Mortgage-Backed Securities: How They Work and Why They Matter for Investors

When you hear mortgage-backed securities, financial products that bundle home loans into tradeable bonds. Also known as MBS, they’re how banks turn monthly house payments into cash they can lend again. It’s not magic—it’s math, and it’s how trillions in home loans move through the economy. You don’t need to be a banker to understand them, but you should know how they affect your investments, your retirement accounts, and even your mortgage rate.

Mortgage-backed securities are built from pools of home loans. When you buy one, you’re essentially lending money to homeowners through a chain of financial middlemen. The payments they make—principal and interest—flow down to you, the investor. These aren’t just random loans either. They’re grouped by type: government-backed (like those from Fannie Mae or Freddie Mac), private-label, or subprime. The safest ones carry implicit government support; the riskier ones helped trigger the 2008 crash. Today, most MBS are far more transparent, with detailed data on loan age, credit scores, and location. They’re a core part of the bond market, and if you own a mutual fund or ETF, you likely already have exposure to them—even if you didn’t know it.

What makes MBS unique is how they react to interest rates. When rates drop, homeowners refinance. That means your MBS gets paid off early—and you lose future interest payments. When rates rise, people hold onto their mortgages longer, and you get more interest—but your bond’s price drops. This is called prepayment risk, and it’s the big trade-off for higher yields than regular Treasuries. That’s why smart investors pair MBS with other assets to balance risk. You’ll find them in many robo-advisors, pension funds, and even some ETFs focused on fixed income. They’re not flashy, but they’re steady—and they’re how everyday people indirectly fund millions of homes.

Related concepts like asset-backed securities, bonds backed by any pool of loans—not just mortgages—include car loans, credit card debt, or student loans. MBS are just one type. And while real estate investing, direct ownership of property gets all the attention, MBS let you tap into housing without buying a single house. No repairs. No tenants. Just steady cash flow.

What you’ll find in this collection aren’t theory-heavy lectures. These are real, practical guides from investors who’ve seen how MBS behave in volatile markets, how they interact with Fed policy, and how they fit into portfolios that need income without taking on too much risk. You’ll see how they connect to tax strategies, portfolio rebalancing, and even how AI is now predicting prepayment patterns. No jargon. No fluff. Just what you need to know to make smarter calls—with or without owning a home.

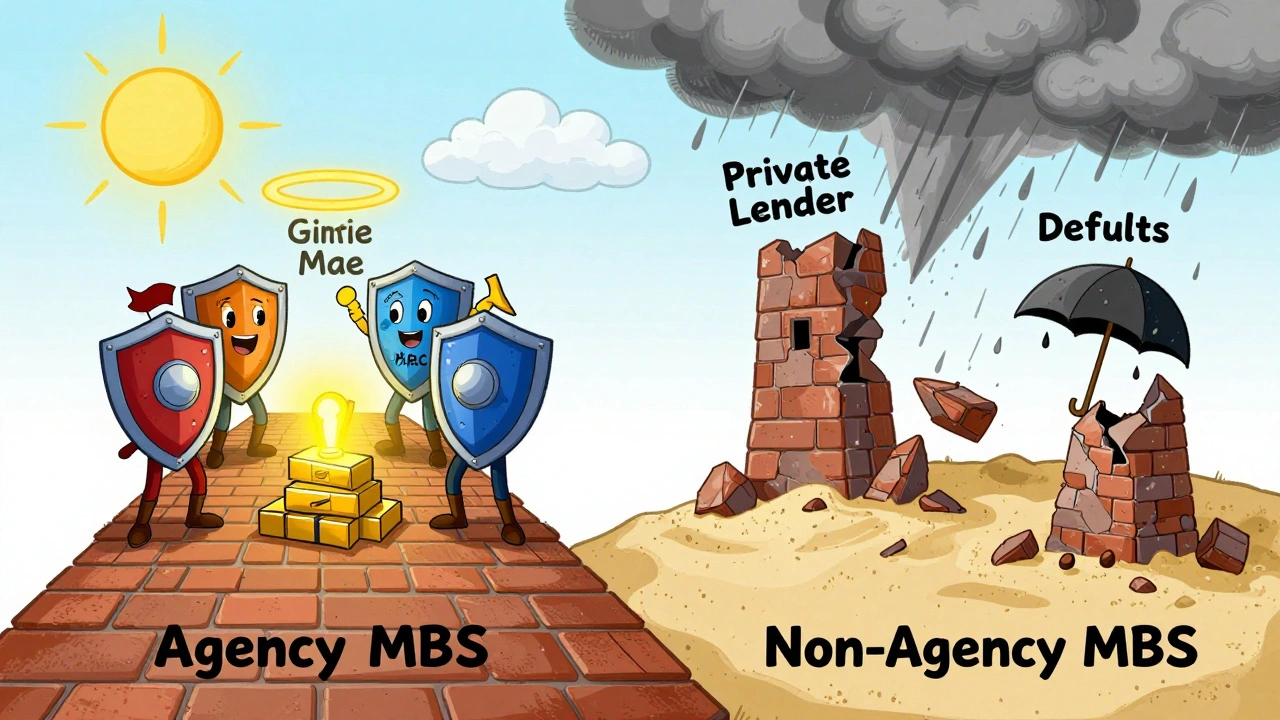

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More