GSE Guarantees: What They Are and How They Protect Your Investments

When you hear GSE guarantees, promises made by government-sponsored enterprises to back financial products like mortgage loans. Also known as government-backed credit guarantees, they’re the invisible safety net behind most home loans in the U.S. These aren’t just bureaucratic terms—they’re the reason millions of people can get mortgages at low rates, and why investors trust mortgage-backed securities. Without GSE guarantees, lending would be riskier, pricier, and far less accessible.

The two biggest players are Fannie Mae, a government-sponsored enterprise that buys and guarantees home loans from lenders and Freddie Mac, its sister organization that does the same thing but focuses on different types of lenders. Together, they guarantee over $5 trillion in mortgages. That means if a borrower defaults, these entities step in to pay the investor—whether it’s a pension fund, a foreign government, or an individual holding a mortgage-backed bond. This guarantee cuts risk so dramatically that these securities often trade like U.S. Treasuries, even though they’re not issued by the federal government.

But here’s what most people miss: GSE guarantees don’t mean the government pays if they fail. They’re privately owned, publicly chartered, and technically not backed by the full faith and credit of the U.S. government—though everyone assumes they are. That’s why the 2008 bailout happened. When the housing market collapsed, the government stepped in to keep them alive because their failure would’ve shattered the entire financial system. Since then, reforms have tightened rules, but the core guarantee remains. For investors, that means GSE-backed bonds are among the safest fixed-income options outside of Treasuries. For everyday people, it means lower mortgage rates and more stable housing markets.

These guarantees also connect to other parts of your financial life. If you’re invested in REIT funds, you’re indirectly exposed to GSE activity since many hold mortgage-backed securities. If you’re using a robo-advisor, it might include GSE-backed bonds in its conservative portfolios. Even tax-loss harvesting strategies can involve selling GSE securities to offset gains elsewhere. And if you’re curious about open finance or payment processing infrastructure, you’re still in the same ecosystem—because all of it relies on trust in financial guarantees.

So why does this matter to you? Because GSE guarantees are one of the quietest, most powerful forces in personal finance. They keep credit flowing, reduce volatility in bond markets, and lower your cost of borrowing. You don’t need to understand every detail—but you do need to know they exist. The posts below break down how these guarantees affect everything from your mortgage rate to your investment returns, and what’s changing as policymakers debate their future.

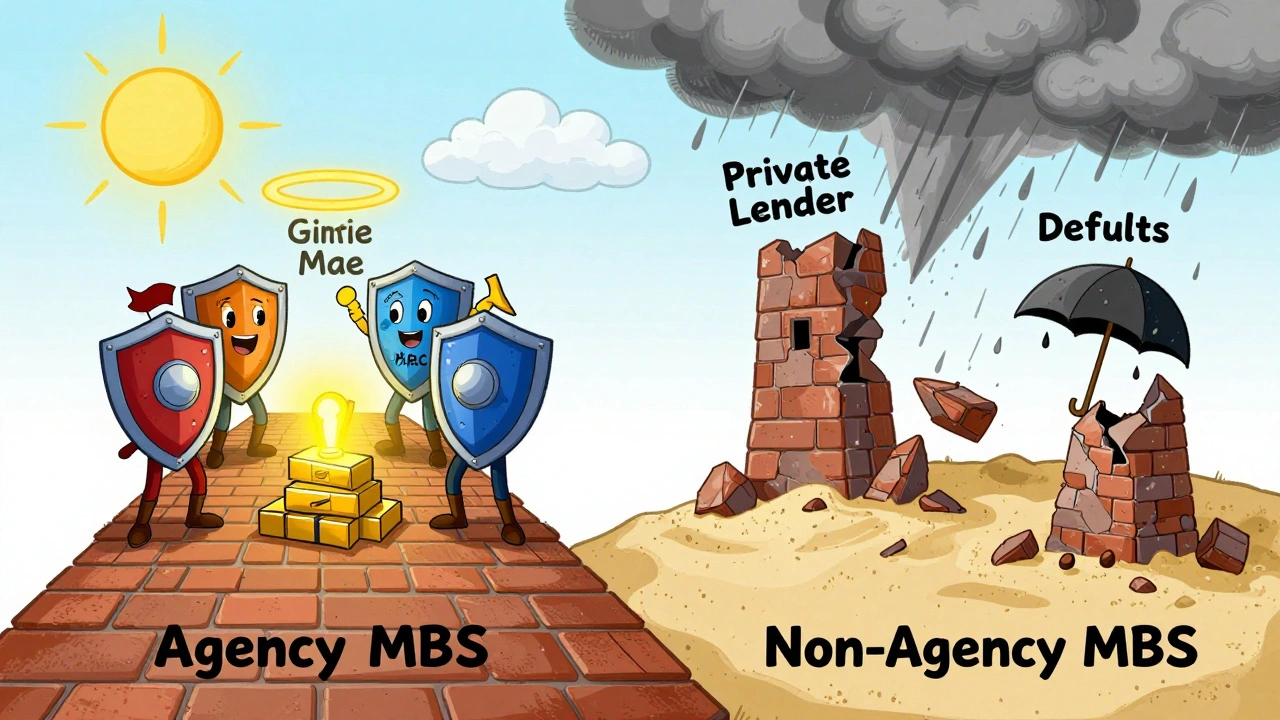

Agency MBS vs Non-Agency MBS: Understanding Credit Backing Differences

Understand the critical difference between agency and non-agency MBS: one has government backing, the other doesn't. Learn how credit risk, yields, liquidity, and structure impact your fixed-income investments.

View More