Fraud Detection Technology: How AI Stops Financial Scams in Real Time

When your bank blocks a strange charge before you even notice it, that’s fraud detection technology, a system that automatically identifies and stops financial scams using data patterns and machine learning. Also known as anomaly detection, it’s the silent guard watching every transaction, login, and transfer you make—without you lifting a finger.

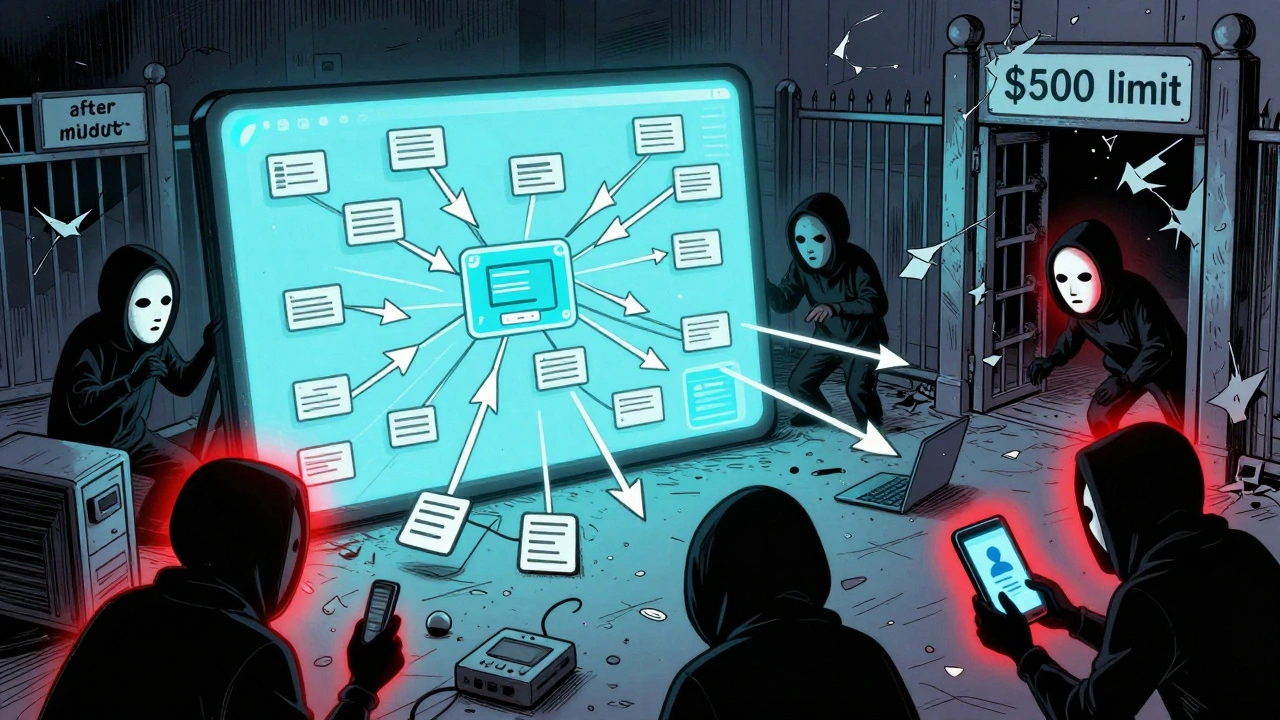

This isn’t just about spotting fake credit card numbers anymore. Modern AI fraud detection, a subset of fraud detection technology that learns from millions of transactions to find hidden patterns works like a supercharged detective. It doesn’t follow rigid rules like "block anything over $500." Instead, it notices when your usual $20 coffee purchase suddenly becomes a $2,000 transfer to a new country at 3 a.m.—and flags it in milliseconds. Companies like PayPal, Stripe, and even your local credit union now use this to cut fraud losses by up to 95%, according to real industry data. And the best part? It gets smarter the more it sees.

Behind the scenes, machine learning fraud, the core engine powering modern fraud detection systems that improve without human programming relies on historical behavior. It knows your spending habits, device usage, location patterns, and even typing speed. If your phone suddenly logs in from a different city while a new account is created, it doesn’t just ask for a password—it might lock the session and text you. This isn’t science fiction. It’s what’s already protecting millions of accounts daily. And it’s not just for banks. Fintech apps, crypto exchanges, and even subscription services use the same tech to keep your money safe.

What makes this different from old-school fraud tools? suspicious activity detection, the process of identifying unusual behavior that doesn’t fit a known fraud pattern doesn’t wait for fraud to happen. It spots the warning signs before the crime is complete. A sudden spike in small transactions? A login from a new browser with a different IP? These aren’t red flags on a checklist—they’re signals in a living model that’s constantly learning. That’s why false alarms are dropping. You’re not getting bombarded with "is this you?" texts anymore because the system is finally getting better at telling real threats from harmless blips.

And it’s not just about stopping theft. real-time fraud prevention, the ability to act within seconds of detecting a threat, stopping fraud before funds leave the account is changing how businesses operate. Small merchants using QR code payments, teens with custodial robo-advisor accounts, and even people using BNPL services all benefit from this invisible layer of protection. It’s why you can swipe your phone to pay at a food truck and walk away without worrying about someone cloning your card.

What you’ll find in the posts below isn’t theory—it’s real breakdowns of how these systems actually work, who uses them, and why they’re becoming non-negotiable in today’s digital economy. From how AI spots fake transactions in seconds to why your budgeting app quietly runs fraud checks every time you log in, these guides cut through the jargon and show you exactly what’s protecting your money—and how you can tell if it’s working right.

Fraud Detection Technology: How AI Identifies Fraudulent Activity

AI fraud detection uses machine learning to spot subtle patterns in transactions, behavior, and device signals-catching fraud that traditional rules miss. With 94% accuracy and fewer false alarms, it's now the standard in fintech.

View More