Inflation Impact: How Rising Prices Affect Your Investments and Wallet

When you hear inflation impact, the erosion of your money’s buying power over time, it’s not just a number on a chart—it’s the reason your coffee costs $6 instead of $3, and your $10,000 savings feels like $8,000. It’s the silent thief that doesn’t break in, it just slowly shrinks what you’ve worked for. And if you’re investing without accounting for it, you’re losing ground every single year—even when your portfolio shows "gains." Real returns aren’t what your statement says. They’re what’s left after inflation takes its cut.

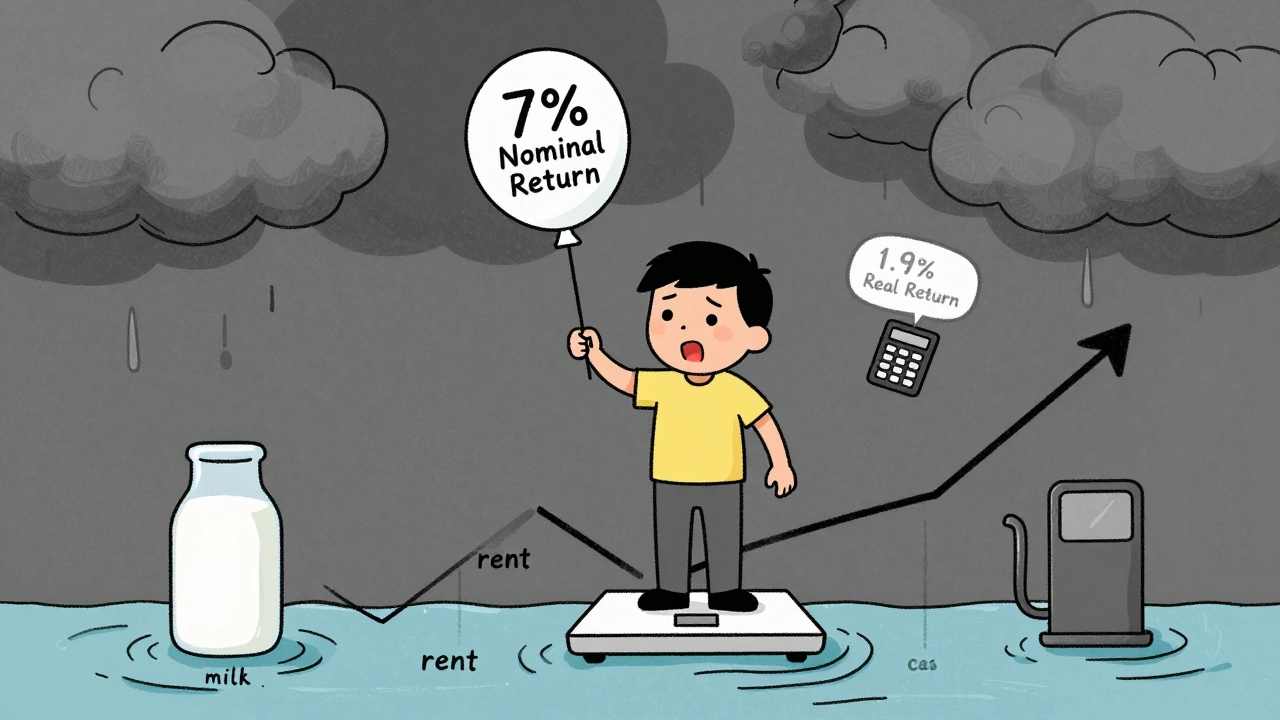

That’s why purchasing power, how much goods and services your money can actually buy matters more than percentage gains. If your savings account earns 2% but inflation is 4%, you’re falling behind. The same goes for bonds, CDs, or cash holdings. Meanwhile, real returns, your investment profit after subtracting inflation are the only metric that tells you if you’re truly building wealth. And when interest rates, what banks pay you to hold your money or charge to lend it lag behind inflation, you’re not just losing ground—you’re being punished for playing it safe.

Here’s the truth: inflation doesn’t hurt everyone the same. It crushes fixed incomes but can help those with debt or assets that rise with prices—like real estate, commodities, or stocks in companies that can raise their own prices. That’s why inflation impact isn’t just about avoiding loss. It’s about positioning your money where it can grow faster than prices. REITs, TIPS, dividend-paying stocks, and even crypto (yes, some use it as a hedge) are tools people turn to when inflation spikes. But none of them work unless you understand the trade-offs. You can’t just chase yield—you need strategy.

Look at the posts below. They don’t just talk about inflation. They show you how it connects to real decisions: Roth conversions to lock in lower tax rates before your income climbs with inflation, asset location to shield gains from higher taxes, REIT ETFs that act as inflation shields, and even how central bank digital currencies might change how governments fight inflation in the future. You’ll find guides on tax-loss harvesting to offset losses when markets dip under inflation pressure, and how to use dollar-cost averaging so you’re not trying to time the market when prices are wild. This isn’t theory. It’s what people are actually doing to protect their money right now.

Real vs Nominal Returns: What Inflation-Adjusted Performance Really Means for Your Investments

Real returns reveal your true investment growth after inflation, while nominal returns can be misleading. Learn why real returns matter more than ever for long-term wealth and how to calculate them correctly.

View More