Non-Agency MBS: What They Are and How They Work in Today's Market

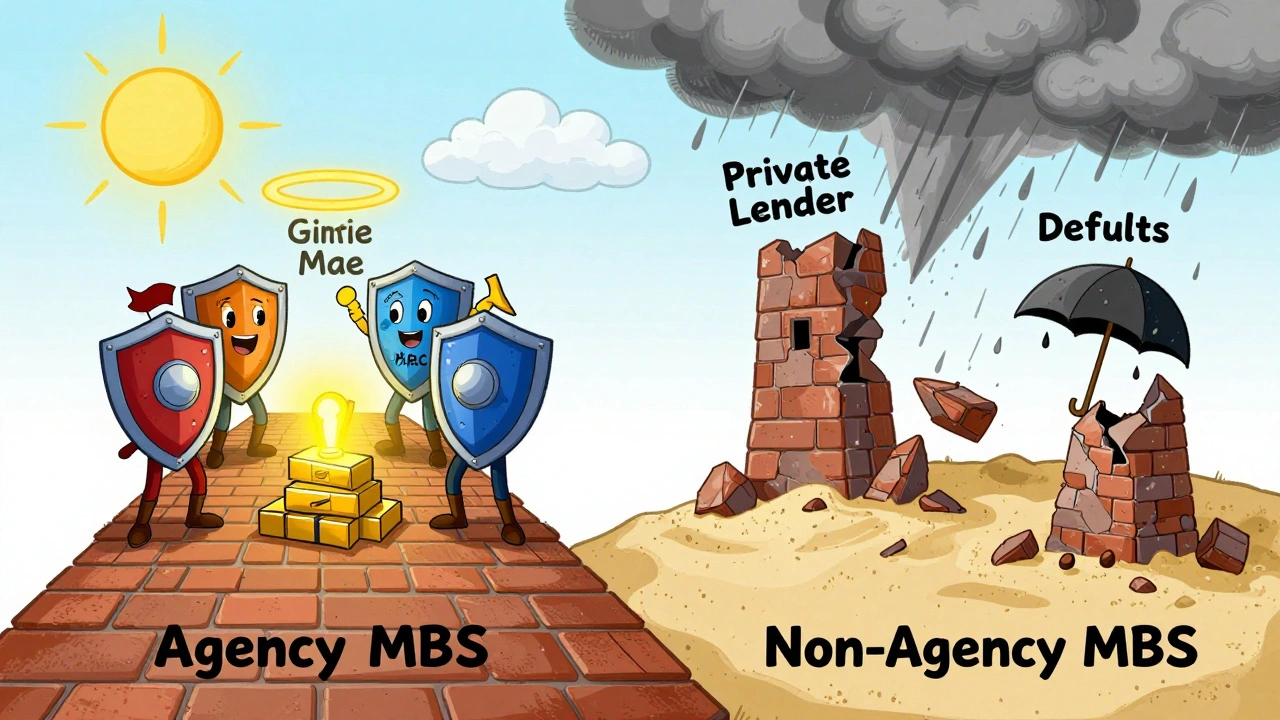

When you hear non-agency MBS, mortgage-backed securities created by private companies, not government entities like Fannie Mae or Freddie Mac. Also known as private-label MBS, these are pools of home loans that banks bundle and sell to investors—without any federal guarantee. Unlike agency MBS, which are backed by the U.S. government, non-agency MBS carry the full weight of borrower default risk. If a homeowner stops paying, there’s no safety net. That’s why these securities pay higher yields—but they also crashed harder in 2008.

What makes non-agency MBS different isn’t just the lack of government backing. It’s the credit risk, the chance that borrowers won’t repay their loans. These loans often go to people with lower credit scores, higher debt loads, or smaller down payments—think subprime, Alt-A, or jumbo mortgages. The investors buying these securities aren’t just betting on housing prices rising; they’re betting that enough people will keep paying, even when rates go up or the economy stumbles. That’s why the performance of non-agency MBS ties directly to unemployment rates, home price trends, and lending standards.

Behind every non-agency MBS is a complex process called securitization, the act of turning individual loans into tradeable financial products. Banks originate the loans, sell them to issuers like Wall Street firms, who then slice them into tranches—different risk levels with different interest rates. The top tranches get paid first, so they’re safer but offer lower returns. The bottom tranches absorb the first losses, so they pay more—but one missed payment can wipe them out. This structure made non-agency MBS attractive to hedge funds, pension funds, and institutional investors looking for yield in a low-interest world.

Today, non-agency MBS are quieter than they were before the financial crisis, but they’re not gone. In fact, they’ve come back with tighter underwriting, better data, and more transparency. Many are now backed by loans to borrowers with FICO scores above 700, and issuers use AI-driven models to predict default risk. Some investors use them to diversify beyond stocks and agency bonds. Others treat them like high-yield corporate debt—risky, but with predictable cash flows if you pick the right tranches.

You won’t find non-agency MBS in most robo-advisors or target-date funds. They’re not for casual investors. But if you’re building a sophisticated portfolio, understanding how they work—and where the real risks lie—can help you spot opportunities others miss. The posts below break down how these securities behave during rate hikes, how to read their prospectuses, which firms issue them today, and how to evaluate their credit quality without a finance degree. No jargon. No fluff. Just what you need to know if you’re even considering putting money into them.

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More