MiCA: What It Is and How It Changes Investing for Tech-Savvy Women

When you buy crypto, use a robo-advisor, or hold stablecoins, you're interacting with something called MiCA, the Markets in Crypto-Assets Regulation, the European Union’s first unified rulebook for digital assets. Also known as EU Crypto Regulation, it doesn’t just apply to exchanges — it reshapes how you access, store, and protect your investments from your laptop. Before MiCA, anyone could launch a crypto token with no disclosure, no audits, and no accountability. Now, platforms must prove they’re secure, transparent, and legally responsible — and that matters because your money is on the line.

MiCA doesn’t just cover Bitcoin or Ethereum. It includes stablecoins, digital currencies pegged to the euro or dollar, now regulated to prevent sudden crashes and ensure redemption, and crypto asset service providers, the platforms that let you trade, store, or issue digital assets — now required to hold capital, segregate client funds, and report suspicious activity. This isn’t just bureaucracy. It’s a shift from the Wild West to something closer to how your brokerage works today. Think of it like CASS 7 for crypto: your money has to be kept separate from the company’s, audited regularly, and protected if things go wrong. That’s the same logic behind client money rules you’ve seen in posts here — now applied to digital assets.

For tech-savvy women investing in crypto or using platforms like Kraken, Bitpanda, or even SoFi’s crypto features, MiCA means fewer scams, clearer fees, and more reliable platforms. It also forces issuers to publish whitepapers, explain risks, and stop misleading marketing. If you’ve ever wondered why some crypto projects vanish overnight, MiCA makes that harder. And if you’re using a robo-advisor that offers crypto exposure, you’ll soon see only MiCA-compliant assets — no random meme coins masquerading as investments.

This regulation doesn’t just affect Europe. If you’re outside the EU but use a platform that serves European clients, you’re already affected. MiCA sets a global standard — just like GDPR did for privacy. Platforms that want to operate across borders will follow its rules, whether they’re based in the US, Canada, or Australia. That means better protections for you, no matter where you live.

Below, you’ll find posts that connect MiCA to real investing decisions: how it changes robo-advisor offerings, why client money rules now extend to crypto, and how investor protection is evolving in the digital age. You won’t find fluff here — just clear links between regulation and your portfolio.

Fintech Regulations: Global Overview and Compliance in 2025

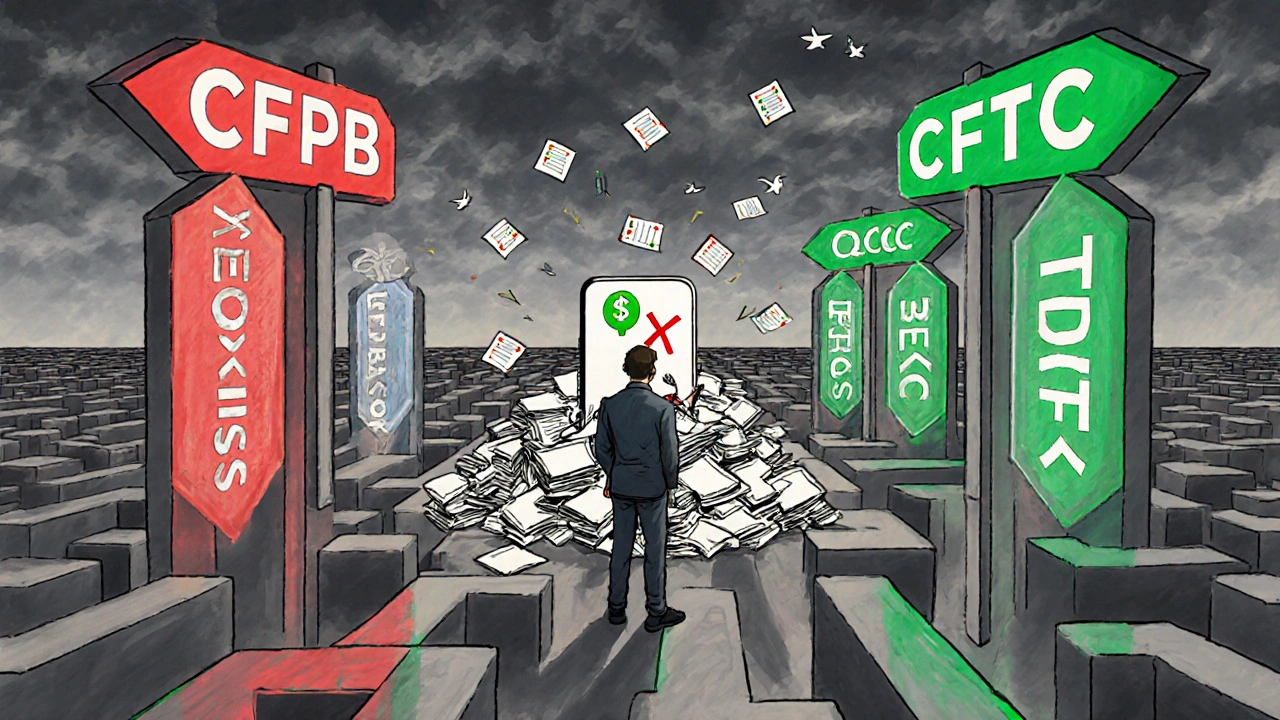

Fintech regulations in 2025 are fragmented, complex, and rapidly evolving. From the EU's MiCA to the U.S. CFPB's Section 1033, compliance is no longer optional-it's a core part of product development. This guide breaks down global rules, costs, and strategies to stay ahead.

View More