Options Spreads: How to Reduce Risk and Boost Profit in Trading

When you trade options spreads, a strategy that combines buying and selling multiple options contracts to limit risk and control cost. Also known as vertical spreads, it’s one of the most practical ways to trade options without betting everything on a single guess. Most beginners buy single calls or puts hoping for a big move. But that’s like buying a lottery ticket—you’re paying high premiums and losing most of the time. Options spreads fix that. They let you set boundaries: you know exactly how much you can lose before you even place the trade. And you can still profit even if the market barely moves.

There are two main types: debit spreads, when you pay a net premium to enter the trade, usually used when you expect a moderate move in one direction, and credit spreads, when you collect a net premium upfront, ideal for sideways markets or when you believe a move won’t happen. Debit spreads are like buying insurance—you pay now to protect against a big swing. Credit spreads are like selling insurance—you get paid to take on the risk that the market stays calm. Both are used daily by professional traders because they don’t rely on luck. They rely on probability, timing, and structure.

These strategies show up in real trading because they match how markets actually behave. Most stocks don’t explode overnight—they drift, bounce, or stall. That’s why options spreads work better than single options for most people. You’ll find them in posts about event trading, stop-loss orders, and partial rebalancing because they’re all about managing risk, not chasing big wins. Whether you’re trading earnings weeks, Fed days, or just trying to make your portfolio more predictable, spreads give you control.

You don’t need a fancy platform or a six-figure account to use them. Most brokers let you set up spreads with one click. The real challenge isn’t the mechanics—it’s knowing when to use which one. That’s why the posts below cover real examples: how to structure a credit spread around a CPI report, how to adjust a debit spread if the market stalls, and why most traders fail by ignoring the time decay factor. You’ll also see how these strategies connect to broader ideas like dollar-cost averaging and style diversification—not because they’re the same, but because they all share the same goal: steady returns without gambling.

What’s below isn’t theory. It’s what actual traders use when they’re not trying to go viral on YouTube. These are the tools that survive market crashes, quiet months, and earnings season chaos. If you’ve ever felt like options are too risky or too confusing, this collection will show you how to make them work for you—not against you.

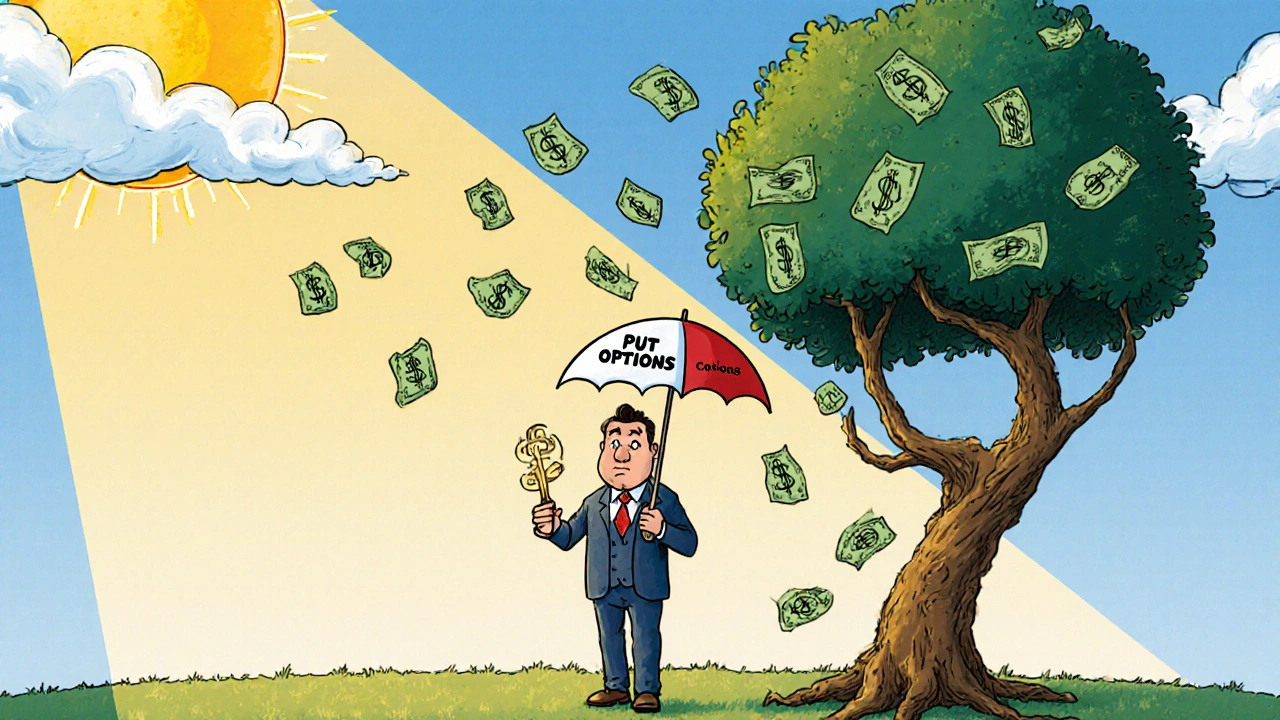

Portfolio Hedging with Options: Protect Your Investments Using Puts, Collars, and Spreads

Learn how to protect your investment portfolio from market crashes using puts, collars, and spreads. Discover practical, real-world strategies that work in 2025 without selling your holdings.

View More