Future Trends in Investing: What’s Shaping Wealth Building in 2025 and Beyond

When thinking about future trends investing, the evolving strategies and technologies that are changing how people grow wealth over time. Also known as next-generation investing, it’s not about guessing the future—it’s about using today’s tools to prepare for it. This isn’t sci-fi. It’s what’s already happening in bank apps, robo-advisors, and brokerage platforms you’re probably using right now.

Take robo-advisors, automated platforms that build and manage investment portfolios with minimal human input. Also known as algorithmic investing, they’re no longer just for beginners—by 2025, they’re handling everything from teen custodial accounts to ESG-focused portfolios for women who want their money to match their values. These systems don’t guess markets. They follow rules: rebalance automatically, tax-loss harvest, and adjust allocations based on your goals. And they’re getting smarter, thanks to synthetic data, fake but realistic financial data used to train AI models without risking real customer privacy. That’s why platforms can now predict how a portfolio might react to a Fed rate hike—even before the news breaks.

Another big shift? ESG portfolios, investment strategies that filter companies based on environmental, social, and governance standards. Also known as values-based investing, they’re not about sacrificing returns. Data shows they often match or beat traditional funds, especially when combined with dollar-cost averaging. Speaking of which—dollar-cost averaging, the practice of investing a fixed amount at regular intervals, regardless of market price. Also known as paycheck investing, it’s the quiet hero of long-term wealth. You don’t need to time the market. You just need to show up. And with automatic payroll deductions, you’re already doing it.

What’s changing fast? Cash isn’t just safety anymore—it’s strategy. Top investors hold dry powder to buy when others panic. Bond ladders are replacing bond funds for steady income. And instead of chasing hot stocks, people are using partial rebalancing to cut taxes and trading fees. These aren’t trends you read about in magazines. They’re tactics you can plug into your own routine today.

Below, you’ll find real, tested guides on exactly how these shifts affect your money. No hype. No jargon. Just clear steps on how to use robo-advisors for teens, why ESG portfolios work without gutting returns, how synthetic data is making AI investing safer, and why dollar-cost averaging with your paycheck is still the most powerful move you can make. These aren’t predictions. They’re the tools already in your hands.

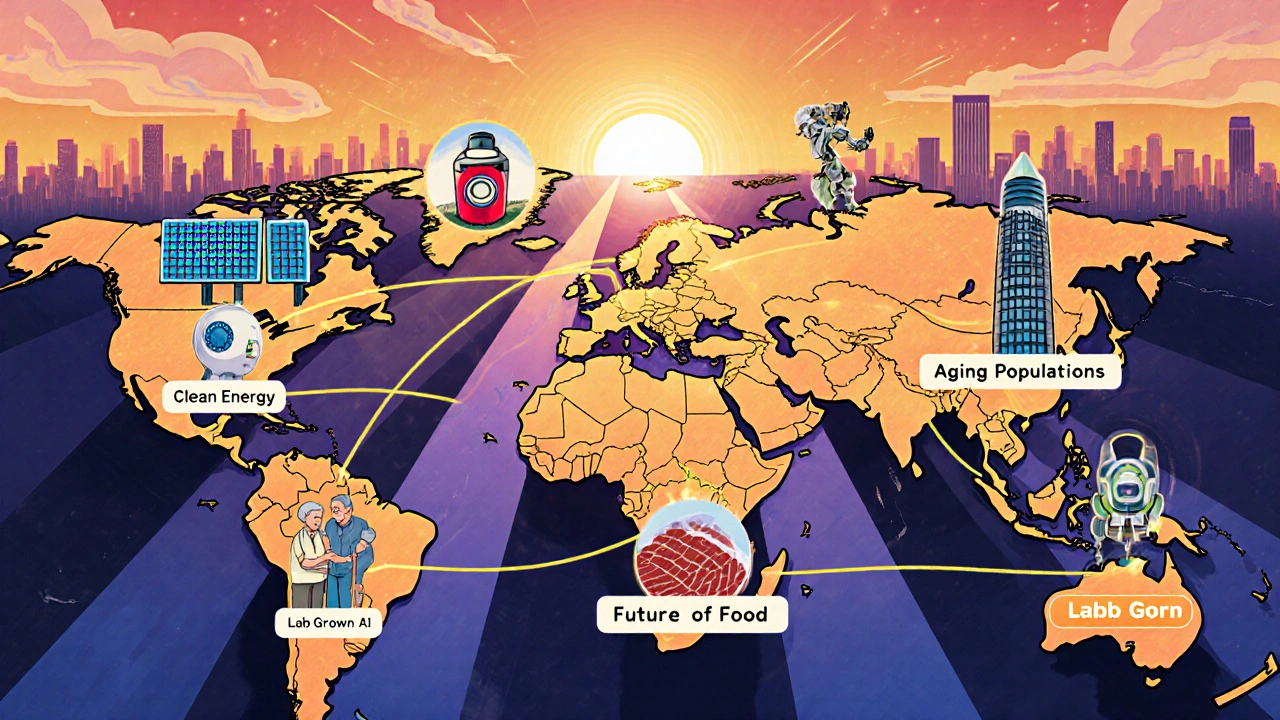

Niche Investing Strategies: Thematic and Trend-Based Approaches

Thematic investing lets you back major global trends like AI, aging populations, and clean energy-not just individual stocks. Learn how to pick the right themes, avoid hype traps, and build a balanced portfolio that aligns with the future.

View More