Inflation-Adjusted Returns: What They Really Mean for Your Investments

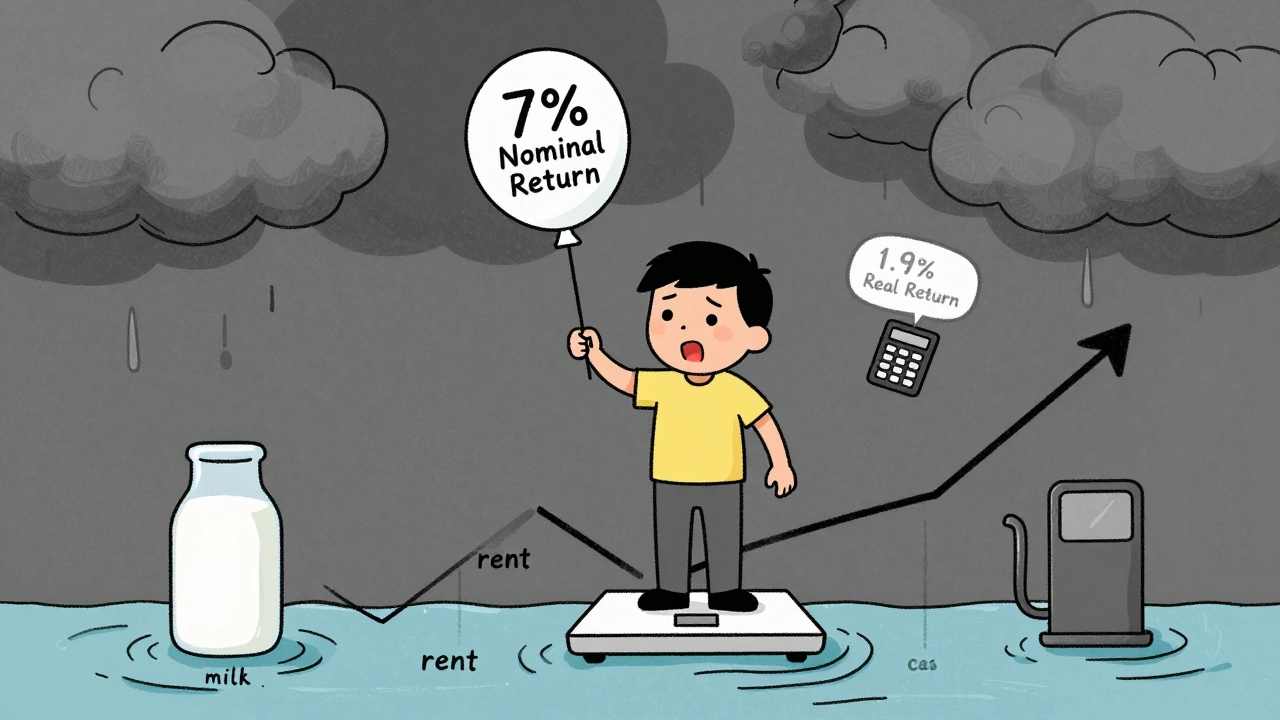

When you hear someone say their portfolio returned 8% last year, don’t celebrate yet. That number doesn’t tell you if you’re actually getting richer—it just tells you how much money was added before inflation-adjusted returns, the true measure of investment growth after accounting for rising prices. Also known as real returns, this is what keeps your savings from losing ground while you sleep. If inflation hit 3%, your 8% gain only turned into a 5% bump in actual buying power. That’s the difference between growing your wealth and just keeping up.

Most people track nominal returns, the raw percentage gain before inflation because it’s easy to find. But if you’re investing for retirement, a house, or your kid’s education, you need to know how much of that gain is real. A bond paying 4% sounds safe—until you realize inflation is at 5%. You’re losing money, even if the bank says you’re winning. That’s why smart investors don’t just look at returns—they look at purchasing power, how much goods and services your money can actually buy over time. This isn’t theory. It’s survival. If your portfolio doesn’t outpace inflation consistently, your future self will be working longer just to afford groceries.

The posts below show you exactly how to spot inflation’s hidden toll on your money. You’ll find guides on inflation-adjusted returns in ETFs, how to use real yield data to pick better bonds, why some robo-advisors ignore this entirely, and how tax strategies like Roth conversions can help you keep more of what you earn. You’ll also see how asset location and tax-loss harvesting work better when you factor in inflation, and how REITs and dividend stocks can act as natural hedges. No fluff. No jargon. Just clear, practical ways to make sure your money grows in value—not just in number.

Real vs Nominal Returns: What Inflation-Adjusted Performance Really Means for Your Investments

Real returns reveal your true investment growth after inflation, while nominal returns can be misleading. Learn why real returns matter more than ever for long-term wealth and how to calculate them correctly.

View More