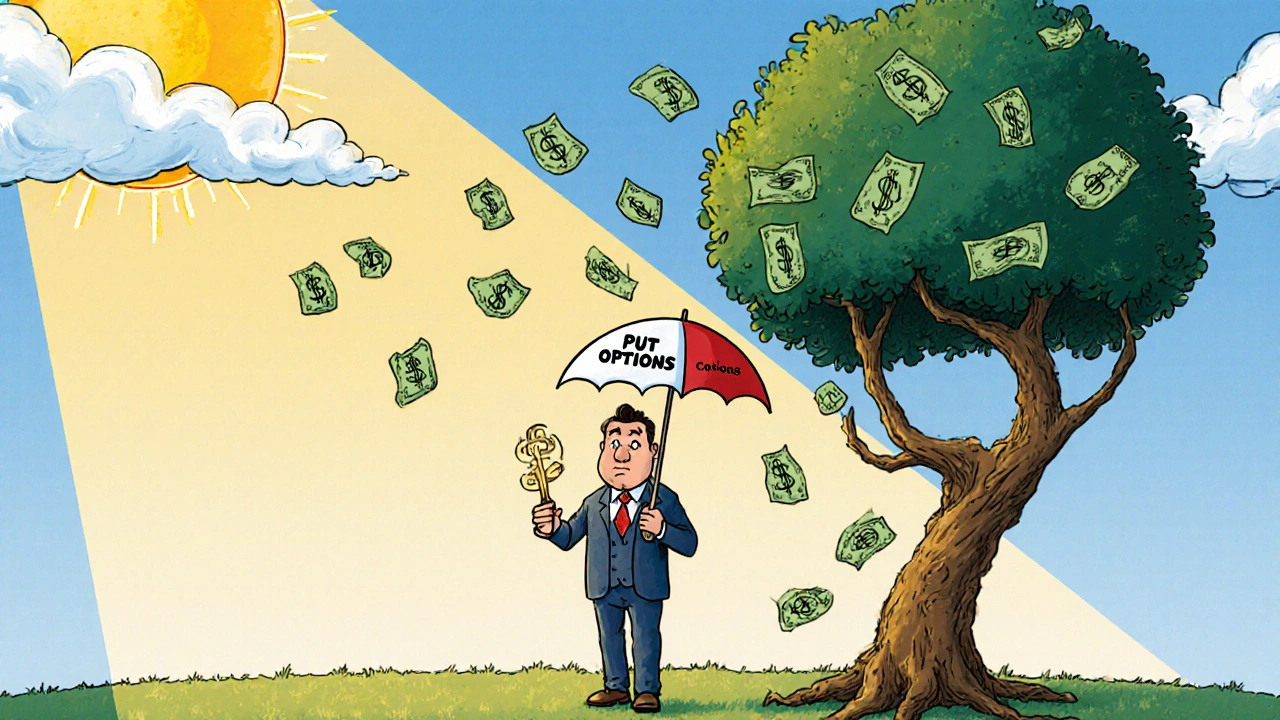

When you buy a put option, a contract that gives you the right to sell a stock at a set price before a certain date. Also known as a put, it’s essentially insurance against a drop in price—not speculation, not gambling, but a tool to control risk. Most people think options are for traders with fancy desks and loud voices. But if you own stocks, especially in volatile sectors like tech or crypto, you’re already exposed to big swings. A put option is how you take back some control.

Put options relate directly to stop-loss orders, automatic sell triggers that execute when a stock hits a certain price. But unlike stop-losses, which can get crushed in a flash crash, puts let you lock in a price without being forced to sell at the worst moment. They also connect to risk management, the practice of protecting your capital from unexpected moves. If you’ve ever held a stock that dropped 30% and hoped it would bounce back, you know how painful that is. A put option doesn’t stop the drop—it just stops you from losing more than you planned.

And here’s the thing: you don’t need to be a day trader to use them. Many investors use puts to protect positions they plan to hold for years. For example, if you own shares in a company you believe in but are worried about an upcoming earnings report, you can buy a put with a strike price just below current value. If the stock crashes, you’re covered. If it rises? You lose the premium you paid—small price for peace of mind.

There’s also a smarter way to think about puts beyond just protection. They’re a way to bet against something without shorting it—no margin calls, no unlimited risk. If you think a sector is overvalued, or a company’s leadership is shaky, you can buy puts instead of betting on the downside with risky leveraged ETFs. It’s cleaner, simpler, and more controlled.

The posts below show real ways people use puts—not as lottery tickets, but as part of a practical strategy. You’ll find guides on timing them around earnings reports, combining them with long stock positions, and even using them to hedge ETFs. Some explain how to calculate the right strike price without a finance degree. Others break down why most people lose money with puts—not because the tool is flawed, but because they treat it like a gamble instead of a tool.

There’s no magic formula. But if you understand what puts can and can’t do, you’ll stop being afraid of them—and start using them the way smart investors do: quietly, deliberately, and only when it makes sense.

Portfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View More