Investment Performance: How to Measure, Improve, and Protect Your Returns

When you talk about investment performance, how much money your portfolio actually makes after taxes, fees, and risk. It's not just about the percentage on your statement—it's about what stays in your pocket. Most people focus on raw returns, but the real game is in after-tax returns, the net profit you actually walk away with after paying taxes. A fund that grows 8% a year might leave you with only 5% after taxes if you’re holding it in the wrong account. That’s where asset location strategy, putting the right investments in the right accounts—taxable, tax-deferred, or tax-free comes in. It’s not fancy. It’s not flashy. But it can add up to 1% or more in extra returns every year, just by moving things around.

Then there’s risk. High returns mean nothing if you lose half your portfolio in a crash. That’s why smart investors don’t just chase gains—they protect them. portfolio hedging, using options like puts and collars to shield your holdings from big drops isn’t just for Wall Street pros. You can use simple, low-cost strategies to limit losses without selling your stocks. And when the market dips, tax-loss harvesting, selling losing investments to offset capital gains and reduce your tax bill turns a loss into a financial win. You’re not just cutting your losses—you’re cutting your taxes. Done right, it can boost your net returns without changing your long-term bets.

What you’ll find in these posts isn’t theory. It’s what real investors are doing right now to make their money work harder. You’ll see how to track performance beyond the headlines, how to stop letting fees and taxes eat your gains, and how to build a portfolio that doesn’t just grow—it survives. Whether you’re just starting out or you’ve been investing for years, the difference between average returns and real wealth isn’t luck. It’s knowing what to look for—and what to avoid.

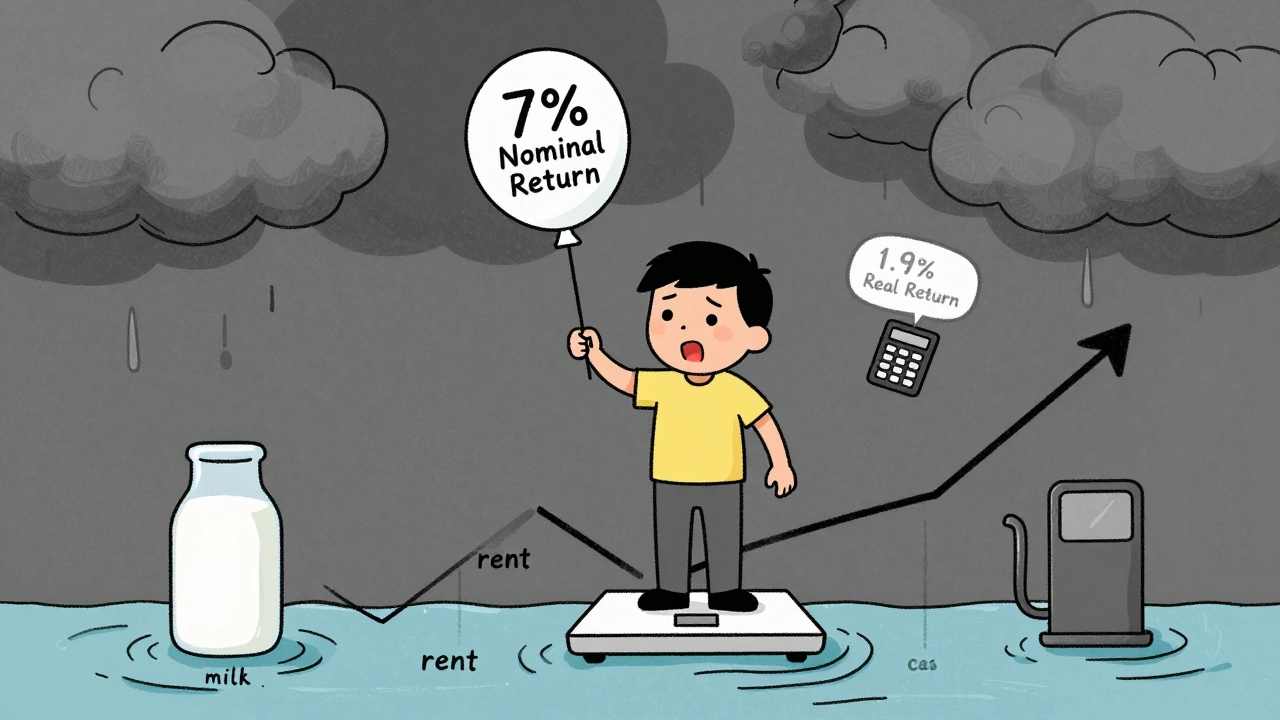

Real vs Nominal Returns: What Inflation-Adjusted Performance Really Means for Your Investments

Real returns reveal your true investment growth after inflation, while nominal returns can be misleading. Learn why real returns matter more than ever for long-term wealth and how to calculate them correctly.

View More