How Much to Save for Emergency: Real Rules for Your Financial Safety Net

When we talk about emergency fund, a cash reserve set aside to cover unexpected expenses like car repairs, medical bills, or job loss. Also known as emergency savings, it's the one financial buffer that stops panic from turning into debt. Most people hear "save 3 to 6 months of expenses"—but that’s not a rule, it’s a starting point. The real question isn’t how much you should save, it’s how much you need to stay safe.

Your emergency fund isn’t about matching a number from a blog. It’s about matching your life. If you’re a freelancer with irregular income, you might need 6 to 9 months. If you’re in a stable job with health insurance and a partner who also earns, 3 months might be enough. But if you’re the sole breadwinner, have kids, or live in a place where medical bills can wipe you out, you’re not safe with less than 6. And if your car is 12 years old and your roof leaks? That’s not a "maybe"—that’s a financial risk waiting to happen.

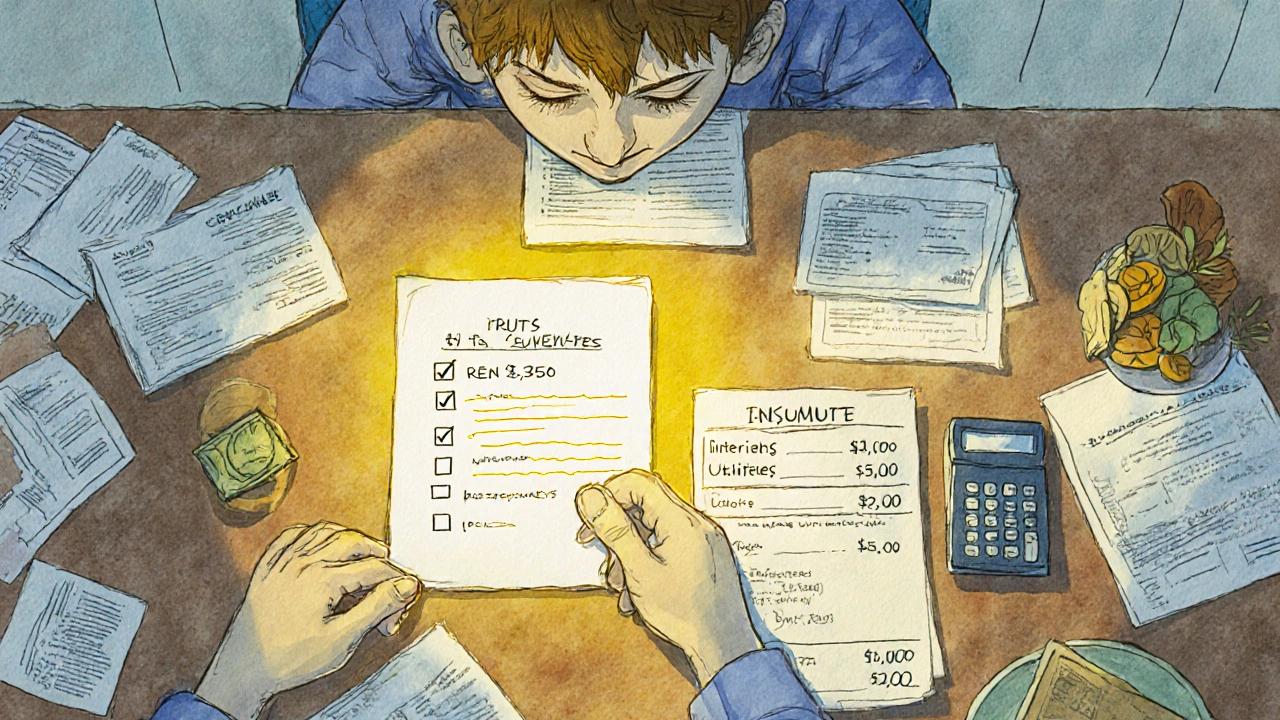

Here’s what most guides miss: your emergency fund should cover your essential expenses only—rent, groceries, utilities, minimum debt payments, and basic transportation. Not vacations, dining out, or that new phone you’ve been eyeing. You don’t need to save $10,000 if your essentials only cost $1,500 a month. And you don’t need to wait until you have it all saved to start. Even $500 buys you breathing room. A $1,000 buffer can keep you from using a credit card when your fridge breaks. And that’s the point: cash reserve isn’t about wealth—it’s about control.

Some people think they’re safe because they have a credit card. But that’s not a safety net—it’s a trap. Interest piles up fast, and if you lose your job, that card becomes a mountain. Others stash cash in a regular savings account that earns nothing. That’s better than nothing, but you’re losing buying power to inflation. The smart move? Keep your emergency fund in a high-yield savings account. It’s FDIC-insured, easy to access, and actually grows a little. No crypto, no stocks, no complex apps. Just simple, reliable cash you can pull out in 24 hours.

And here’s the truth no one tells you: your emergency fund isn’t static. It changes when you get a raise, move cities, have a baby, or switch careers. Revisit it every six months. Did your rent go up? Did your insurance deductible double? Did your partner lose their side gig? Adjust your target. This isn’t a one-time task—it’s part of your financial rhythm.

You’ll find posts here that break down how much you really need based on your income type, how to build it without feeling broke, and why holding cash isn’t lazy—it’s strategic. You’ll see how top investors use dry powder to buy during crashes, and how behavioral biases make us hold onto bad investments instead of protecting our safety net. You’ll also find real comparisons of the best high-yield accounts and tools that automate your savings without you thinking about it.

Stop guessing. Stop comparing yourself to people on social media who say they "saved $20K in a year." Your emergency fund isn’t a trophy. It’s your insurance policy against chaos. And the right amount? It’s the number that lets you sleep at night—no matter what happens tomorrow.

How Much Should You Save in Emergency Fund? Step-by-Step Calculation Method

Stop using generic advice. Learn the exact step-by-step method to calculate your emergency fund based on your real expenses, income stability, and risks. Get your personalized savings target now.

View More