Lower Tax Brackets: How to Stay in Them and Keep More of Your Income

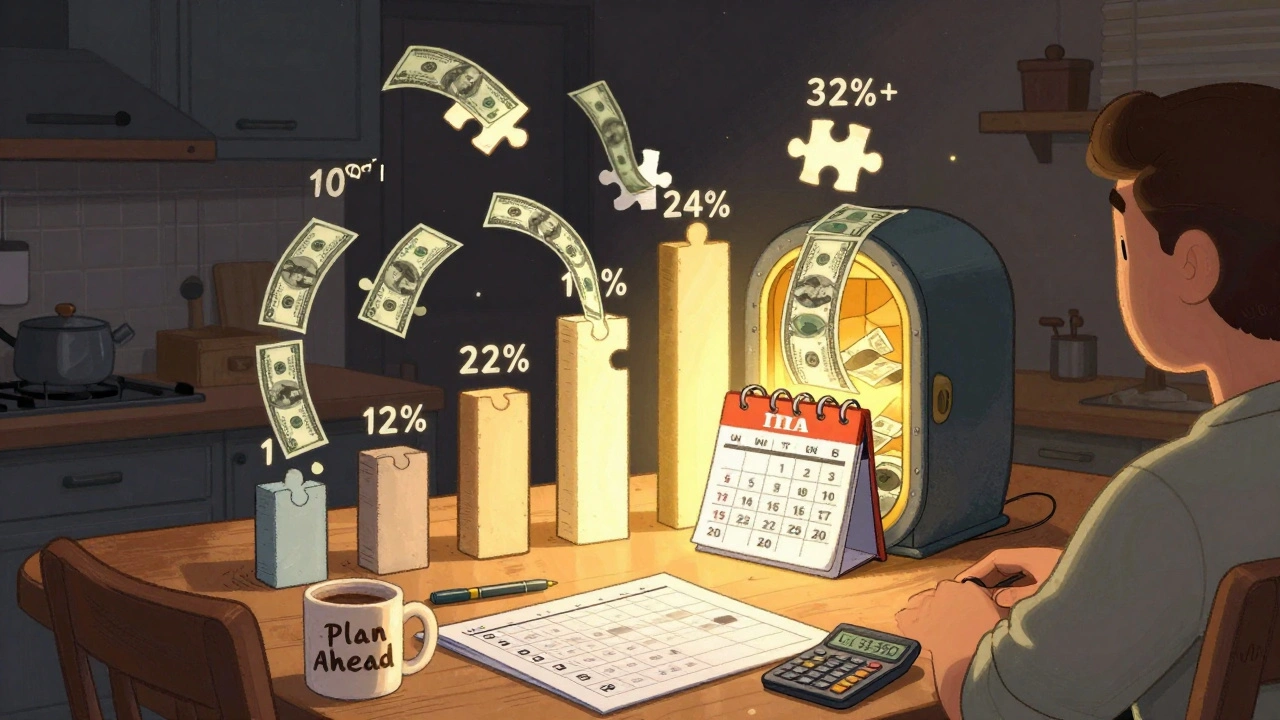

When you’re in a lower tax bracket, the percentage of your income the IRS takes is smaller because your total taxable income falls within a specific range. Also known as tax brackets for moderate earners, being in one isn’t about earning less—it’s about managing how and where your money is counted. Most people think tax brackets only matter when they get a raise, but the truth is, how you invest can move you up or keep you right where you want to be.

Here’s the thing: your taxable accounts, regular brokerage accounts where every dividend, interest payment, or sale triggers a tax event are the biggest risk to staying in a lower bracket. If you sell stocks for a profit in a taxable account and your income jumps even a little, you could push yourself into the next bracket and pay more in capital gains tax, the tax you pay when you sell an investment for more than you paid for it. But if you use asset location strategy, the practice of putting different types of investments in different accounts to reduce taxes, you can keep high-growth assets in Roth IRAs, dividend stocks in tax-deferred accounts, and only touch taxable accounts for low-turnover, tax-efficient funds. That’s how people in the 12% or 22% bracket stay there—even as their wealth grows.

It’s not magic. It’s timing, placement, and awareness. Tax-loss harvesting, partial rebalancing, and avoiding big lump-sum sales in high-income years all help you stay put. You don’t need to be rich to benefit—you just need to know where your money is being taxed and why. The posts below show real ways women are using these tactics: how to harvest losses without triggering wash sales, how to rebalance without bumping your income, and how to pick investments that quietly grow without sending your tax bill up. No guesswork. No complex formulas. Just clear, step-by-step moves that keep your money where it belongs—yours.

Tax Bracket Management: How to Fill Lower Brackets with Roth Conversions to Save Thousands

Learn how to use Roth IRA conversions to fill lower tax brackets and reduce your lifetime tax bill. This guide shows exactly when, how much, and why to convert-based on 2025 tax rules and real-world examples.

View More